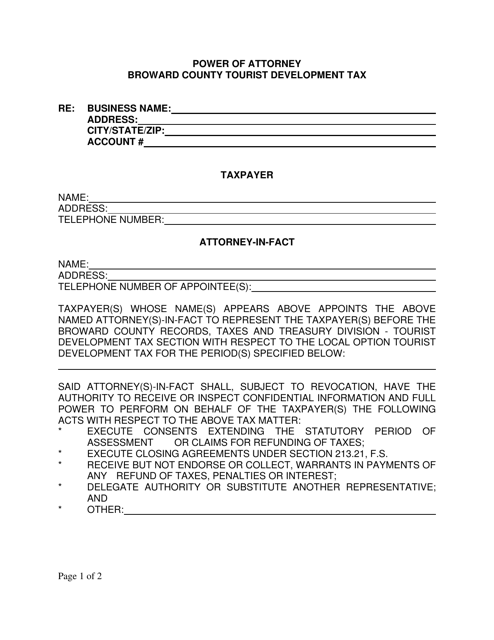

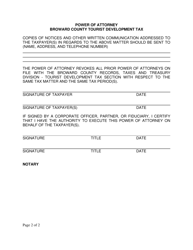

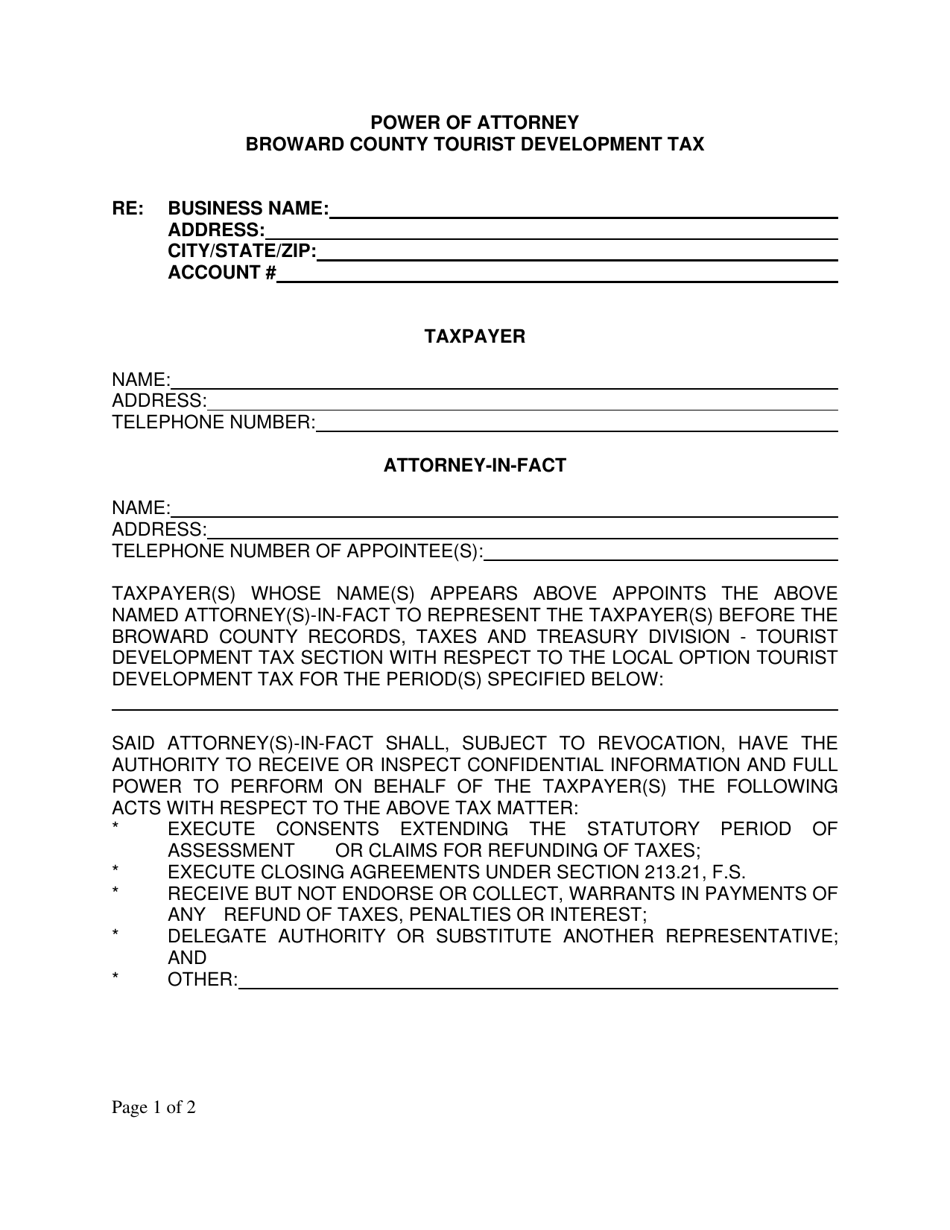

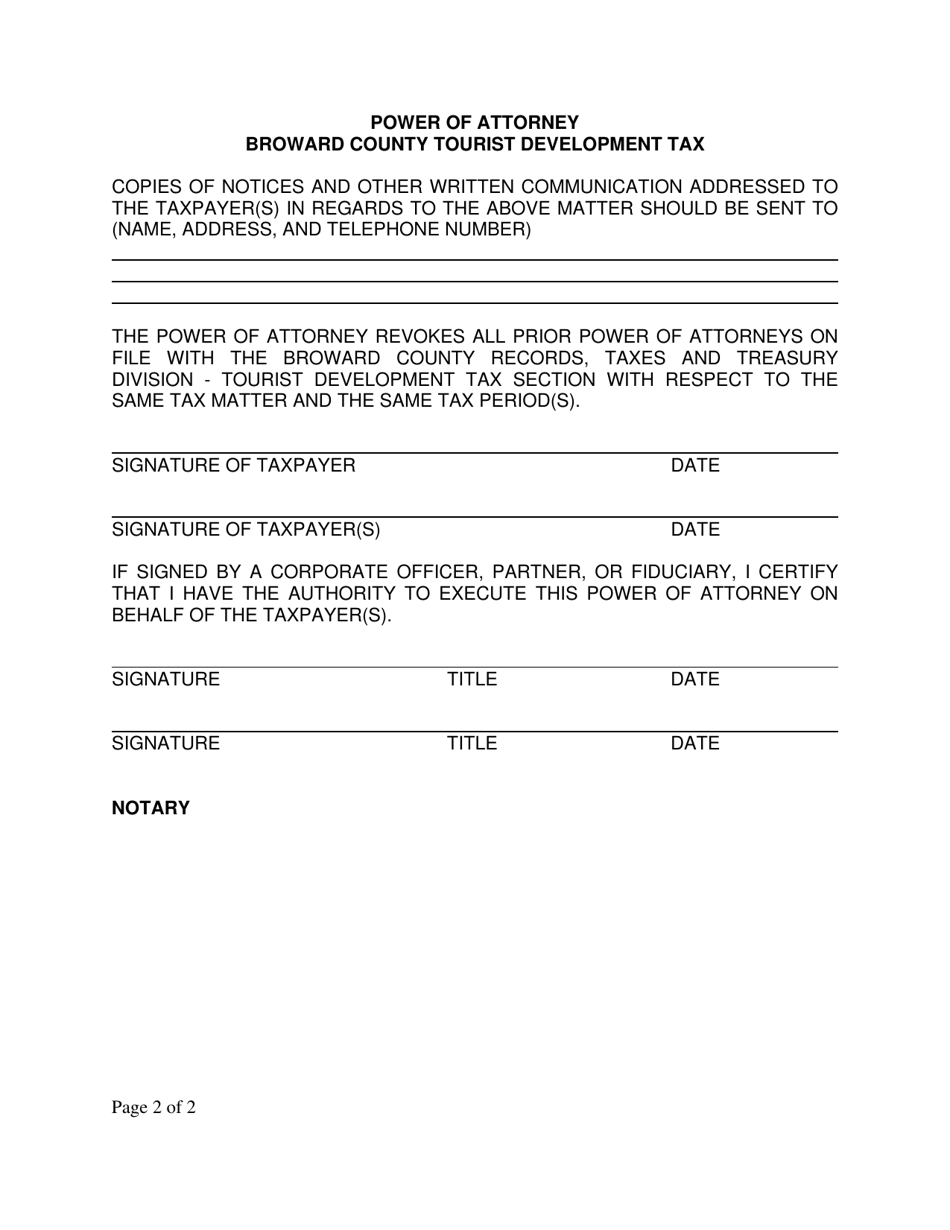

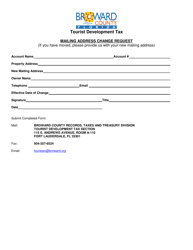

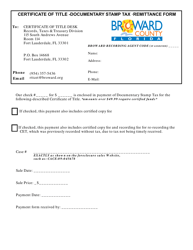

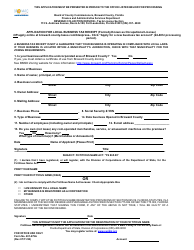

Power of Attorney - Tourist Development Tax - Broward County, Florida

Power of Attorney - Tourist Development Tax is a legal document that was released by the Records, Taxes & Treasury Division - Broward County, Florida - a government authority operating within Florida. The form may be used strictly within Broward County.

FAQ

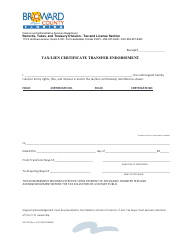

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that gives someone the authority to act on your behalf in financial or legal matters.

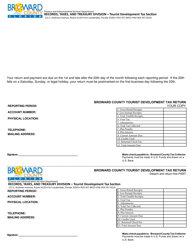

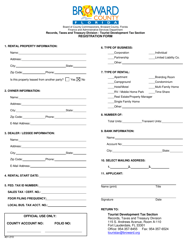

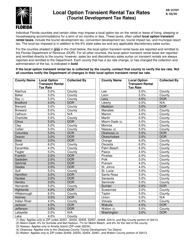

Q: What is Tourist Development Tax?

A: Tourist Development Tax is a tax imposed on individuals who rent accommodations for periods of less than six months in Broward County, Florida.

Q: Why would I need a Power of Attorney for Tourist Development Tax in Broward County?

A: You may need a Power of Attorney if you are unable to personally handle your Tourist Development Tax obligations and need someone else to handle it on your behalf.

Q: Who can I appoint as my Power of Attorney for Tourist Development Tax?

A: You can appoint any competent adult to be your Power of Attorney for Tourist Development Tax.

Q: How do I create a Power of Attorney for Tourist Development Tax?

A: To create a Power of Attorney for Tourist Development Tax, you should consult with an attorney who specializes in estate planning and tax matters.

Q: Is a Power of Attorney for Tourist Development Tax specific to Broward County, Florida?

A: No, a Power of Attorney for Tourist Development Tax can be used in any jurisdiction where Tourist Development Tax is applicable, not just Broward County, Florida.

Form Details:

- The latest edition currently provided by the Records, Taxes & Treasury Division - Broward County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Records, Taxes & Treasury Division - Broward County, Florida.