This version of the form is not currently in use and is provided for reference only. Download this version of

Form SI-550

for the current year.

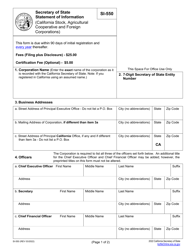

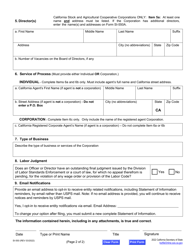

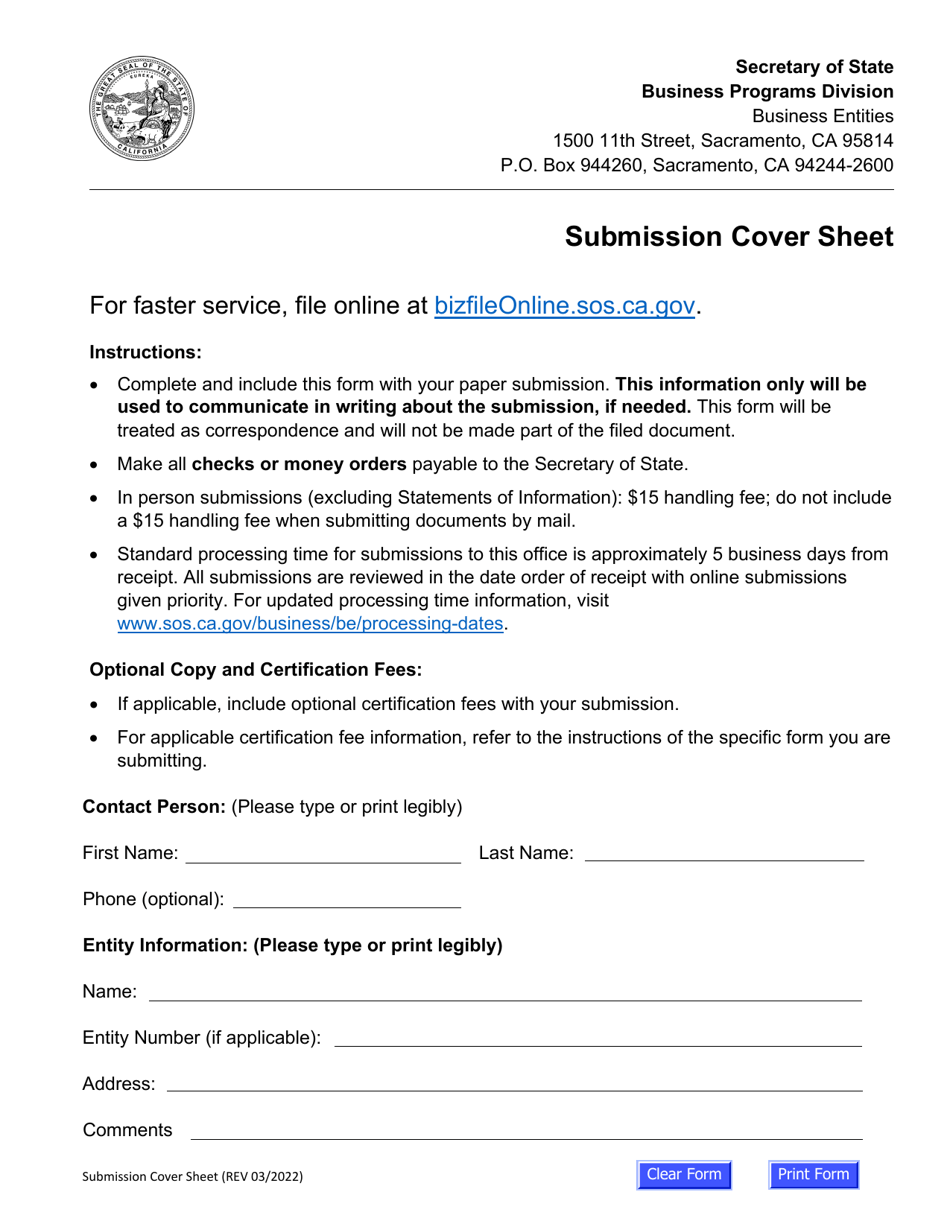

Form SI-550 Statement of Information (California Stock, Agricultural Cooperative and Foreign Corporations) - California

