This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-028 Schedule I

for the current year.

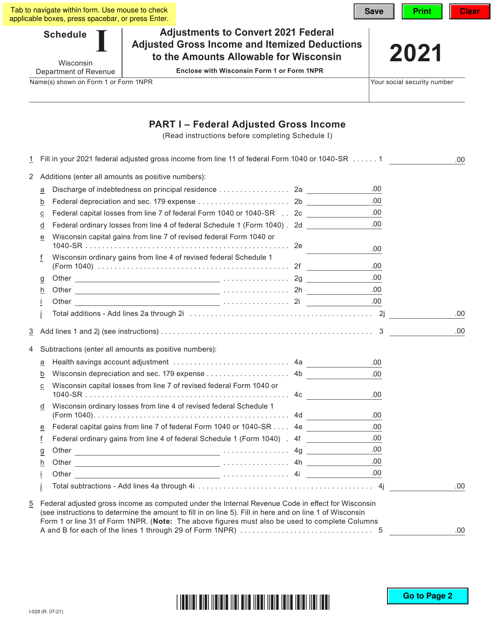

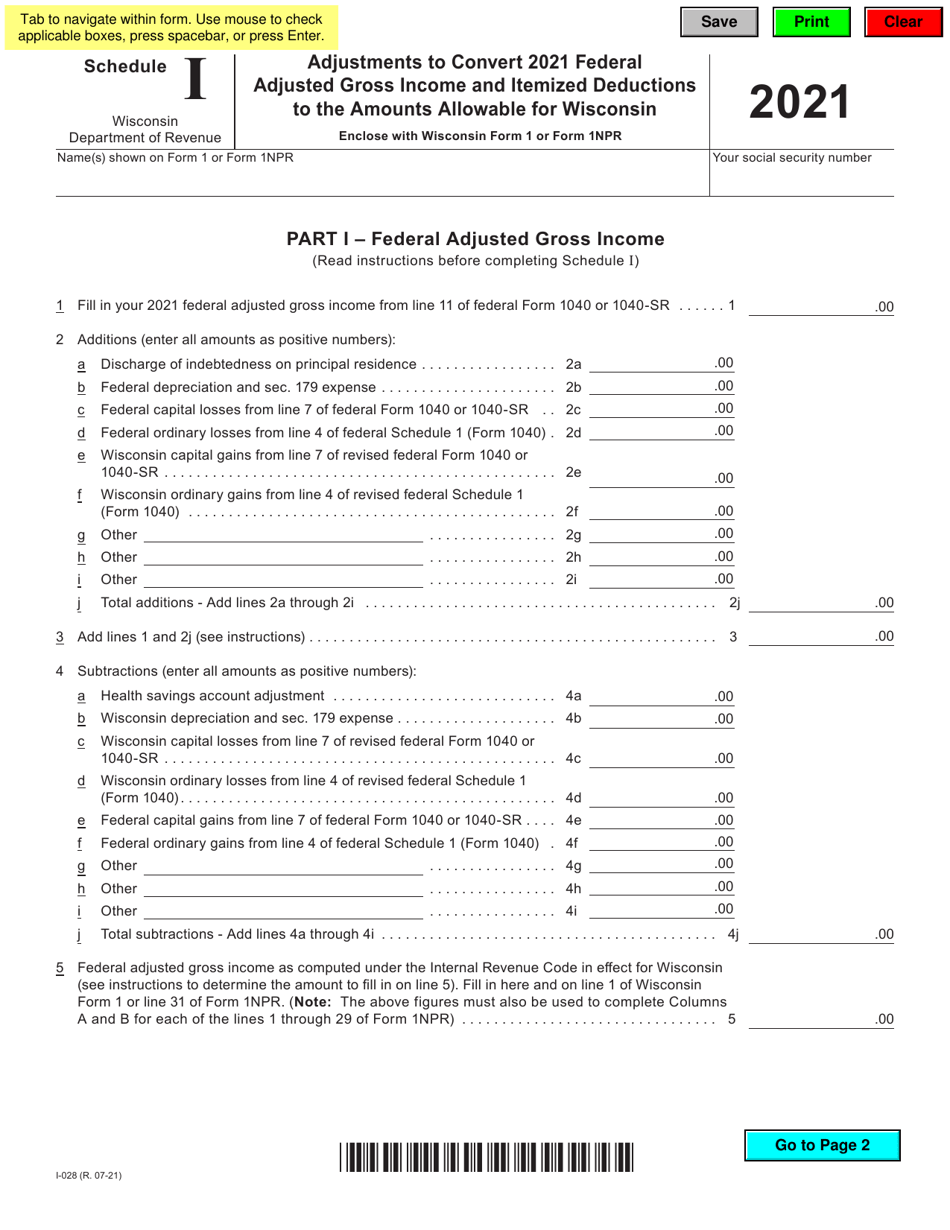

Form I-028 Schedule I Adjustments to Convert Federal Adjusted Gross Income and Itemized Deductions to the Amounts Allowable for Wisconsin - Wisconsin

What Is Form I-028 Schedule I?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-028?

A: Form I-028 is a schedule used to adjust federal adjusted gross income and itemized deductions to the amounts allowable for Wisconsin.

Q: What is the purpose of Form I-028?

