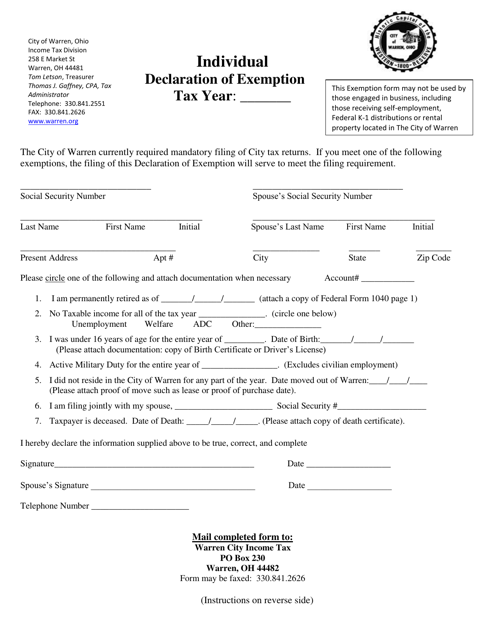

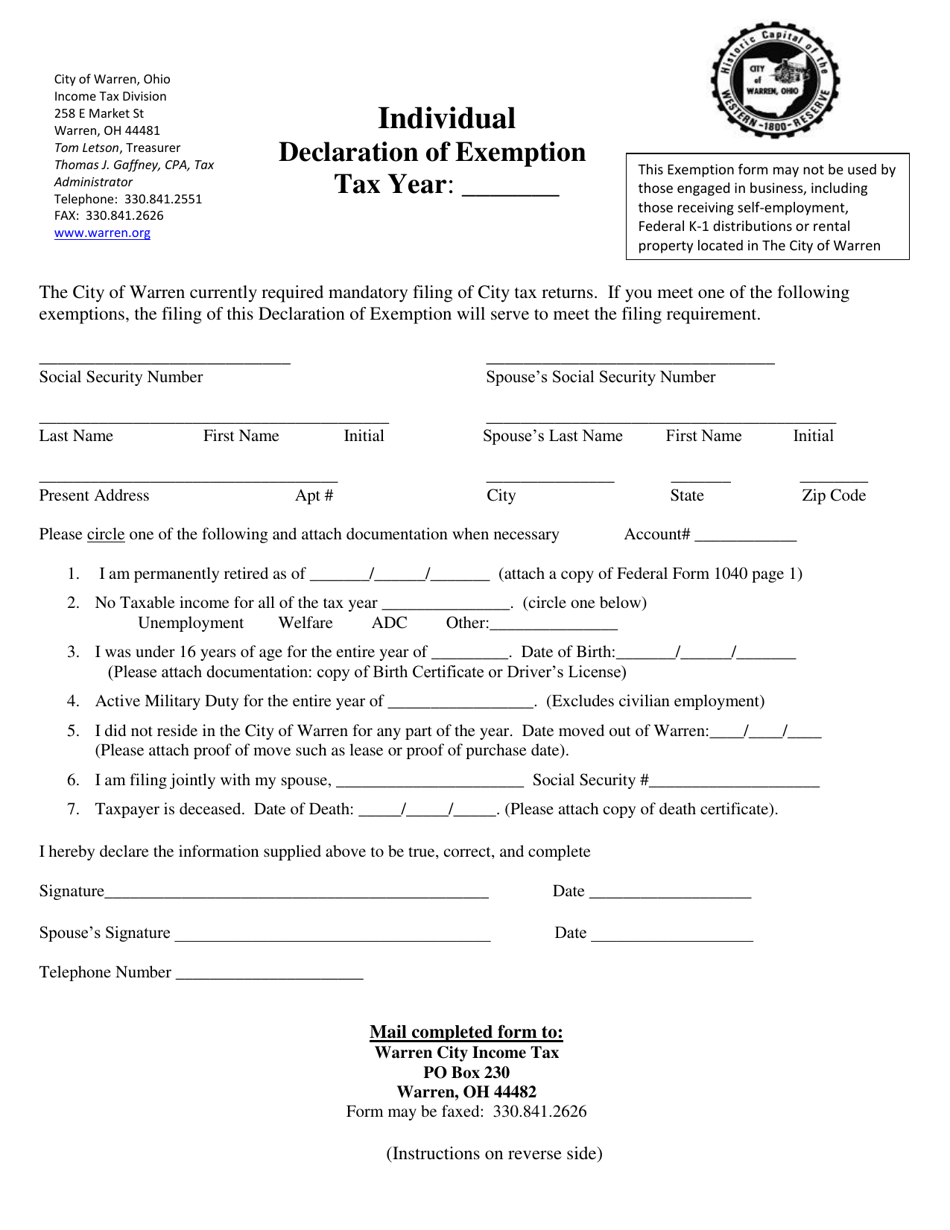

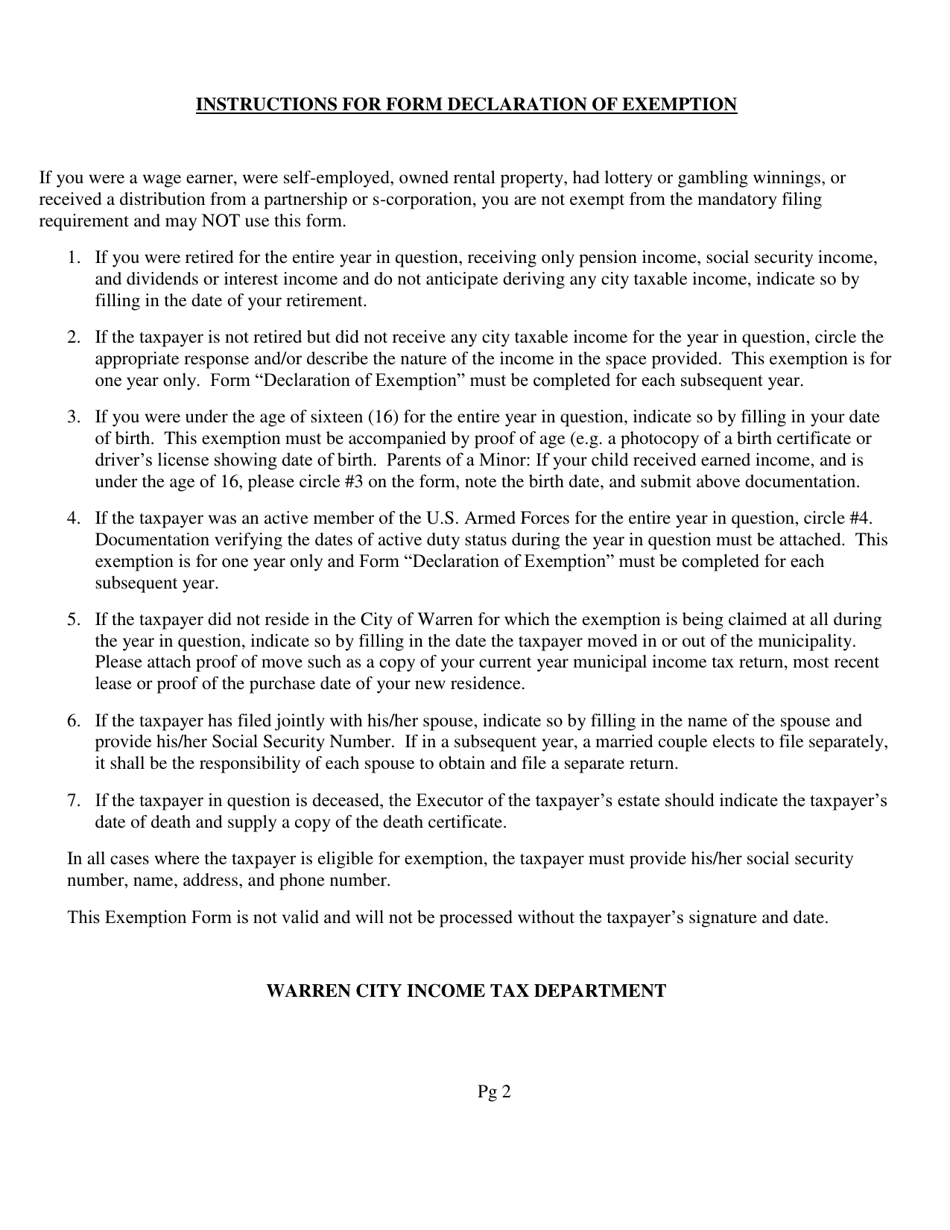

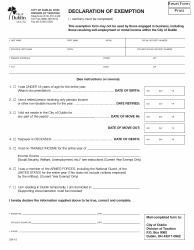

Individual Declaration of Exemption - City of Warren, Ohio

Individual Declaration of Exemption is a legal document that was released by the Income Tax Department - City of Warren, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Warren.

FAQ

Q: What is the Individual Declaration of Exemption?

A: The Individual Declaration of Exemption is a form used in the City of Warren, Ohio.

Q: Who needs to file the Individual Declaration of Exemption?

A: Any individual who is claiming an exemption from certain taxes in the City of Warren, Ohio needs to file the form.

Q: What taxes can be exempted using the Individual Declaration of Exemption?

A: The form can be used to claim exemptions from the income tax and the property tax in the City of Warren, Ohio.

Q: When is the deadline to file the Individual Declaration of Exemption?

