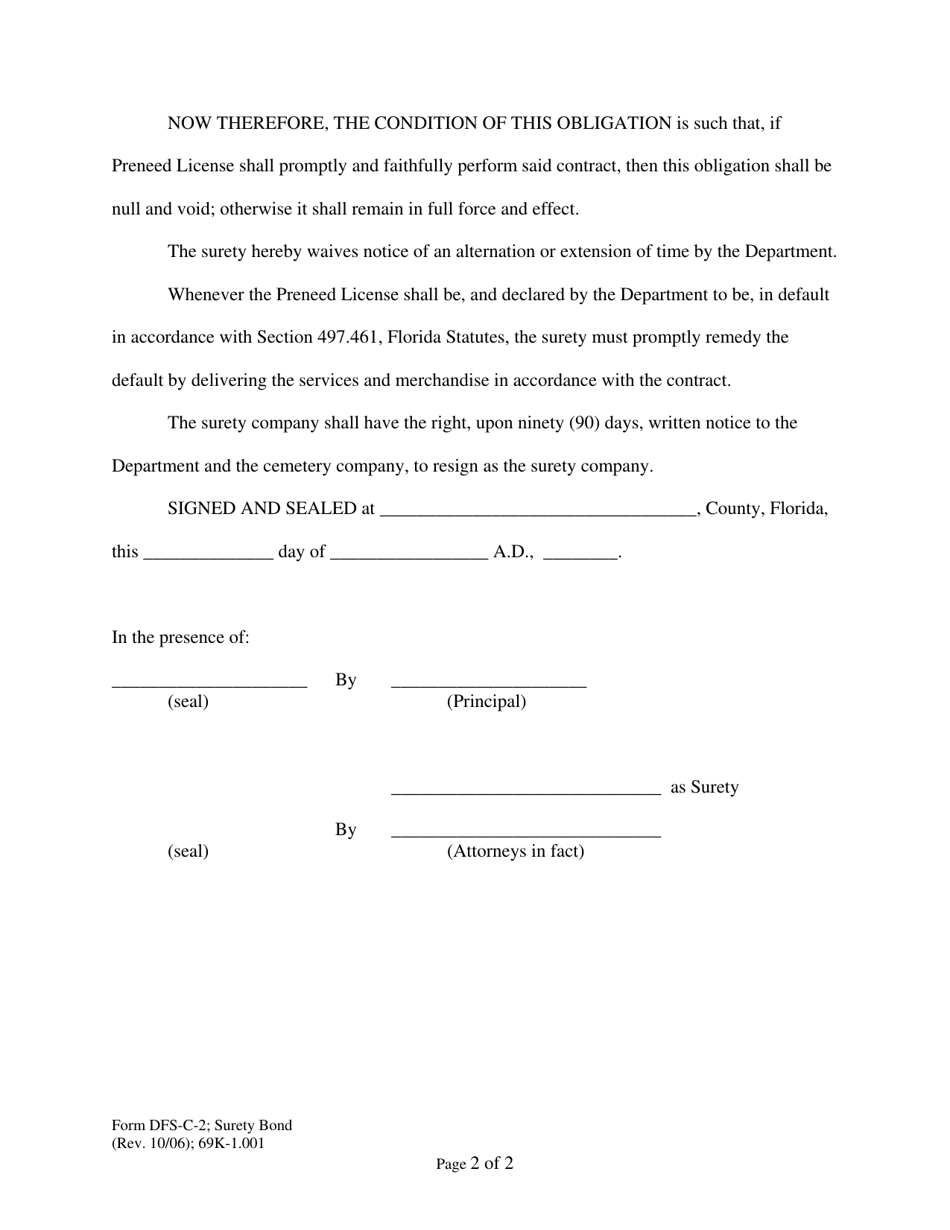

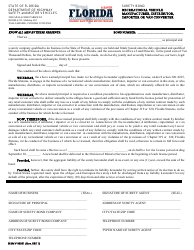

Form DFS-C-2 Surety Bond - Florida

What Is Form DFS-C-2?

This is a legal form that was released by the Florida Department of Financial Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

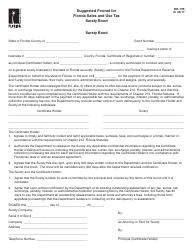

Q: What is a Form DFS-C-2 Surety Bond?

A: A Form DFS-C-2 Surety Bond is a type of bond required in the state of Florida for certain industries or professions.

Q: Who needs a Form DFS-C-2 Surety Bond?

A: Certain industries or professions in Florida may require individuals or businesses to obtain a Form DFS-C-2 Surety Bond as a condition of licensure or to meet other regulatory requirements.

Q: What is the purpose of a Form DFS-C-2 Surety Bond?

A: The purpose of a Form DFS-C-2 Surety Bond is to provide financial protection to the public in case of any damages or losses resulting from the actions or omissions of the bond holder.

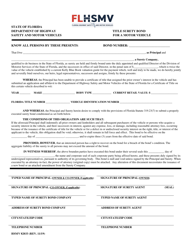

Q: How does a Form DFS-C-2 Surety Bond work?

A: A Form DFS-C-2 Surety Bond is a three-party agreement between the principal (bond holder), the obligee (entity requiring the bond), and the surety (bond provider), where the surety guarantees to pay a specified amount to the obligee in case of a valid claim against the bond.

