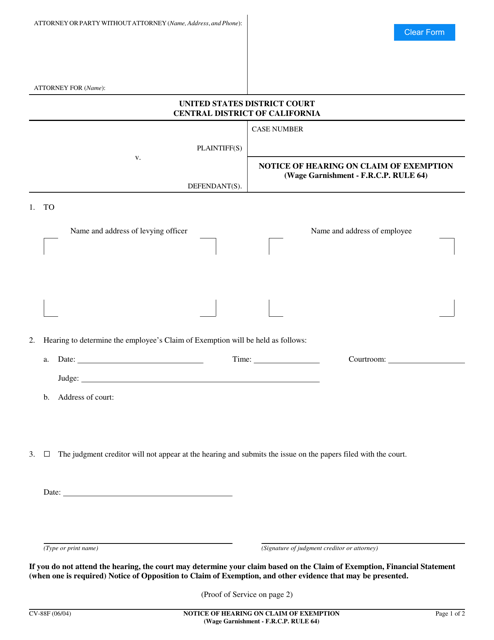

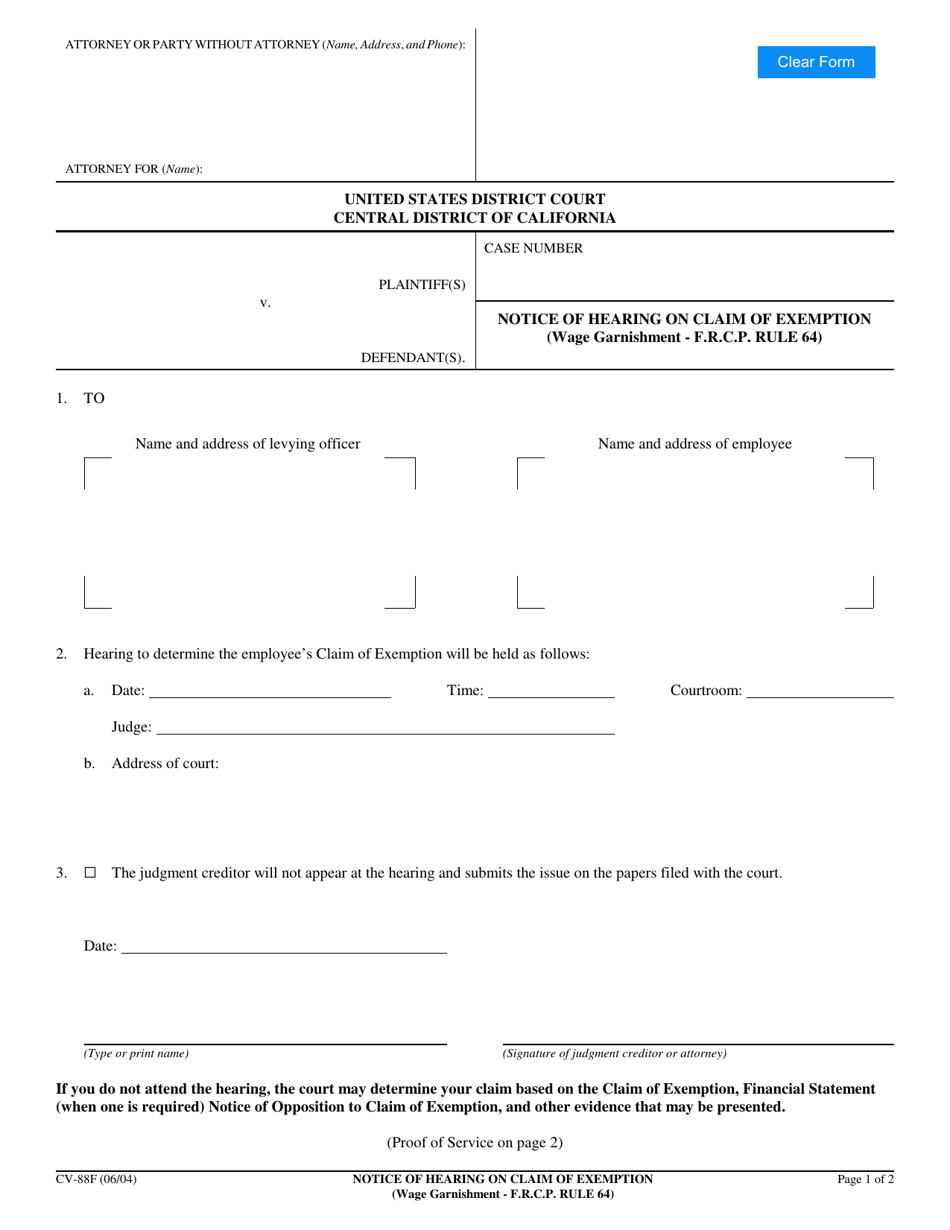

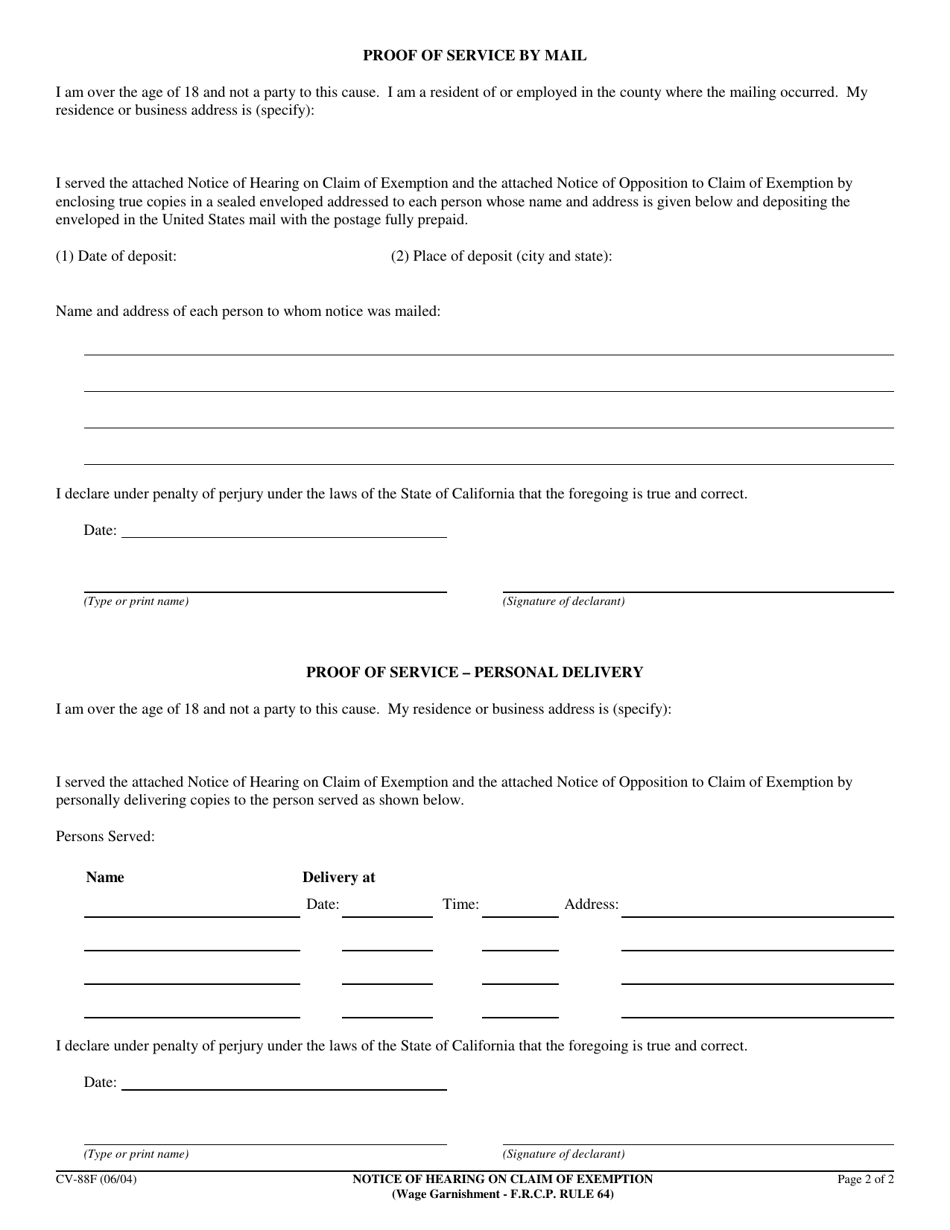

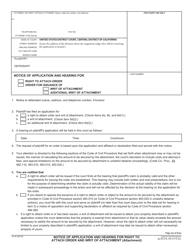

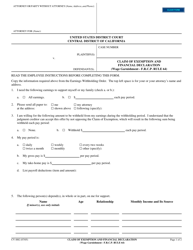

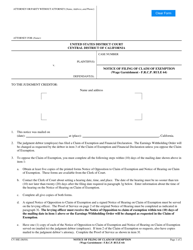

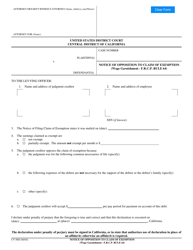

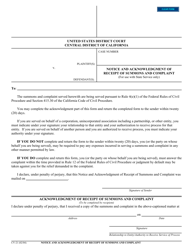

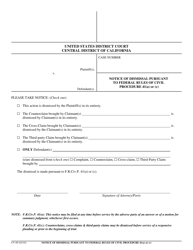

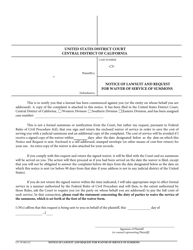

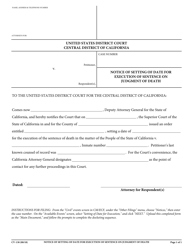

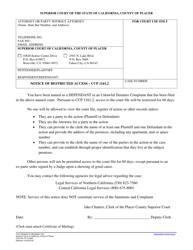

Form CV-88F Notice of Hearing on Claim of Exemption (Wage Garnishment - F.r.c.p. Rule 64) - California

What Is Form CV-88F?

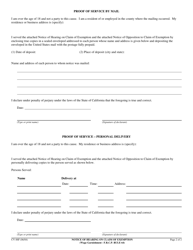

This is a legal form that was released by the United States District Court - Central District of California - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CV-88F?

A: Form CV-88 is a notice of hearing on a claim of exemption for wage garnishment in California.

