This version of the form is not currently in use and is provided for reference only. Download this version of

Form AA1

for the current year.

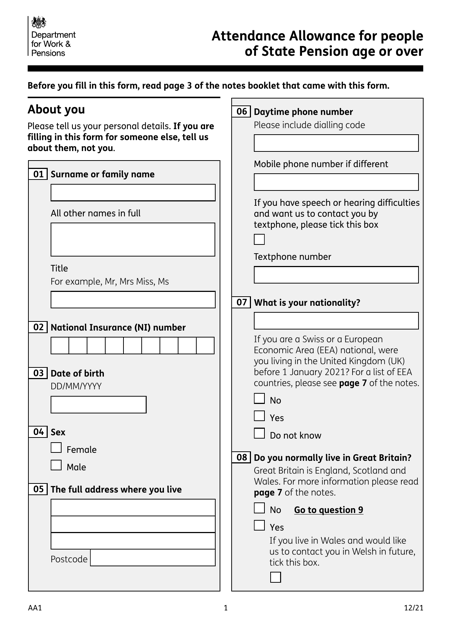

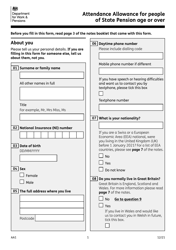

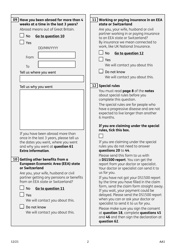

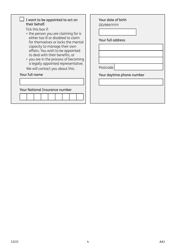

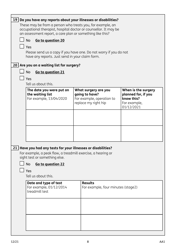

