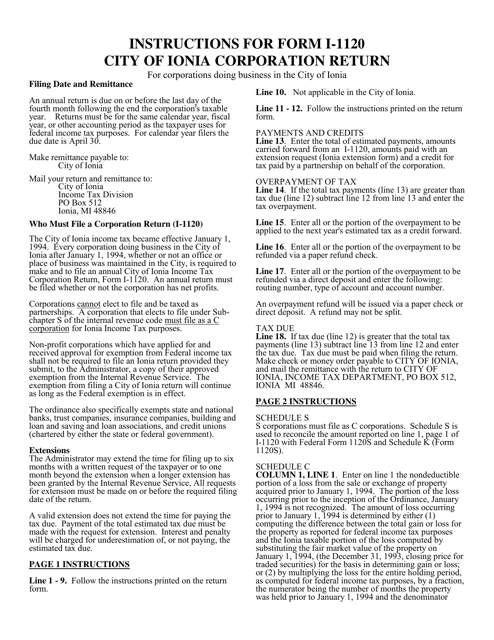

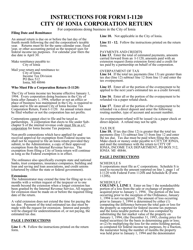

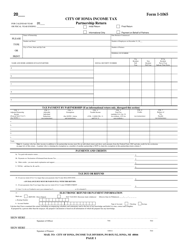

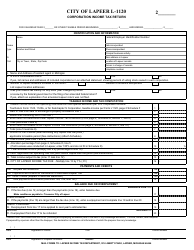

Instructions for Form I-1120 Corporation Income Tax Return - City of Ionia, Michigan

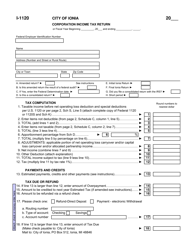

This document contains official instructions for Form I-1120 , Corporation Income Tax Return - a form released and collected by the Income Tax Department - City of Ionia, Michigan. An up-to-date fillable Form I-1120 is available for download through this link.

FAQ

Q: What is Form I-1120?

A: Form I-1120 is the Corporation Income Tax Return form.

Q: Who needs to file Form I-1120?

A: Corporations in the City of Ionia, Michigan need to file Form I-1120.

Q: What is the purpose of Form I-1120?

A: Form I-1120 is used to report the income, deductions, and tax liability of a corporation.

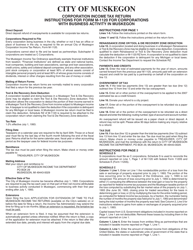

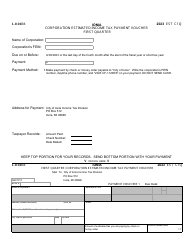

Q: When is the deadline to file Form I-1120?

A: The deadline to file Form I-1120 is usually the 15th day of the 4th month following the end of the corporation's tax year.

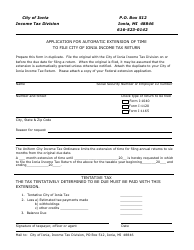

Q: What if I cannot file Form I-1120 on time?

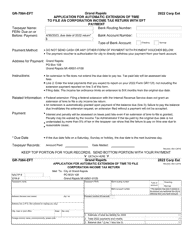

A: If you cannot file Form I-1120 on time, you may request an extension by filing Form 7004.

Q: What information do I need to complete Form I-1120?

A: To complete Form I-1120, you will need information about the corporation's income, deductions, credits, and tax liability.

Q: Are there any penalties for not filing Form I-1120?

A: Yes, there may be penalties for not filing Form I-1120 or for filing it late.

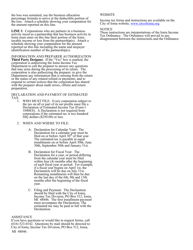

Q: Can I e-file Form I-1120?

A: Yes, you can e-file Form I-1120 if you meet the requirements.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Ionia, Michigan.