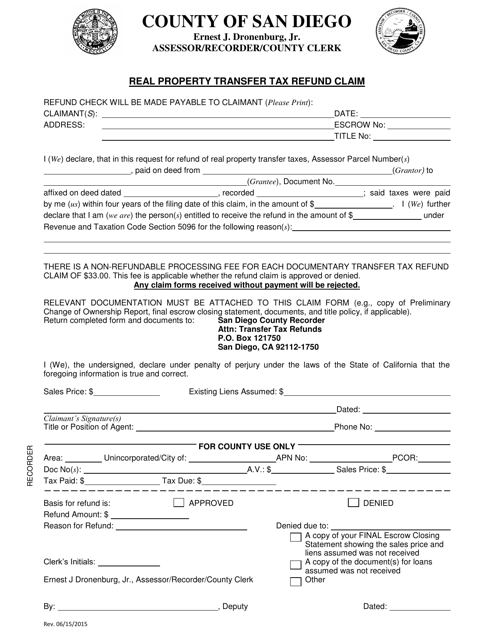

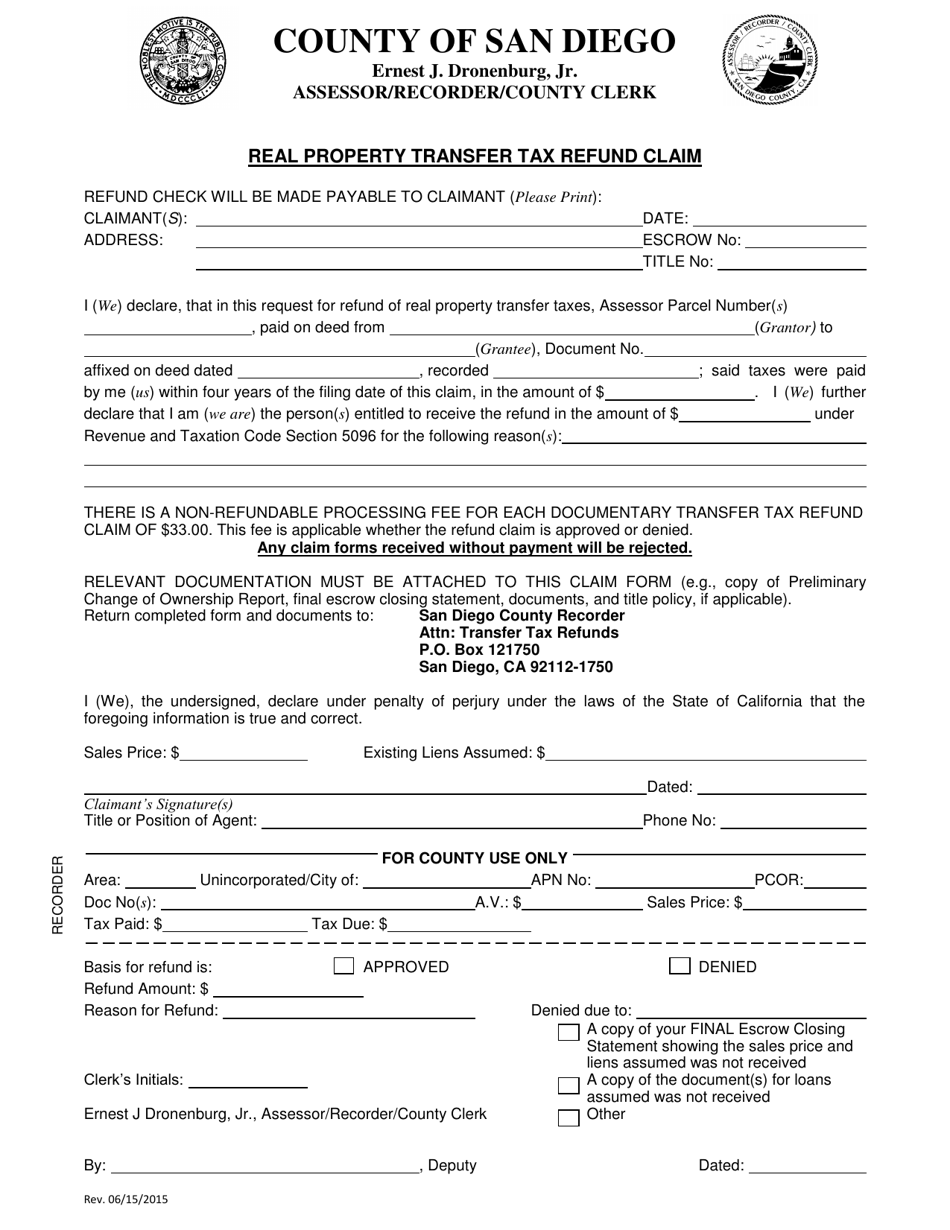

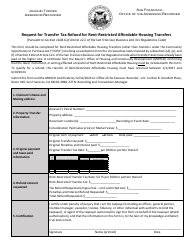

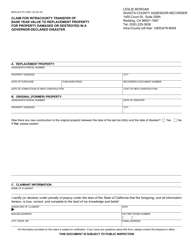

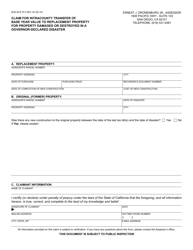

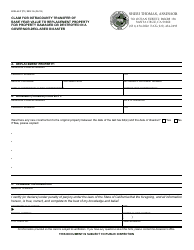

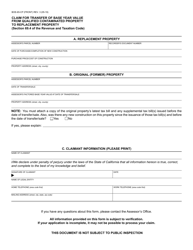

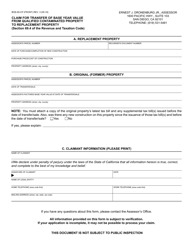

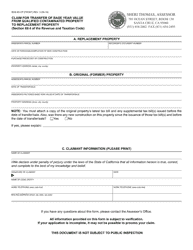

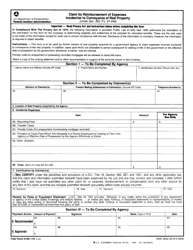

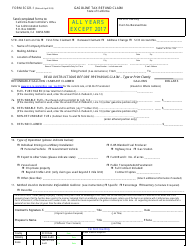

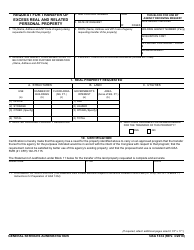

Real Property Transfer Tax Refund Claim - County of San Diego, California

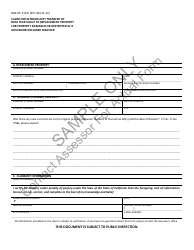

Real Property Transfer Tax Refund Claim is a legal document that was released by the Assessor, Recorder, County Clerk's Office - County of San Diego, California - a government authority operating within California. The form may be used strictly within County of San Diego.

FAQ

Q: What is a Real Property Transfer Tax Refund Claim?

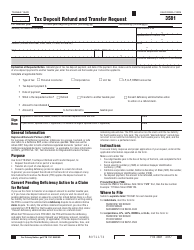

A: A Real Property TransferTax Refund Claim is a form used to request a refund of transfer taxes paid on a property in the County of San Diego, California.

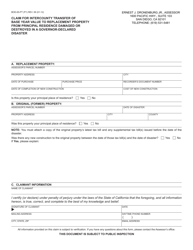

Q: Who can file a Real Property Transfer Tax Refund Claim?

A: The person(s) who paid the transfer tax or the person(s) who acquired the property can file a Real Property Transfer Tax Refund Claim.

Q: When should a Real Property Transfer Tax Refund Claim be filed?

