This version of the form is not currently in use and is provided for reference only. Download this version of

Form 3 (IP-030)

for the current year.

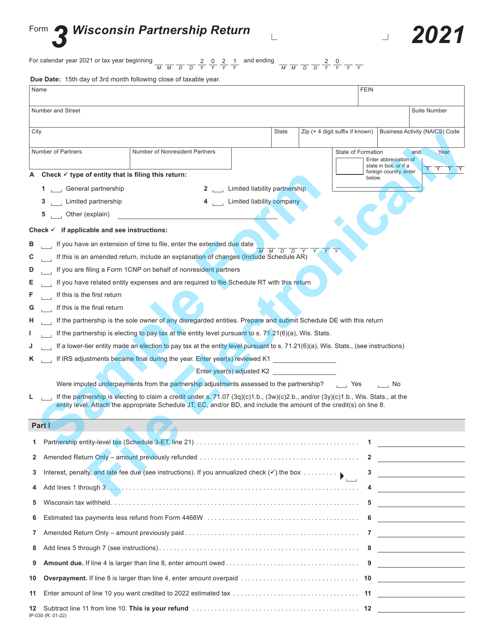

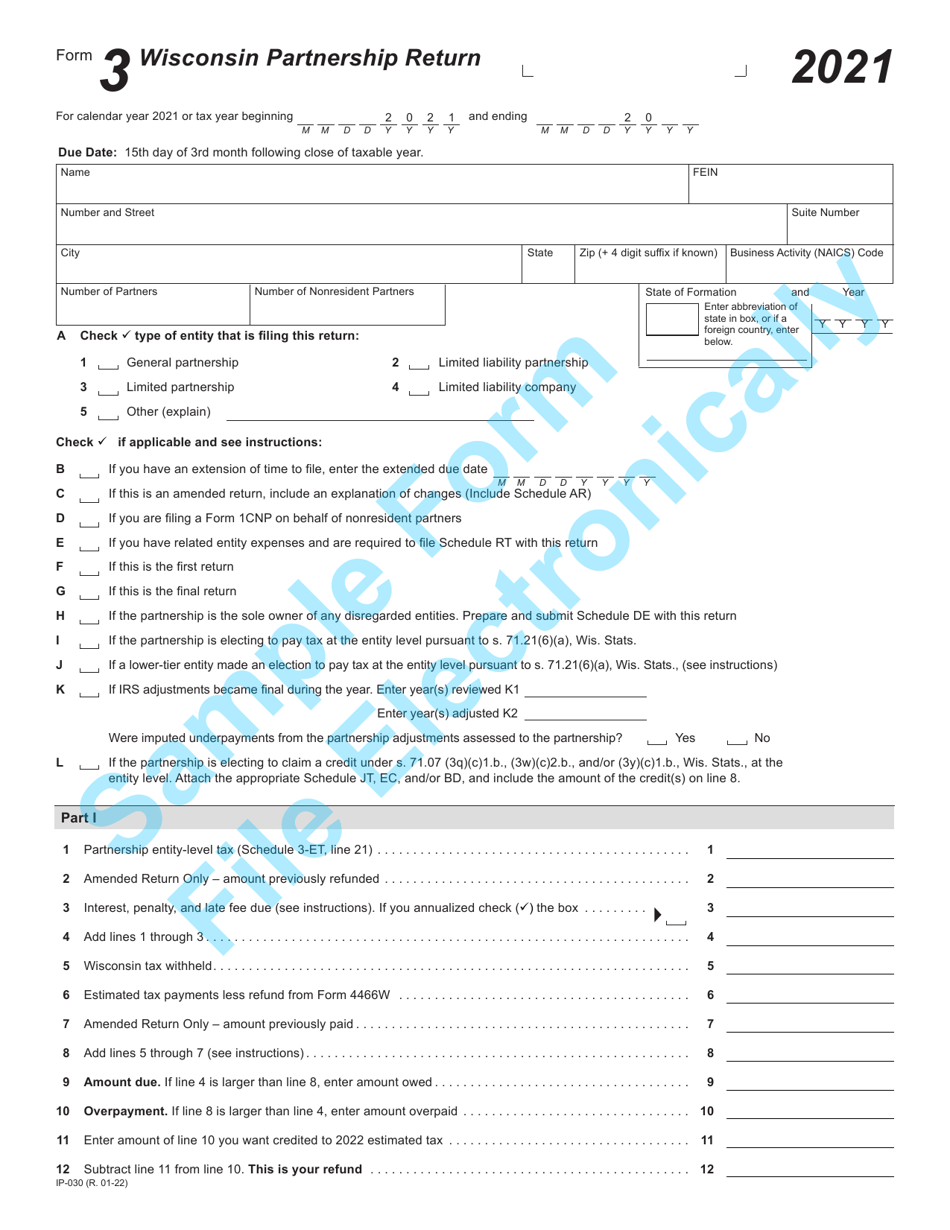

Form 3 (IP-030) Wisconsin Partnership Return - Sample - Wisconsin

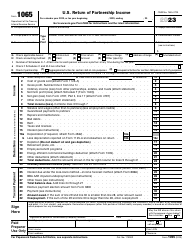

What Is Form 3 (IP-030)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3 (IP-030) Wisconsin Partnership Return?

