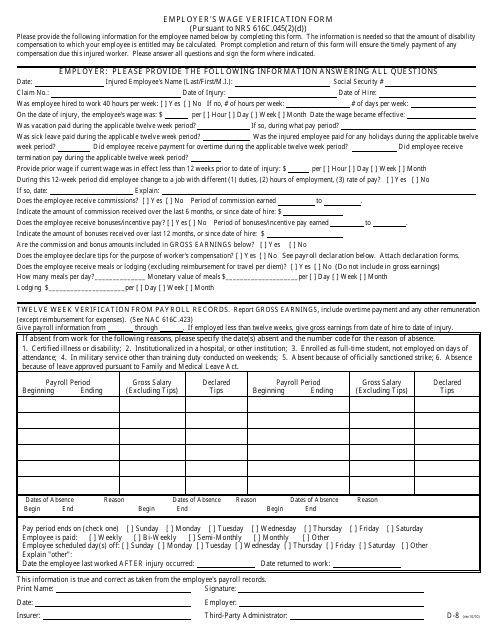

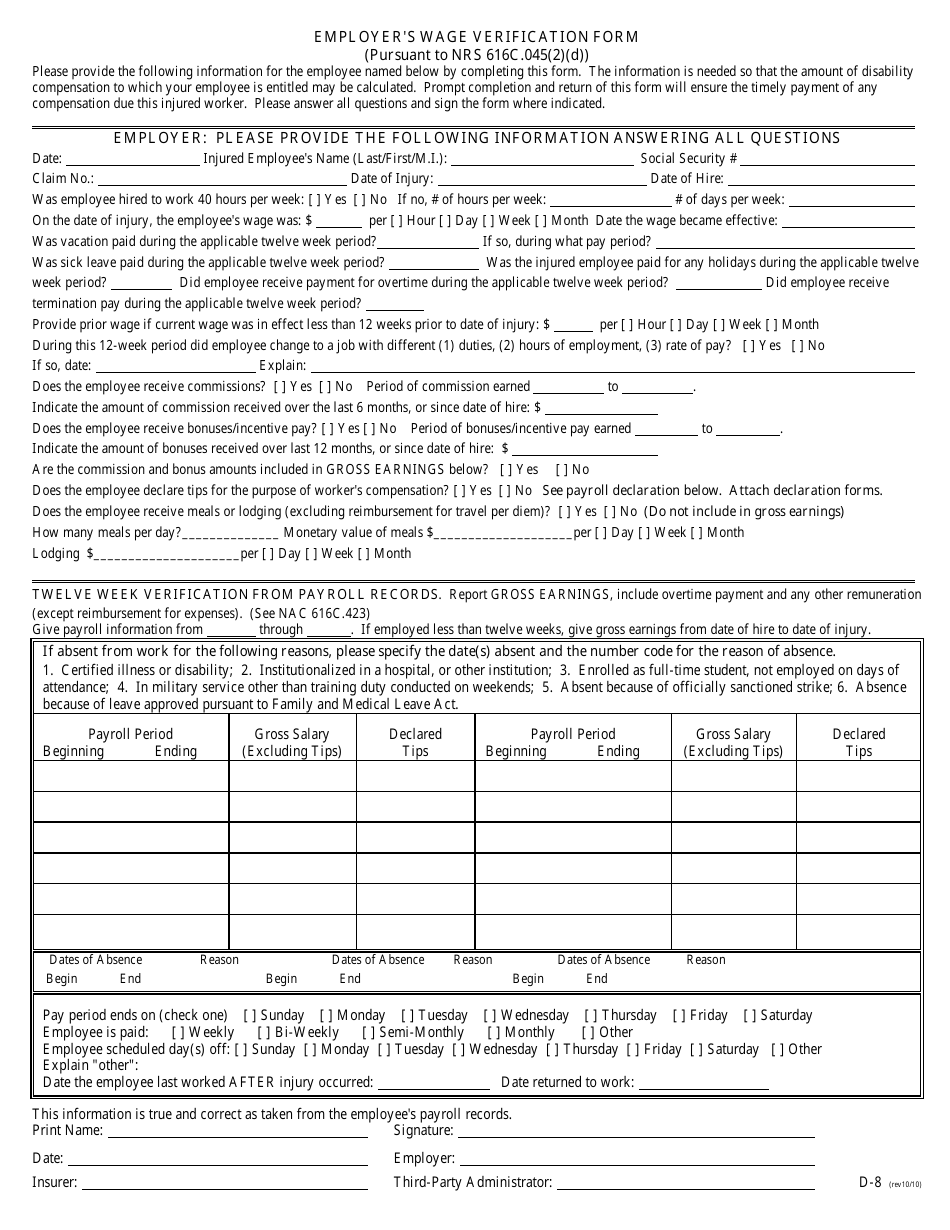

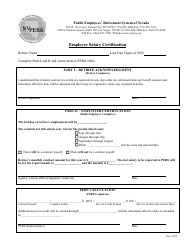

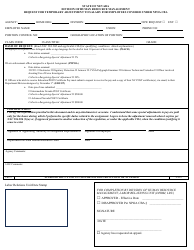

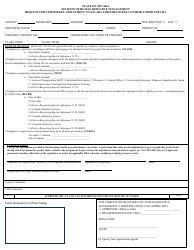

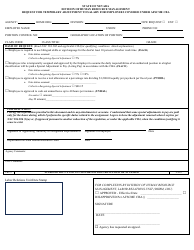

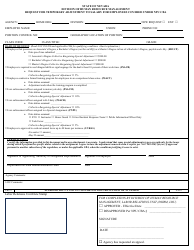

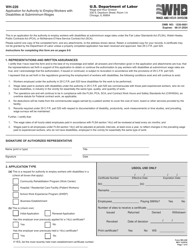

Form D-8 Employer's Wage Verification Form - Nevada

What Is Form D-8?

This is a legal form that was released by the Nevada Department of Administration - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-8?

A: Form D-8 is the Employer's Wage Verification Form.

Q: Who needs to file Form D-8?

A: Employers in Nevada need to file Form D-8.

Q: What is the purpose of Form D-8?

A: The purpose of Form D-8 is to verify wages paid by employers in Nevada.

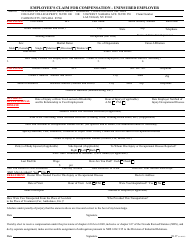

Q: What information is required on Form D-8?

A: Form D-8 requires information such as the employer's name, address, identification number, and wage information for each employee.

Q: When should Form D-8 be filed?

A: Form D-8 should be filed quarterly, within 30 days after the end of each calendar quarter.

Q: Are there any penalties for not filing Form D-8?

A: Yes, failure to file Form D-8 or providing false information may result in penalties and interests.

Q: Can I request an extension to file Form D-8?

A: Yes, you can request an extension to file Form D-8 by contacting the Nevada Department of Employment, Training and Rehabilitation.

Q: Who can I contact for more information about Form D-8?

A: For more information about Form D-8, you can contact the Nevada Department of Employment, Training and Rehabilitation.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Nevada Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form D-8 by clicking the link below or browse more documents and templates provided by the Nevada Department of Administration.