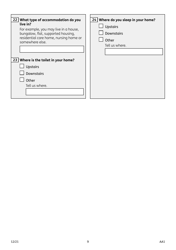

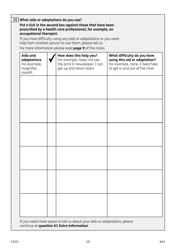

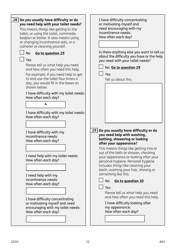

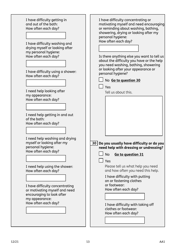

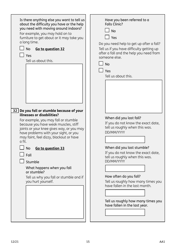

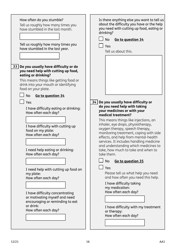

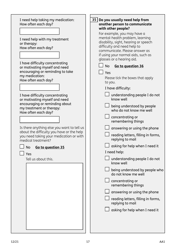

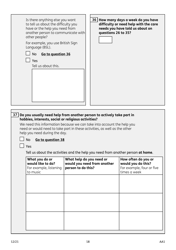

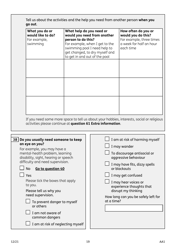

