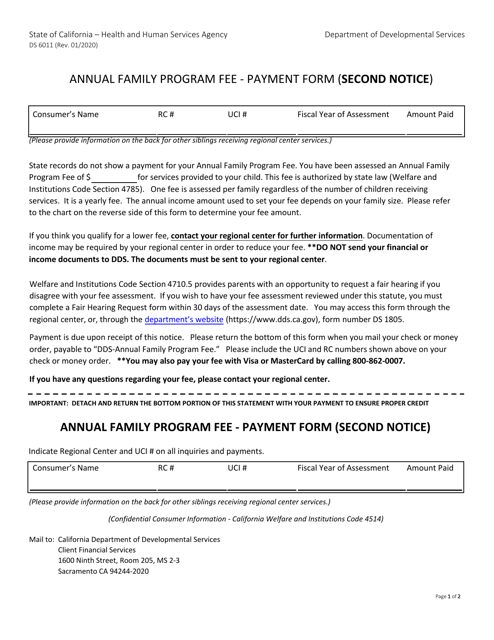

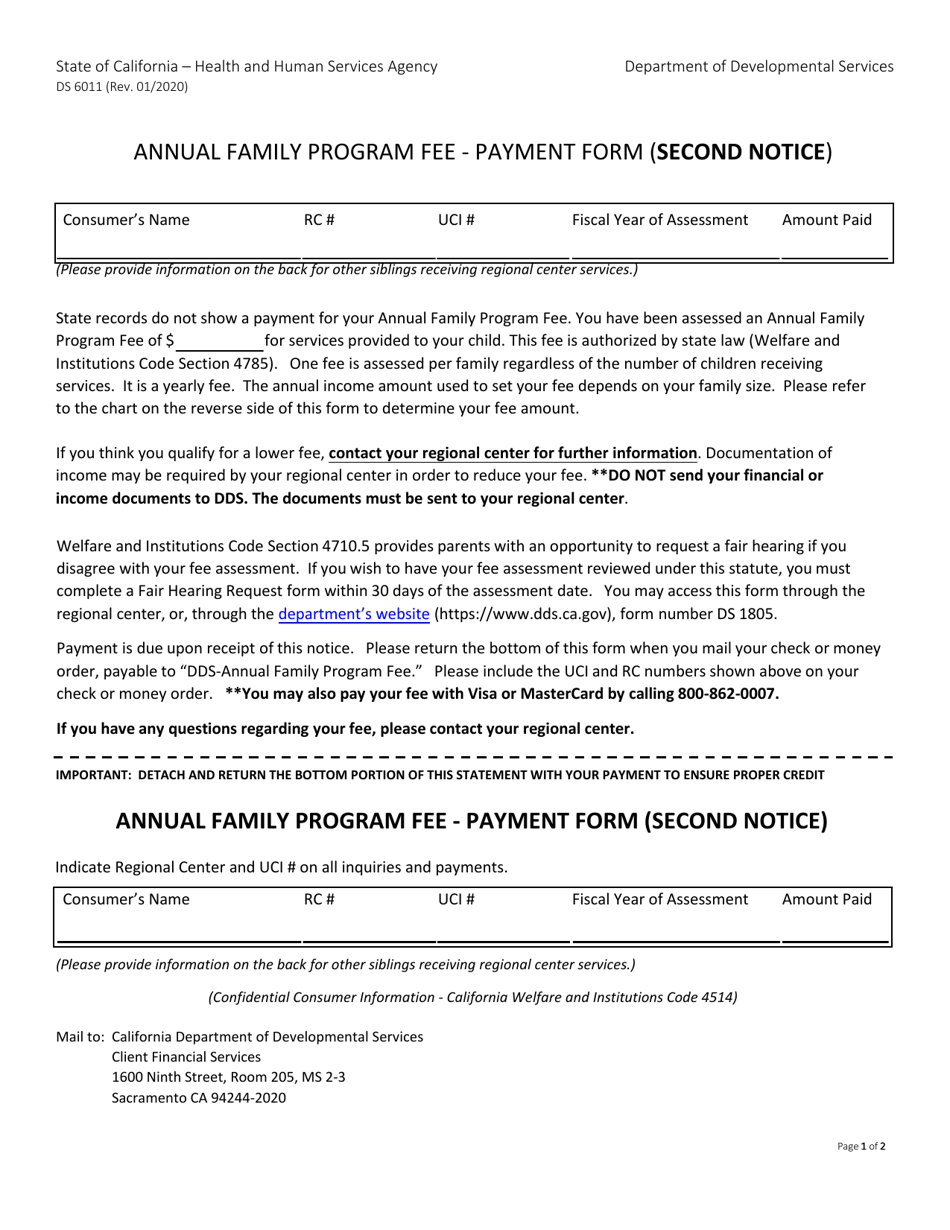

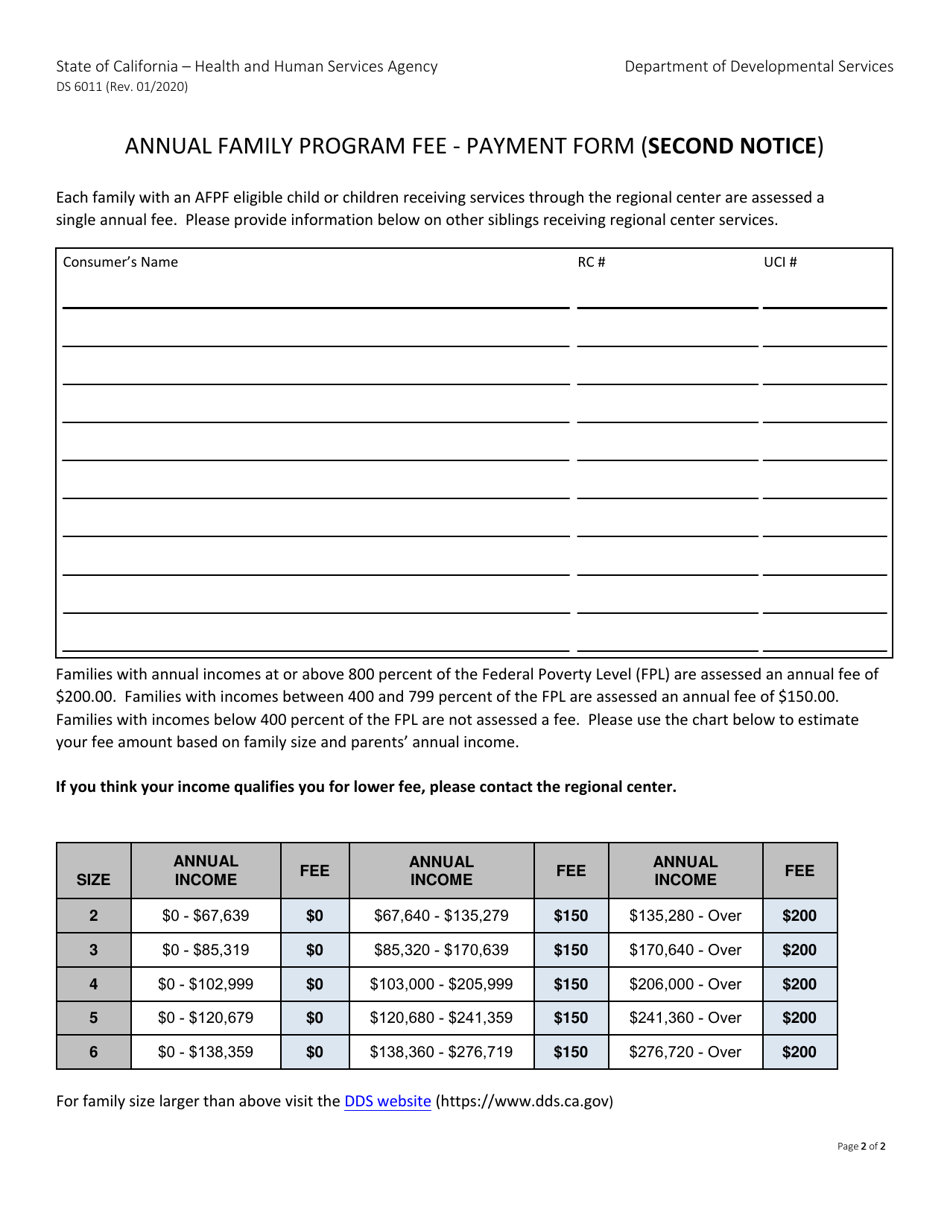

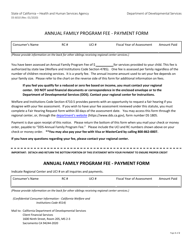

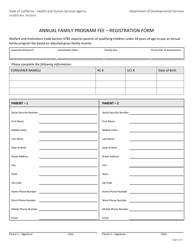

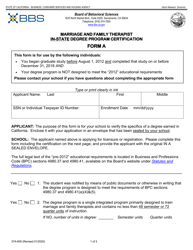

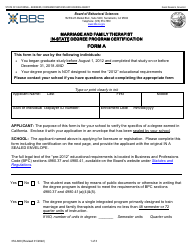

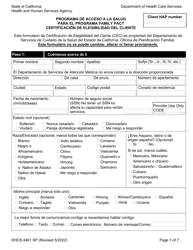

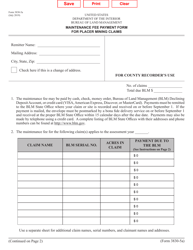

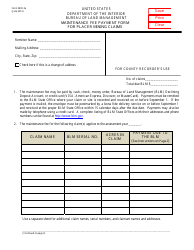

Form DS6011 Annual Family Program Fee - Payment Form (Second Notice) - California

What Is Form DS6011?

This is a legal form that was released by the California Department of Developmental Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

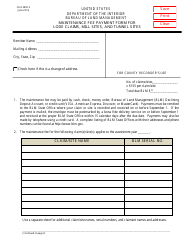

Q: What is Form DS6011?

A: Form DS6011 is the Annual Family Program Fee - Payment Form (Second Notice) for California.

