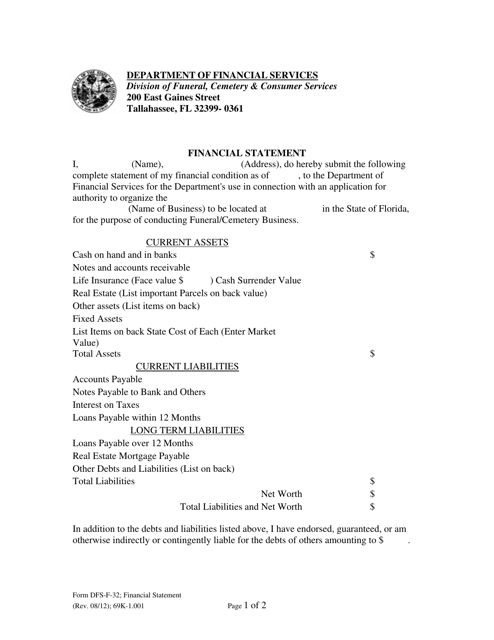

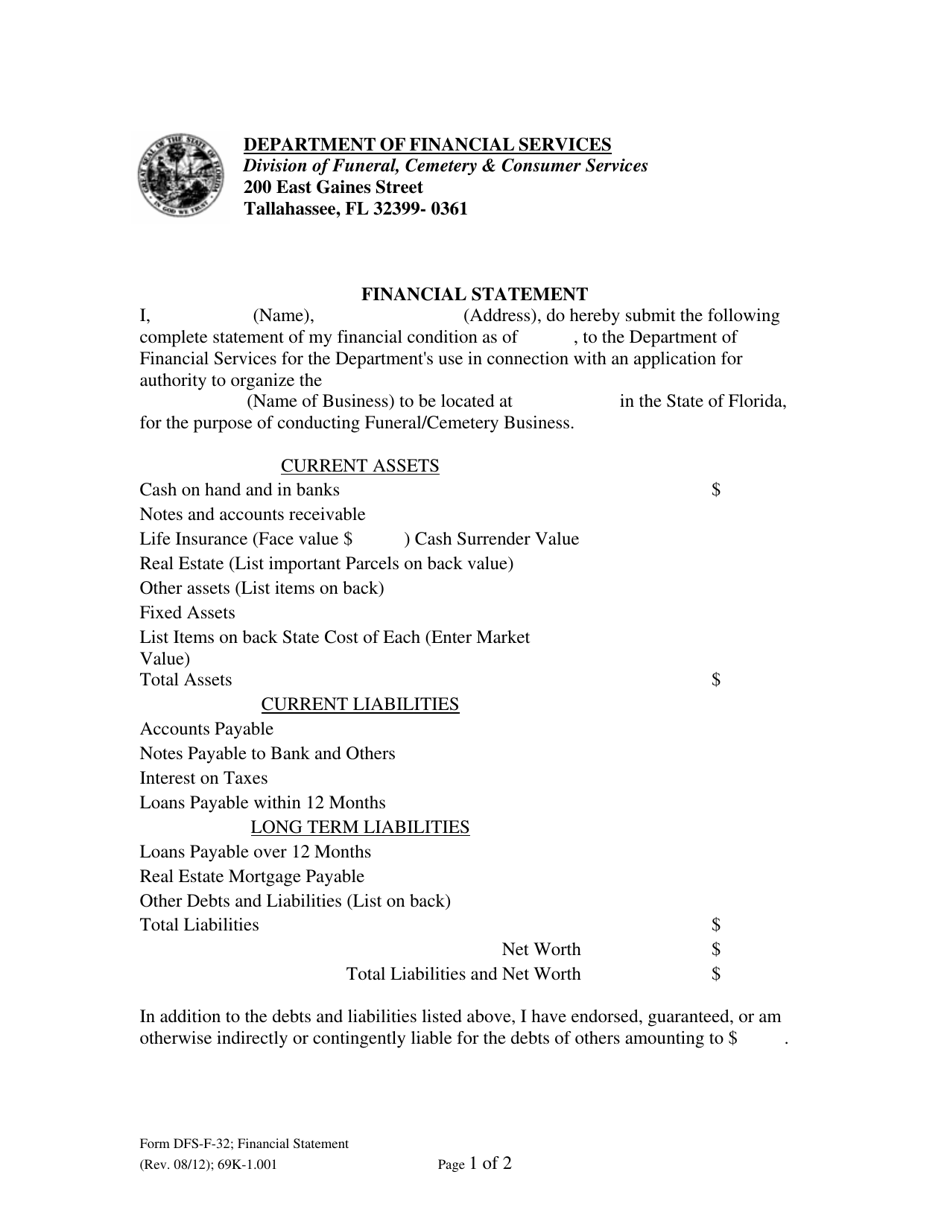

Form DFS-F-32 Financial Statement - Florida

What Is Form DFS-F-32?

This is a legal form that was released by the Florida Department of Financial Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DFS-F-32?

A: DFS-F-32 is a financial statement form used in Florida.

Q: Who needs to use DFS-F-32?

A: DFS-F-32 is typically used by individuals or businesses in Florida to provide information about their financial status.

Q: What information is required in DFS-F-32?

A: DFS-F-32 typically requires information about income, expenses, assets, and liabilities.

Q: Are there any fees for using DFS-F-32?

A: There are no fees associated with using DFS-F-32 form.

Q: Can I use DFS-F-32 in other states?

A: DFS-F-32 is specifically designed for use in the state of Florida. Other states may have their own financial statement forms.

Q: Do I need to submit DFS-F-32 annually?

A: The frequency of submitting DFS-F-32 may vary depending on specific requirements or circumstances. It is advisable to consult with the relevant authorities or professional advisors.

Q: What should I do if I need help completing DFS-F-32?

A: If you need assistance completing DFS-F-32, you can reach out to the Florida Department of Financial Services or consult a financial professional.

Q: Is DFS-F-32 confidential?

A: DFS-F-32 may contain sensitive financial information, and it is generally treated as confidential. However, it is important to review the specific privacy and confidentiality policies associated with the form.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Florida Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DFS-F-32 by clicking the link below or browse more documents and templates provided by the Florida Department of Financial Services.