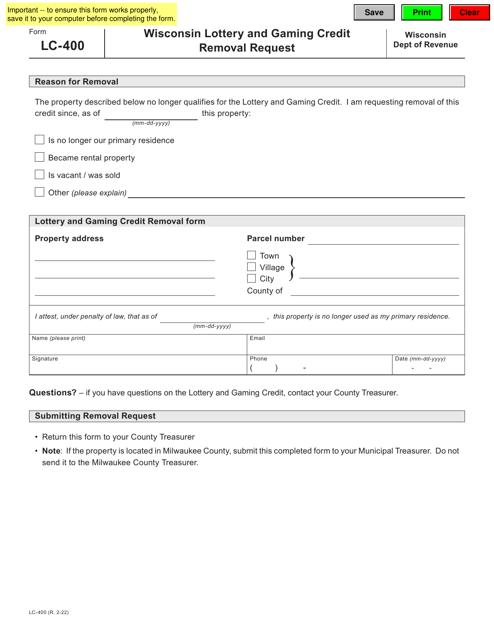

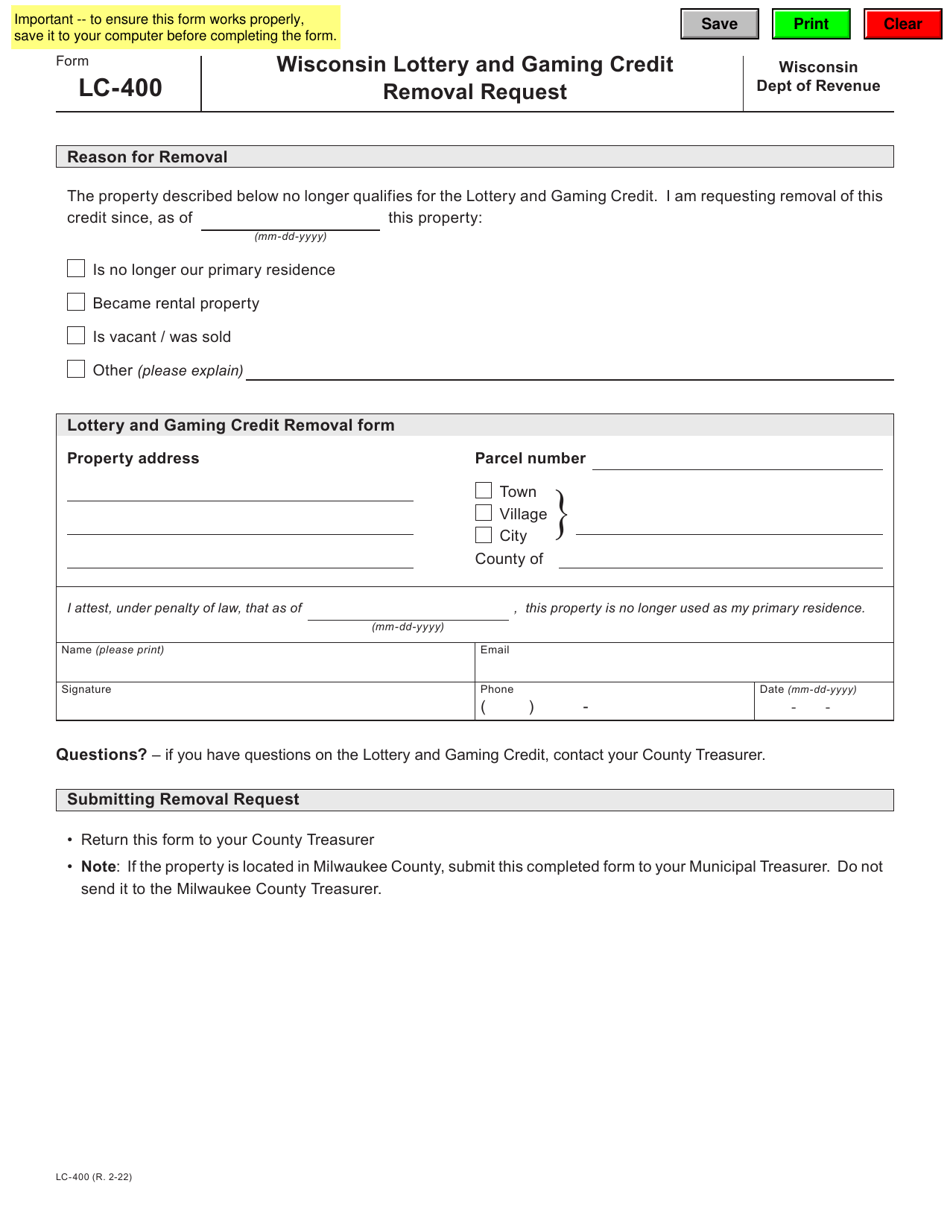

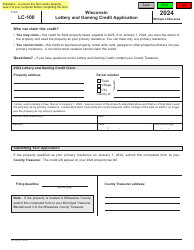

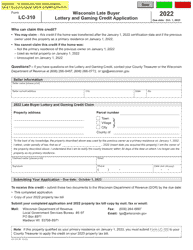

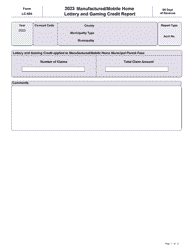

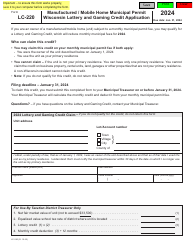

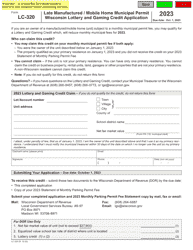

Form LC-400 Wisconsin Lottery and Gaming Credit Removal Request - Wisconsin

What Is Form LC-400?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LC-400?

A: Form LC-400 is the Wisconsin Lottery and Gaming Credit Removal Request Form.

Q: What is the purpose of Form LC-400?

A: The purpose of Form LC-400 is to request the removal of the Lottery and Gaming Credit from property tax bills in Wisconsin.

Q: Who needs to fill out Form LC-400?

A: Property owners in Wisconsin who no longer qualify for the Lottery and Gaming Credit need to fill out Form LC-400.

Q: When should I submit Form LC-400?

A: Form LC-400 should be submitted to your local county treasurer's office before the tax bill is issued.

Q: What information do I need to provide on Form LC-400?

A: You will need to provide your property's address, property identification number, and the reason for requesting the removal of the Lottery and Gaming Credit.

Q: Is there a deadline for submitting Form LC-400?

A: There is no specific deadline for submitting Form LC-400, but it is recommended to submit the form as soon as you no longer qualify for the Lottery and Gaming Credit.

Q: Will I be notified if my request to remove the Lottery and Gaming Credit is approved?

A: Yes, you will be notified by the county treasurer's office if your request to remove the Lottery and Gaming Credit is approved.

Q: Can I appeal if my request to remove the Lottery and Gaming Credit is denied?

A: Yes, you can appeal the denial of your request to remove the Lottery and Gaming Credit by contacting your local county treasurer's office.

Q: What will happen if I don't submit Form LC-400?

A: If you don't submit Form LC-400 and no longer qualify for the Lottery and Gaming Credit, you may be responsible for paying the credit amount on your property tax bill.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LC-400 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.