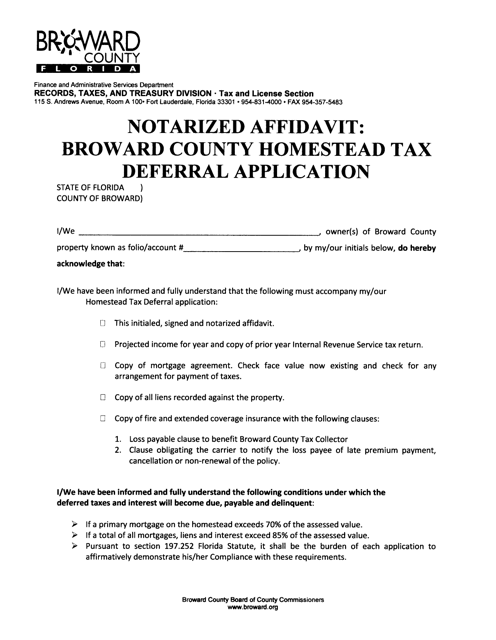

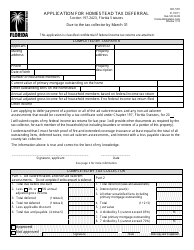

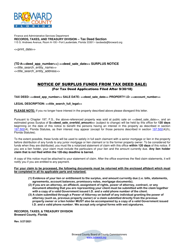

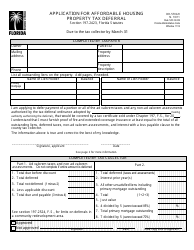

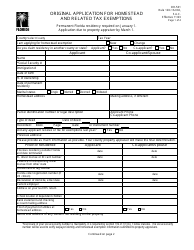

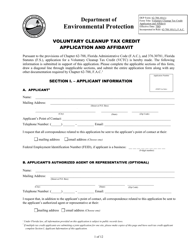

Notarized Affidavit: Broward County Homestead Tax Deferral Application - Broward County, Florida

Notarized Affidavit: Broward County Homestead Tax Deferral Application is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

