This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IC-024 Schedule 4W

for the current year.

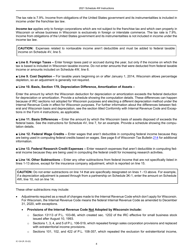

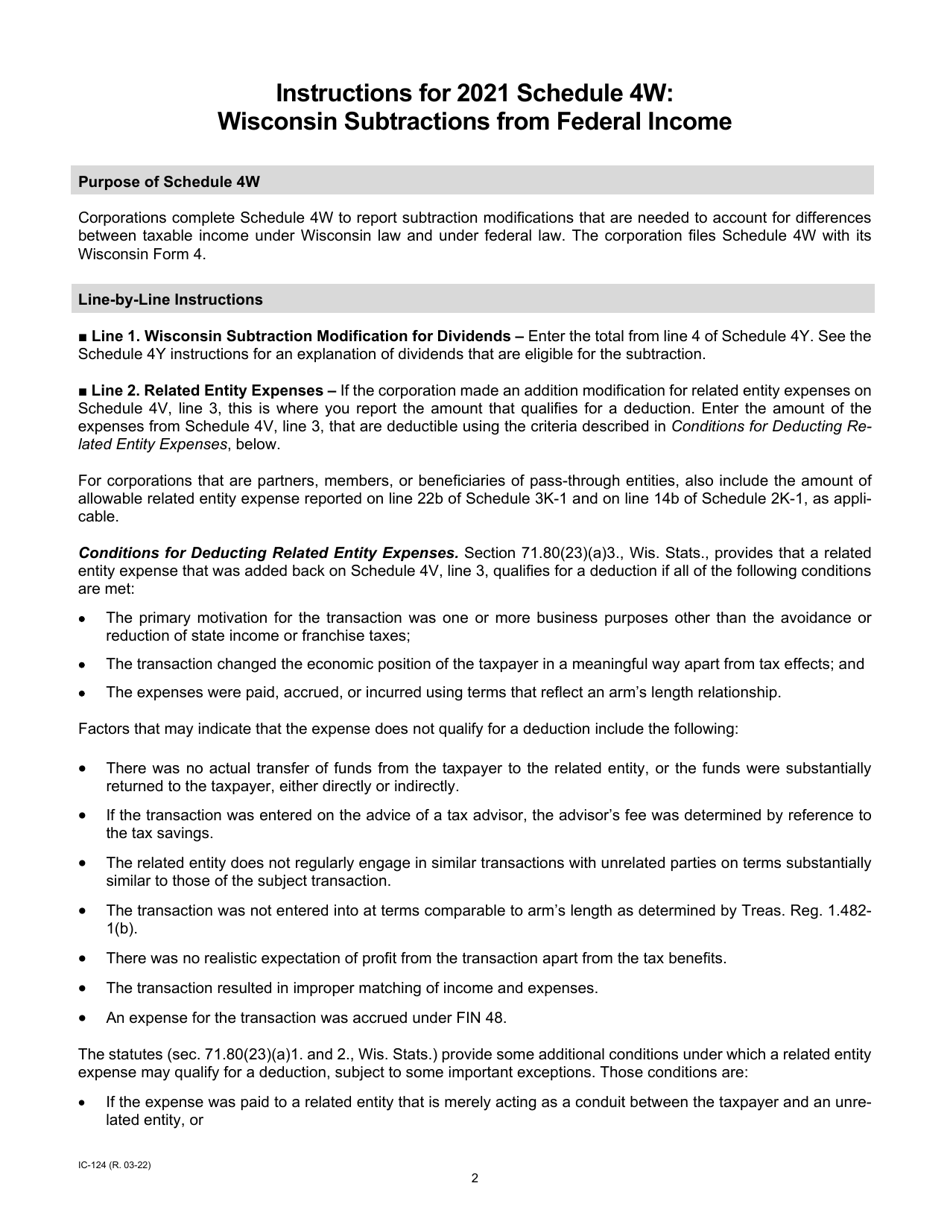

Instructions for Form IC-024 Schedule 4W Wisconsin Subtractions From Federal Income - Wisconsin

This document contains official instructions for Form IC-024 Schedule 4W, Wisconsin Subtractions From Federal Income - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form IC-024 Schedule 4W is available for download through this link.

FAQ

Q: What is Form IC-024 Schedule 4W?

A: Form IC-024 Schedule 4W is a tax form used in Wisconsin to report subtractions from federal income.

Q: What are Wisconsin Subtractions from Federal Income?

A: Wisconsin Subtractions from Federal Income are certain deductions that can be made to reduce your taxable income specifically for Wisconsin state tax purposes.

Q: What is the purpose of Form IC-024 Schedule 4W?

A: The purpose of Form IC-024 Schedule 4W is to calculate and report the specific subtractions from federal income that you are eligible to claim in Wisconsin.

Q: Who needs to file Form IC-024 Schedule 4W?

A: Anyone who has Wisconsin subtractions from federal income and is required to file a Wisconsin state tax return needs to include Form IC-024 Schedule 4W with their return.

Q: What documents do I need to complete Form IC-024 Schedule 4W?

A: You may need your federal tax return, including all related schedules. You may also need any specific documentation related to the subtractions you are claiming.

Q: Are there any filing deadlines for Form IC-024 Schedule 4W?

A: Form IC-024 Schedule 4W must be completed and included with your Wisconsin state tax return by the regular tax filing deadline, which is usually April 15th.

Q: Can I e-file Form IC-024 Schedule 4W?

A: Yes, you can e-file your Wisconsin state tax return, including Form IC-024 Schedule 4W, if you choose to do so. Check with your tax preparation software or service for further instructions.

Q: What if I make a mistake on Form IC-024 Schedule 4W?

A: If you make a mistake on Form IC-024 Schedule 4W, you may need to file an amended Wisconsin state tax return using Form WI-1040X to correct the error.

Instruction Details:

- This 10-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.