This version of the form is not currently in use and is provided for reference only. Download this version of

Form LLC-LP-11

for the current year.

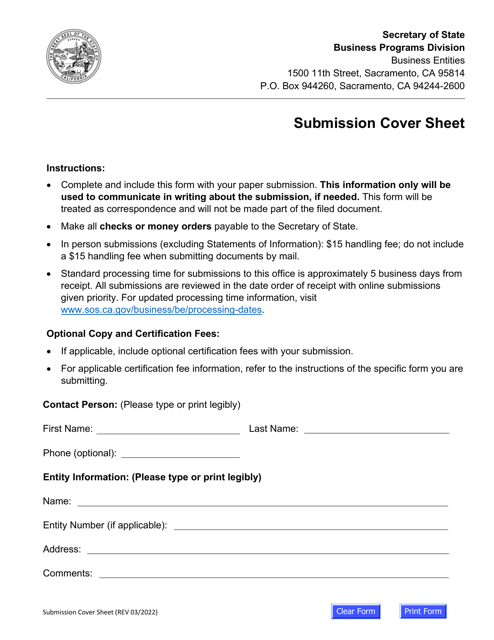

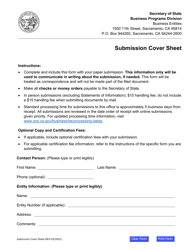

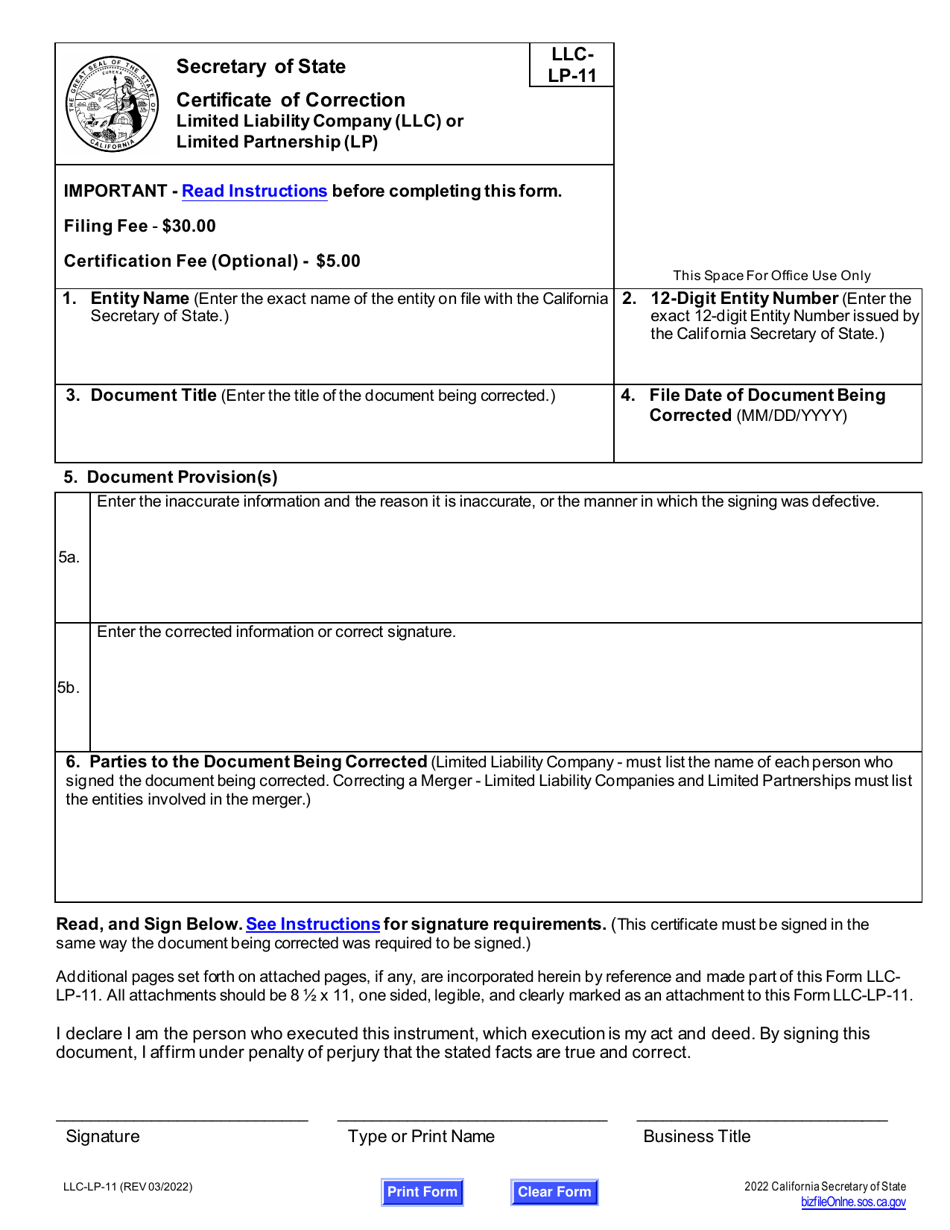

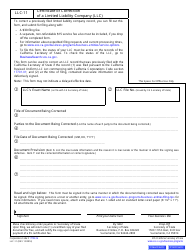

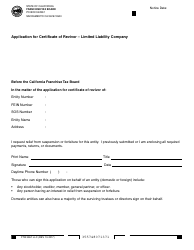

Form LLC-LP-11 Certificate of Correction - Limited Liability Company (LLC) or Limited Partnership (Lp) - California

What Is Form LLC-LP-11?

