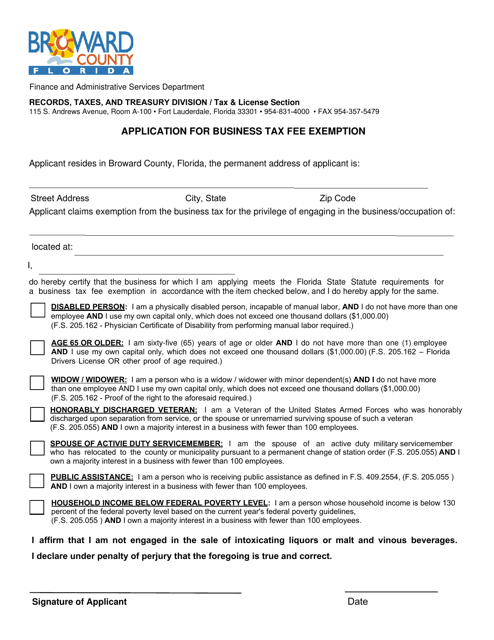

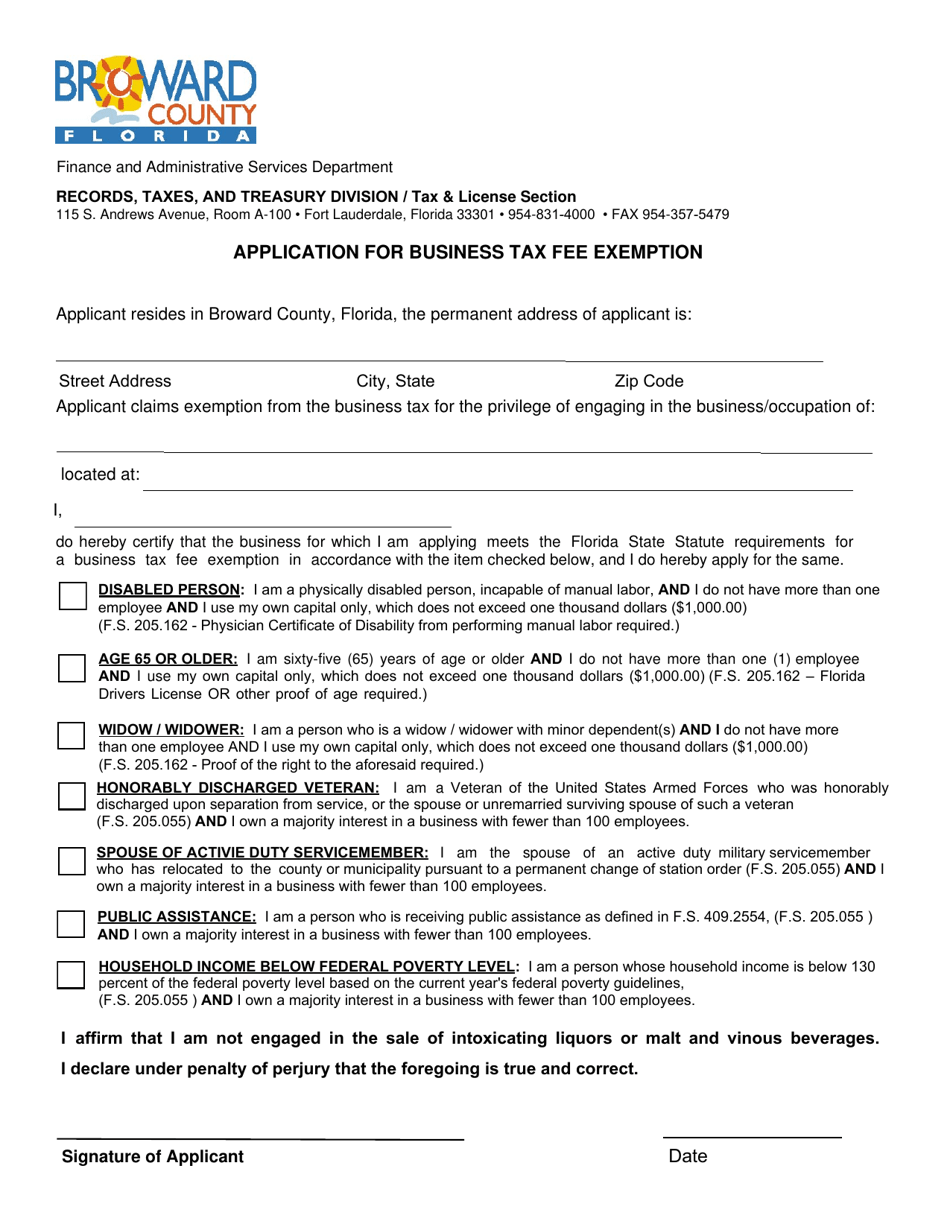

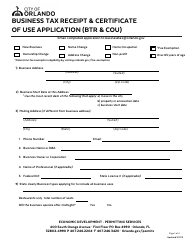

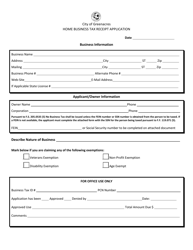

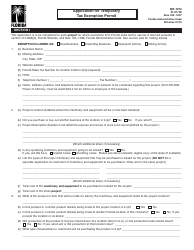

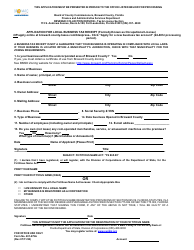

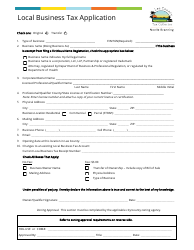

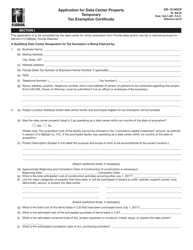

Application for Business Tax Fee Exemption - Broward County, Florida

Application for Business Tax Fee Exemption is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

Q: What is the application for?

A: The application is for a Business Tax Fee Exemption in Broward County, Florida.

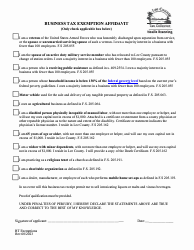

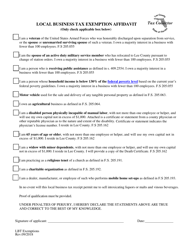

Q: Who can apply for the exemption?

A: Any business operating in Broward County, Florida can apply for the exemption.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to waive or reduce business tax fees for eligible businesses.

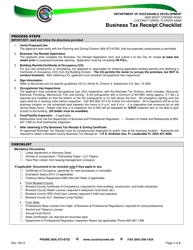

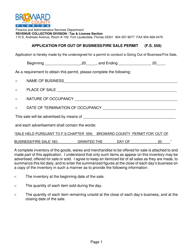

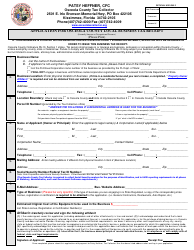

Q: How can I apply for the exemption?

A: You can apply for the exemption by completing the application form provided by Broward County.

Q: Are there any eligibility criteria for the exemption?

A: Yes, there are eligibility criteria that businesses must meet in order to qualify for the exemption.

Q: Is there a deadline for submitting the application?

A: There may be a deadline for submitting the application, so it's important to check the specific requirements and deadlines for Broward County.