Q: What is a claim of exemption?

A: A claim of exemption is a legal process that allows a person to protect certain income or assets from being seized or garnished to pay off a debt.

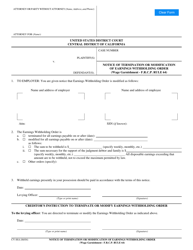

Q: What is wage garnishment?

A: Wage garnishment is when a certain amount of money is deducted from a person's paycheck to pay off a debt.

Q: What is F.R.C.P. Rule 64?

A: F.R.C.P. Rule 64 refers to Rule 64 of the Federal Rules of Civil Procedure, which governs the process of seizing or garnishing property to satisfy a judgment.

Q: Who needs to use Form CV-88F?

A: Form CV-88F is used by individuals who want to claim an exemption from wage garnishment in California.

Q: What information is required on Form CV-88F?

A: Form CV-88F requires the person's name, address, contact information, details about the debt and creditor, and reasons for claiming the exemption.

Q: What happens after submitting Form CV-88F?

A: After submitting Form CV-88F, a hearing will be scheduled where the court will review the claim of exemption and make a decision.

Q: Can I hire an attorney to help with Form CV-88F?

A: Yes, you can hire an attorney to assist you with completing and filing Form CV-88F.

Q: What should I do if my claim of exemption is approved?

A: If your claim of exemption is approved, the wage garnishment process will be stopped or modified, and you may be able to protect your income or assets from being seized.

Form Details:

- Released on June 1, 2004;

- The latest edition provided by the United States District Court - Central District of California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CV-88F by clicking the link below or browse more documents and templates provided by the United States District Court - Central District of California.