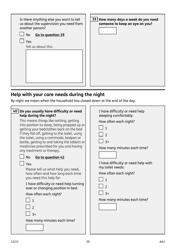

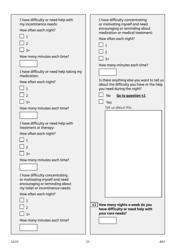

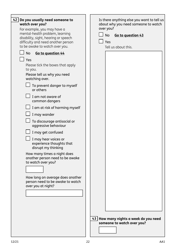

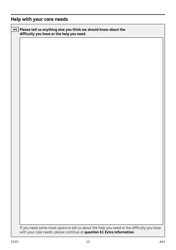

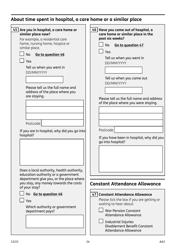

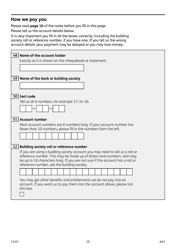

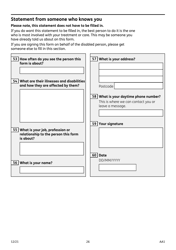

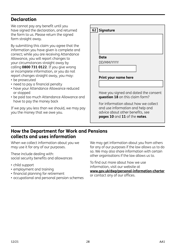

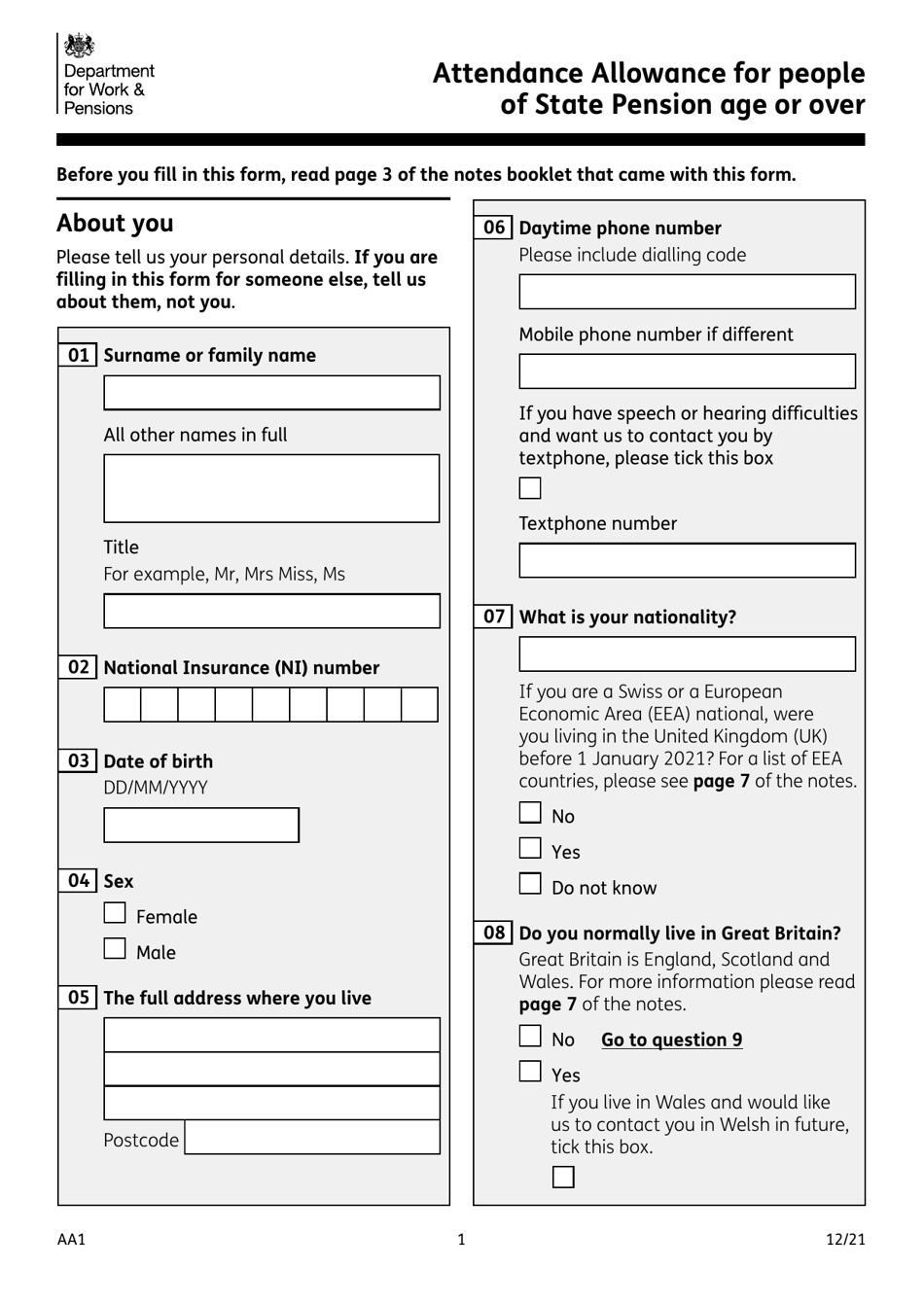

