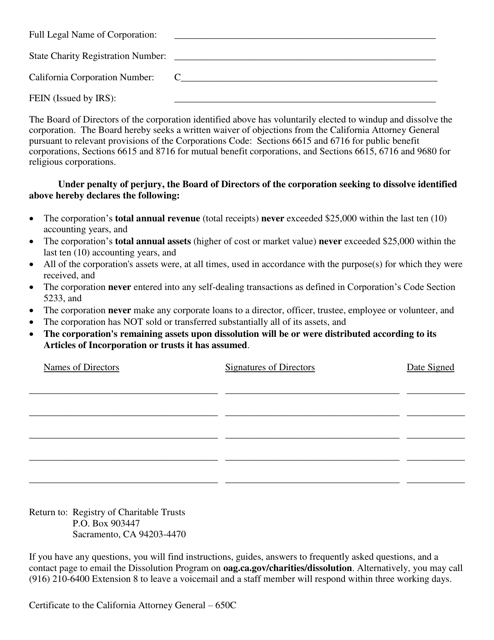

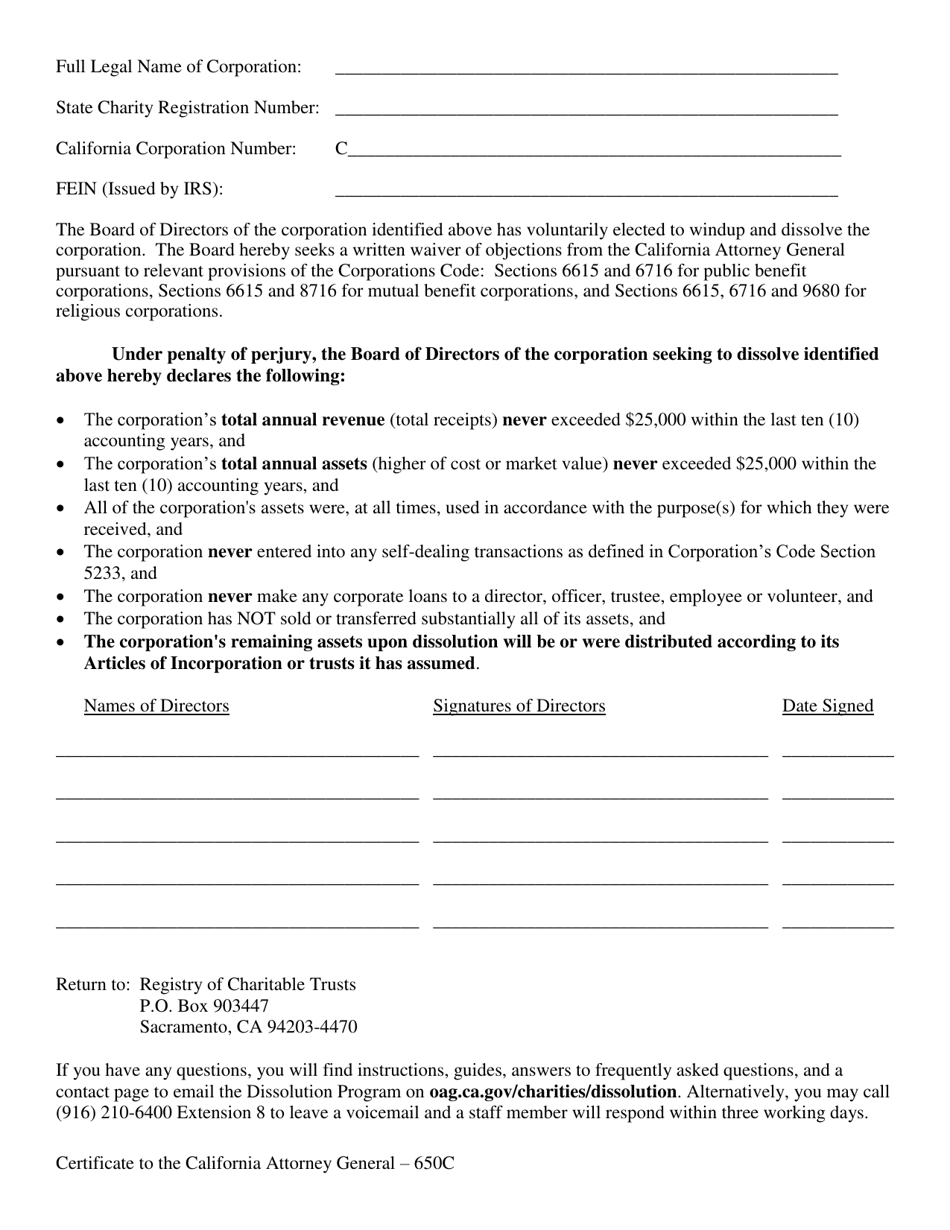

Form 650C Certificate to the California Attorney General - California

What Is Form 650C?

This is a legal form that was released by the California Department of Justice - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 650C?

A: Form 650C is the Certificate to the California Attorney General.

Q: Who needs to complete Form 650C?

A: Nonprofit organizations located in California need to complete Form 650C.

Q: What is the purpose of Form 650C?

A: The purpose of Form 650C is to provide information about the nonprofit organization to the California Attorney General.

Q: Is there a fee for filing Form 650C?

A: No, there is no fee for filing Form 650C.

Q: What information is required on Form 650C?

A: Form 650C requires information about the organization's name, address, purpose, officers, and financial information.

Q: When should Form 650C be filed?

A: Form 650C should be filed within 30 days after the organization is formed or qualifies to conduct business in California.

Q: What happens after filing Form 650C?

A: After filing Form 650C, the organization will receive a Certificate of Compliance from the California Attorney General.

Form Details:

- The latest edition provided by the California Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 650C by clicking the link below or browse more documents and templates provided by the California Department of Justice.