This version of the form is not currently in use and is provided for reference only. Download this version of

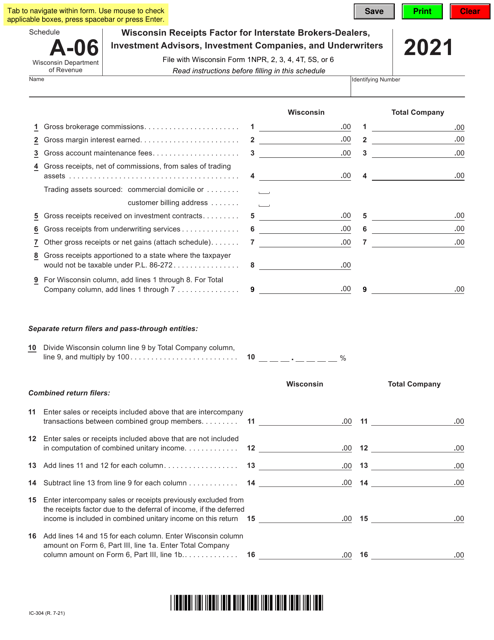

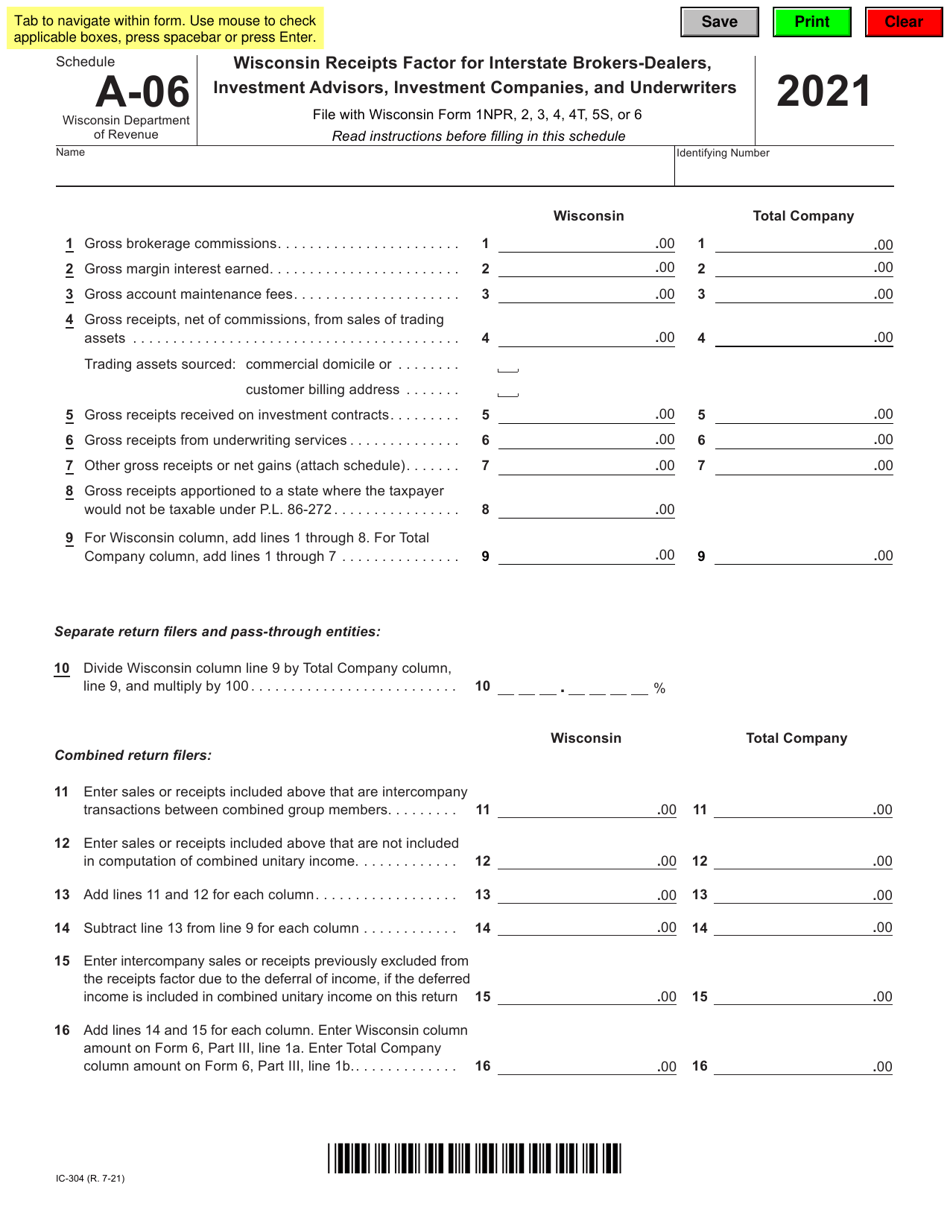

Form IC-304 Schedule A-06

for the current year.

Form IC-304 Schedule A-06 Wisconsin Receipts Factor for Interstate Brokers-Dealers,investment Advisors, Investment Companies, and Underwriters - Wisconsin

What Is Form IC-304 Schedule A-06?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is IC-304 Schedule A-06?

A: IC-304 Schedule A-06 is a form used in Wisconsin for computing the receipts factor for interstate brokers-dealers, investment advisors, investment companies, and underwriters.

Q: Who uses IC-304 Schedule A-06?

A: Interstate brokers-dealers, investment advisors, investment companies, and underwriters in Wisconsin use IC-304 Schedule A-06.

Q: What does IC-304 Schedule A-06 calculate?

A: IC-304 Schedule A-06 is used to calculate the receipts factor for interstate brokers-dealers, investment advisors, investment companies, and underwriters in Wisconsin.

Q: Why is IC-304 Schedule A-06 important?

A: IC-304 Schedule A-06 is important for determining the tax liability of interstate brokers-dealers, investment advisors, investment companies, and underwriters in Wisconsin.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-304 Schedule A-06 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.