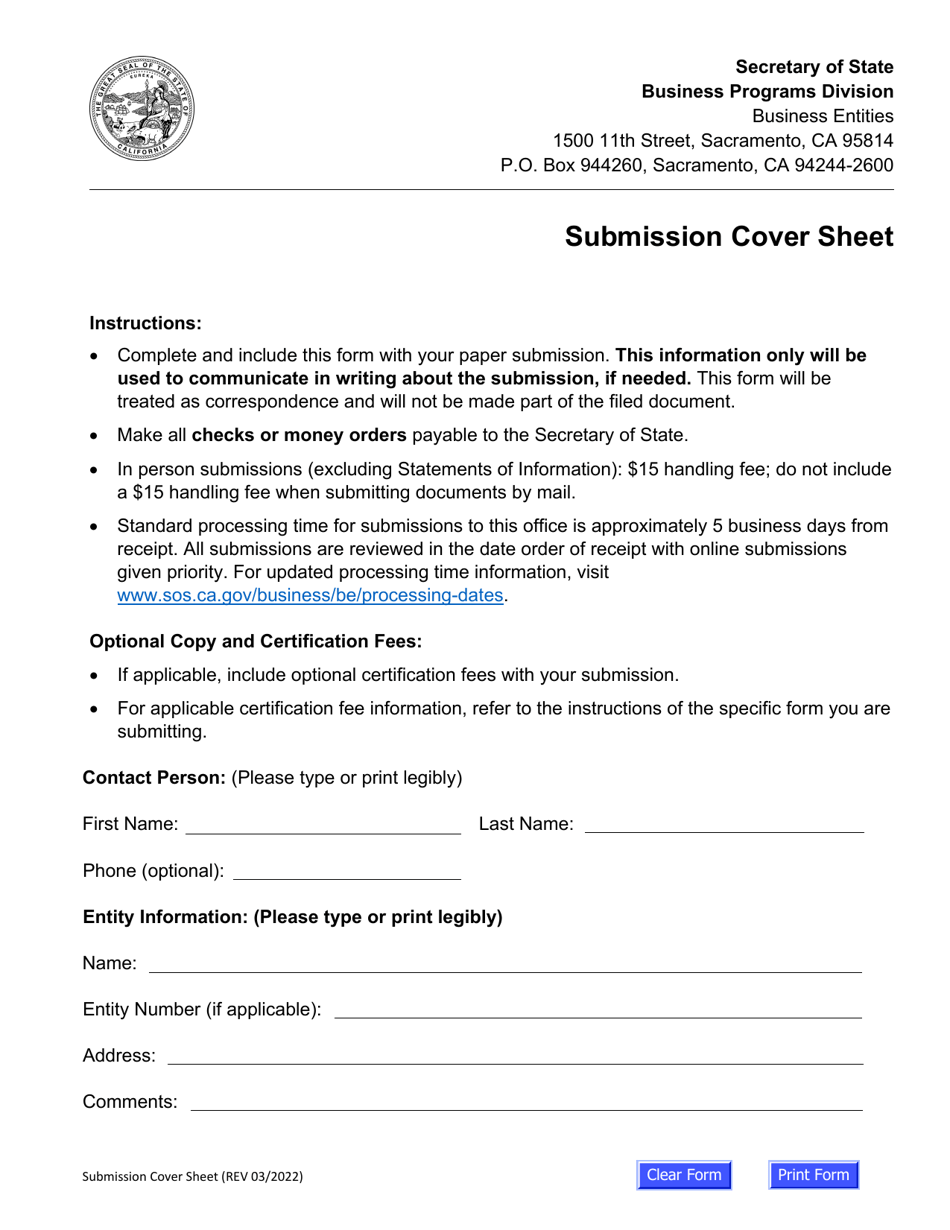

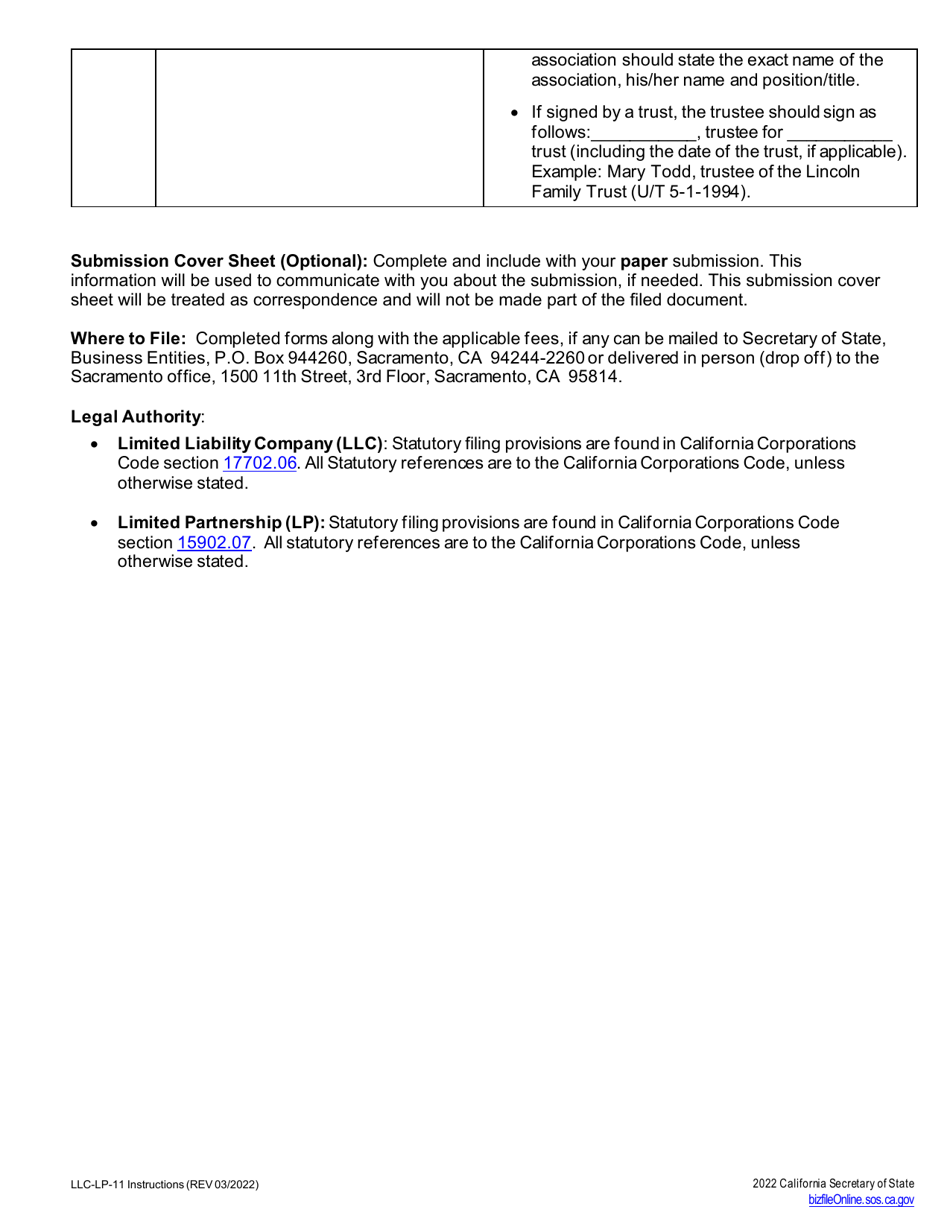

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

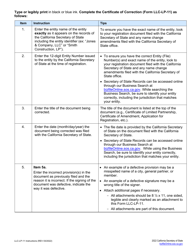

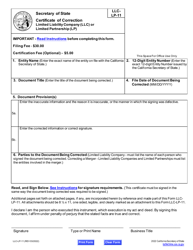

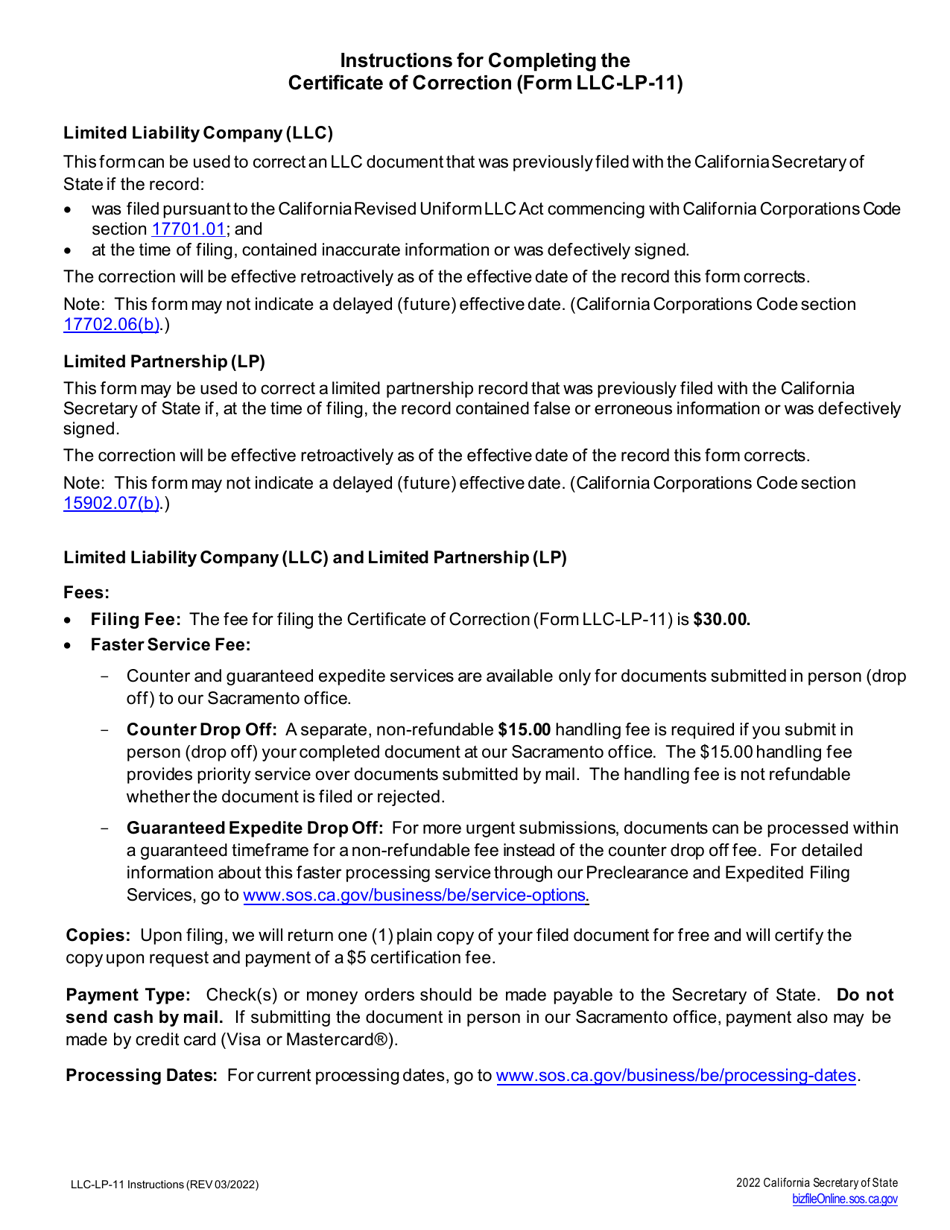

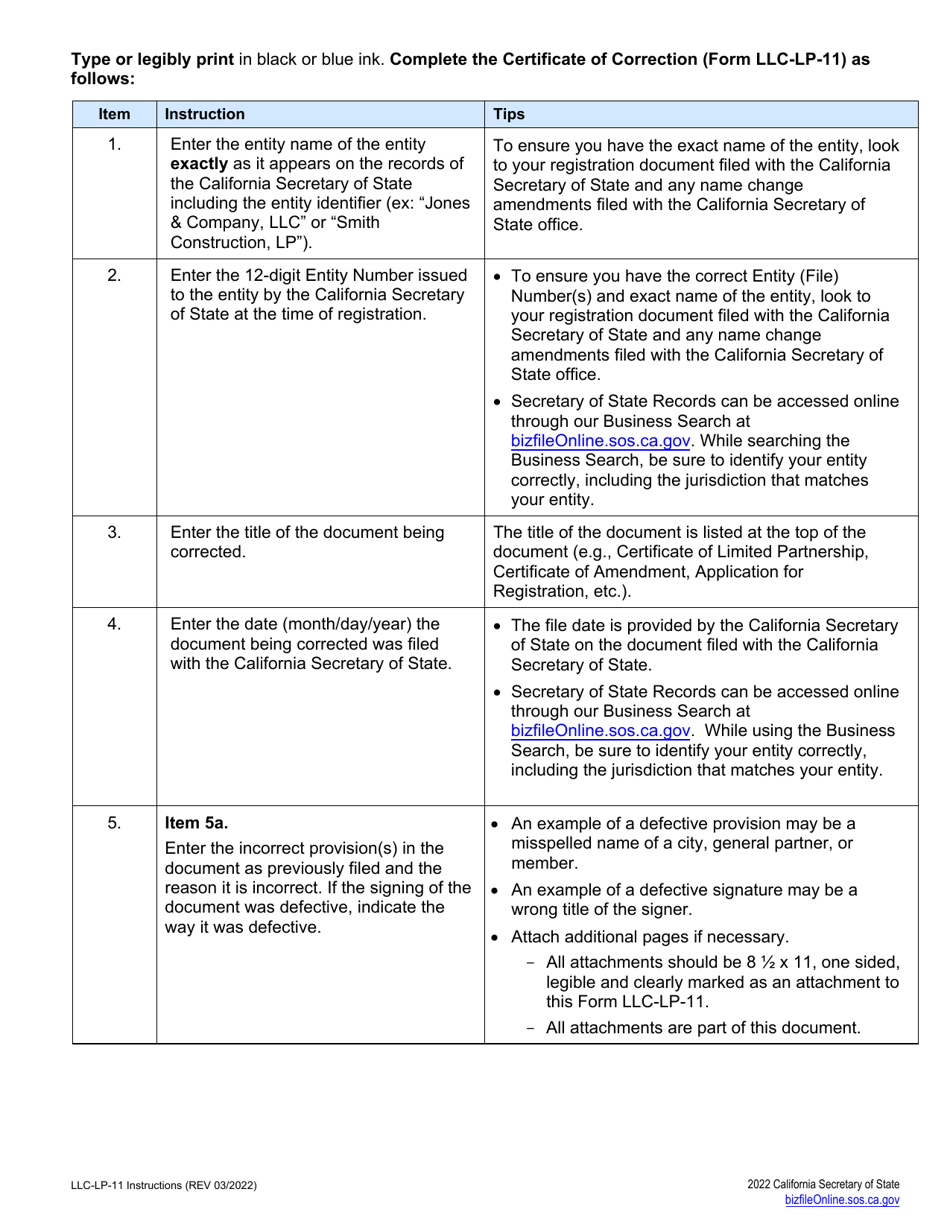

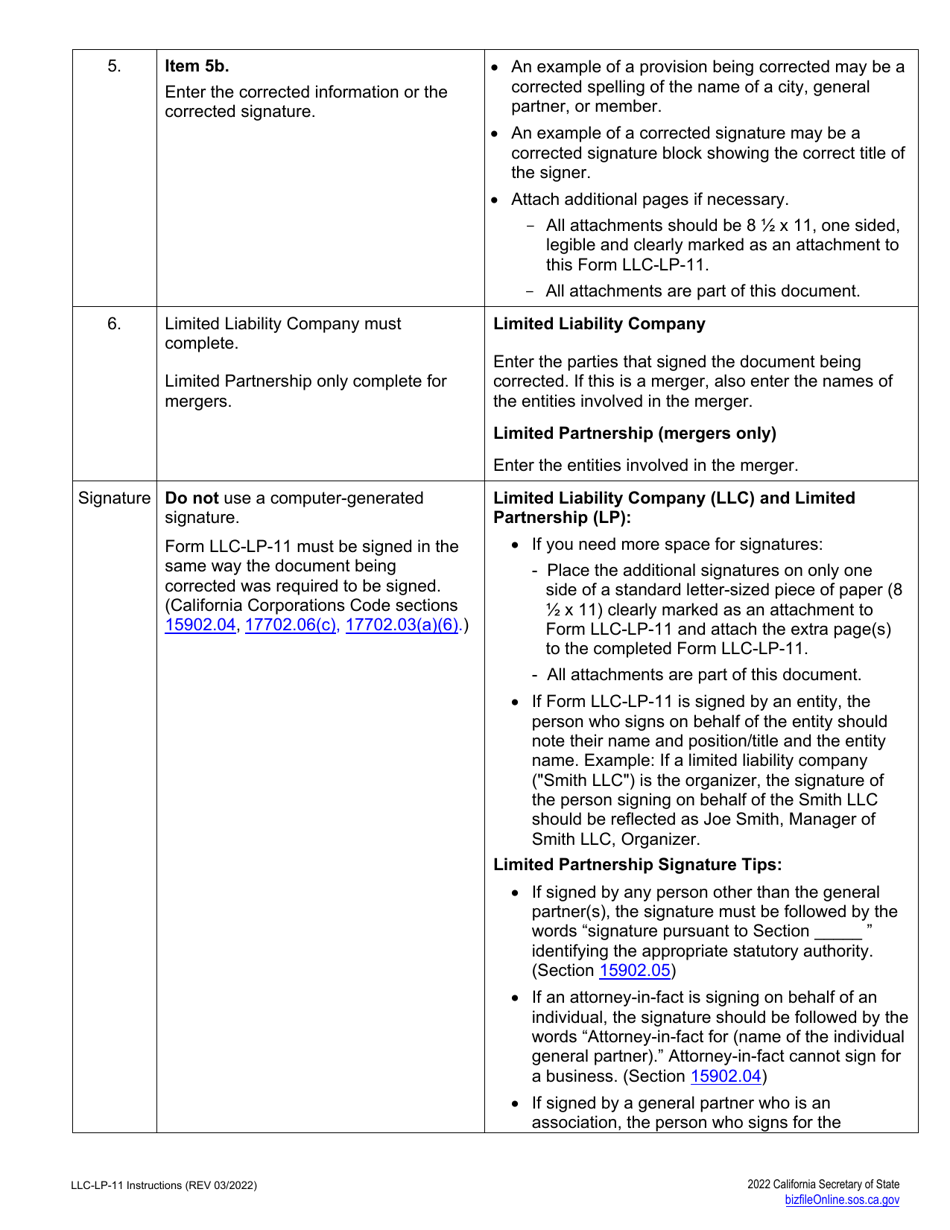

Q: What is the LLC-LP-11 Certificate of Correction?

A: The LLC-LP-11 Certificate of Correction is a form used in California for limited liability companies (LLCs) or limited partnerships (LPs) to correct certain information in their filed documents.