A: The deadline to file the form is usually April 15th of the tax year.

Q: Do I need to submit any supporting documents with the form?

A: Yes, you may need to submit supporting documents such as proof of residency or income.

Q: What happens after I file the Individual Declaration of Exemption?

A: Your exemption claim will be reviewed by the City of Warren's tax department. If approved, you will be exempted from the relevant taxes.

Q: Is the Individual Declaration of Exemption form applicable to businesses?

A: No, the form is only for use by individuals to claim exemptions.

Q: What should I do if I have more questions about the Individual Declaration of Exemption?

A: You can contact the City of Warren's tax office for further assistance.

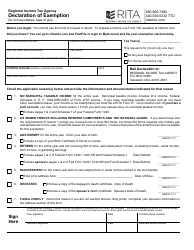

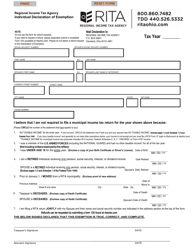

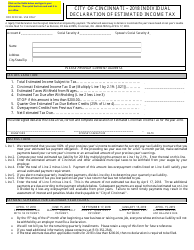

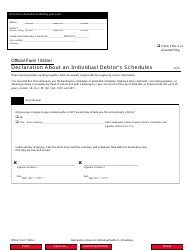

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Warren, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Warren, Ohio.