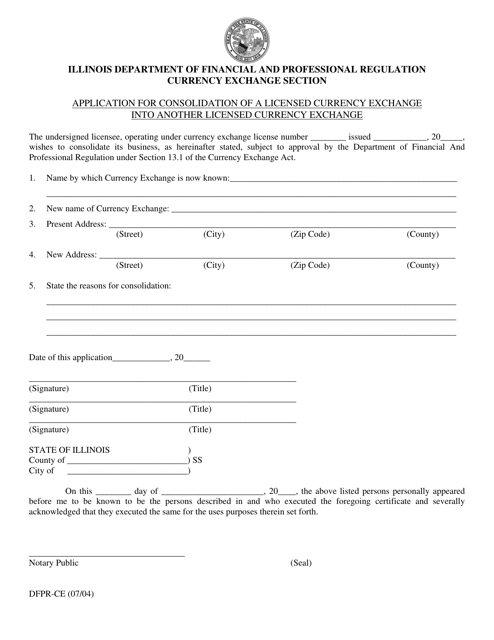

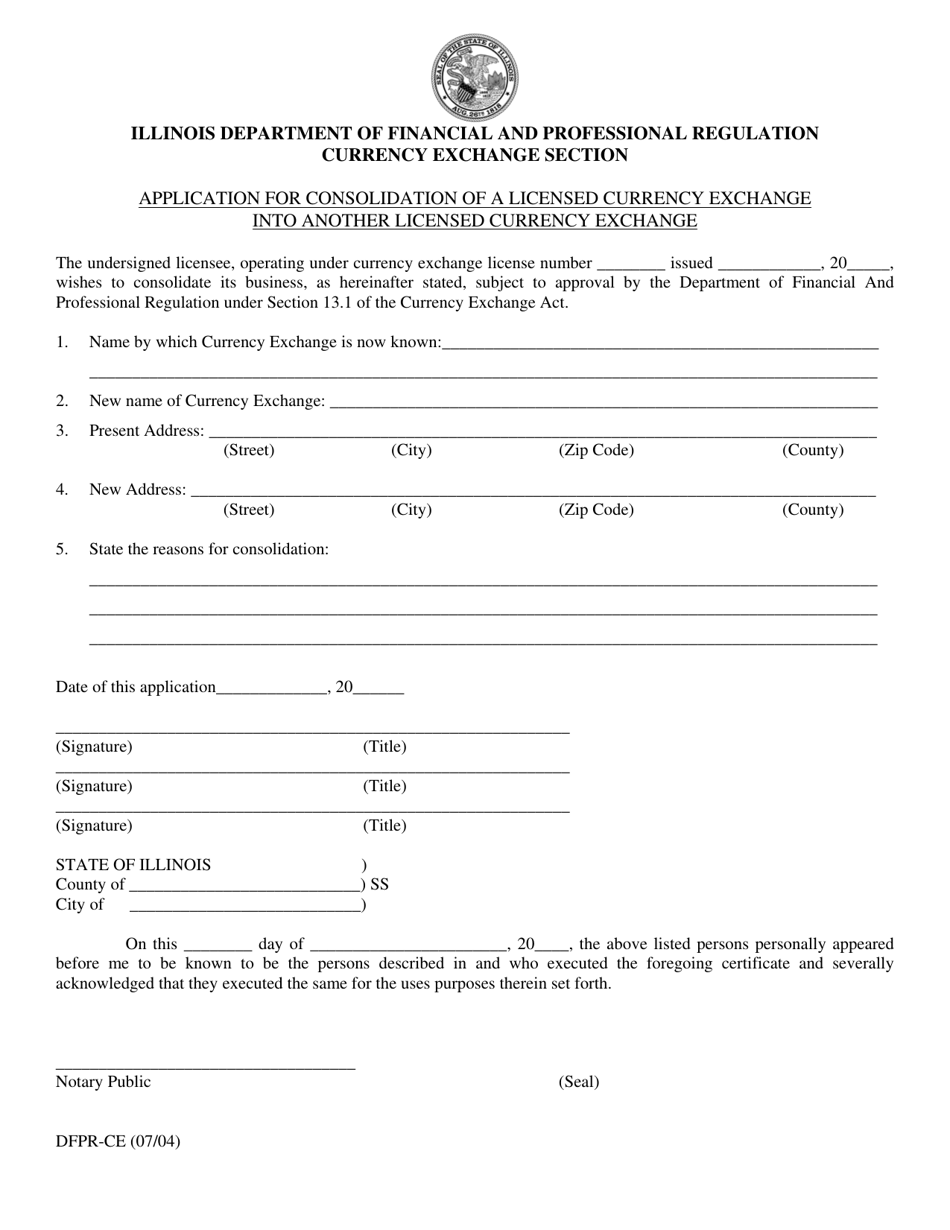

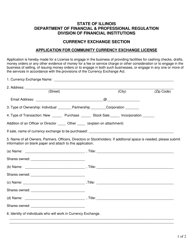

Application for Consolidation of a Licensed Currency Exchange Into Another Licensed Currency Exchange - Illinois

Application for Consolidation of a Licensed Currency Exchange Into Another Licensed Currency Exchange is a legal document that was released by the Illinois Department of Financial and Professional Regulation - a government authority operating within Illinois.

FAQ

Q: What is an application for consolidation of a licensed currency exchange?

A: An application for consolidation of a licensed currency exchange is a request to combine two licensed currency exchanges into one.

Q: What is a licensed currency exchange?

A: A licensed currency exchange is a business that provides services such as check cashing, money transfers, and currency exchange.

Q: Why would a licensed currency exchange want to consolidate with another licensed currency exchange?

A: A licensed currency exchange may want to consolidate with another licensed currency exchange to streamline operations, reduce costs, or expand their customer base.

Q: What is the process for consolidating a licensed currency exchange in Illinois?

A: The process for consolidating a licensed currency exchange in Illinois involves submitting an application to the Illinois Department of Financial and Professional Regulation (IDFPR), providing necessary documentation, and meeting certain requirements set by the IDFPR.

Q: Are there any fees associated with the application for consolidation of a licensed currency exchange?

A: Yes, there are fees associated with the application for consolidation of a licensed currency exchange. The exact fees may vary, so it is recommended to consult the IDFPR for the current fee schedule.

Q: What are the requirements for consolidation of a licensed currency exchange in Illinois?

A: The requirements for consolidation of a licensed currency exchange in Illinois include having a valid license, providing financial statements, submitting a business plan, and meeting any other requirements specified by the IDFPR.

Q: How long does the consolidation process take?

A: The duration of the consolidation process for a licensed currency exchange can vary. It is advisable to contact the IDFPR for an estimate of the timeline.

Q: Can a licensed currency exchange consolidate with a non-licensed currency exchange?

A: No, a licensed currency exchange can only consolidate with another licensed currency exchange in Illinois.

Q: What are the potential benefits of consolidating licensed currency exchanges?

A: The potential benefits of consolidating licensed currency exchanges include increased efficiency, cost savings, and the ability to offer a wider range of services to customers.

Form Details:

- Released on July 1, 2004;

- The latest edition currently provided by the Illinois Department of Financial and Professional Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Financial and Professional Regulation.