A: A Real Property Transfer Tax Refund Claim should be filed within three years from the date of payment of the transfer tax.

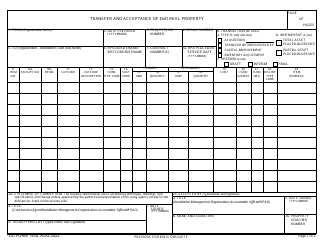

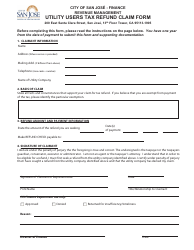

Q: What documentation is required to file a Real Property Transfer Tax Refund Claim?

A: The documentation required to file a Real Property Transfer Tax Refund Claim includes a completed claim form, proof of payment of transfer tax, and supporting documentation.

Q: How long does it take to process a Real Property Transfer Tax Refund Claim?

A: The processing time for a Real Property Transfer Tax Refund Claim can vary, but it typically takes several weeks to several months.

Q: Are there any fees associated with filing a Real Property Transfer Tax Refund Claim?

A: No, there are no fees associated with filing a Real Property Transfer Tax Refund Claim.

Q: What is the purpose of a Real Property Transfer Tax?

A: The purpose of a Real Property Transfer Tax is to generate revenue for the County of San Diego by taxing the transfer of real estate ownership.

Q: Can I claim a refund if I sold my property at a loss?

A: No, a Real Property Transfer Tax Refund Claim is only eligible for a refund of transfer taxes paid, not for any losses incurred during the sale of the property.

Form Details:

- Released on June 15, 2015;

- The latest edition currently provided by the Assessor, Recorder, County Clerk's Office - County of San Diego, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessor, Recorder, County Clerk's Office - County of San Diego, California.