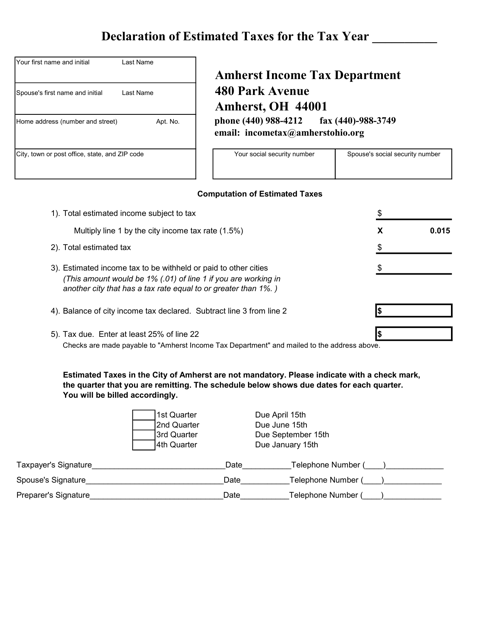

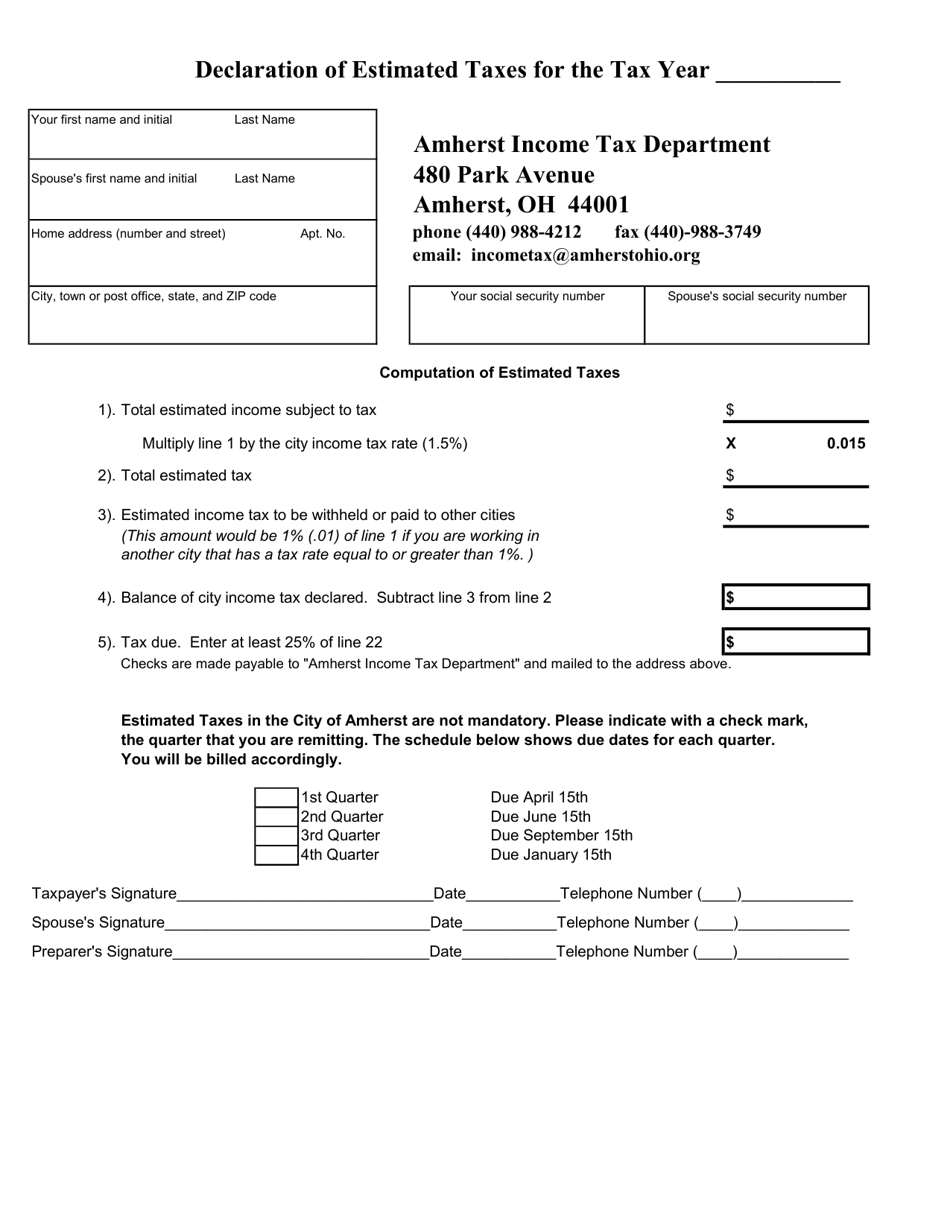

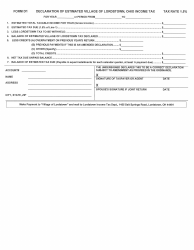

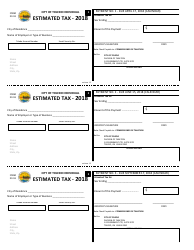

Declaration of Estimated Taxes - Amherst, Ohio

Declaration of Estimated Taxes is a legal document that was released by the Income Tax Department - City of Amherst, Ohio - a government authority operating within Ohio. The form may be used strictly within Amherst.

FAQ

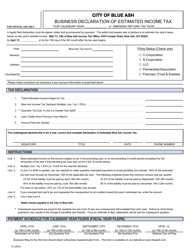

Q: What is the Declaration of Estimated Taxes?

A: The Declaration of Estimated Taxes is a form used to report and pay estimated taxes on income that is not subject to withholding.

Q: Who needs to file the Declaration of Estimated Taxes?

A: Individuals who expect to owe at least $1,000 in taxes after subtracting their withholding and credits, or who expect their withholding and credits to be less than 90% of their current year's tax liability, generally need to file the Declaration of Estimated Taxes.

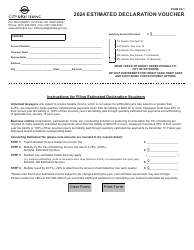

Q: When is the deadline to file the Declaration of Estimated Taxes?

A: The deadline to file the Declaration of Estimated Taxes is usually April 15th, but it may vary depending on the specific tax year and whether you are filing as an individual or a corporation.

Q: How do I calculate my estimated taxes?

A: To calculate your estimated taxes, you generally need to estimate your income for the year, determine your tax liability based on that estimate, and then subtract any withholding and credits you expect to have.

Q: How do I pay my estimated taxes?

A: You can pay your estimated taxes using IRS Direct Pay, Electronic Federal Tax Payment System (EFTPS), credit or debit card, or by check or money order.

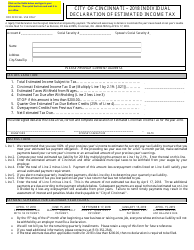

Q: What happens if I don't file or pay my estimated taxes?

A: If you don't file or pay your estimated taxes on time, you may be subject to penalties and interest on the amount owed. It's best to file and pay on time to avoid these penalties.

Q: Can I amend my estimated tax payments if my income changes?

A: Yes, if your income changes during the year, you can adjust your estimated tax payments by filing a new Declaration of Estimated Taxes form with your revised estimates.

Q: Are estimated taxes the same as self-employment taxes?

A: While self-employment taxes are a type of estimated tax, estimated taxes generally apply to all types of income that are not subject to withholding, including self-employment income.

Q: Do I need to file estimated taxes if I have a regular paycheck?

A: If you have a regular paycheck with income taxes withheld, you may not need to file estimated taxes. However, if you have additional income that is not subject to withholding, you may still need to file.

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Amherst, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Amherst, Ohio.