This version of the form is not currently in use and is provided for reference only. Download this version of

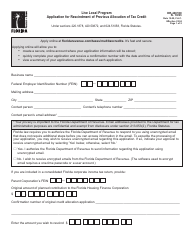

Form 401-279A

for the current year.

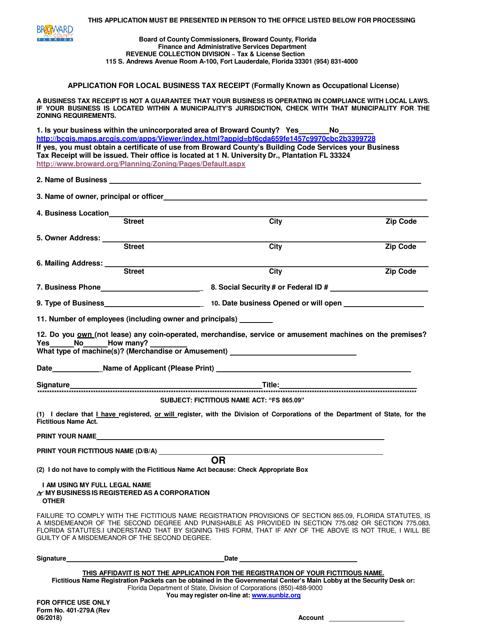

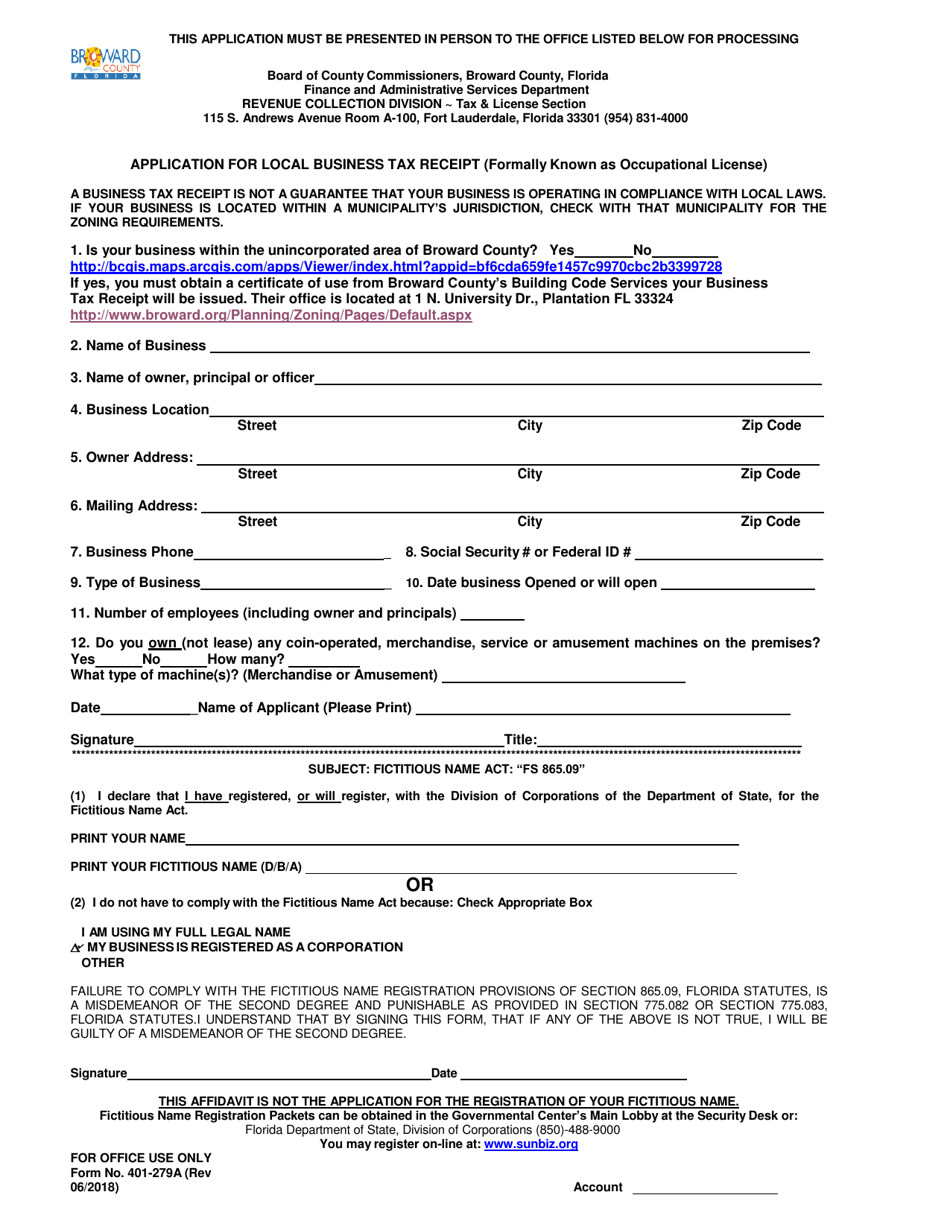

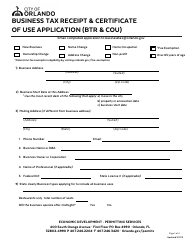

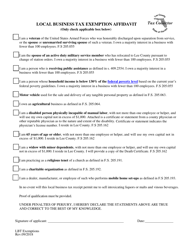

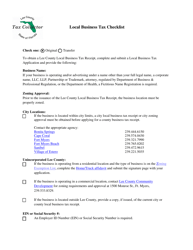

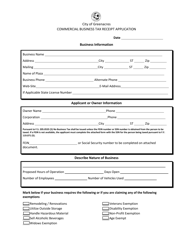

Form 401-279A Application for Local Business Tax Receipt - Broward County, Florida

What Is Form 401-279A?

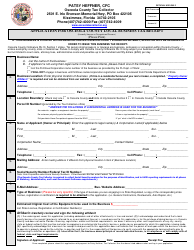

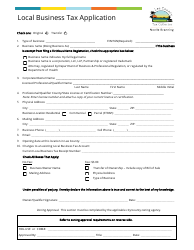

This is a legal form that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 401-279A?

A: Form 401-279A is an application for a Local BusinessTax Receipt in Broward County, Florida.

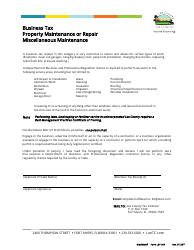

Q: What is a Local Business Tax Receipt?

A: A Local Business Tax Receipt is a document required for operating a business in Broward County, Florida.

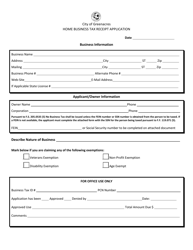

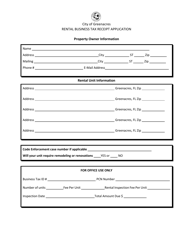

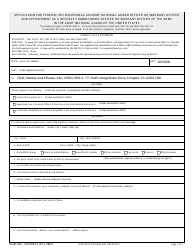

Q: What information is required on Form 401-279A?

A: Form 401-279A requires information such as the business name, owner information, address, type of business, and other specific details.

Q: Are there any fees associated with the application?

A: Yes, there are fees associated with the application. The fee amount depends on the type of business and the number of employees.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it typically takes a few weeks to receive the Local Business Tax Receipt.

Q: Is the Local Business Tax Receipt renewable?

A: Yes, the Local Business Tax Receipt is renewable on an annual basis.

Q: What happens if I operate a business without a Local Business Tax Receipt?

A: Operating a business without a Local Business Tax Receipt is a violation and can result in penalties and fines.

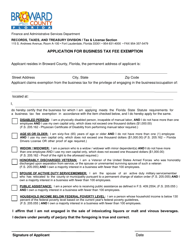

Q: Are there any exemptions or discounts available?

A: Yes, there may be exemptions and discounts available for certain types of businesses. It is recommended to contact the Broward County Business Tax Office for more information.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 401-279A by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.