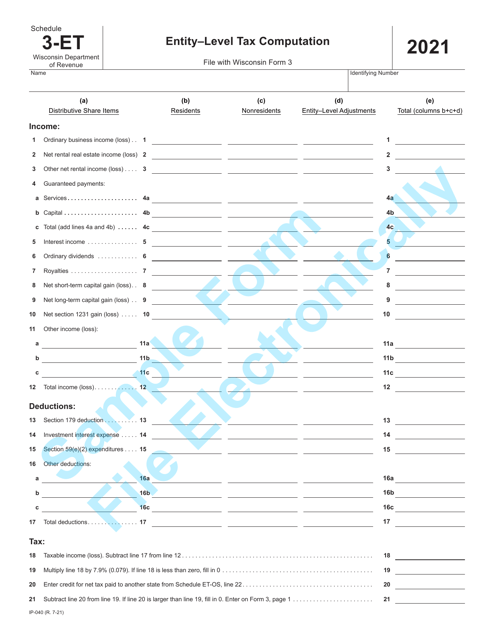

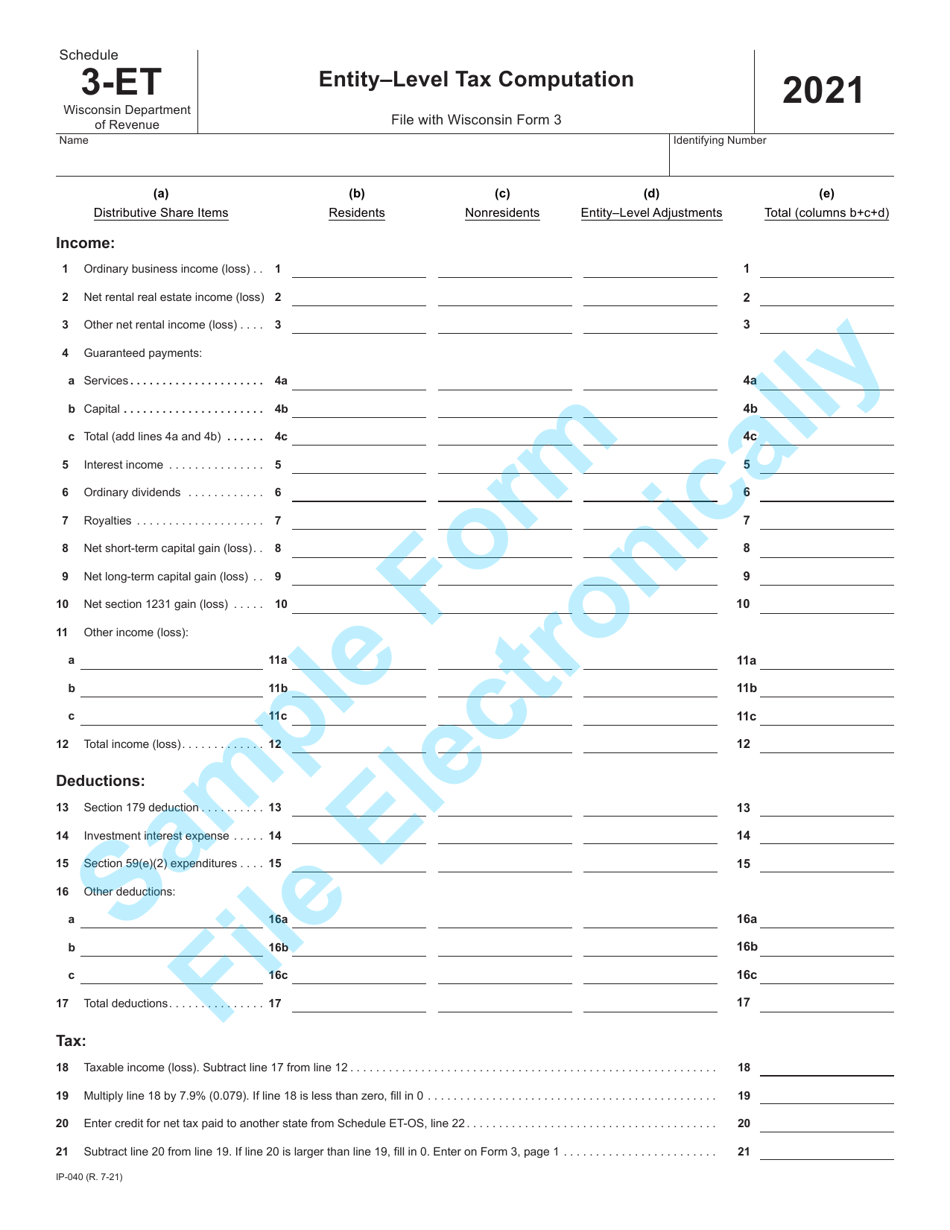

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IP-040 Schedule 3-ET

for the current year.

Form IP-040 Schedule 3-ET Entity-Level Tax Computation - Sample - Wisconsin

What Is Form IP-040 Schedule 3-ET?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IP-040 Schedule 3-ET?

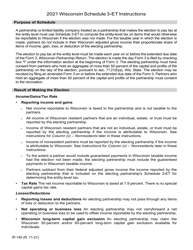

A: Form IP-040 Schedule 3-ET is a form used to compute entity-level tax in Wisconsin.

Q: What is entity-level tax?

A: Entity-level tax is a tax imposed on an entity, such as a corporation or partnership, rather than on its individual owners.

Q: Who needs to file Form IP-040 Schedule 3-ET?

A: Entities subject to entity-level tax in Wisconsin need to file Form IP-040 Schedule 3-ET.

Q: What information is required to complete Form IP-040 Schedule 3-ET?

A: To complete Form IP-040 Schedule 3-ET, you will need information about your entity's income, deductions, and credits.

Q: Is Form IP-040 Schedule 3-ET specific to Wisconsin?

A: Yes, Form IP-040 Schedule 3-ET is specific to Wisconsin and is used to compute entity-level tax in the state.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IP-040 Schedule 3-ET by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.