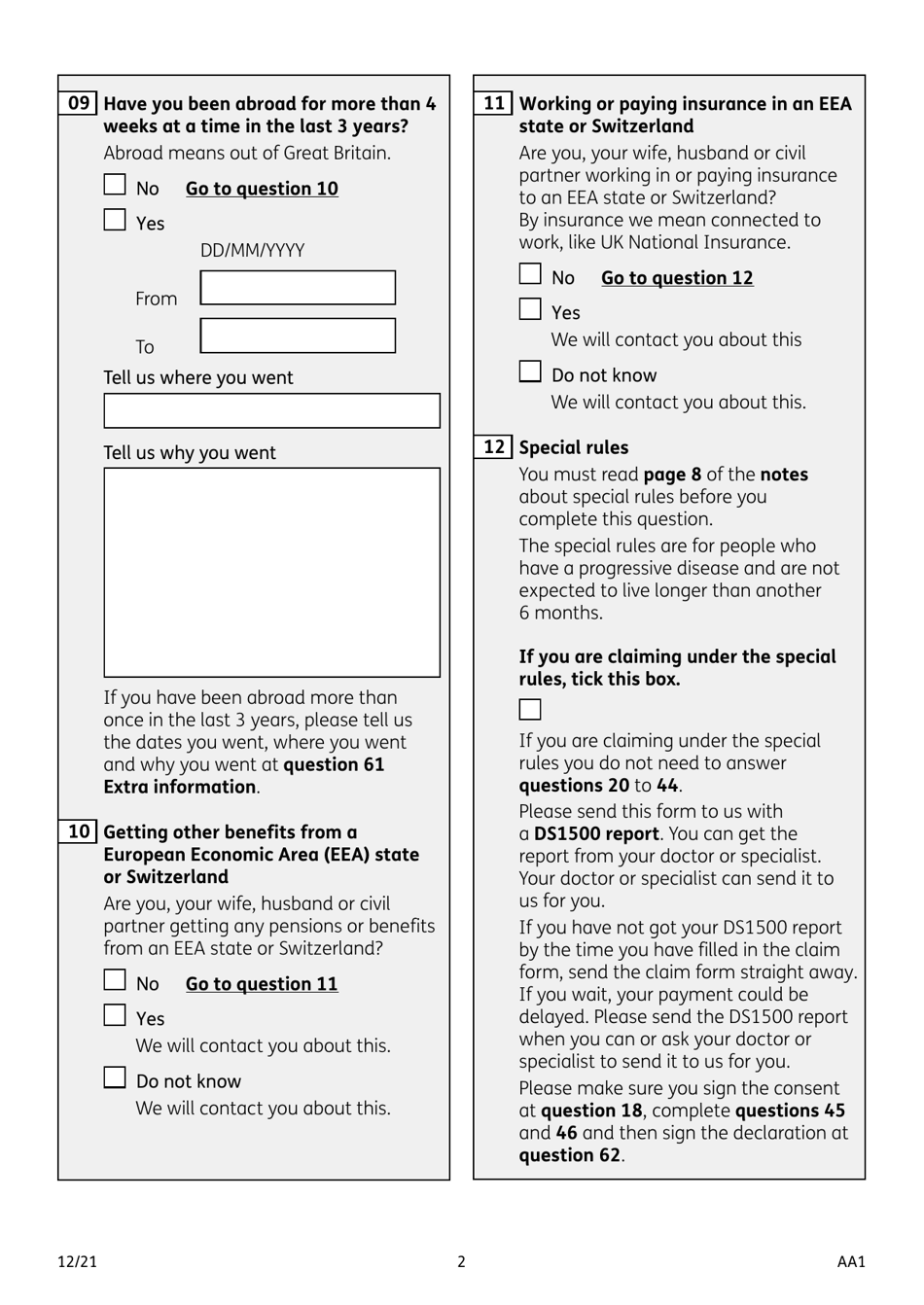

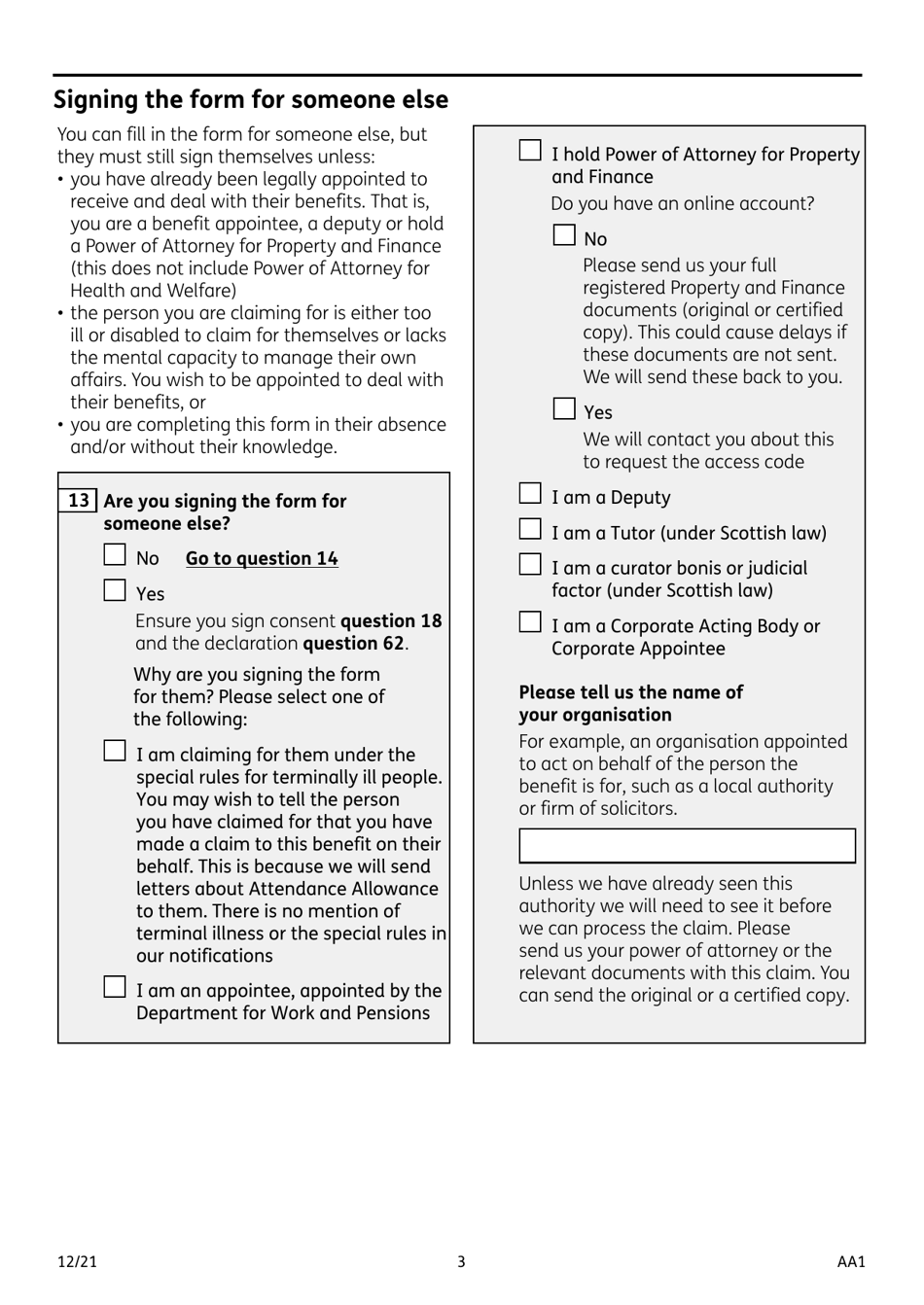

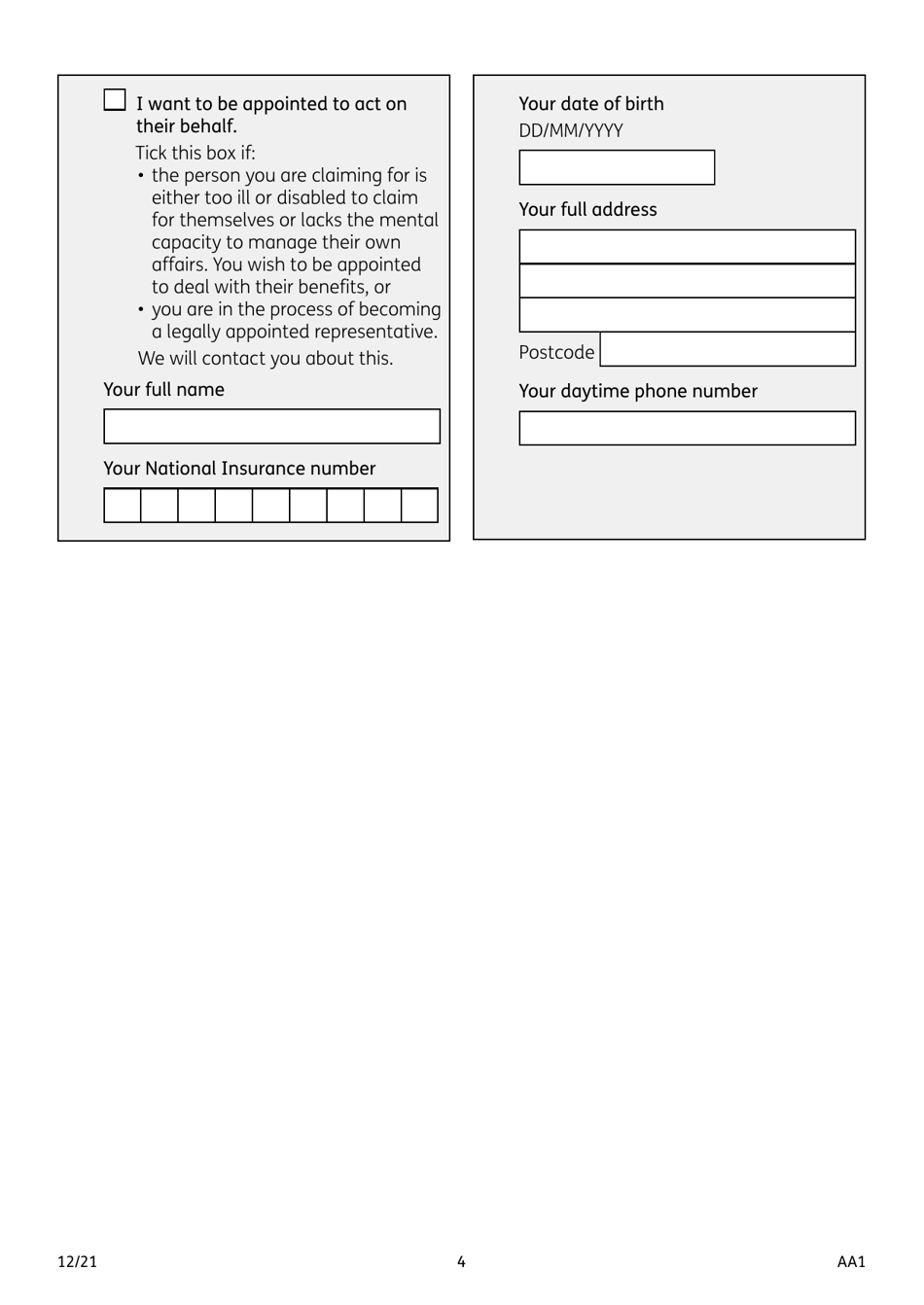

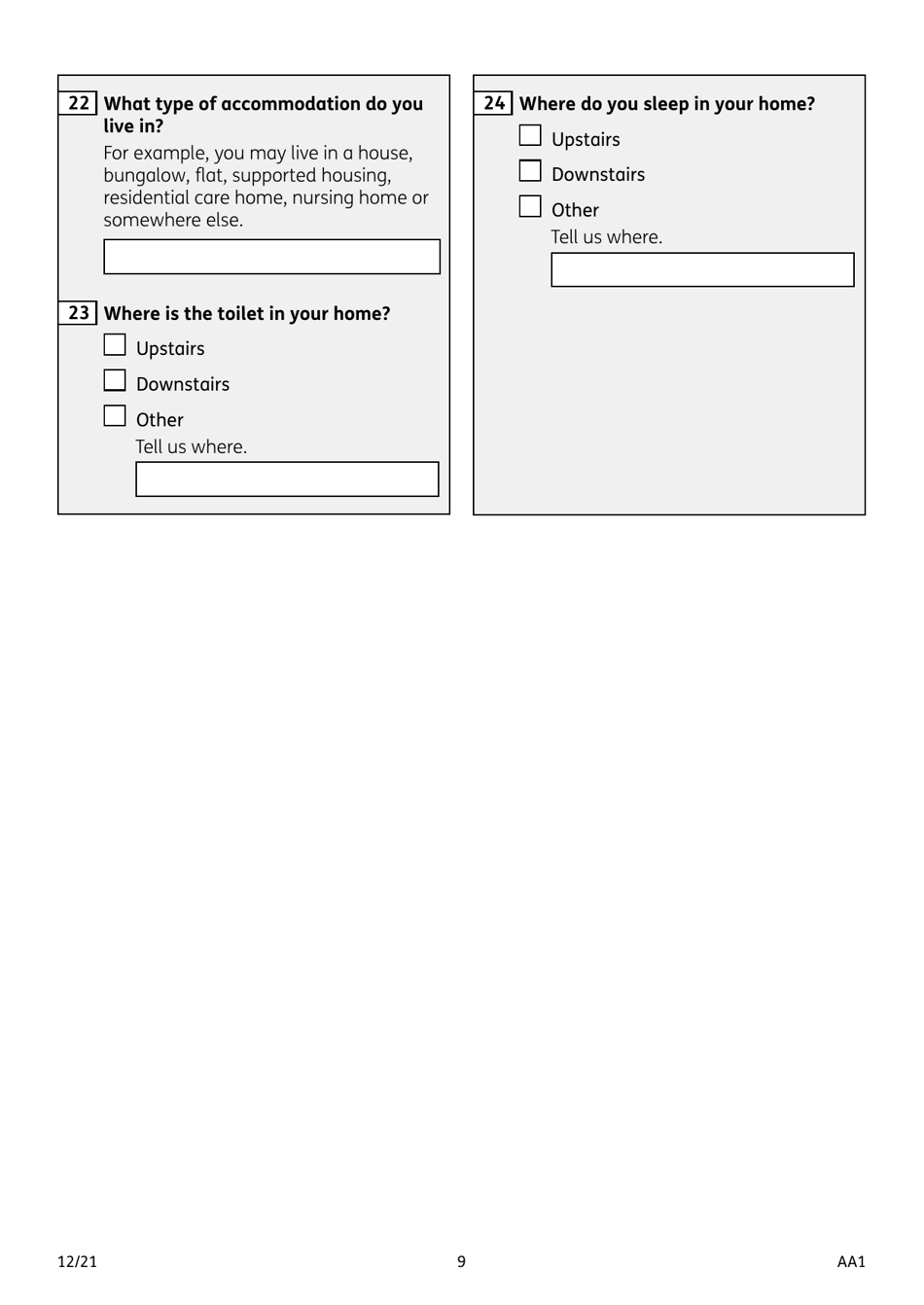

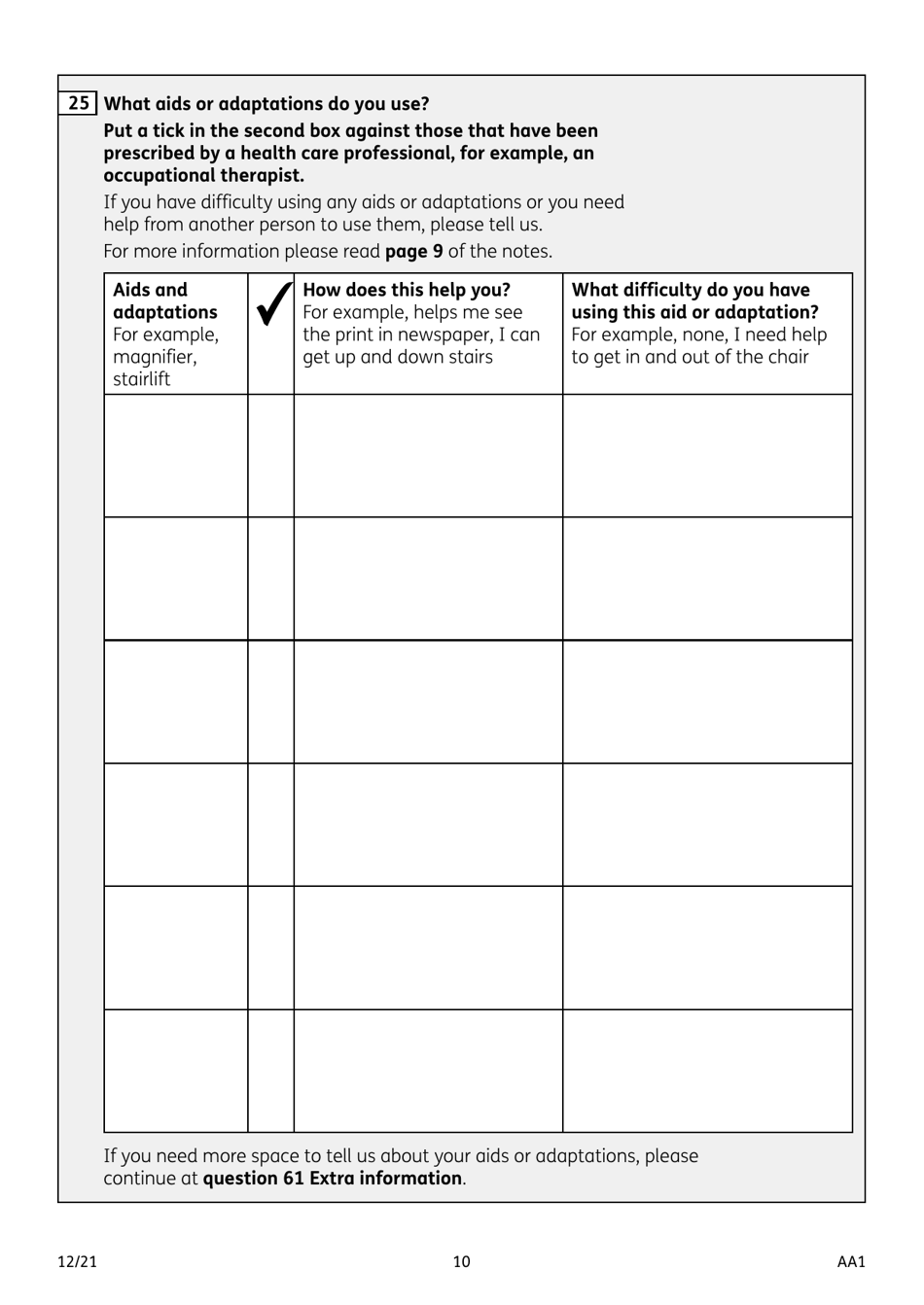