Q: When do I need to file the LLC-LP-11 Certificate of Correction?

A: You need to file the LLC-LP-11 Certificate of Correction when you need to correct information that was incorrect or omitted in your previously filed LLC or LP documents.

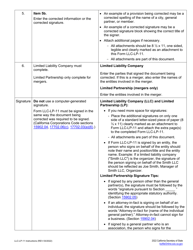

Q: What types of information can be corrected using the LLC-LP-11 Certificate of Correction?

A: The LLC-LP-11 Certificate of Correction can be used to correct various types of information, such as the name of the LLC or LP, its registered agent information, its principal office address, or the name and address of its officers.

Q: What is the filing fee for the LLC-LP-11 Certificate of Correction?

A: The filing fee for the LLC-LP-11 Certificate of Correction is $30.

Q: Is there a deadline for filing the LLC-LP-11 Certificate of Correction?

A: There is no specific deadline for filing the LLC-LP-11 Certificate of Correction, but it is recommended to file it as soon as you discover the error or omission.

Q: What happens after I file the LLC-LP-11 Certificate of Correction?

A: After you file the LLC-LP-11 Certificate of Correction, the California Secretary of State will review the form and make the necessary corrections or updates to your LLC or LP documents.

Q: Do I need to notify anyone else about the LLC-LP-11 Certificate of Correction filing?

A: No, there is no requirement to notify anyone else about the LLC-LP-11 Certificate of Correction filing. The Secretary of State will update the public records accordingly.

Q: Can I use the LLC-LP-11 Certificate of Correction form for other types of business entities?

A: No, the LLC-LP-11 Certificate of Correction form is specifically for limited liability companies (LLCs) or limited partnerships (LPs) in California. Other types of business entities have their own respective forms for correction purposes.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-LP-11 by clicking the link below or browse more documents and templates provided by the California Secretary of State.