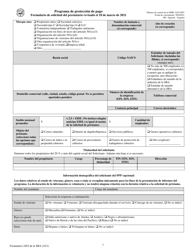

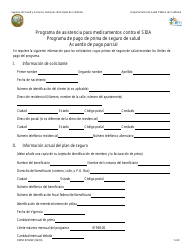

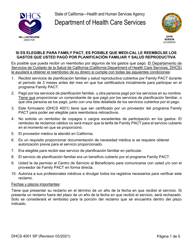

Q: What is the purpose of Form DS6011?

A: The purpose of Form DS6011 is to collect the annual family program fee in California.

Q: Who needs to file Form DS6011?

A: Anyone in California who is subject to the annual family program fee needs to file Form DS6011.

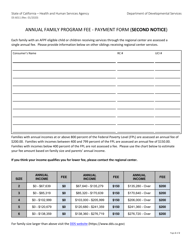

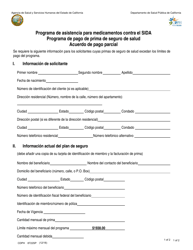

Q: What is the annual family program fee?

A: The annual family program fee is a fee imposed on certain individuals in California to support various family programs.

Q: Do I need to pay the annual family program fee?

A: If you are subject to the fee based on your income and family size, you need to pay the annual family program fee.

Q: When is Form DS6011 due?

A: The due date for Form DS6011 is specified on the form. Make sure to submit it before the deadline.

Q: What happens if I don't pay the annual family program fee?

A: If you fail to pay the annual family program fee, you may face penalties and enforcement actions.

Q: Can the annual family program fee be waived?

A: In some cases, you may be eligible for a waiver or a reduction of the annual family program fee. Contact the appropriate authorities for more information.

Q: Is the annual family program fee refundable?

A: No, the annual family program fee is not refundable once paid.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the California Department of Developmental Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DS6011 by clicking the link below or browse more documents and templates provided by the California Department of Developmental Services.