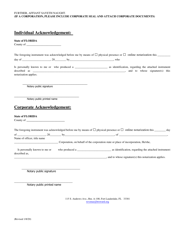

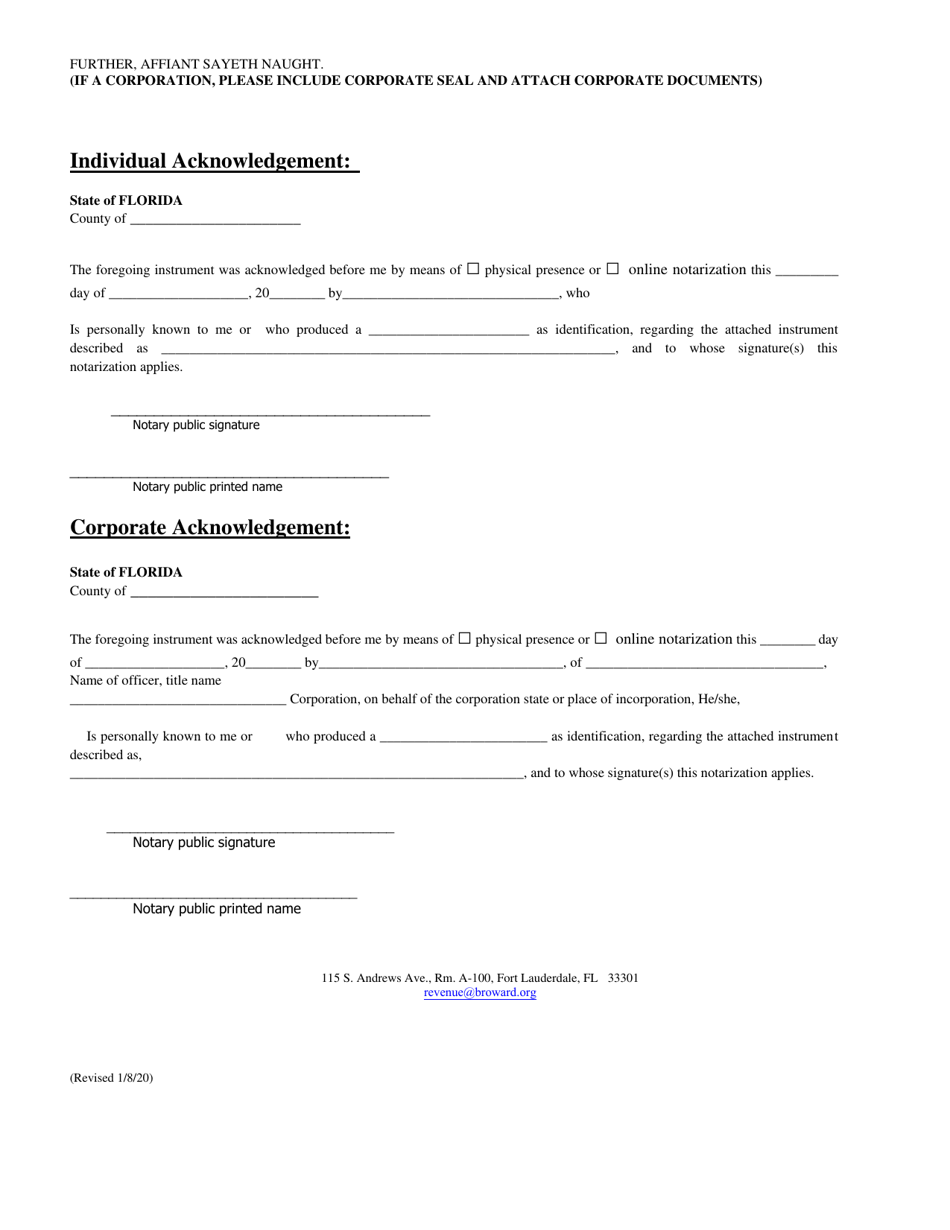

Q: What is a notarized affidavit?

A: A notarized affidavit is a sworn statement that has been signed in the presence of a notary public.

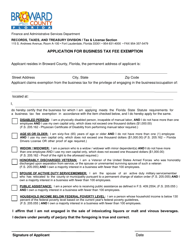

Q: What is the Broward County Homestead Tax Deferral Application?

A: The Broward County Homestead Tax Deferral Application is a form that allows eligible homeowners in Broward County, Florida to defer paying their property taxes.

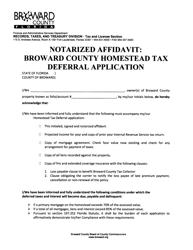

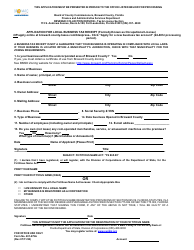

Q: Who is eligible to apply for the Broward County Homestead Tax Deferral?

A: Homeowners who are 65 years or older, have a household income of $30,000 or less, and have owned and occupied their homestead property for at least 25 years are eligible to apply for the Broward County Homestead Tax Deferral.

Q: What is the purpose of the Broward County Homestead Tax Deferral?

A: The purpose of the Broward County Homestead Tax Deferral is to provide financial assistance to eligible homeowners who may have difficulty paying their property taxes.

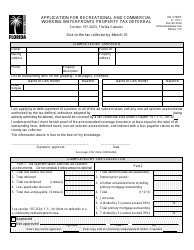

Q: What does it mean to defer property taxes?

A: To defer property taxes means that homeowners can delay paying their property taxes until a later date, usually when the property is sold or transferred.

Q: Is the Broward County Homestead Tax Deferral a permanent exemption?

A: No, the Broward County Homestead Tax Deferral is not a permanent exemption. It allows eligible homeowners to defer their property tax payments, but the taxes will still need to be paid at a later date.

