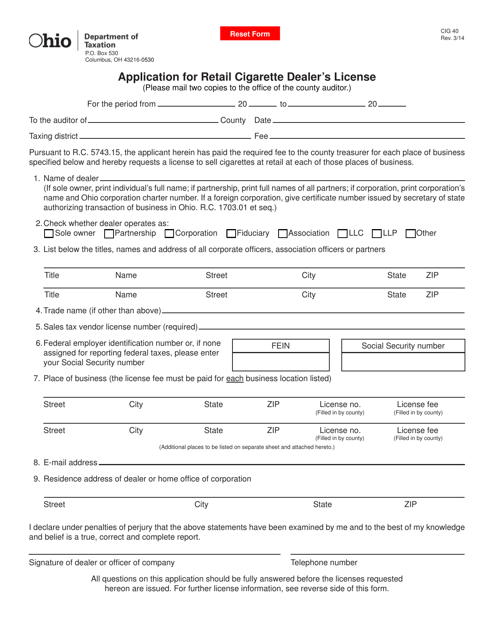

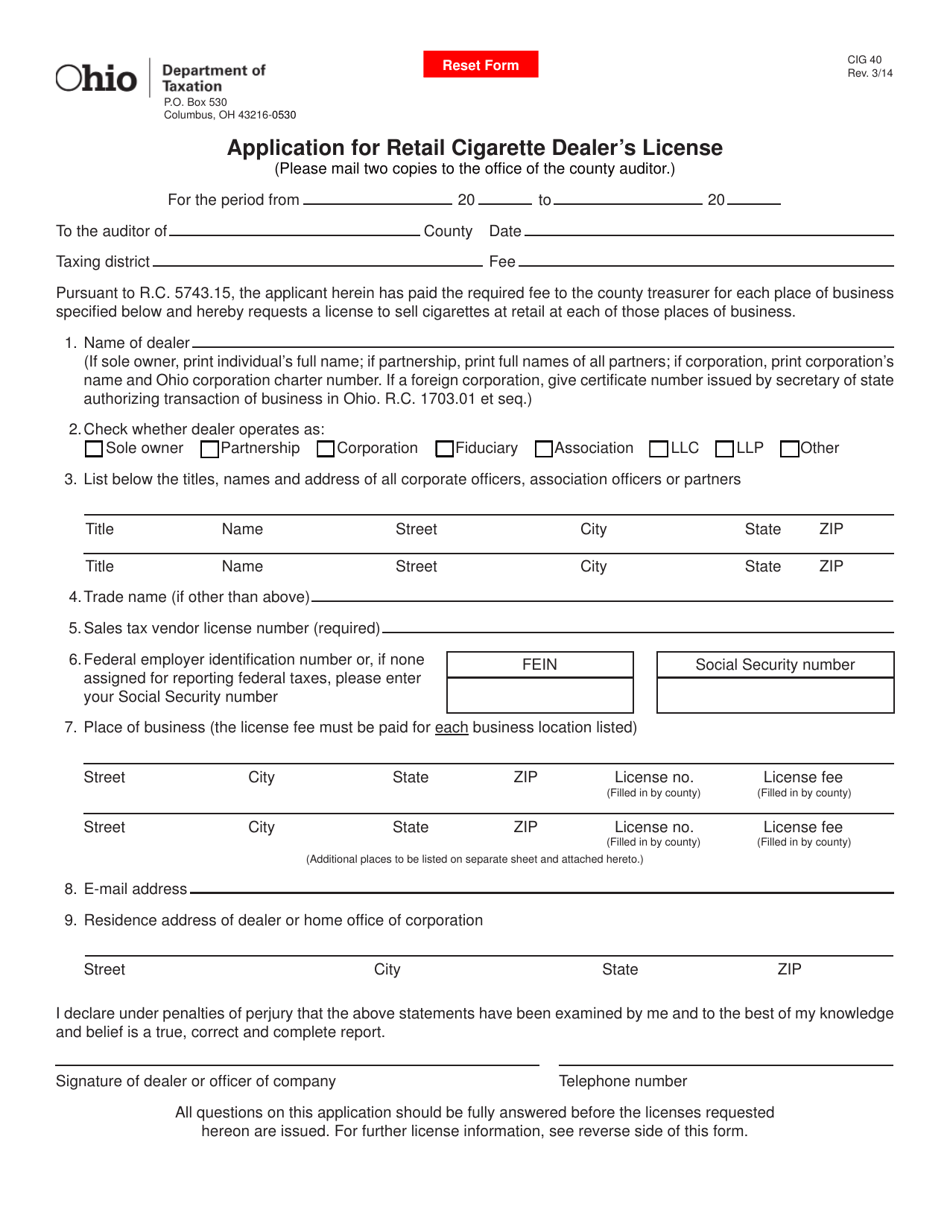

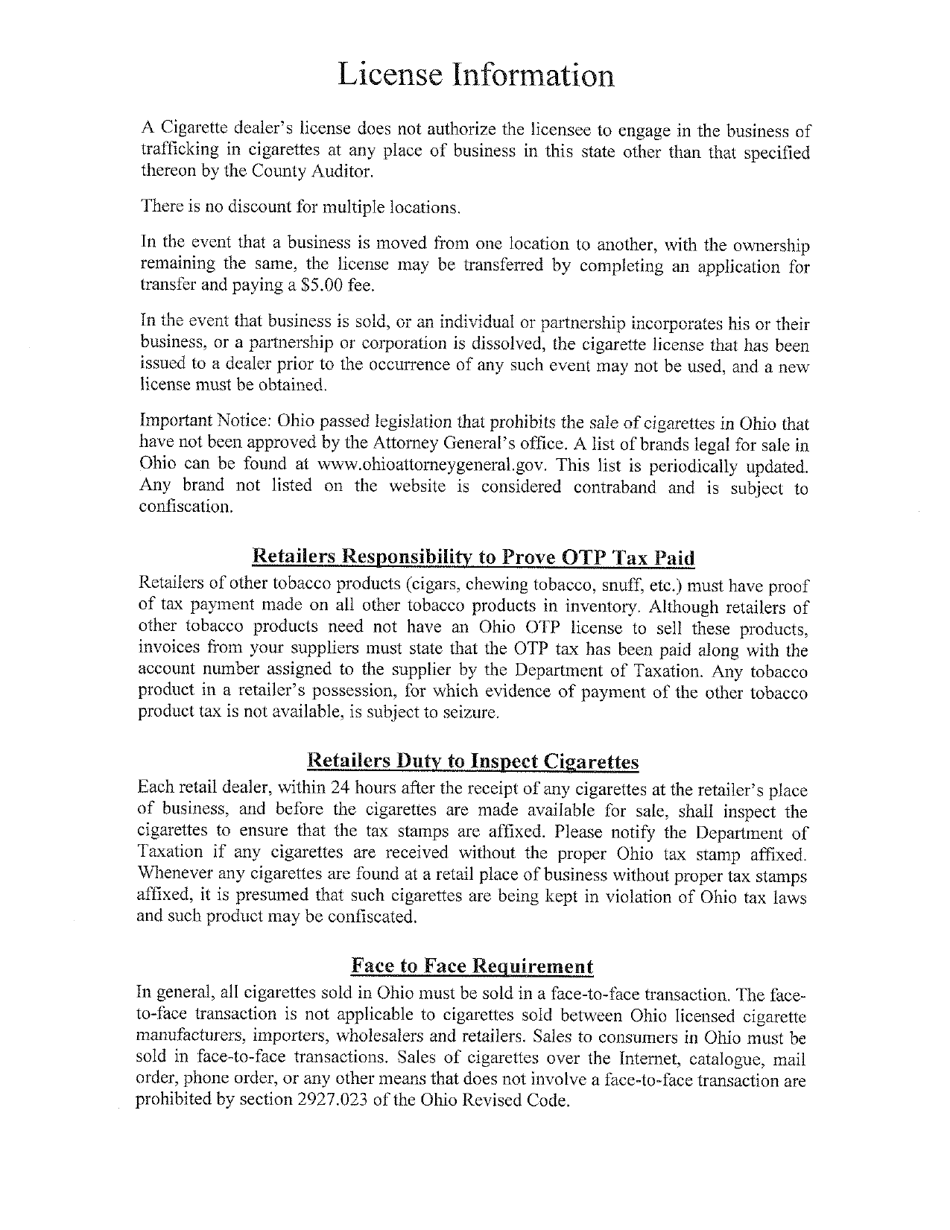

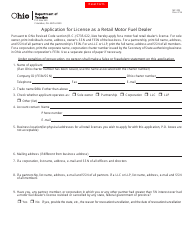

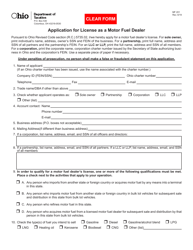

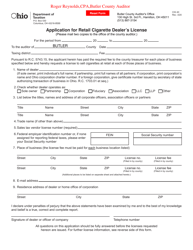

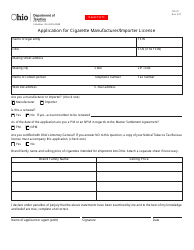

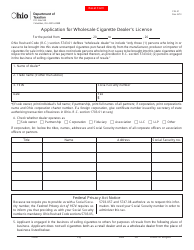

Form CIG40 Application for Retail Cigarette Dealer's License - Ohio

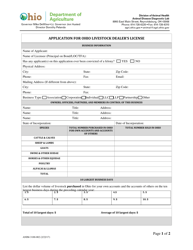

What Is Form CIG40?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CIG40 Application?

A: A CIG40 Application is a form to apply for a Retail Cigarette Dealer's License in Ohio.

Q: Who needs to complete the CIG40 Application?

A: Any individual or business intending to sell cigarettes at retail in Ohio must complete the CIG40 Application.

Q: What information is required on the CIG40 Application?

A: The CIG40 Application requires information about the applicant's personal details, business information, and any additional locations where cigarettes will be sold.

Q: Are there any fees associated with the CIG40 Application?

A: Yes, there is a non-refundable application fee required when submitting the CIG40 Application.

Q: How long does it take to process the CIG40 Application?

A: The processing time for the CIG40 Application may vary, but it usually takes several weeks to receive a decision from the Ohio Department of Taxation.

Q: Is the CIG40 Application required to be renewed?

A: Yes, the CIG40 Application must be renewed annually by submitting a new application and paying the required fees.

Q: What happens if the CIG40 Application is denied?

A: If the CIG40 Application is denied, the applicant will receive a notification explaining the reason for the denial and their options to appeal the decision.

Q: Can I sell cigarettes without a CIG40 Application?

A: No, selling cigarettes at retail in Ohio without a valid Retail Cigarette Dealer's License obtained through the CIG40 Application is illegal.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG40 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.