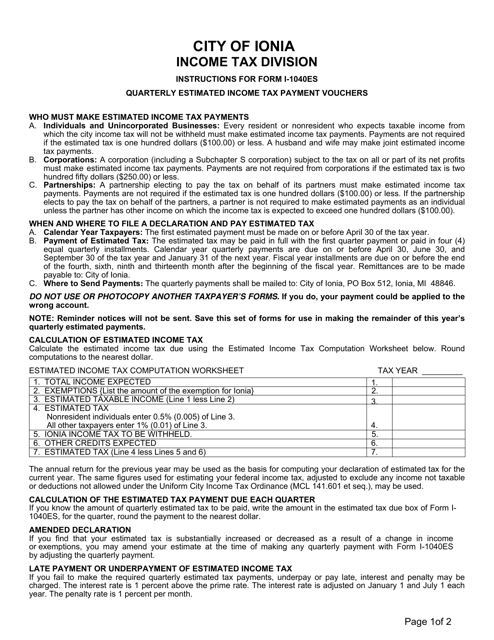

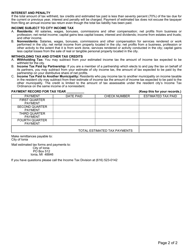

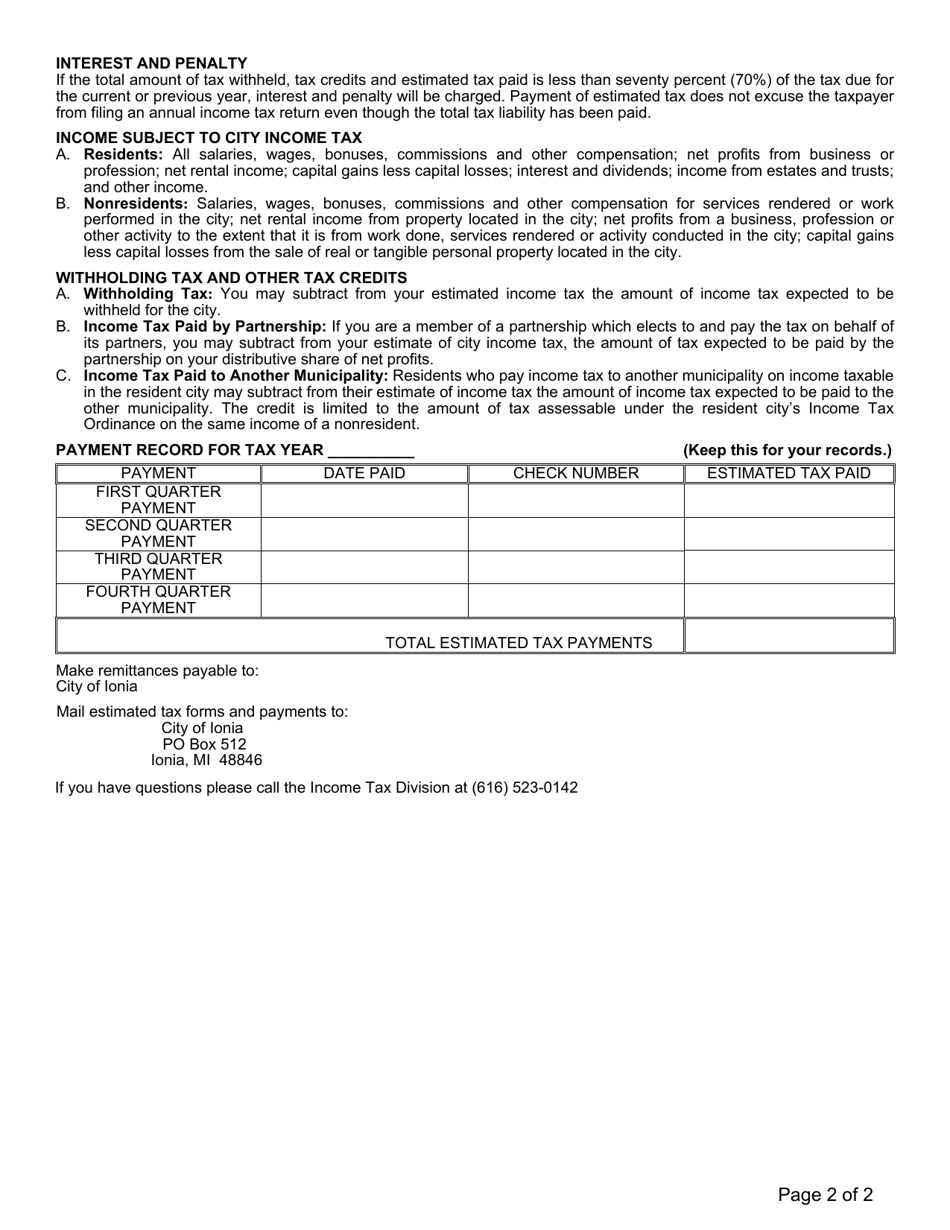

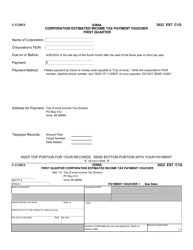

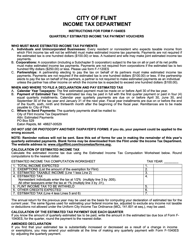

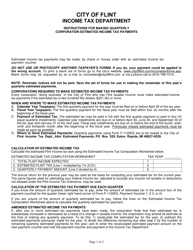

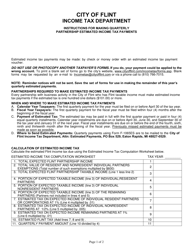

Instructions for Form I-1040ES Estimated Income Tax Payment Voucher - City of Ionia, Michigan

This document contains official instructions for Form I-1040ES , Estimated Income Tax Payment Voucher - a form released and collected by the Income Tax Department - City of Ionia, Michigan.

FAQ

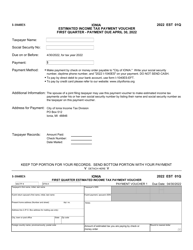

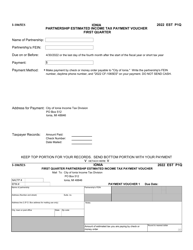

Q: What is Form I-1040ES?

A: Form I-1040ES is the Estimated Income Tax Payment Voucher.

Q: What is the purpose of Form I-1040ES?

A: The purpose of Form I-1040ES is to make estimated income tax payments.

Q: Who needs to use Form I-1040ES?

A: Individuals who expect to owe additional tax for the year and want to avoid penalties should use Form I-1040ES to make estimated income tax payments.

Q: What is the City of Ionia, Michigan?

A: The City of Ionia is a city located in the state of Michigan.

Q: What is the significance of the City of Ionia, Michigan in regards to Form I-1040ES?

A: There is no specific significance of the City of Ionia, Michigan in regards to Form I-1040ES. It is likely mentioned in the document due to the location where the form may need to be filed or where the instructions were originally created.

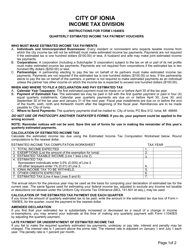

Q: Are there any penalties for not using Form I-1040ES to make estimated income tax payments?

A: Yes, individuals who do not use Form I-1040ES to make estimated income tax payments may be subject to penalties.

Q: Can I use Form I-1040ES if I don't live in the City of Ionia, Michigan?

A: Yes, Form I-1040ES can be used by individuals living in any location, not just the City of Ionia, Michigan.

Q: What other documents do I need to file along with Form I-1040ES?

A: The specific documents that need to be filed along with Form I-1040ES may vary depending on personal circumstances, but generally include tax returns and any other supporting documents.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Ionia, Michigan.