This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IC-032 Schedule DC

for the current year.

Instructions for Form IC-032 Schedule DC Wisconsin Development Zones Credits - Wisconsin

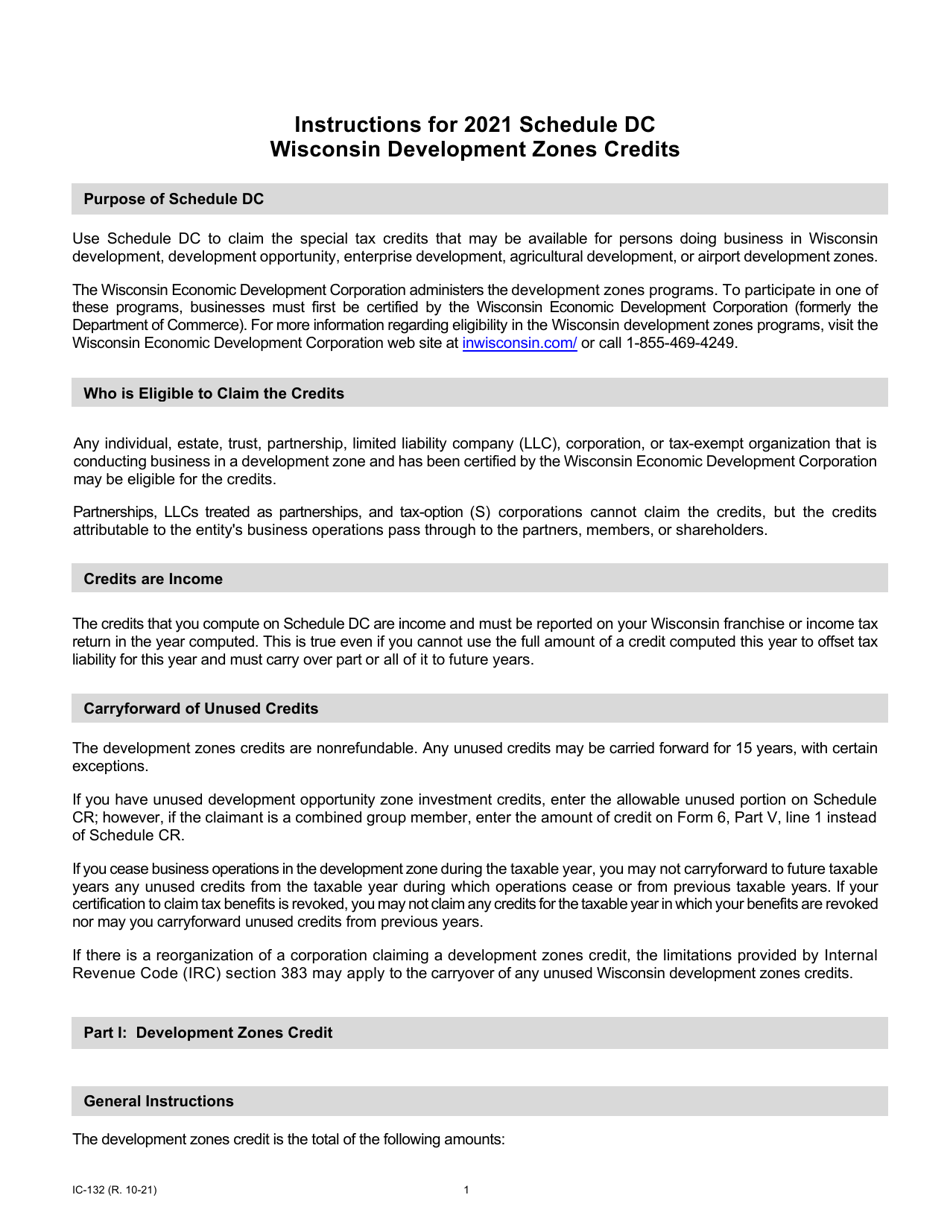

This document contains official instructions for Form IC-032 Schedule DC, Wisconsin Development Zones Credits - a form released and collected by the Wisconsin Department of Revenue. An up-to-date fillable Form IC-032 Schedule DC is available for download through this link.

FAQ

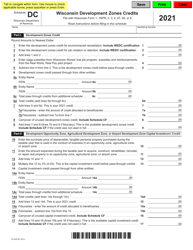

Q: What is Form IC-032 Schedule DC?

A: Form IC-032 Schedule DC is a tax form used in Wisconsin to claim the Development Zones Credits.

Q: What are the Wisconsin Development Zones Credits?

A: Wisconsin Development Zones Credits are credits provided by the state of Wisconsin to encourage economic development in designated areas.

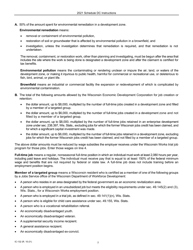

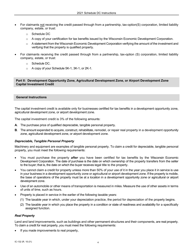

Q: Who is eligible to claim the Wisconsin Development Zones Credits?

A: Taxpayers who meet the eligibility criteria and have incurred eligible expenses in a designated development zone in Wisconsin are eligible to claim these credits.

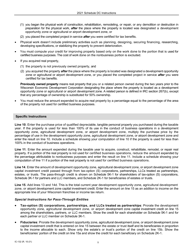

Q: What expenses qualify for the Wisconsin Development Zones Credits?

A: Eligible expenses include investments in new buildings, equipment, and infrastructure in designated development zones in Wisconsin.

Q: How can I claim the Wisconsin Development Zones Credits?

A: You can claim the credits by filling out Form IC-032 Schedule DC and attaching it to your Wisconsin tax return.

Q: What supporting documents do I need to submit with Form IC-032 Schedule DC?

A: You may be required to submit documentation such as receipts, invoices, and proof of eligible expenses to support your claim for the Wisconsin Development Zones Credits.

Q: Are there any deadlines for claiming the Wisconsin Development Zones Credits?

A: Yes, the deadline for claiming the credits is typically the same as the deadline for filing your Wisconsin tax return.

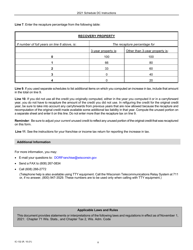

Q: Can I carry forward unused Wisconsin Development Zones Credits?

A: Yes, unused credits can be carried forward for up to 15 years.

Q: Are there any limitations or restrictions for claiming the Wisconsin Development Zones Credits?

A: Yes, there may be limitations on the amount of credits you can claim based on your tax liability and the availability of credits in the designated development zone.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.