This version of the form is not currently in use and is provided for reference only. Download this version of

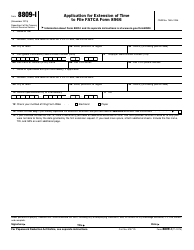

Form IT-370

for the current year.

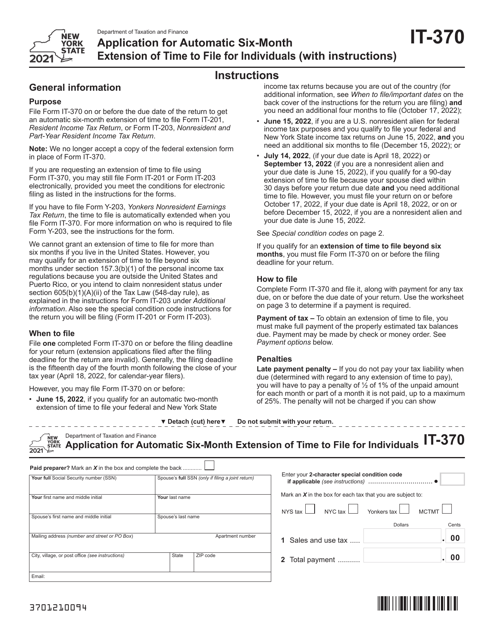

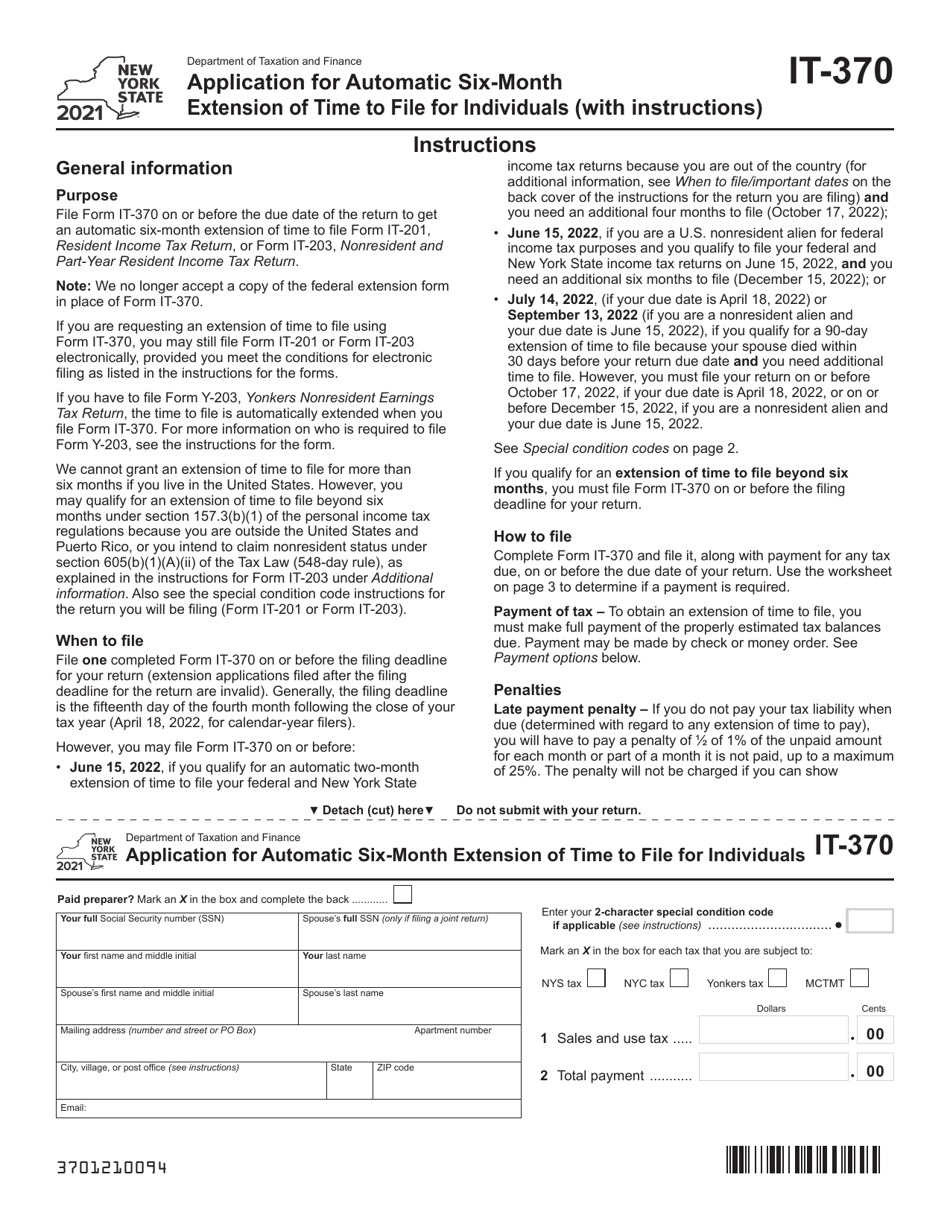

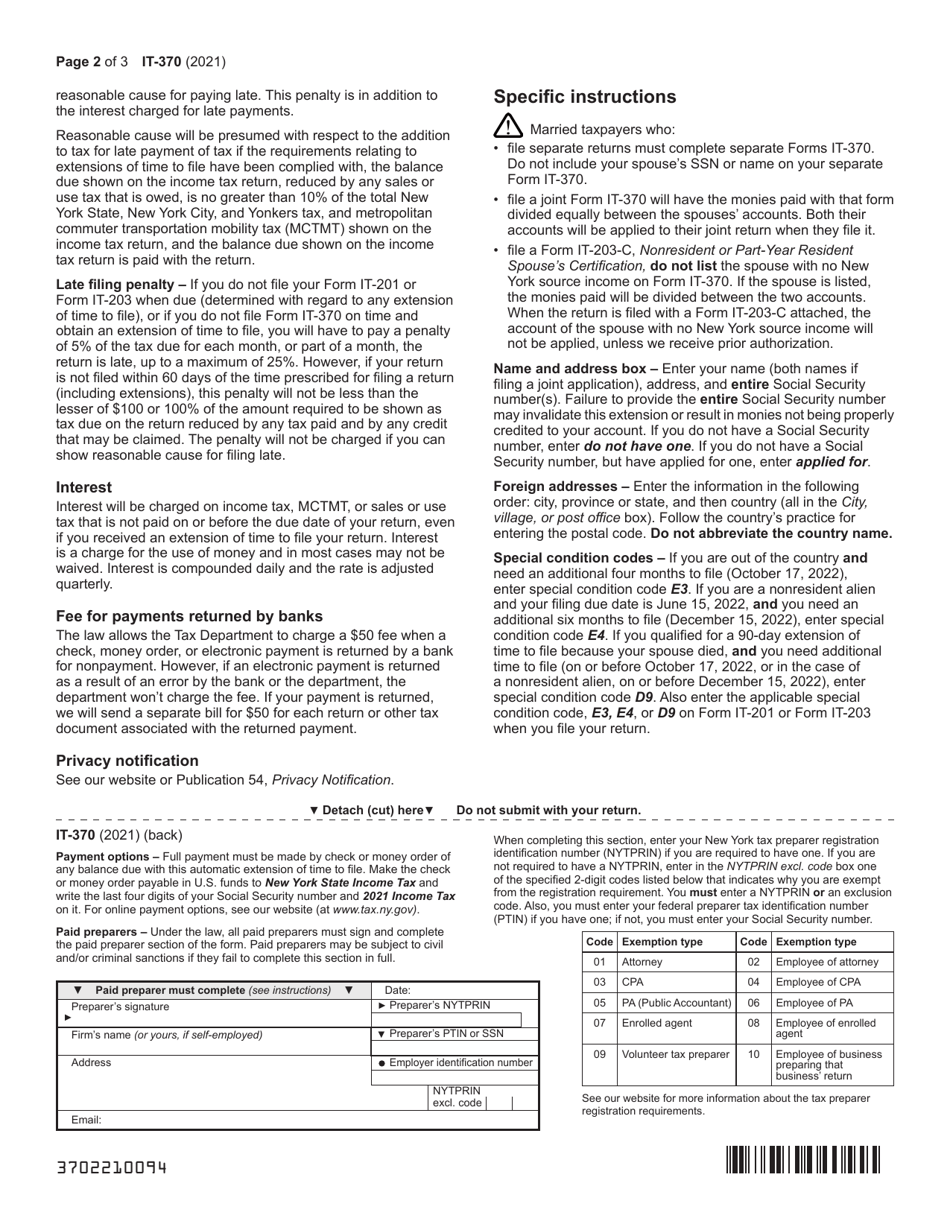

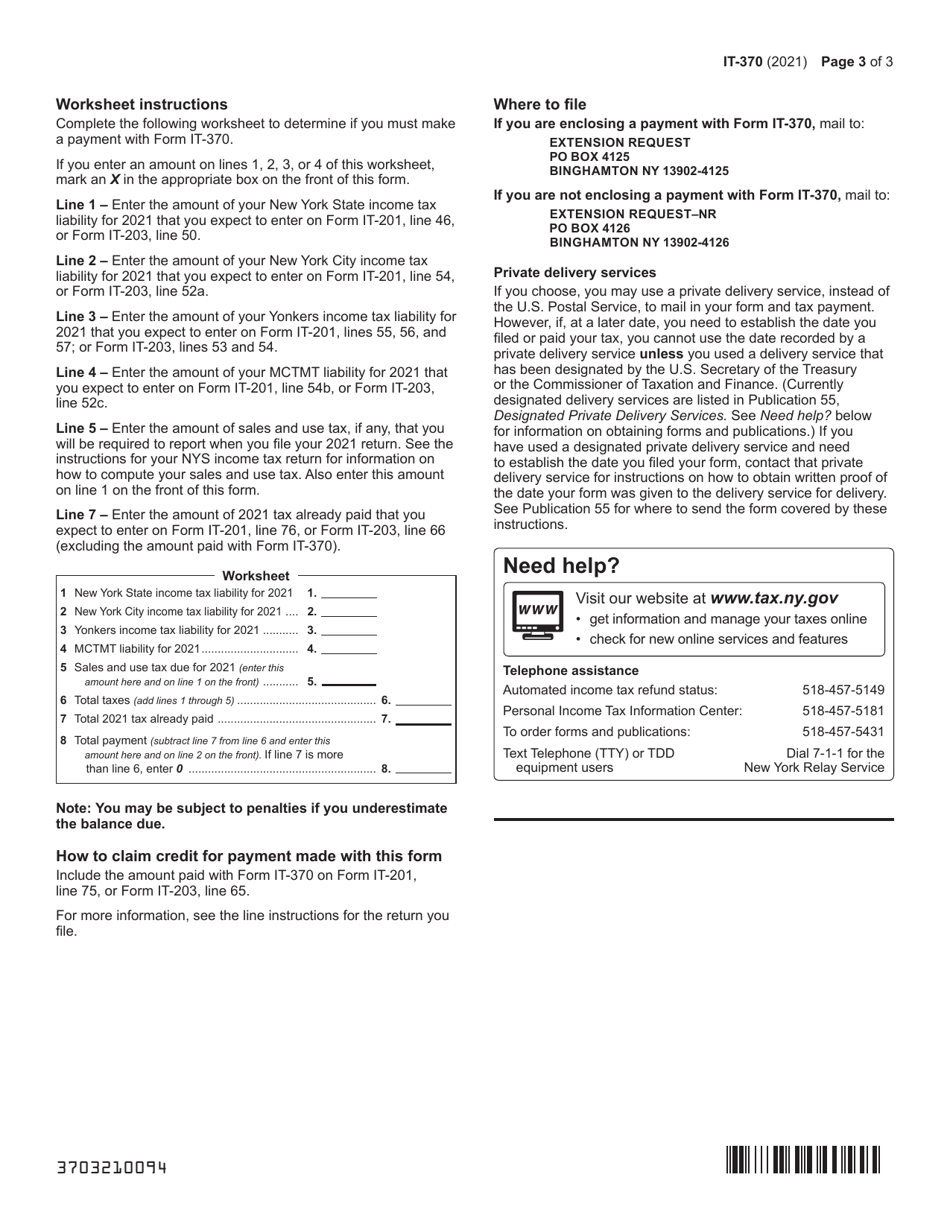

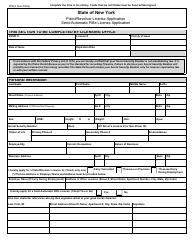

Form IT-370 Application for Automatic Six-Month Extension of Time to File for Individuals - New York

What Is Form IT-370?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-370?

A: Form IT-370 is an application for automatic six-month extension of time to file for individuals in New York.

Q: Who can use Form IT-370?

A: Individuals in New York who need additional time to file their state income tax return can use Form IT-370.

Q: What does the six-month extension mean?

A: The six-month extension allows individuals to extend the due date of their state income tax return by six months, giving them more time to prepare and file their return.

Q: Is there a fee to file Form IT-370?

A: No, there is no fee to file Form IT-370.

Q: What is the deadline to file Form IT-370?

A: Form IT-370 must be filed on or before the original due date of your state income tax return, which is usually April 15th.

Q: What happens if I file Form IT-370 but still can't file my return within the six-month extension?

A: If you are unable to file your state income tax return within the six-month extension, you may be granted an additional extension under certain circumstances. Contact the New York State Department of Taxation and Finance for more information.

Q: What information do I need to include on Form IT-370?

A: You will need to provide your personal information, estimated tax liability, and the reason for requesting the extension on Form IT-370.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-370 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.