This version of the form is not currently in use and is provided for reference only. Download this version of

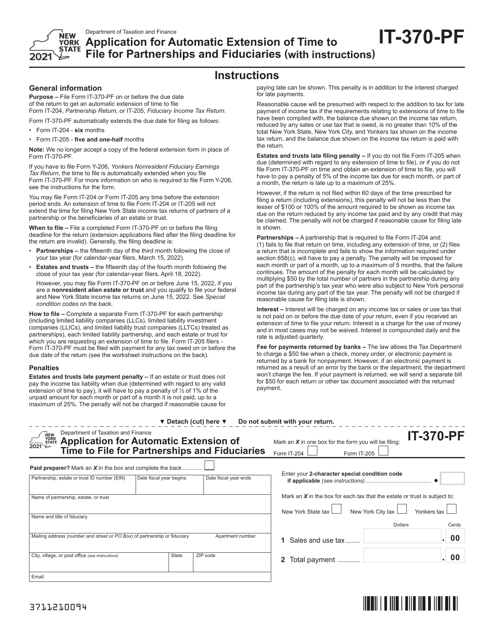

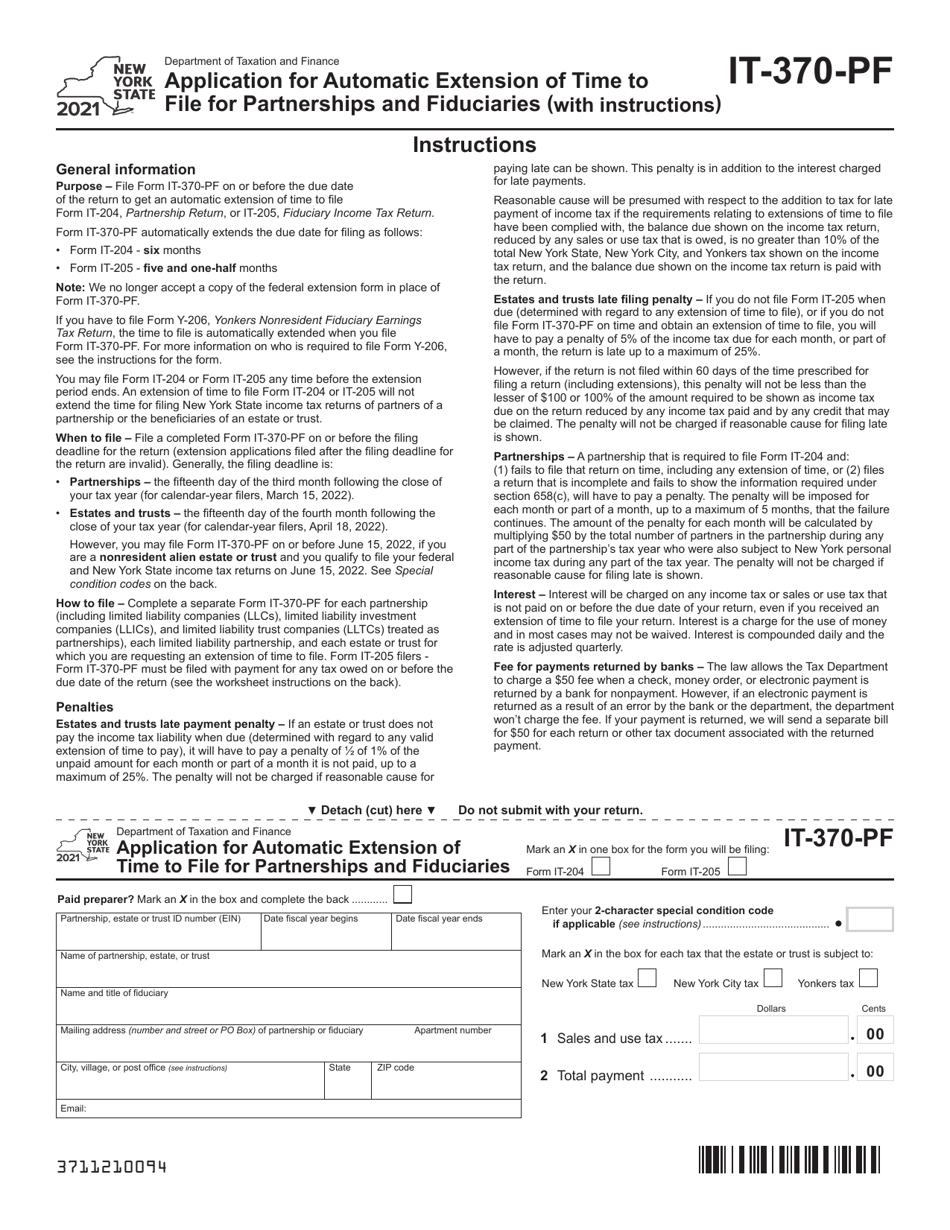

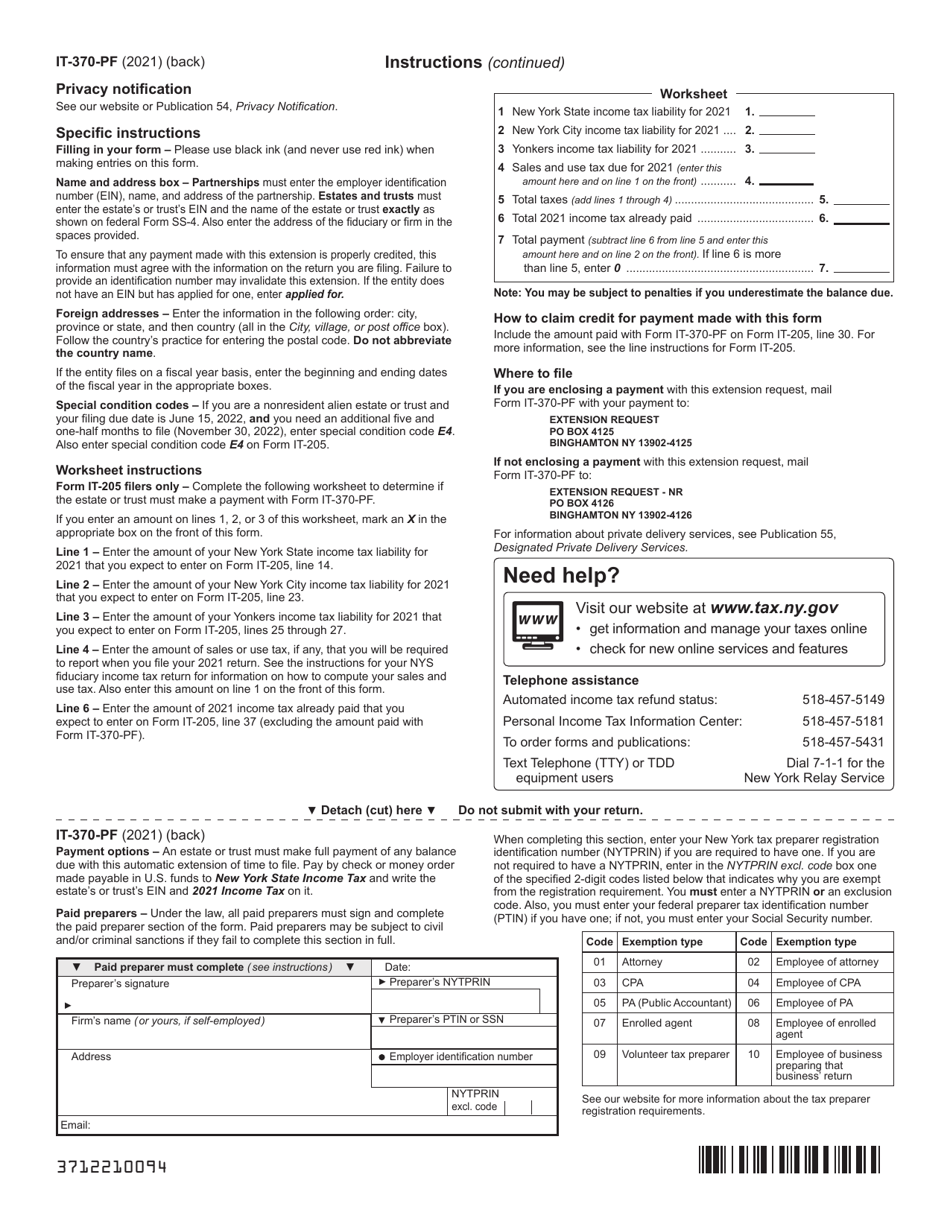

Form IT-370-PF

for the current year.

Form IT-370-PF Application for Automatic Extension of Time to File for Partnerships and Fiduciaries - New York

What Is Form IT-370-PF?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-370-PF?

A: Form IT-370-PF is an application for an automatic extension of time to file for partnerships and fiduciaries in New York.

Q: Who needs to file Form IT-370-PF?

A: Partnerships and fiduciaries in New York who need more time to file their tax returns.

Q: What is the purpose of filing Form IT-370-PF?

A: The purpose of filing Form IT-370-PF is to request an extension of time to file the tax return for partnerships and fiduciaries.

Q: When is Form IT-370-PF due?

A: Form IT-370-PF is due on or before the original due date of the tax return for partnerships and fiduciaries.

Q: How do I file Form IT-370-PF?

A: Form IT-370-PF can be filed electronically or by mail. Check the instructions on the form for more details.

Q: Is there a fee for filing Form IT-370-PF?

A: No, there is no fee for filing Form IT-370-PF.

Q: Does filing Form IT-370-PF grant an extension for payment?

A: No, filing Form IT-370-PF only grants an extension of time to file, not an extension of time to pay. Payment is still due by the original due date of the tax return.

Q: What happens if I don't file Form IT-370-PF?

A: If you don't file Form IT-370-PF and fail to file your tax return by the original due date, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-370-PF by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.