What Is Form SI-550?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

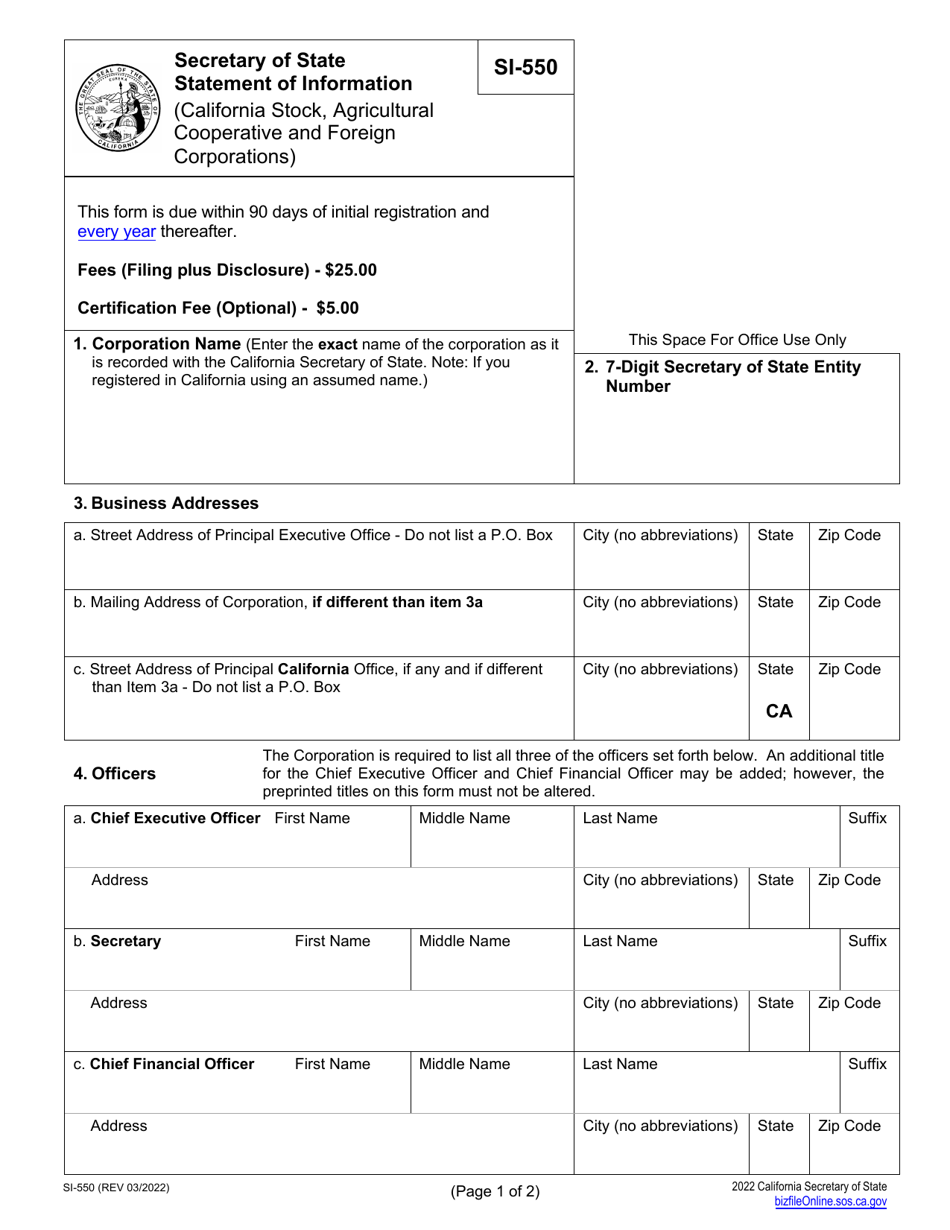

Q: What is Form SI-550?

A: Form SI-550 is a statement of information that needs to be filed by certain types of corporations in California.

Q: Which types of corporations need to file Form SI-550?

A: California Stock Corporations, Agricultural Cooperative Corporations, and Foreign Corporations that are qualified to transact business in California need to file Form SI-550.

