This version of the form is not currently in use and is provided for reference only. Download this version of

Form U (DC-033)

for the current year.

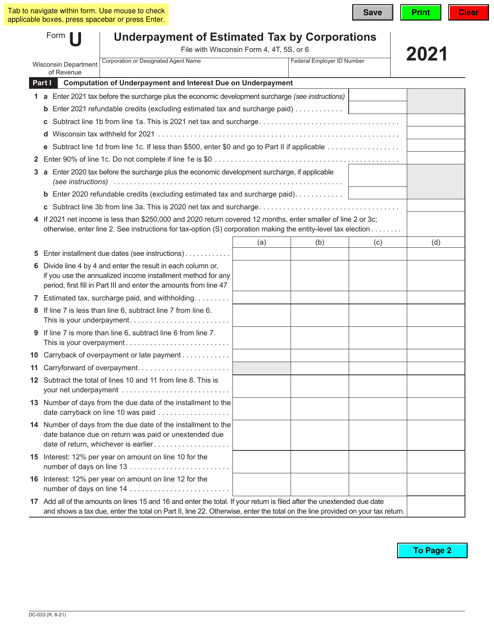

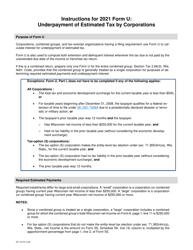

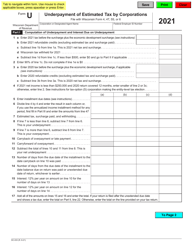

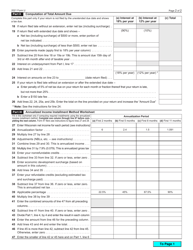

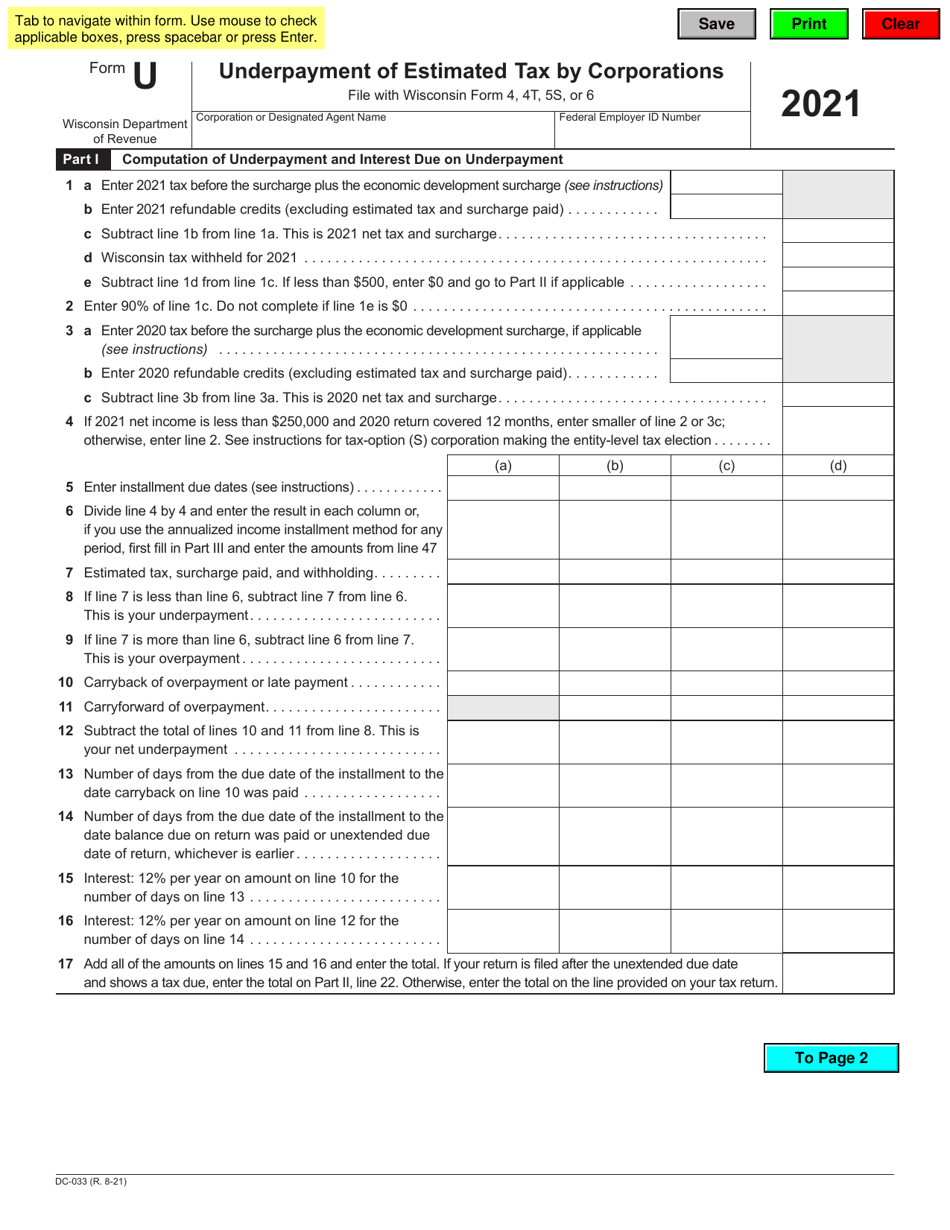

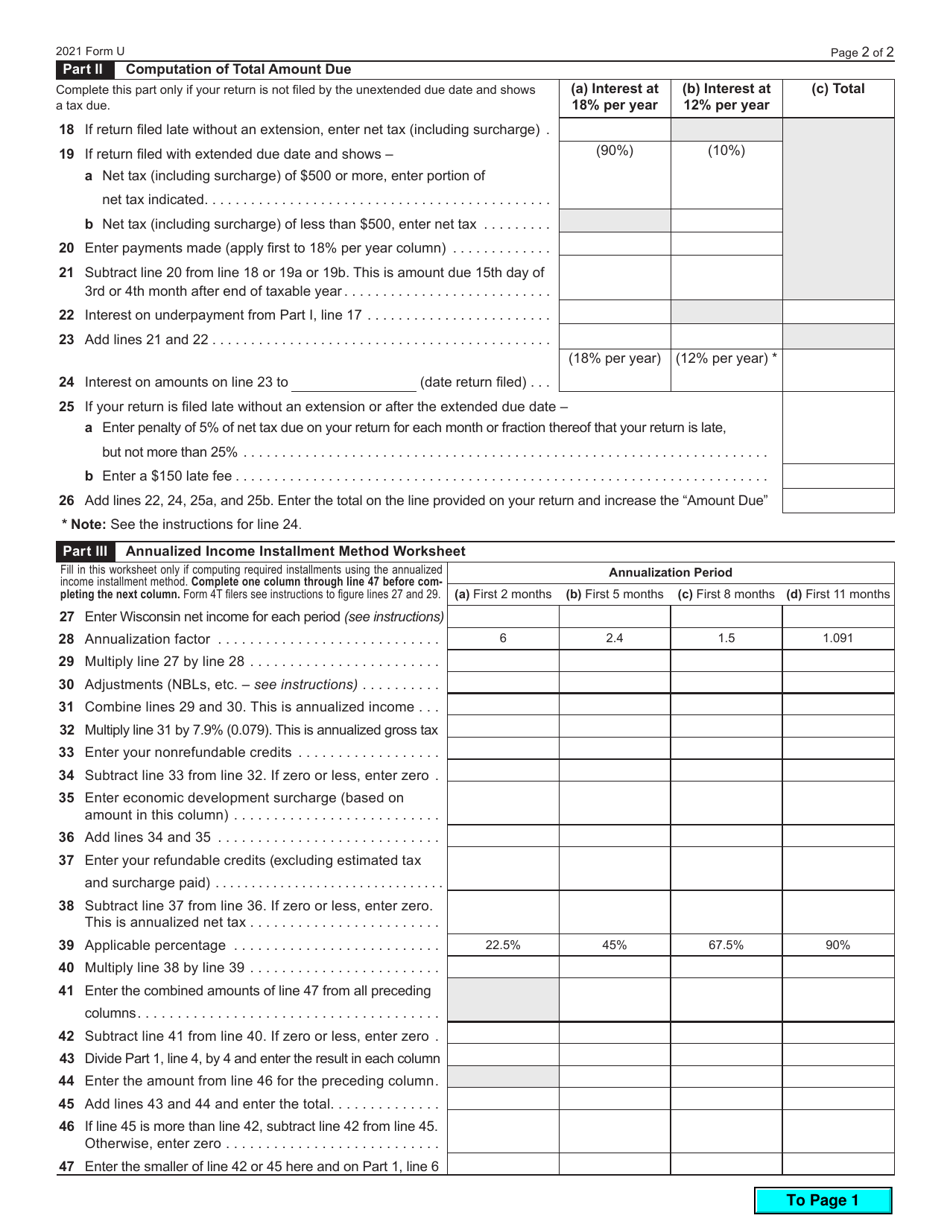

Form U (DC-033) Underpayment of Estimated Tax by Corporations - Wisconsin

What Is Form U (DC-033)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form U (DC-033)?

A: Form U (DC-033) is the form used by corporations in Wisconsin to report underpayment of estimated tax.

Q: Who should use Form U (DC-033)?

A: Corporations in Wisconsin that have underpaid their estimated tax should use Form U (DC-033).

Q: What is the purpose of Form U (DC-033)?

A: The purpose of Form U (DC-033) is to calculate and report the amount of underpayment of estimated tax by corporations in Wisconsin.

Q: When is Form U (DC-033) due?

A: Form U (DC-033) is due on or before the due date of the corporation's tax return, including extensions.

Q: Is there a penalty for underpayment of estimated tax in Wisconsin?

A: Yes, there is a penalty for underpayment of estimated tax in Wisconsin. The penalty amount is calculated based on the underpayment amount and the interest rate.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form U (DC-033) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.