A: Form 3 (IP-030) Wisconsin Partnership Return is a tax form used by partnerships in Wisconsin to report their income, deductions, and credits.

Q: Who needs to file Form 3 (IP-030) Wisconsin Partnership Return?

A: Partnerships in Wisconsin are required to file Form 3 (IP-030) Wisconsin Partnership Return.

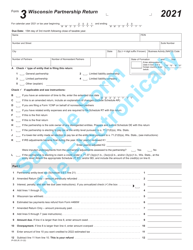

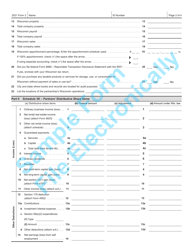

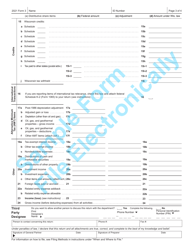

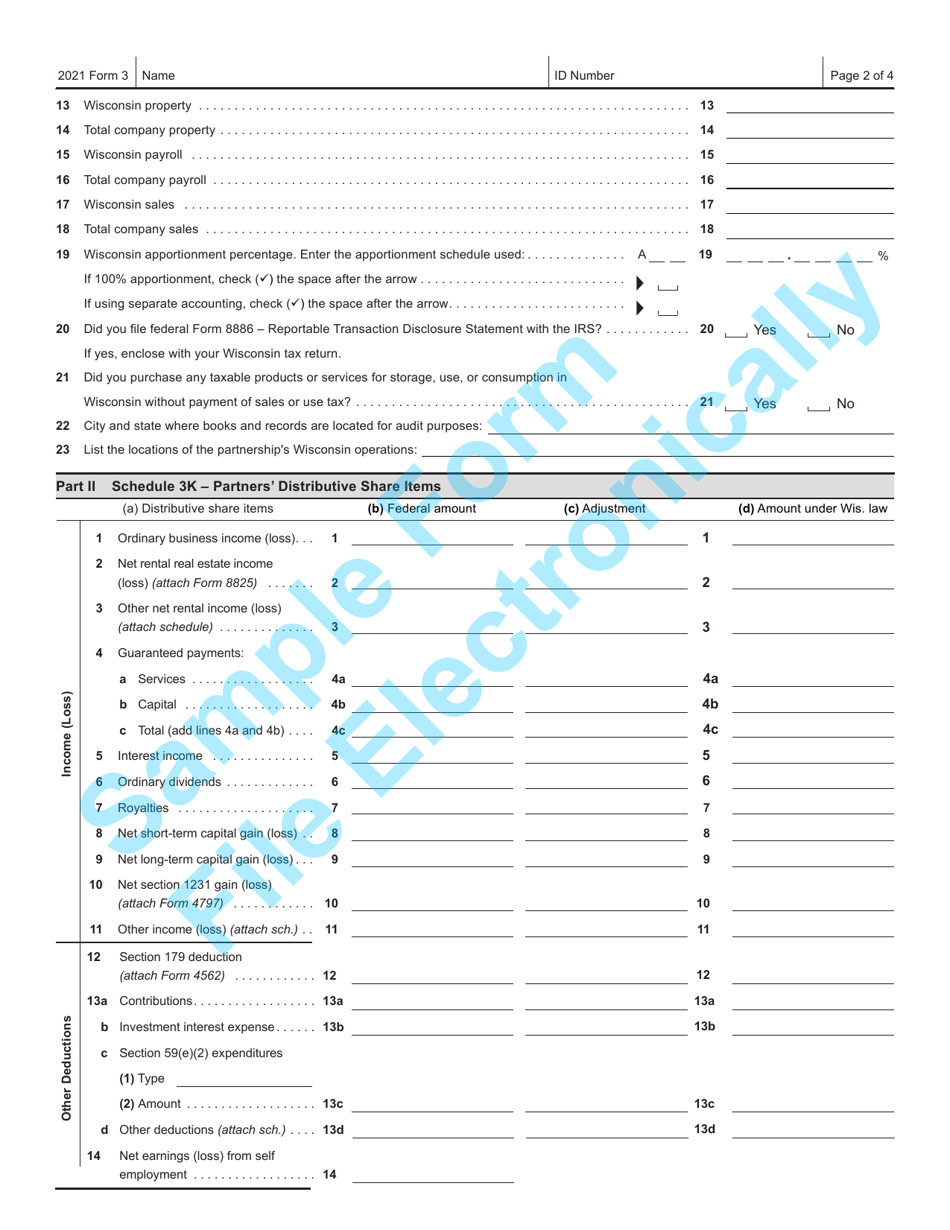

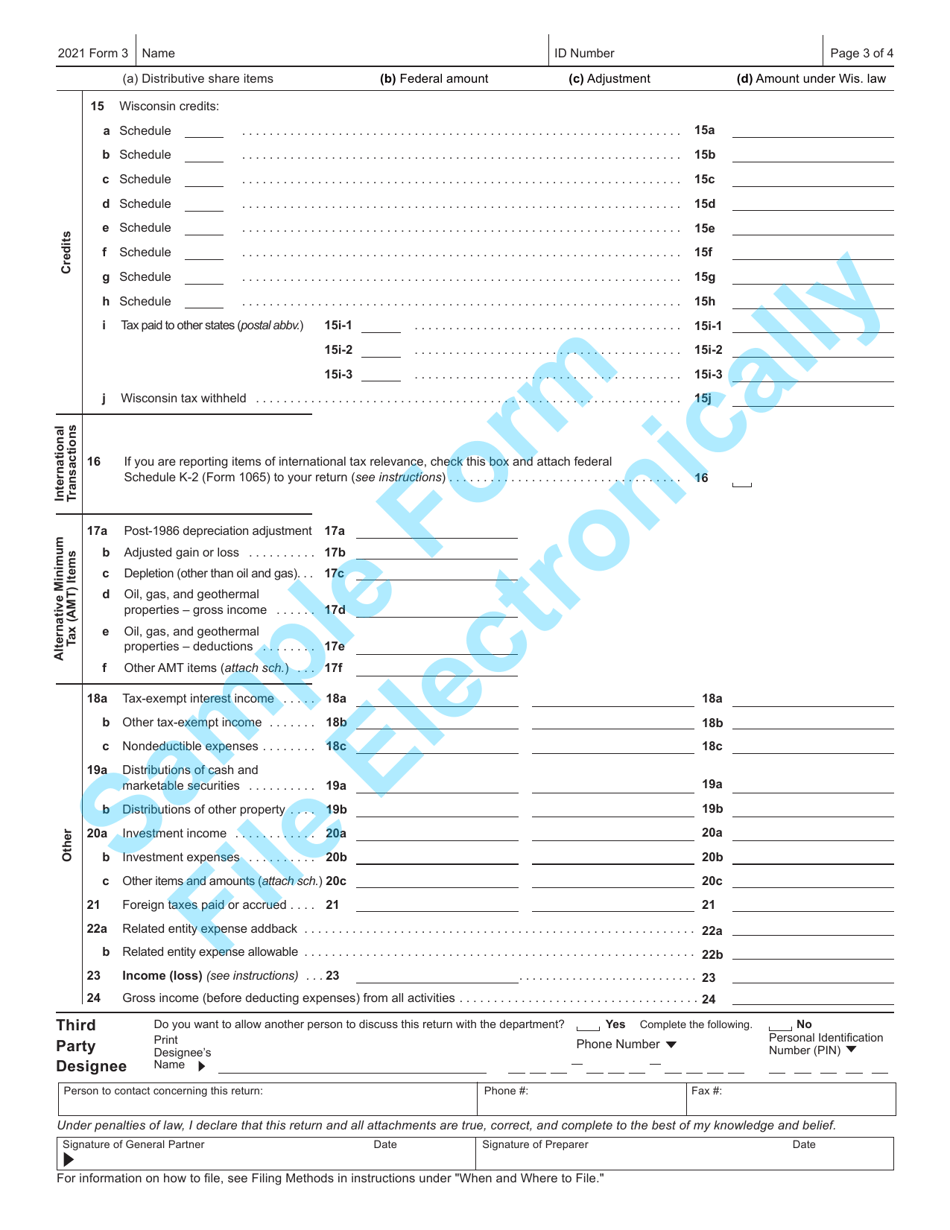

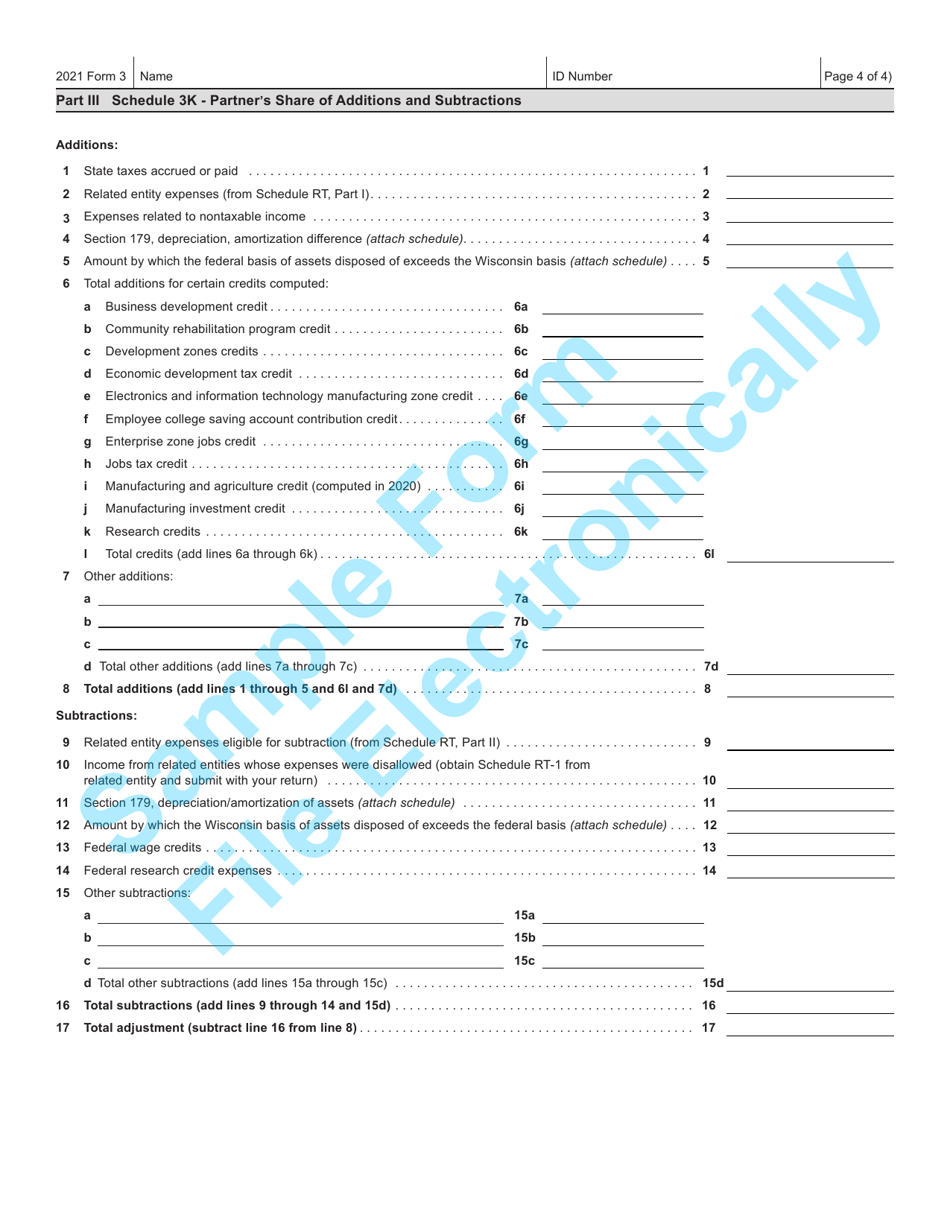

Q: What information is required on Form 3 (IP-030) Wisconsin Partnership Return?

