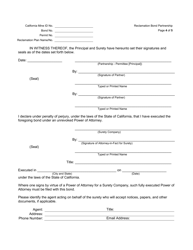

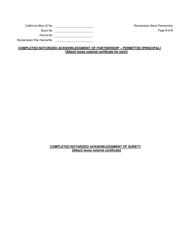

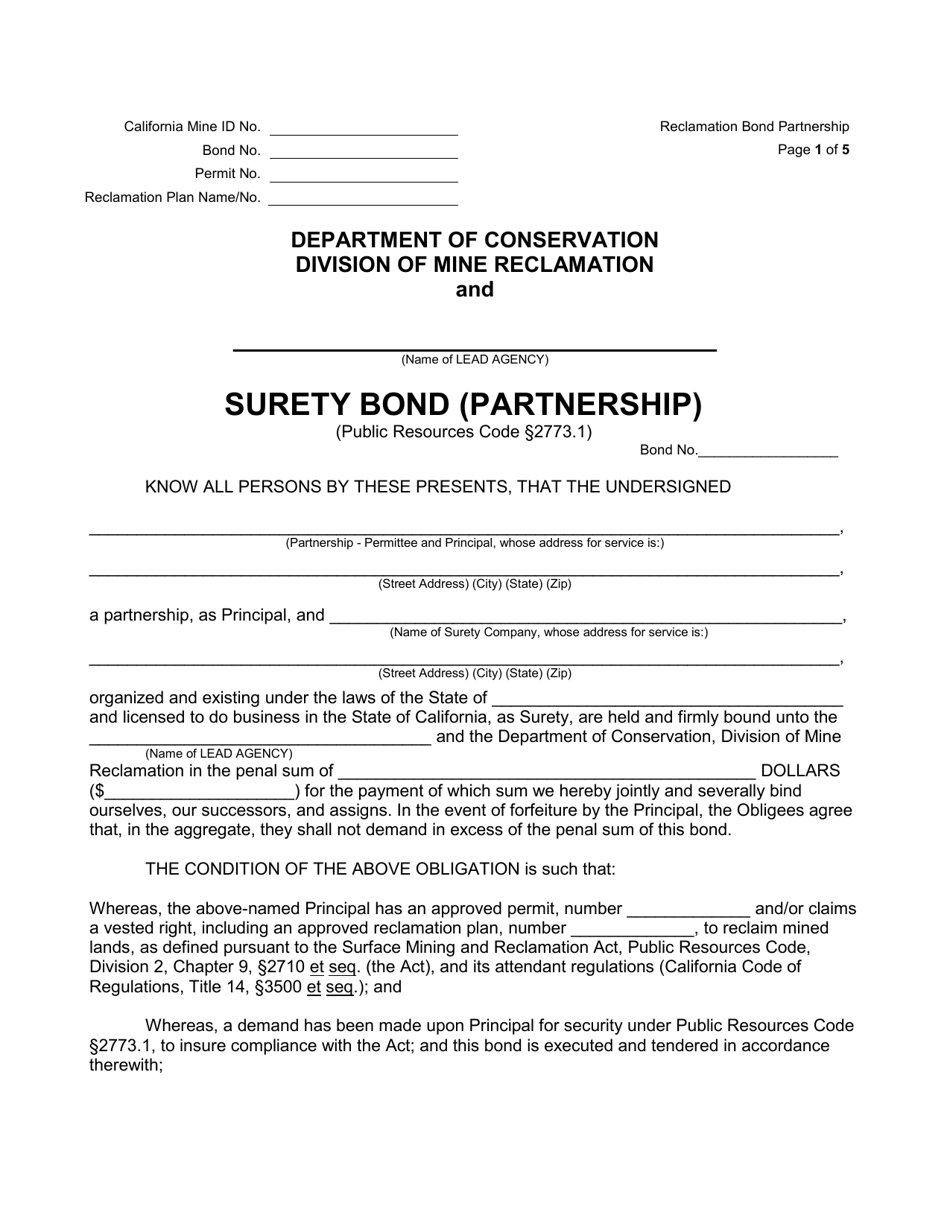

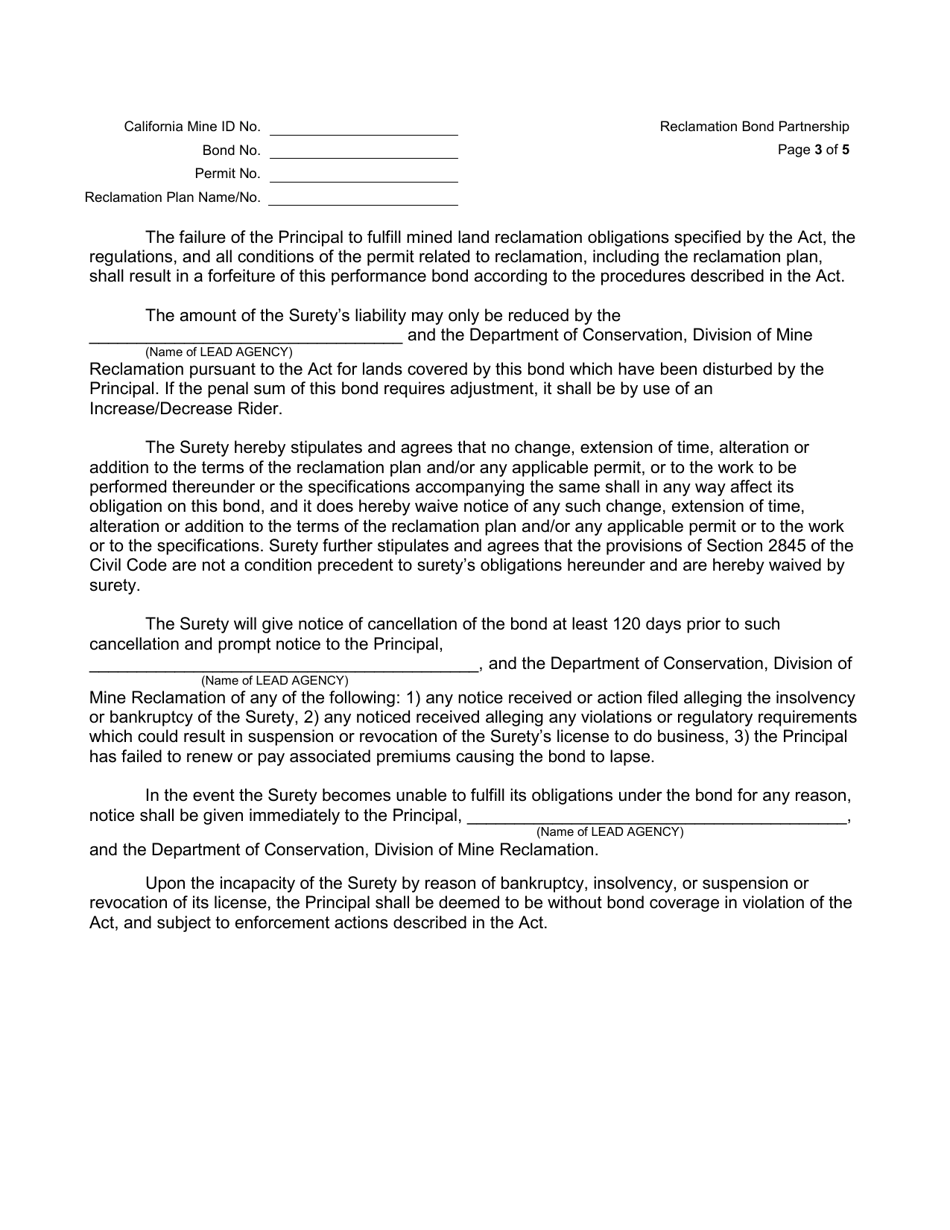

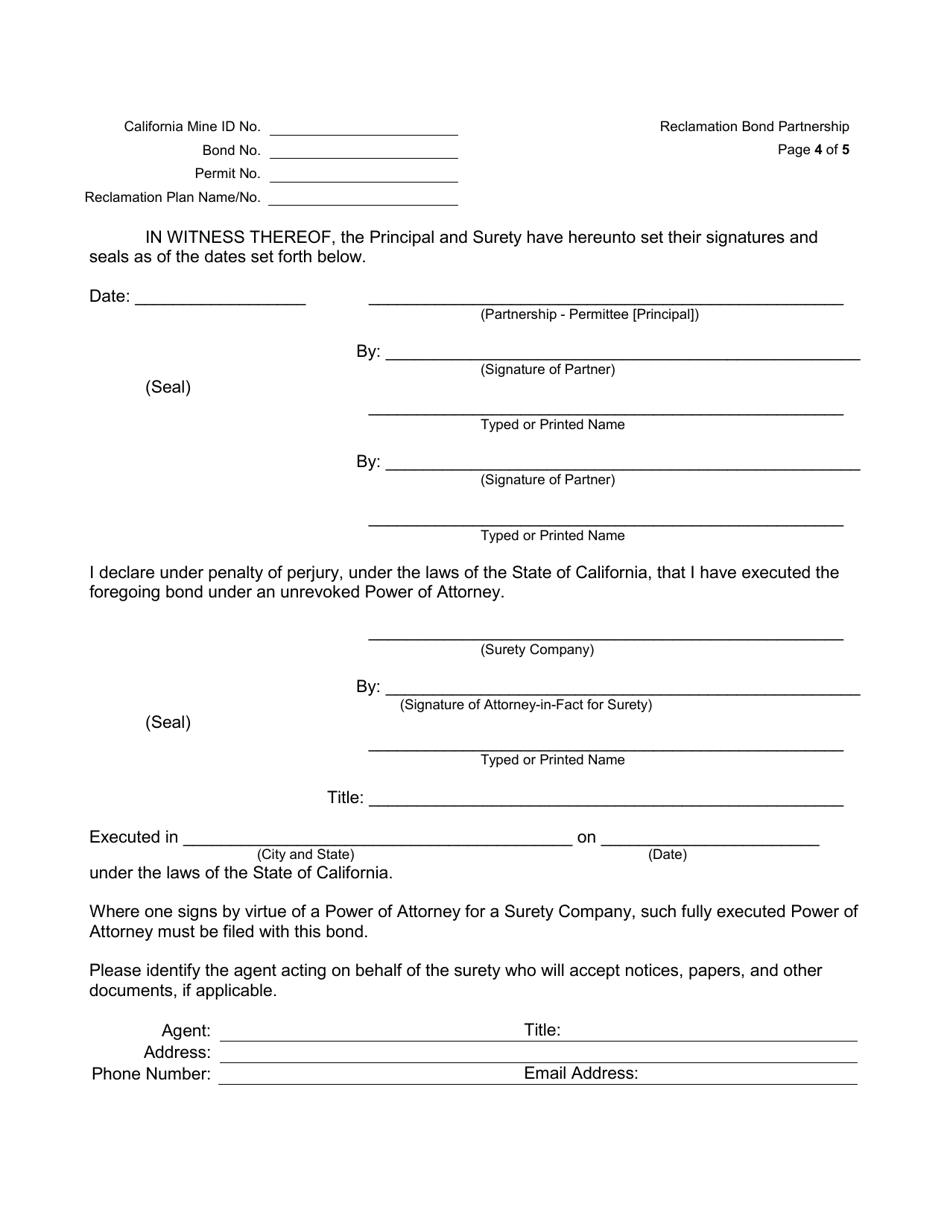

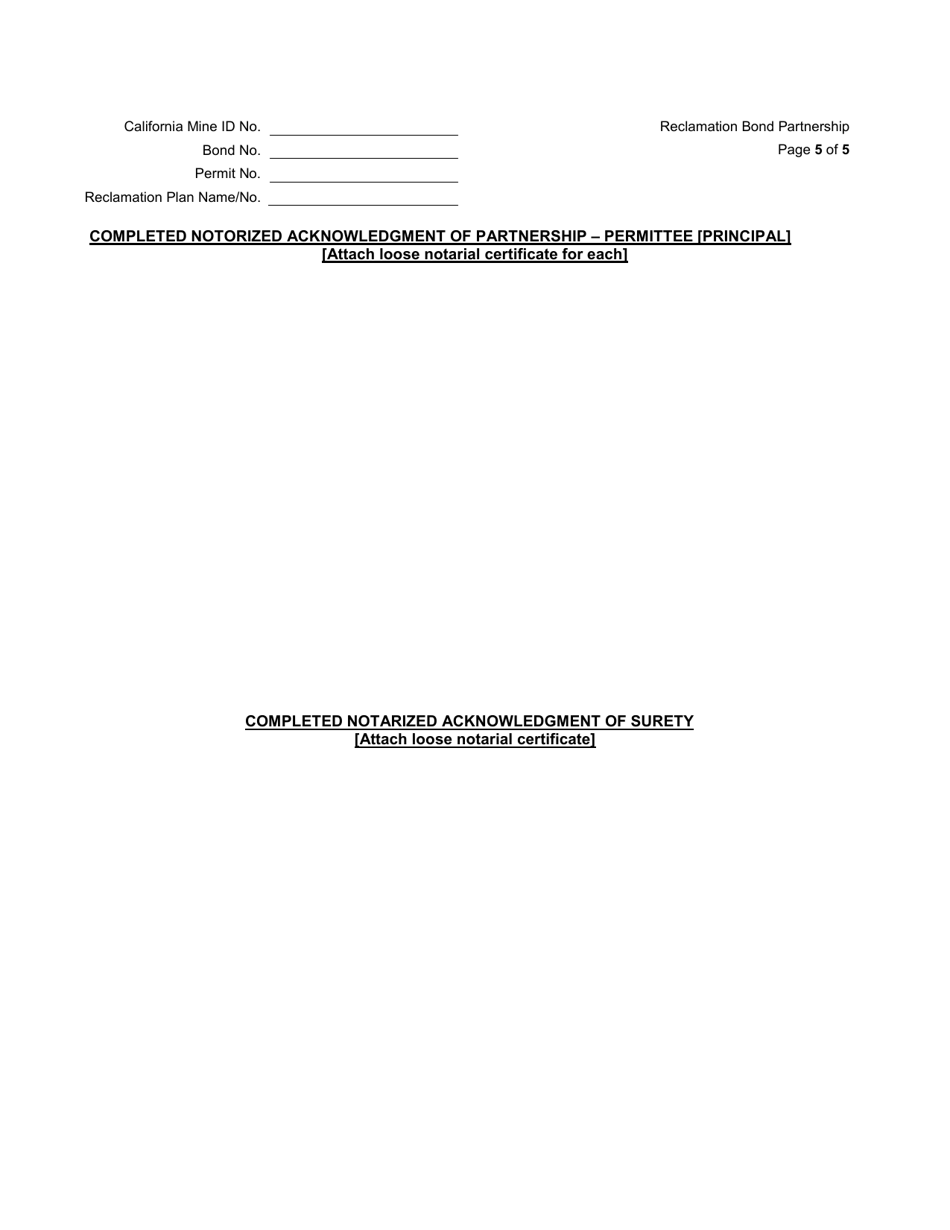

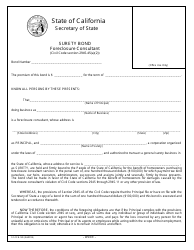

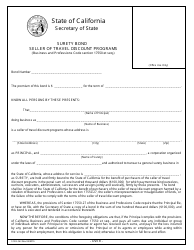

Surety Bond (Partnership) - California

Surety Bond (Partnership) is a legal document that was released by the California Department of Conservation - a government authority operating within California.

FAQ

Q: What is a surety bond?

A: A surety bond is a legal agreement between three parties: the principal (partnership), the obligee (government or private entity requiring the bond), and the surety (bonding company). It provides financial protection to the obligee in case the principal fails to fulfill their obligations.

Q: Why would a partnership need a surety bond in California?

A: Partnerships in California may be required to obtain a surety bond for various reasons, such as obtaining a license or permit, ensuring payment of taxes or employees' wages, or fulfilling contractual obligations.

Q: How much does a surety bond for a partnership in California cost?

A: The cost of a surety bond for a partnership in California depends on various factors, including the bond amount required, the partnership's financial stability, and the type of bond needed.

Q: Are surety bonds for partnerships in California refundable?

A: No, surety bonds for partnerships in California are not refundable. The premium paid for the bond is the cost of insurance coverage for the bond's duration.

Q: Is a surety bond the same as insurance?

A: No, a surety bond is not the same as insurance. While insurance protects the insured party, a surety bond protects the obligee (the party requiring the bond).

Form Details:

- The latest edition currently provided by the California Department of Conservation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Conservation.