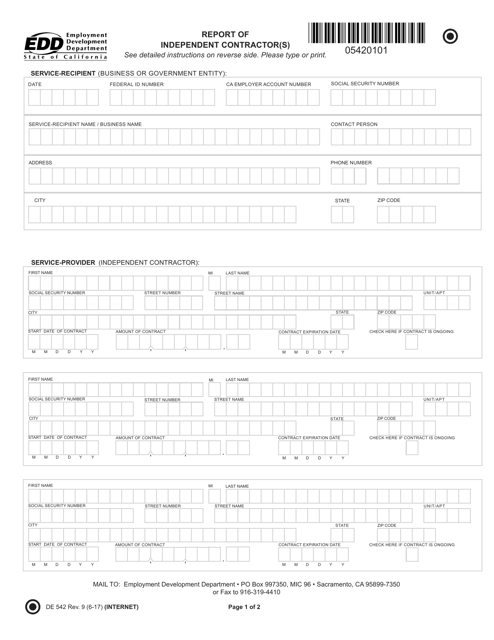

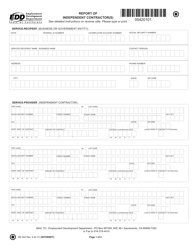

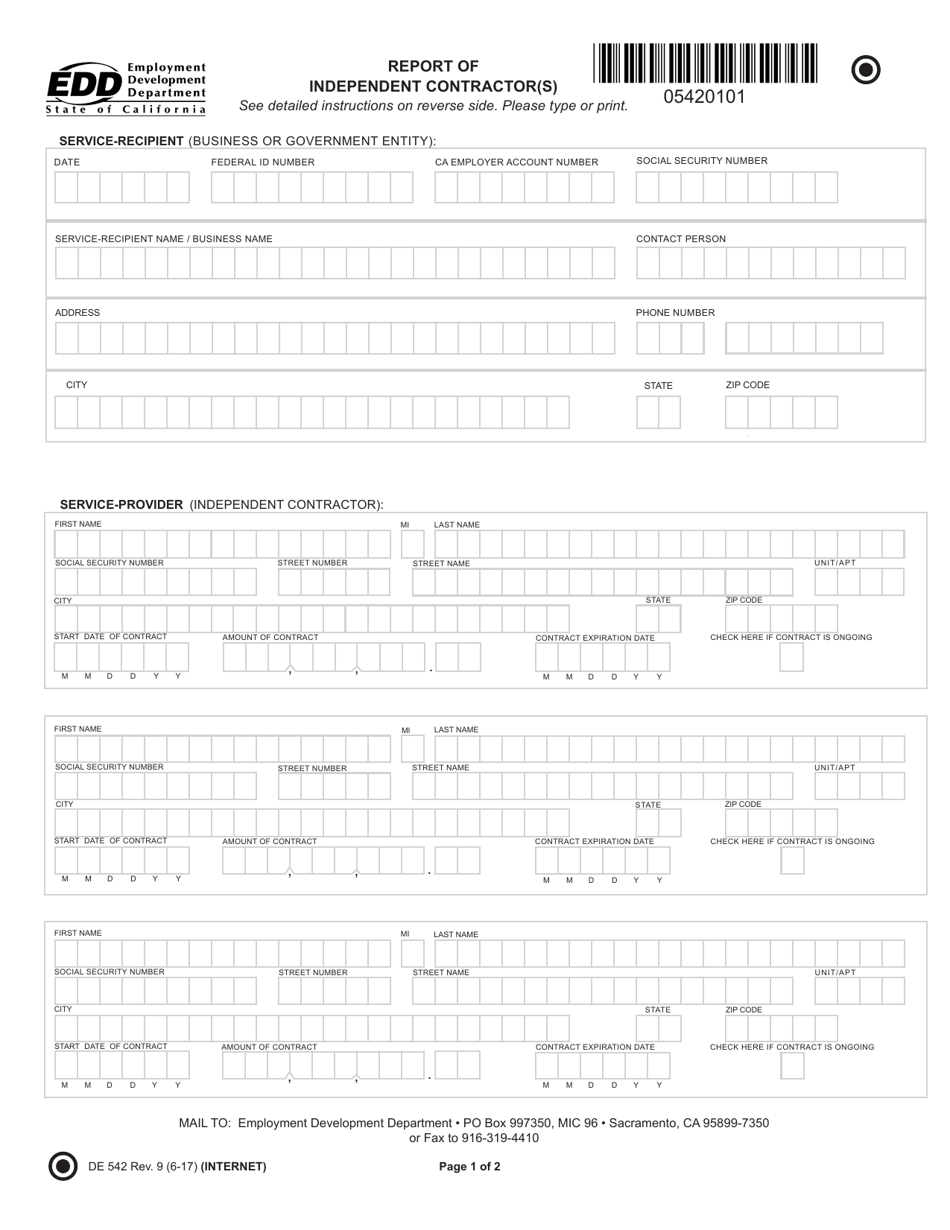

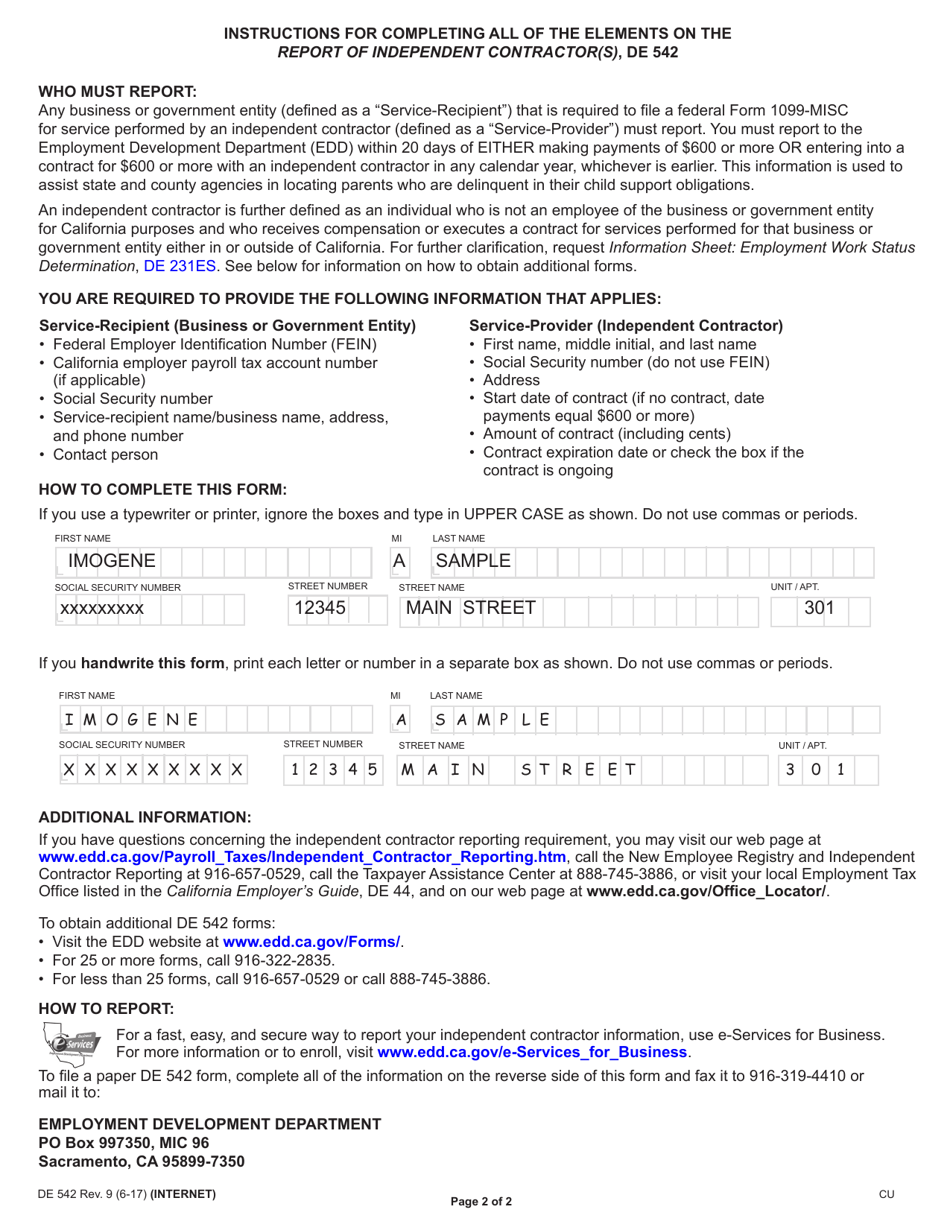

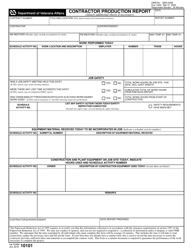

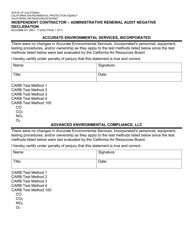

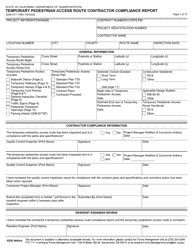

Form DE542 Report of Independent Contractor(S) - California

What Is Form DE542?

This is a legal form that was released by the California Employment Development Department - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DE542?

A: Form DE542 is the Report of Independent Contractor(s) form in California.

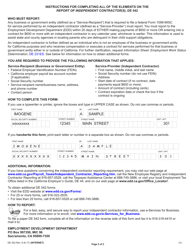

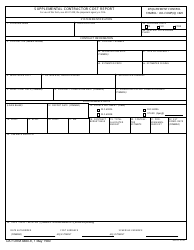

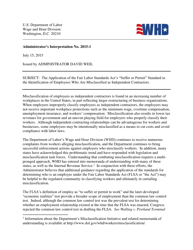

Q: Who needs to file form DE542?

A: Businesses in California who have paid $600 or more to an independent contractor or unincorporated business must file form DE542.

Q: When is form DE542 due?

A: Form DE542 is due by January 31st of each year for the previous tax year.

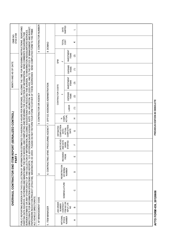

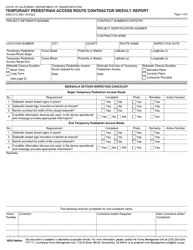

Q: What information is required on form DE542?

A: Form DE542 requires the business name, address, federal employer identification number (FEIN), total amount paid to independent contractors, and other relevant information.

Q: Are there any penalties for not filing form DE542?

A: Yes, failure to file form DE542 or filing incorrect information may result in penalties and interest.

Q: Can I file form DE542 electronically?

A: Yes, you can file form DE542 electronically through the EDD's e-Services for Business portal.

Q: Do I need to send a copy of form DE542 to independent contractors?

A: Yes, you are required to provide a copy of form DE542 to each independent contractor you paid $600 or more during the tax year.

Q: Is form DE542 only for California residents?

A: No, form DE542 is specifically for businesses in California regardless of their residency status.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the California Employment Development Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE542 by clicking the link below or browse more documents and templates provided by the California Employment Development Department.