This version of the form is not currently in use and is provided for reference only. Download this version of

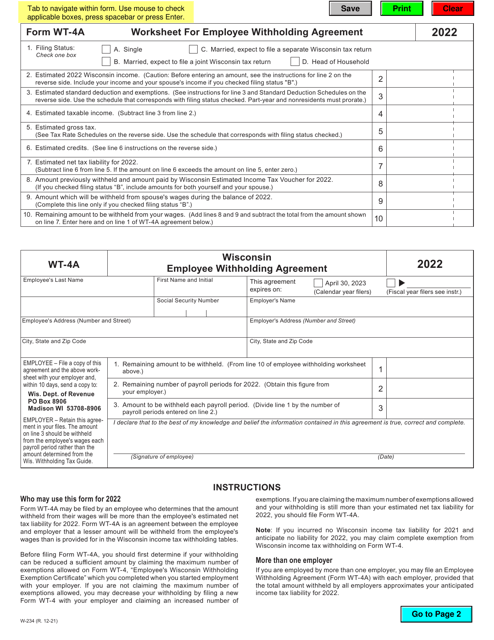

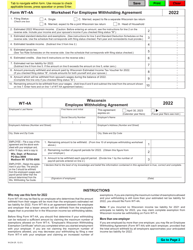

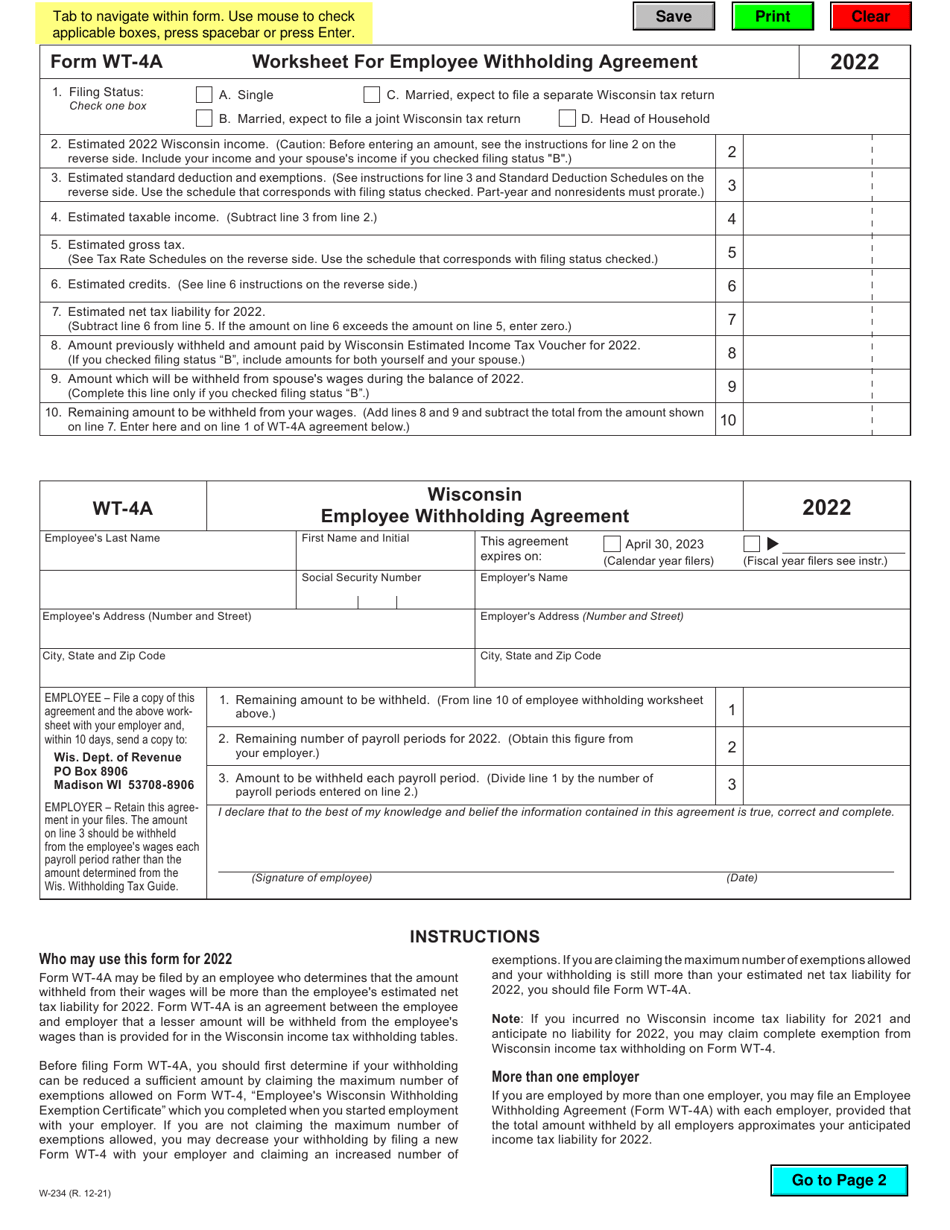

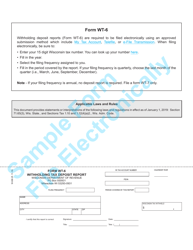

Form WT-4A (W-234)

for the current year.