A: Form 3 (IP-030) Wisconsin Partnership Return requires information about the partnership's income, deductions, credits, and other relevant financial details.

Q: When is the deadline to file Form 3 (IP-030) Wisconsin Partnership Return?

A: Form 3 (IP-030) Wisconsin Partnership Return is due on or before the 15th day of the 4th month following the close of the partnership's taxable year.

Q: Are there any penalties for not filing Form 3 (IP-030) Wisconsin Partnership Return?

A: Yes, there are penalties for not filing Form 3 (IP-030) Wisconsin Partnership Return, including late filing penalties and interest on any unpaid taxes.

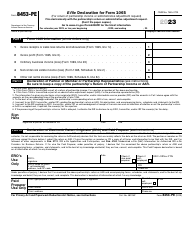

Q: Can I e-file Form 3 (IP-030) Wisconsin Partnership Return?

A: Yes, Form 3 (IP-030) Wisconsin Partnership Return can be e-filed using the Wisconsin Department of Revenue's e-file system.

Q: Do I need to include supporting documents with Form 3 (IP-030) Wisconsin Partnership Return?

A: Yes, you may need to include supporting documents, such as W-2 forms and 1099 forms, with Form 3 (IP-030) Wisconsin Partnership Return.

Q: Can I amend Form 3 (IP-030) Wisconsin Partnership Return?

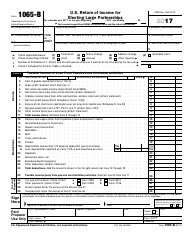

A: Yes, you can amend Form 3 (IP-030) Wisconsin Partnership Return by filing an amended return using Form 3X (IP-041).

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3 (IP-030) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.