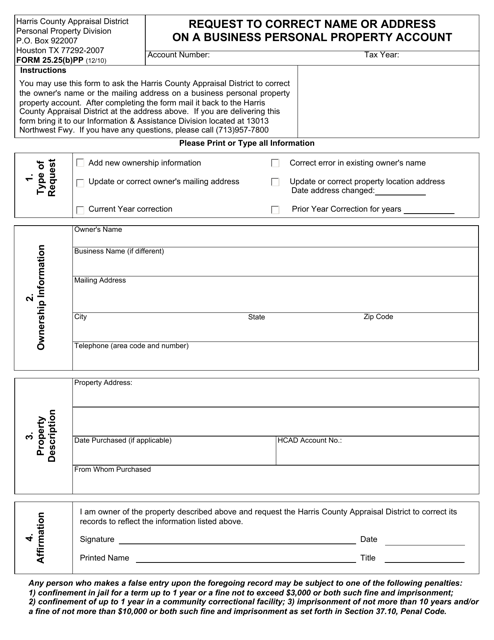

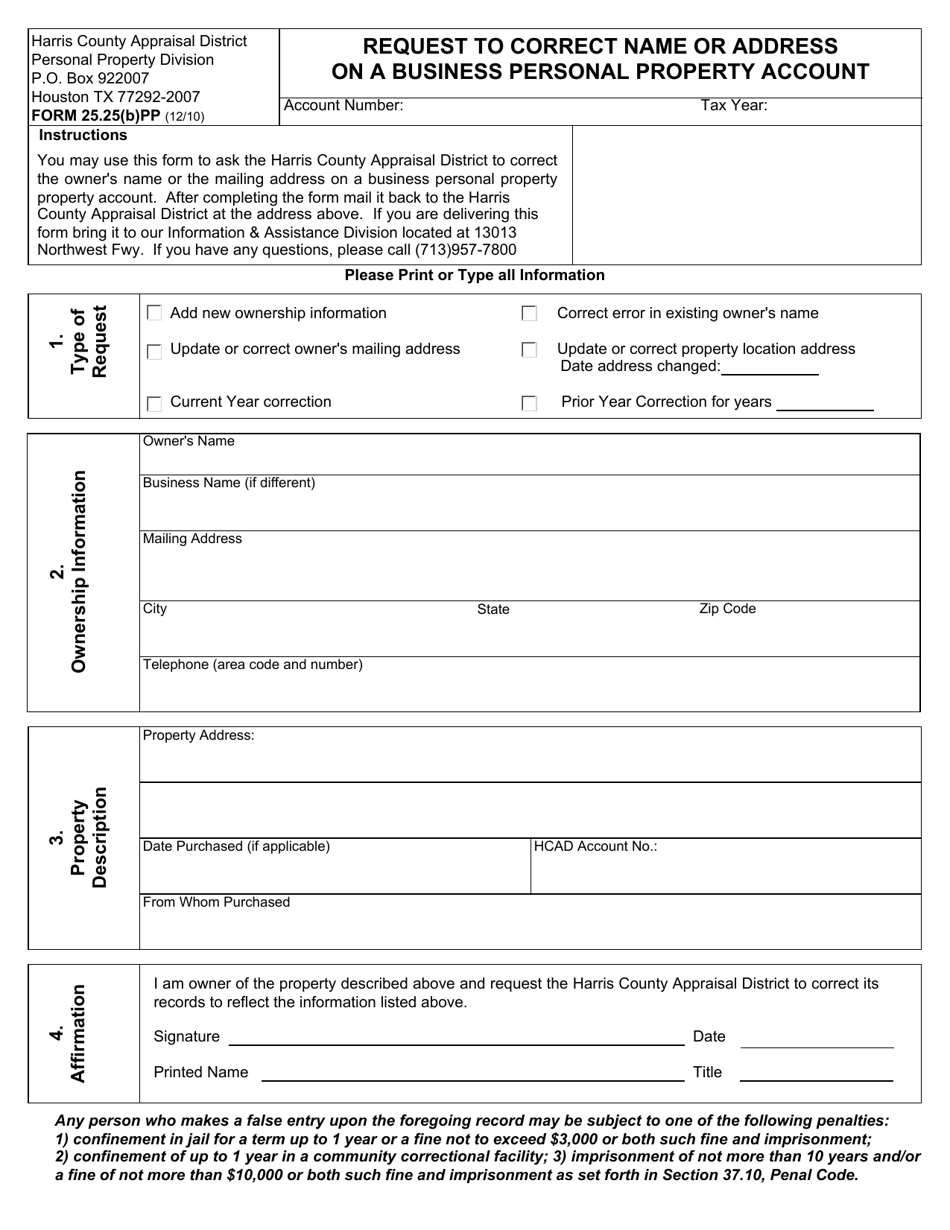

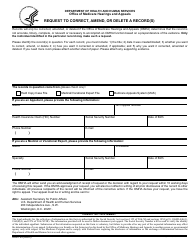

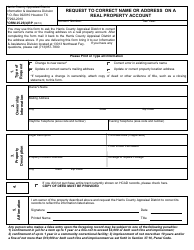

Form 25.25(B)PP Request to Correct Name or Address on a Business Personal Property Account - Harris County, Texas

What Is Form 25.25(B)PP?

This is a legal form that was released by the Appraisal District - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 25.25(B)PP?

A: Form 25.25(B)PP is a request form to correct the name or address on a business personal property account in Harris County, Texas.

Q: What is a business personal property account?

A: A business personal property account refers to the assessment of personal property owned by a business for taxation purposes.

Q: Why would someone need to correct the name or address on a business personal property account?

A: Someone may need to correct the name or address on a business personal property account if there has been a change in ownership or if there are errors in the existing records.

Q: Who should use Form 25.25(B)PP?

A: Anyone who needs to correct the name or address on a business personal property account in Harris County, Texas should use Form 25.25(B)PP.

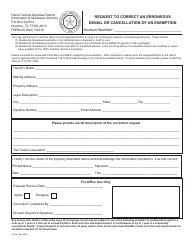

Q: What information is required on Form 25.25(B)PP?

A: Form 25.25(B)PP requires information such as the property owner's name, property address, and the correct name or address to be updated.

Q: Is there a fee for submitting Form 25.25(B)PP?

A: There is no fee for submitting Form 25.25(B)PP to correct the name or address on a business personal property account in Harris County, Texas.

Q: How long does it take to process Form 25.25(B)PP?

A: Processing times may vary, but it is typically done within a few weeks after submitting the form.

Q: What should I do if I need further assistance with Form 25.25(B)PP?

A: If you need further assistance with Form 25.25(B)PP, you can contact the Harris County Appraisal District office for guidance.

Form Details:

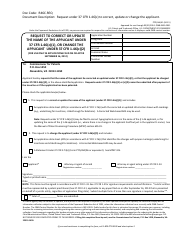

- Released on December 1, 2010;

- The latest edition provided by the Appraisal District - Harris County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 25.25(B)PP by clicking the link below or browse more documents and templates provided by the Appraisal District - Harris County, Texas.