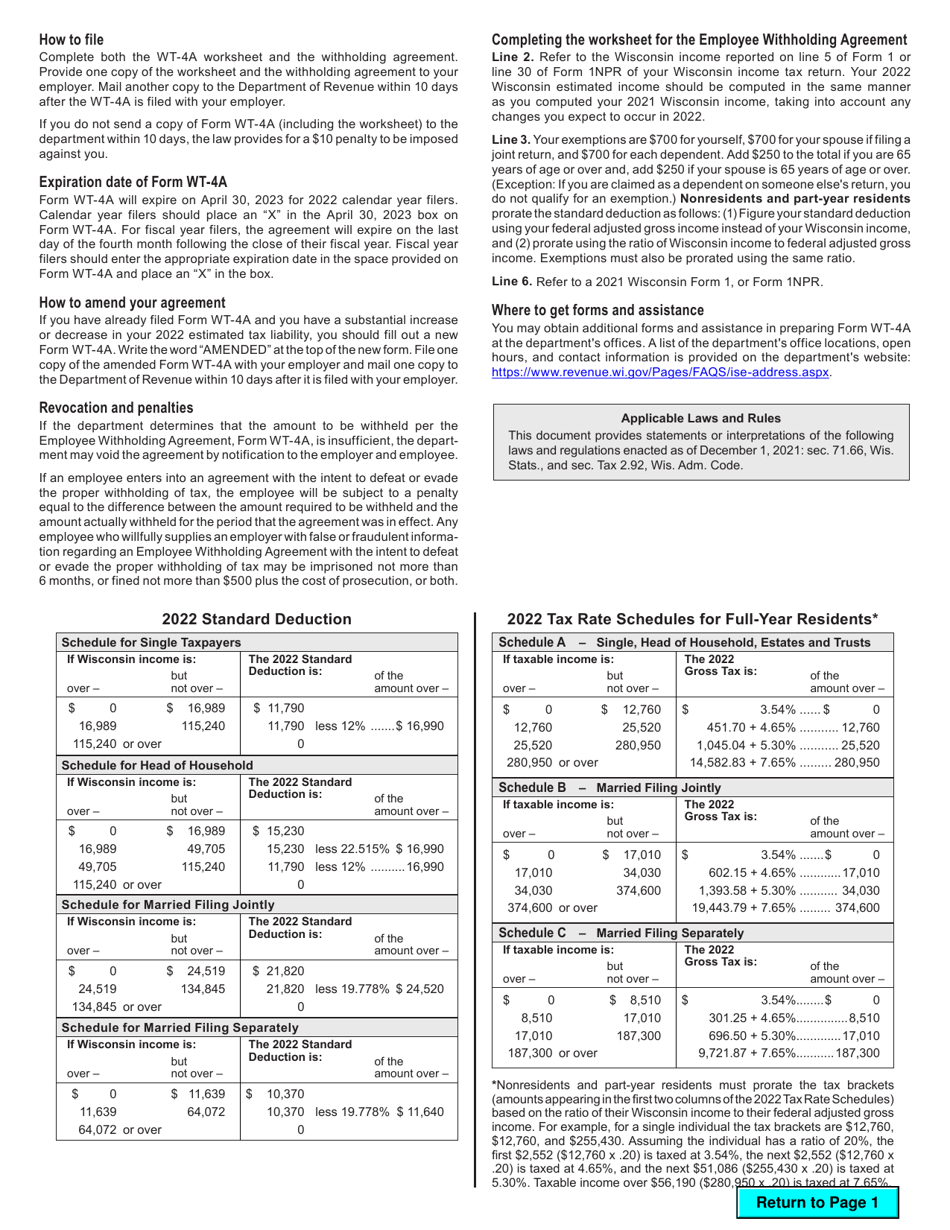

Form WT-4A (W-234) Worksheet for Employee Withholding Agreement - Wisconsin

What Is Form WT-4A (W-234)?

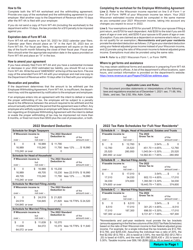

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT-4A?

A: Form WT-4A is a worksheet for employee withholding agreement in Wisconsin.

Q: What is the purpose of Form WT-4A?

A: The purpose of Form WT-4A is to determine the amount of Wisconsin income tax to be withheld from an employee's wages.

Q: Who needs to complete Form WT-4A?

A: Employees who work in Wisconsin and want to have additional incometax withheld from their wages need to complete Form WT-4A.

Q: What information is required on Form WT-4A?

A: Form WT-4A requires information such as the employee's name, social security number, filing status, allowances, and additional withholding amount.

Q: Is Form WT-4A mandatory?

A: No, Form WT-4A is not mandatory. It is optional for employees who want to have additional withholding for Wisconsin income tax.

Q: How often should Form WT-4A be completed?

A: Form WT-4A should be completed whenever there is a change in the employee's withholding status or when the employee wants to have additional withholding.

Q: Can Form WT-4A be amended?

A: Yes, if there is a change in the employee's withholding status or the employee wants to change the additional withholding amount, a new Form WT-4A can be submitted.

Q: What should I do with Form WT-4A once completed?

A: The completed Form WT-4A should be submitted to the employer's payroll department.

Q: Are there any penalties for not completing Form WT-4A?

A: There are no penalties for not completing Form WT-4A. However, failure to have enough tax withheld may result in owing additional taxes when filing the Wisconsin income tax return.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WT-4A (W-234) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.