Q: How much does a Form DFS-C-2 Surety Bond cost?

A: The cost of a Form DFS-C-2 Surety Bond can vary depending on factors such as the bond amount required, the financial stability of the bond holder, and other underwriting considerations.

Q: How long does a Form DFS-C-2 Surety Bond remain in effect?

A: The duration of a Form DFS-C-2 Surety Bond can vary depending on the specific requirements of the obligee, but it is typically valid for a specified period of time, such as one year.

Q: Can a Form DFS-C-2 Surety Bond be cancelled?

A: Yes, a Form DFS-C-2 Surety Bond can be cancelled, but the cancellation typically requires advance notice to the obligee and may be subject to certain conditions specified in the bond agreement.

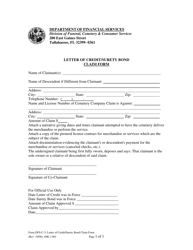

Q: What happens if a claim is made against a Form DFS-C-2 Surety Bond?

A: If a valid claim is made against a Form DFS-C-2 Surety Bond, the surety may investigate the claim and if approved, make payment up to the bond amount to the obligee, pending any required resolution or legal process.

Q: Can I use a Form DFS-C-2 Surety Bond from another state?

A: In most cases, a Form DFS-C-2 Surety Bond must be specific to the state of Florida and issued by a surety bond provider authorized to issue bonds in Florida.

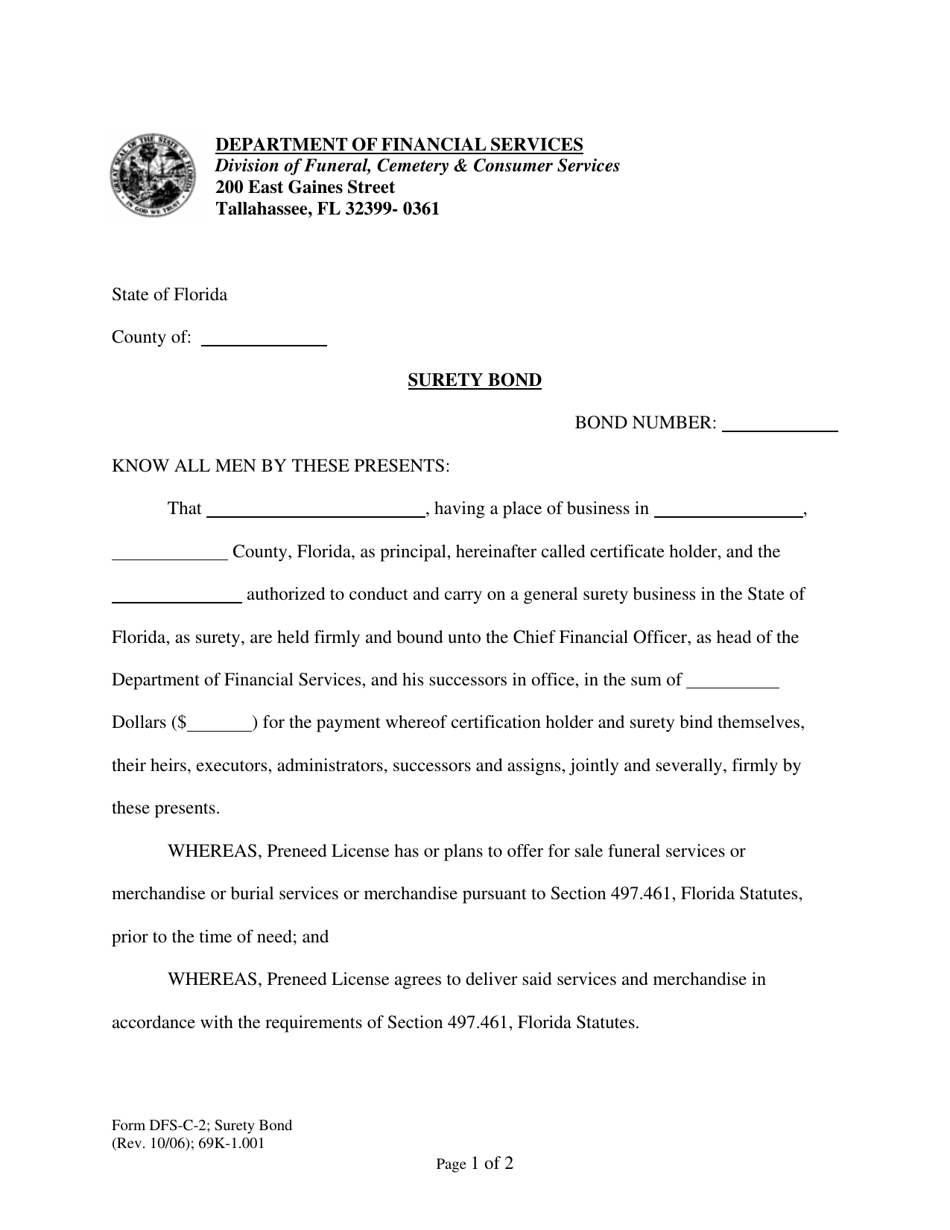

Form Details:

- Released on October 1, 2006;

- The latest edition provided by the Florida Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DFS-C-2 by clicking the link below or browse more documents and templates provided by the Florida Department of Financial Services.