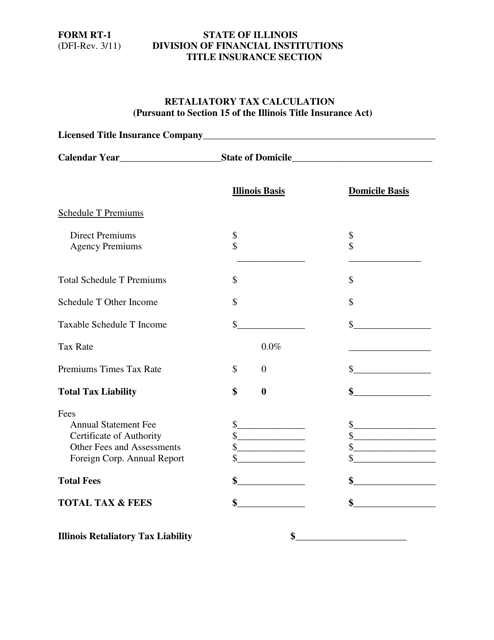

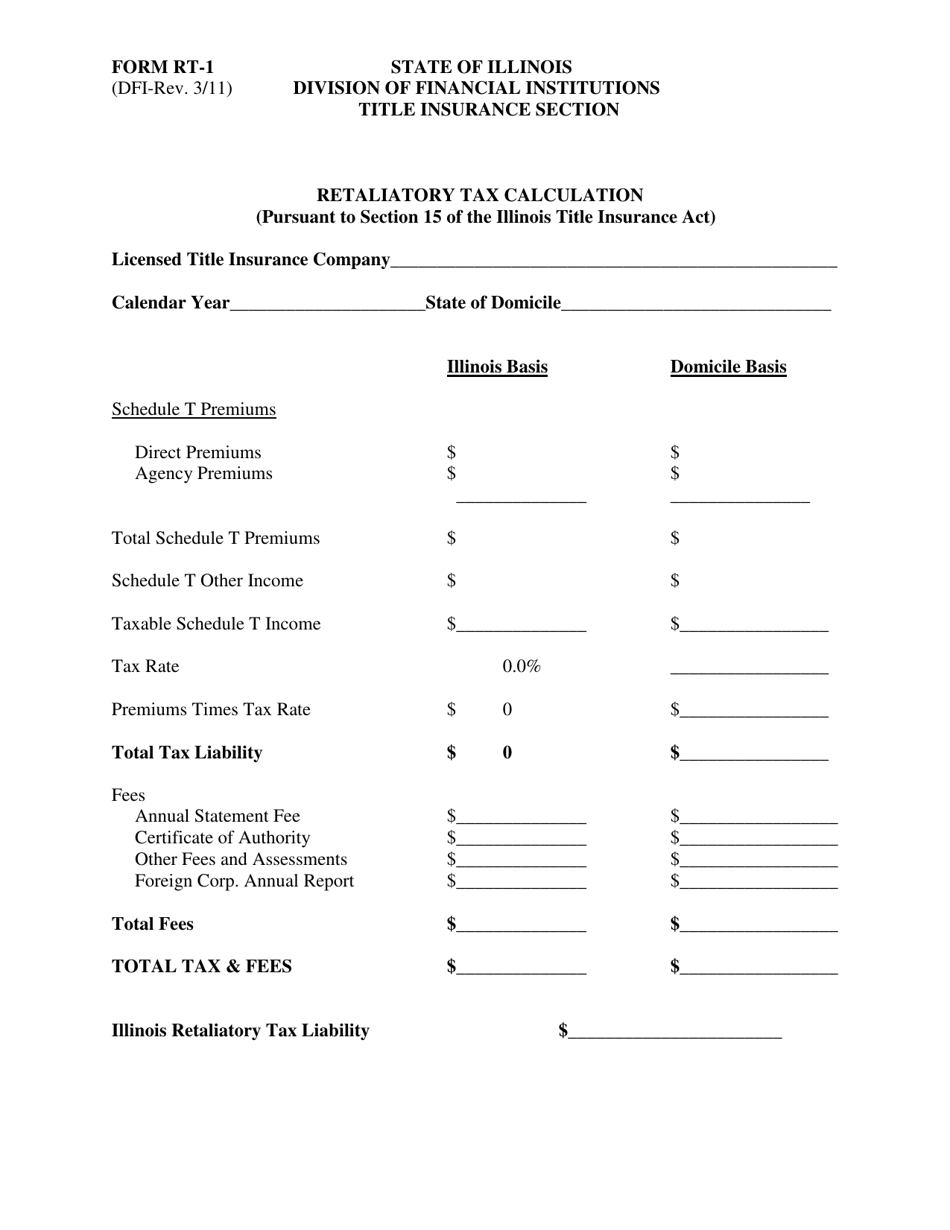

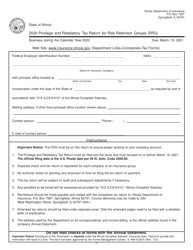

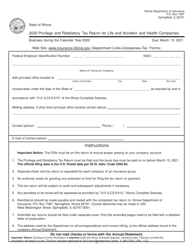

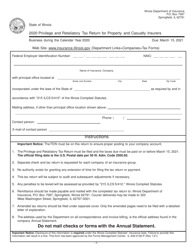

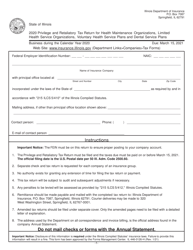

Form RT-1 Retaliatory Tax Calculation - Illinois

What Is Form RT-1?

This is a legal form that was released by the Illinois Department of Financial and Professional Regulation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RT-1?

A: Form RT-1 is used for retaliatory tax calculation in Illinois.

Q: What is retaliatory tax?

A: Retaliatory tax is a tax imposed by a state on out-of-state insurance companies based on the taxes and fees imposed on in-state insurance companies by their home state.

Q: What is the purpose of form RT-1?

A: The purpose of form RT-1 is to calculate the retaliatory tax owed by an out-of-state insurance company operating in Illinois.

Q: Who needs to file form RT-1?

A: Out-of-state insurance companies operating in Illinois need to file form RT-1.

Q: When is form RT-1 due?

A: Form RT-1 is due on or before the 15th day of the third month following the close of the taxable year.

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Illinois Department of Financial and Professional Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RT-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Financial and Professional Regulation.