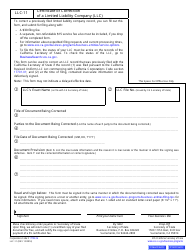

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CORR-CORP

for the current year.

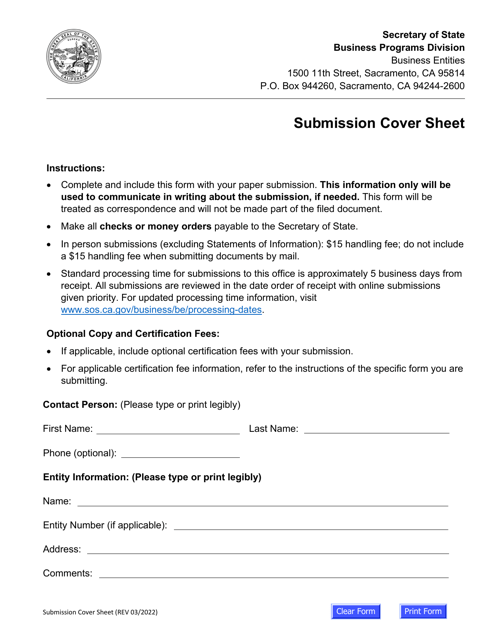

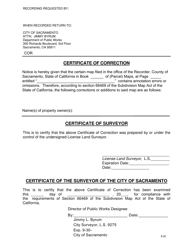

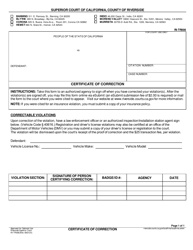

Form CORR-CORP Certificate of Correction - California

What Is Form CORR-CORP?

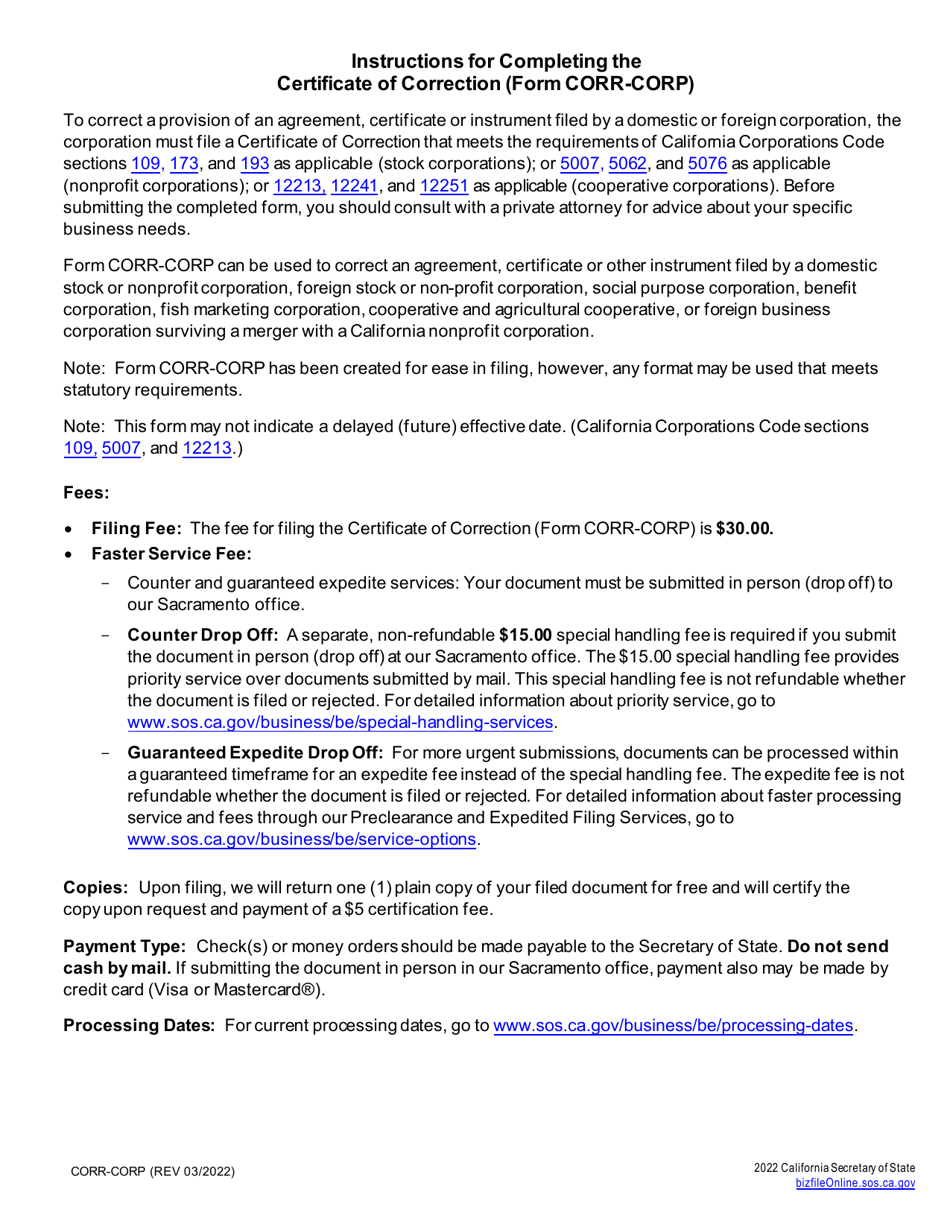

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

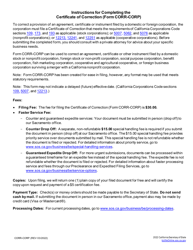

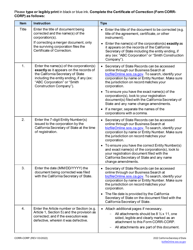

Q: What is a CORR-CORP certificate of correction?

A: A CORR-CORP certificate of correction is a document used in California to correct errors or provide additional information on a previously filed corporation document.

Q: When is a CORR-CORP certificate of correction needed?

A: A CORR-CORP certificate of correction is needed when there are errors or omissions in a previously filed corporation document in California.

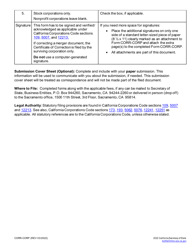

Q: How do I file a CORR-CORP certificate of correction?

A: To file a CORR-CORP certificate of correction, you need to complete the form with the correct information and submit it to the California Secretary of State.

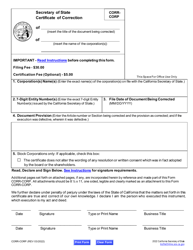

Q: What information is required in a CORR-CORP certificate of correction?

A: The CORR-CORP certificate of correction form requires information such as the corporation's name, entity number, and the specific information that needs to be corrected or added.

Q: Is there a fee for filing a CORR-CORP certificate of correction?

A: Yes, there is a fee for filing a CORR-CORP certificate of correction in California.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CORR-CORP by clicking the link below or browse more documents and templates provided by the California Secretary of State.