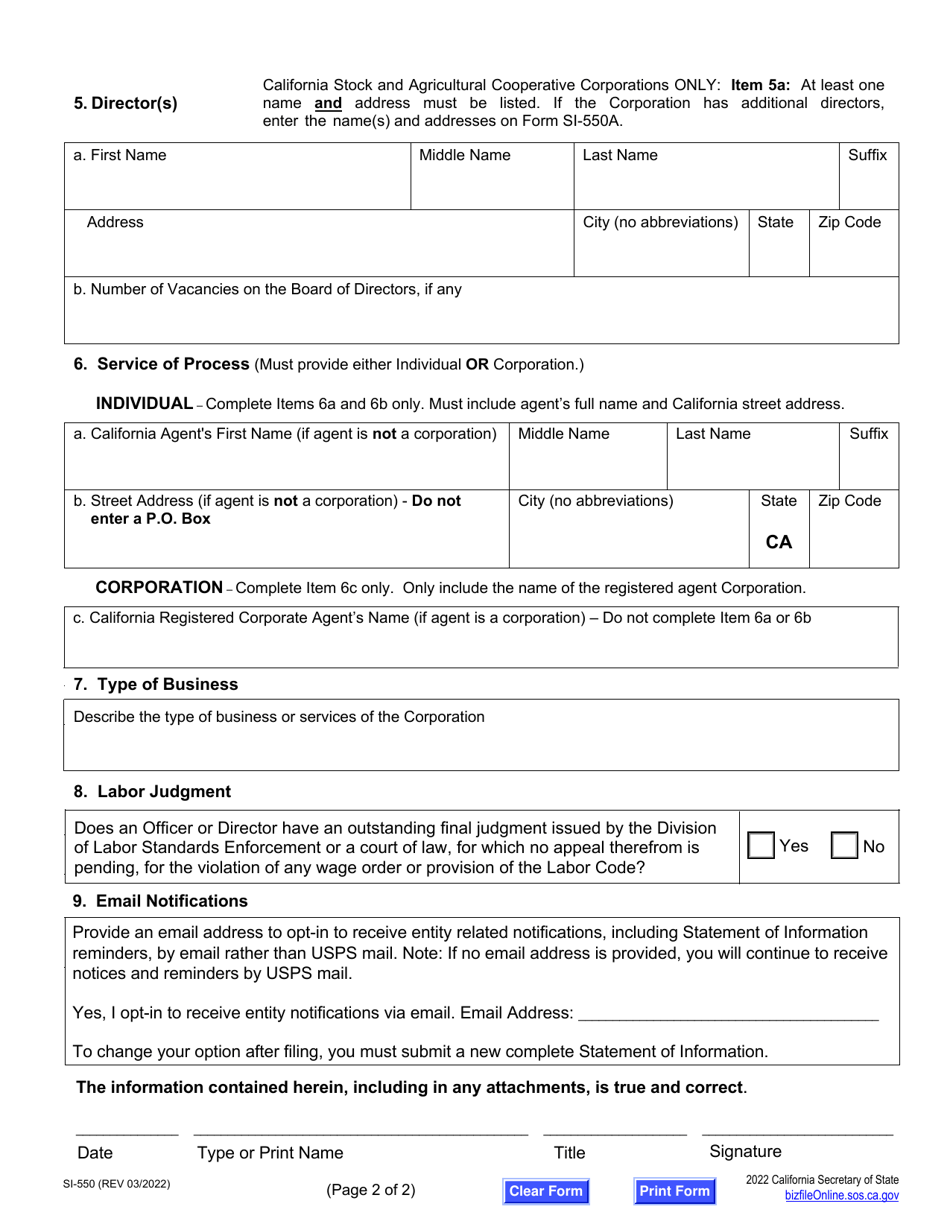

Q: What information is required on Form SI-550?

A: Form SI-550 requires information such as the corporation's name, address, registered agent, directors, and officers.

Q: How often does Form SI-550 need to be filed?

A: Form SI-550 needs to be filed within 90 days of the corporation's initial registration and then annually thereafter.

Q: What is the filing fee for Form SI-550?

A: The filing fee for Form SI-550 is $25 for stock corporations and $15 for agricultural cooperative corporations.

Q: Can the filing fee for Form SI-550 be waived?

A: No, the filing fee for Form SI-550 cannot be waived.

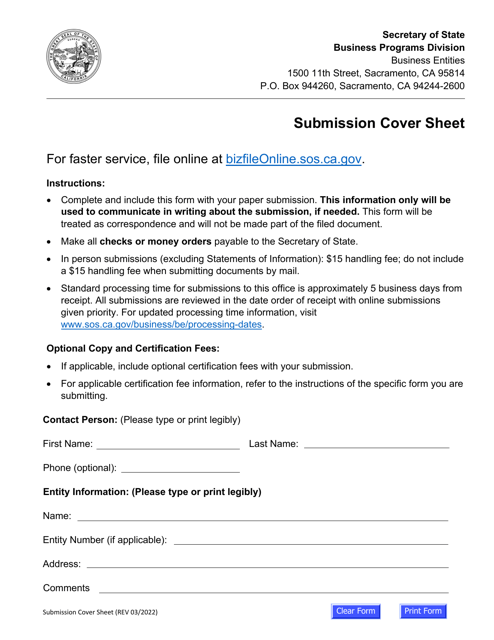

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-550 by clicking the link below or browse more documents and templates provided by the California Secretary of State.