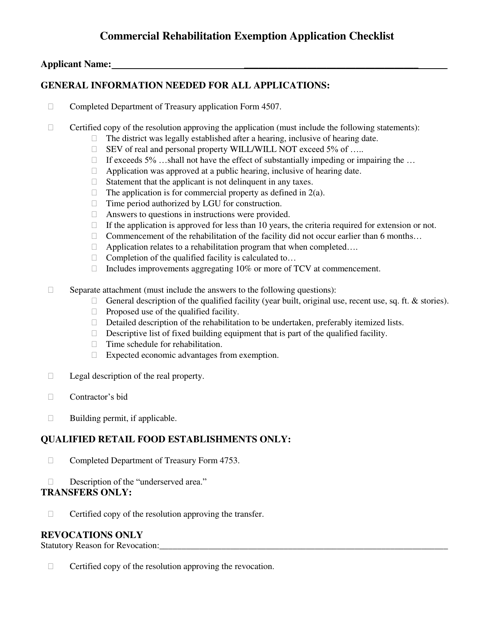

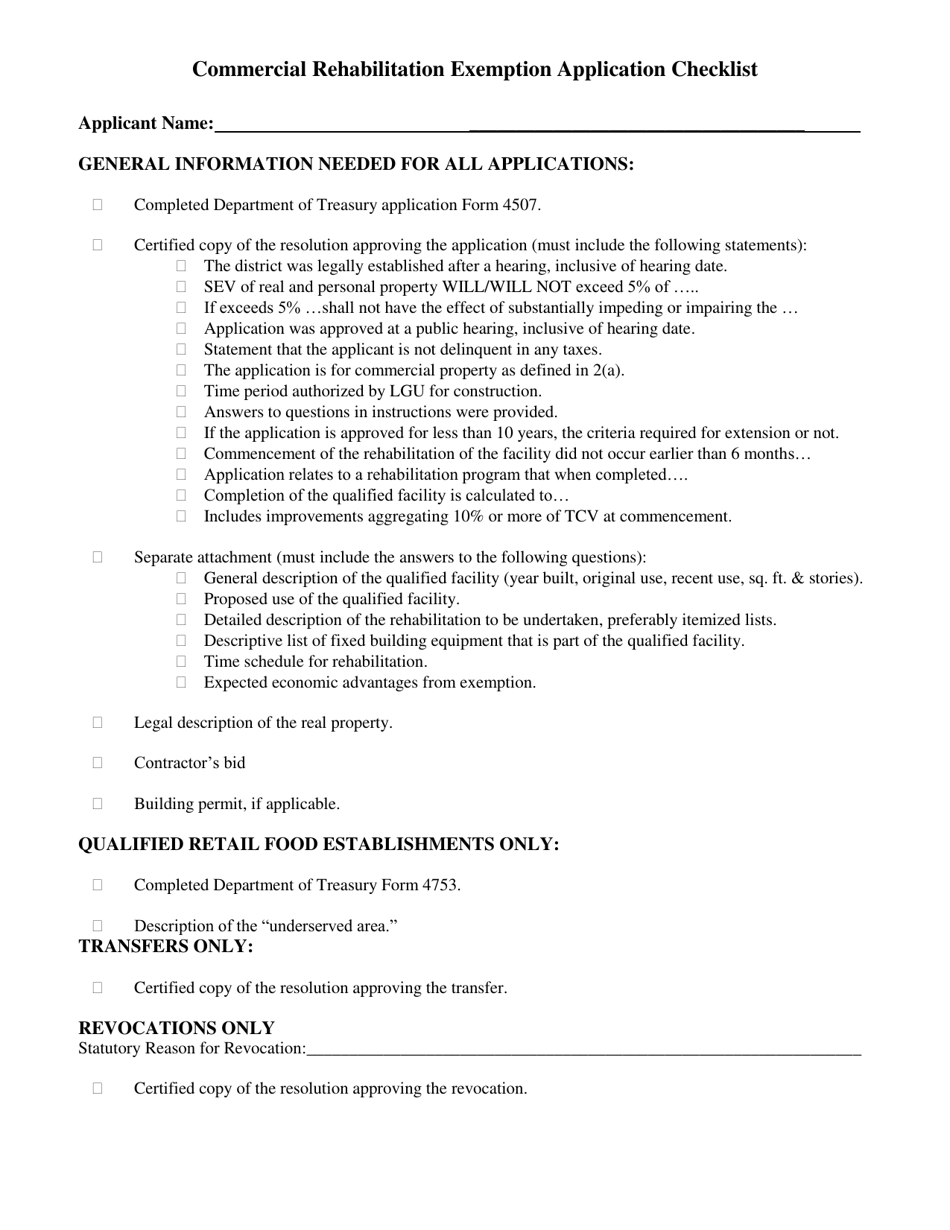

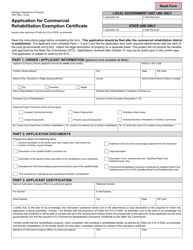

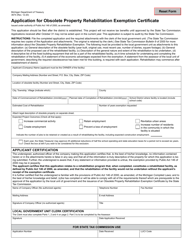

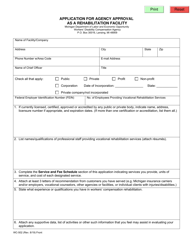

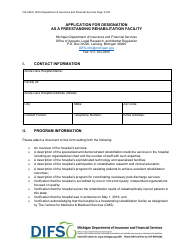

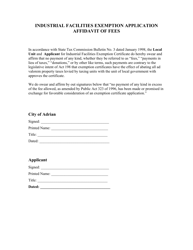

Commercial Rehabilitation Exemption Application Checklist - Michigan

Commercial Rehabilitation Exemption Application Checklist is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan.

FAQ

Q: What is a Commercial Rehabilitation Exemption?

A: A Commercial Rehabilitation Exemption is a tax incentive provided by the state of Michigan to encourage the rehabilitation and redevelopment of commercial properties.

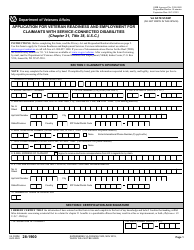

Q: Who can apply for a Commercial Rehabilitation Exemption?

A: Property owners or developers can apply for a Commercial Rehabilitation Exemption in Michigan.

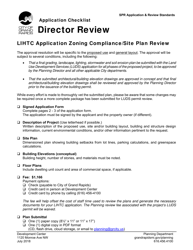

Q: What is the purpose of the Commercial Rehabilitation Exemption Application Checklist?

A: The Commercial Rehabilitation Exemption Application Checklist is a helpful tool to ensure that all required documents and information are provided when applying for the exemption.

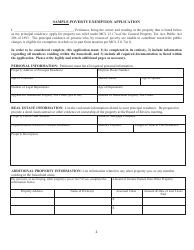

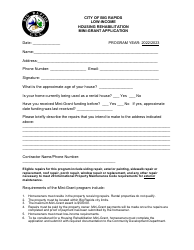

Q: What documents are required for the application?

A: The application generally requires documentation such as project plans, cost estimates, and a description of the rehabilitation work.

Q: Are there any fees associated with the application?

A: Yes, there are processing fees associated with the Commercial Rehabilitation Exemption application in Michigan.

Q: How long does it take to process the application?

A: The processing time for the Commercial Rehabilitation Exemption application can vary, but it typically takes several weeks.

Q: What are the benefits of a Commercial Rehabilitation Exemption?

A: The main benefit of a Commercial Rehabilitation Exemption is a reduction in property taxes for a certain period of time, which can incentivize property owners to invest in the rehabilitation of their properties.

Q: Can any type of commercial property be eligible for the exemption?

A: Eligibility for the Commercial Rehabilitation Exemption depends on various factors, such as the age and condition of the property, as well as its location.

Form Details:

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.