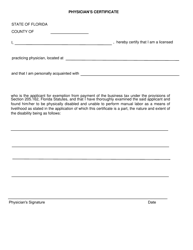

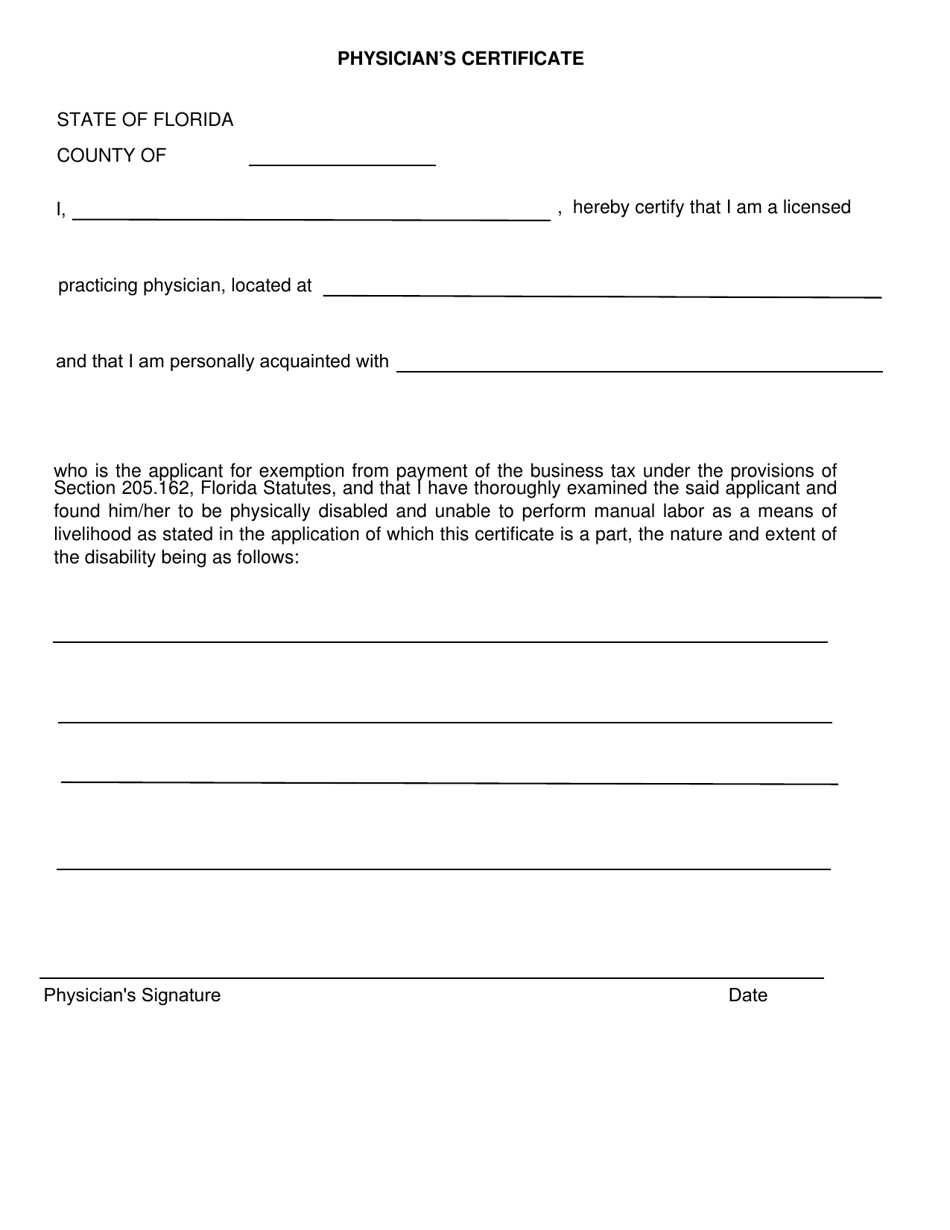

Q: What documentation do I need to submit with the application?

A: You may need to submit certain documents such as proof of business ownership or registration, financial statements, and other supporting documentation.

Q: How long does it take to process the application?

A: Processing times for the application may vary, so it's best to contact Broward County's Business Tax Division for more information.

Q: Is the exemption guaranteed once I apply?

A: The exemption is not guaranteed and will be subject to review and approval by Broward County's Business Tax Division.

Form Details:

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.