A: The purpose of Form I-028 is to calculate the adjustments needed to convert federal adjusted gross income and itemized deductions to the amounts allowable for Wisconsin.

Q: What is federal adjusted gross income?

A: Federal adjusted gross income is the total income reported on your federal income tax return after certain deductions.

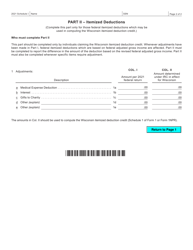

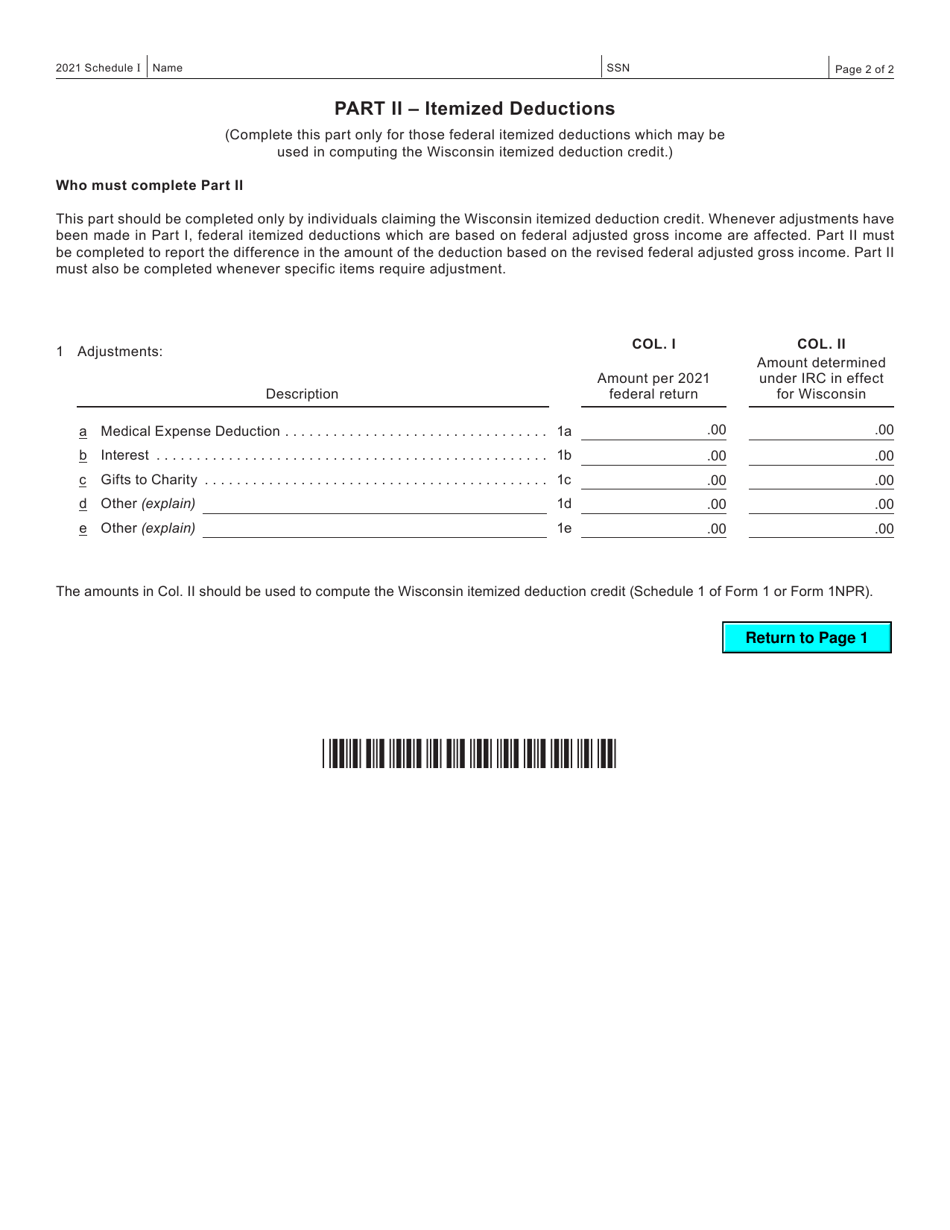

Q: What are itemized deductions?

A: Itemized deductions are specific expenses that you can subtract from your adjusted gross income to reduce your taxable income.

Q: Why do I need to convert federal adjusted gross income and itemized deductions to the amounts allowable for Wisconsin?

A: You need to convert them to comply with Wisconsin tax laws and determine the correct amount of income and deductions for your Wisconsin tax return.

Q: How do I calculate the adjustments on Form I-028?

A: The adjustments are calculated based on the specific instructions provided on Form I-028. You will need to refer to your federal income tax return and the Wisconsin tax laws to determine the appropriate adjustments.

Q: Is Form I-028 required for all Wisconsin taxpayers?

A: Form I-028 is not required for all taxpayers. It is only necessary if you have federal adjustments or itemized deductions that need to be converted to the amounts allowable for Wisconsin.

Q: What should I do if I have questions about Form I-028?

A: If you have questions about Form I-028 or need assistance with completing it, you should consult a tax professional or contact the Wisconsin Department of Revenue for guidance.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form I-028 Schedule I by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.