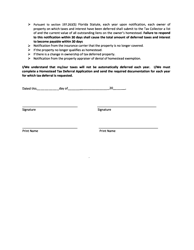

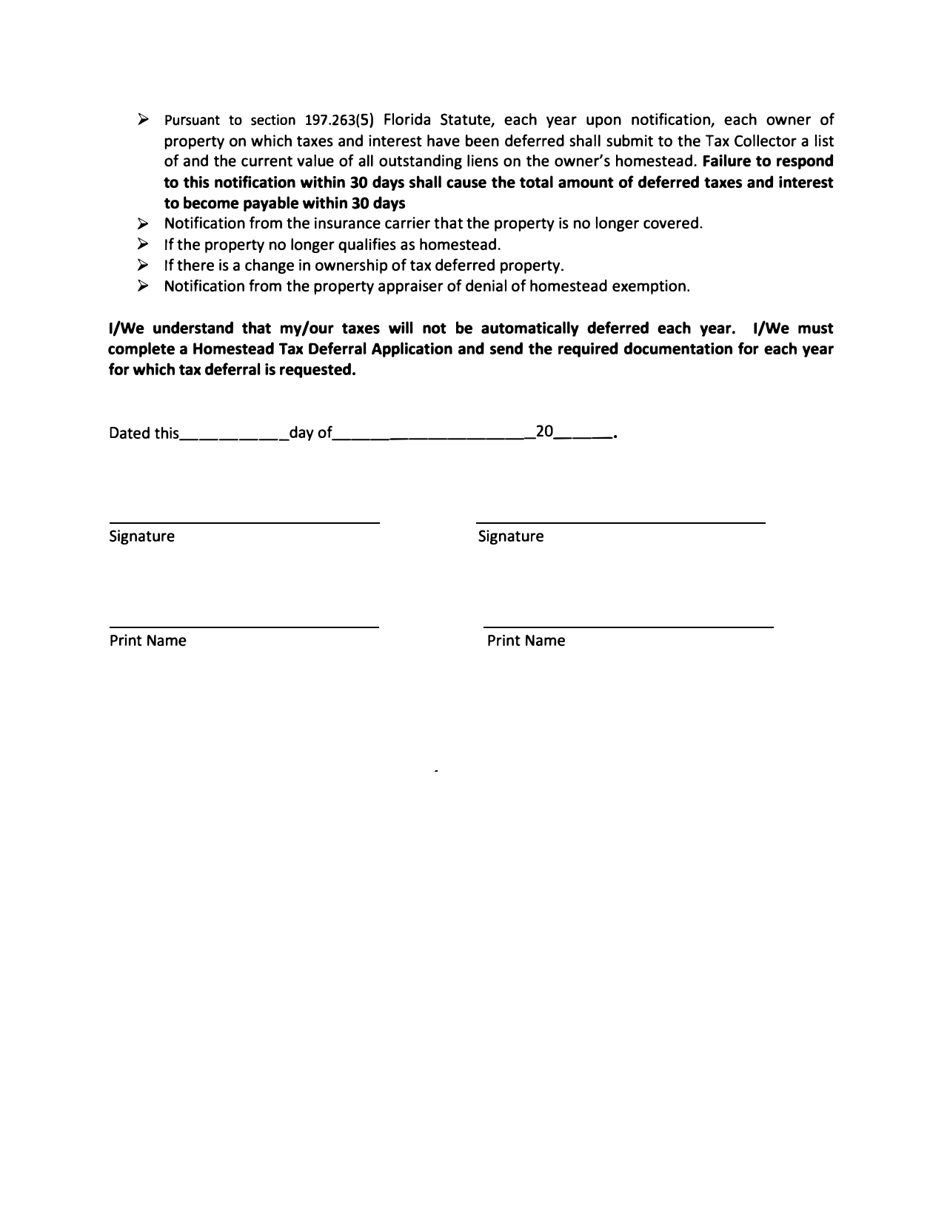

Q: How do I apply for the Broward County Homestead Tax Deferral?

A: To apply for the Broward County Homestead Tax Deferral, you will need to fill out the application form, provide supporting documentation, and submit it to the Broward County Property Appraiser's Office.

Q: What supporting documentation is required for the Broward County Homestead Tax Deferral application?

A: The required supporting documentation may include proof of age, proof of household income, and proof of ownership and occupancy of the homestead property.

Q: Is there a deadline to apply for the Broward County Homestead Tax Deferral?

A: Yes, the deadline to apply for the Broward County Homestead Tax Deferral is March 1st of each year.

Form Details:

- Released on January 8, 2020;

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.