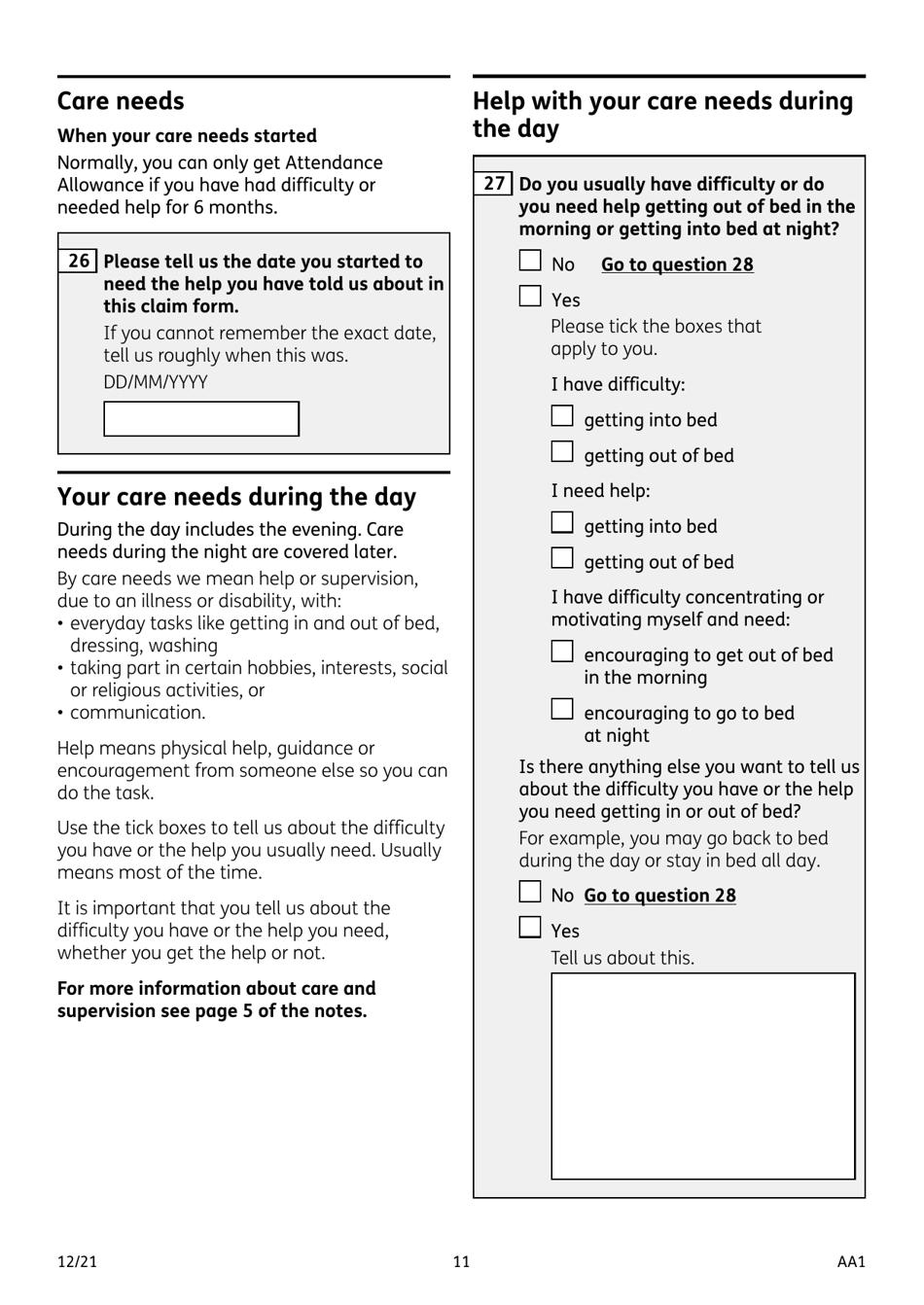

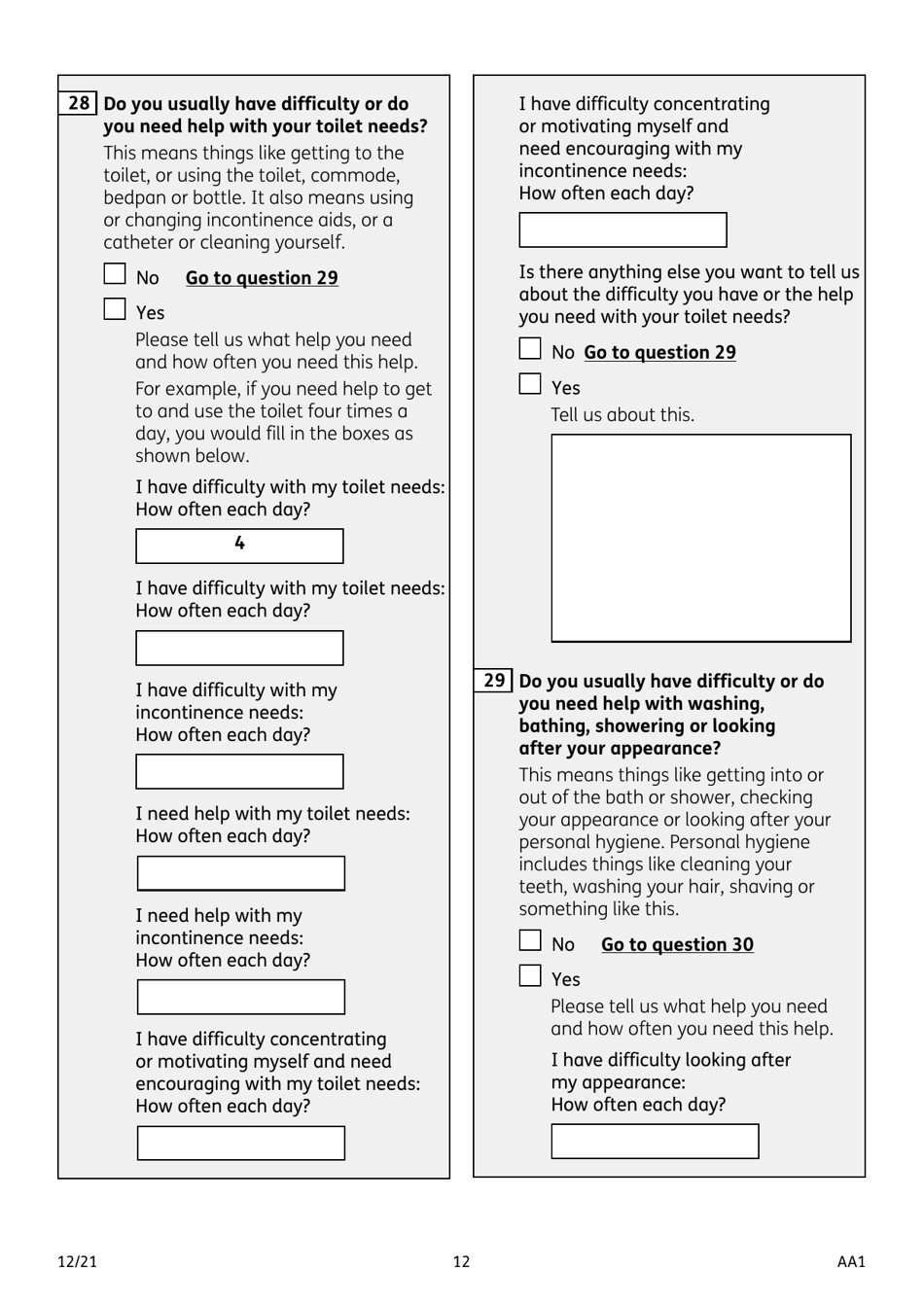

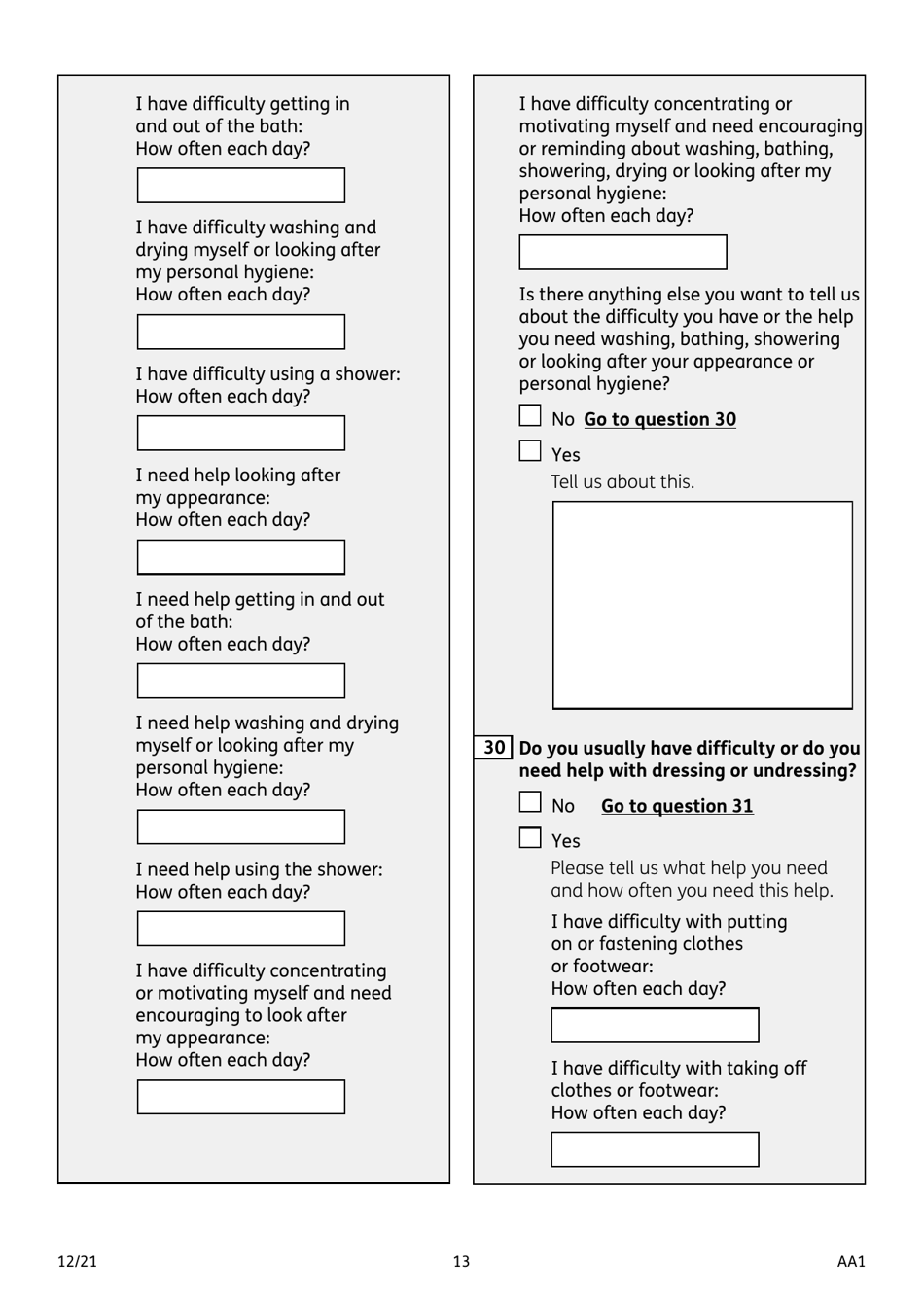

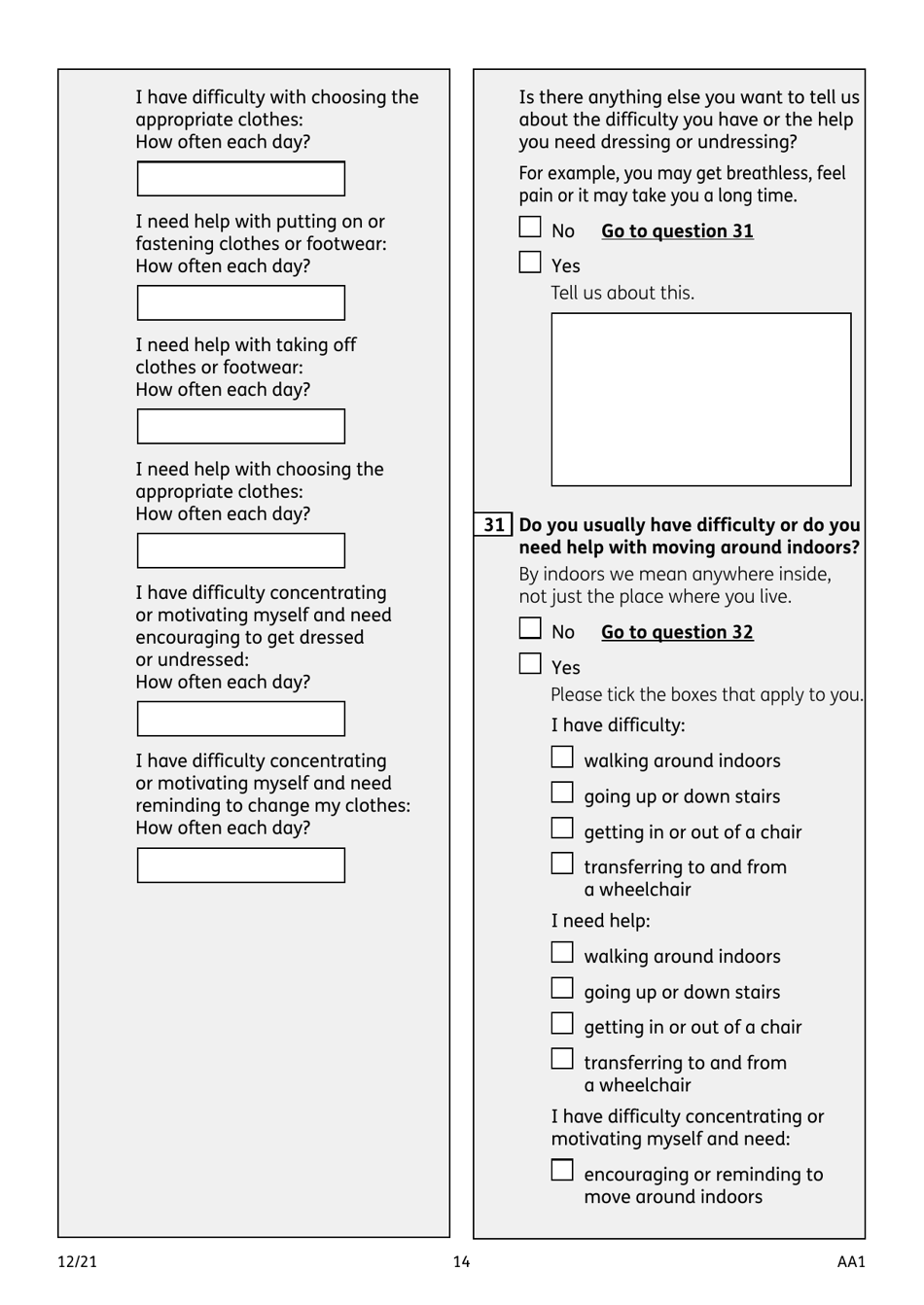

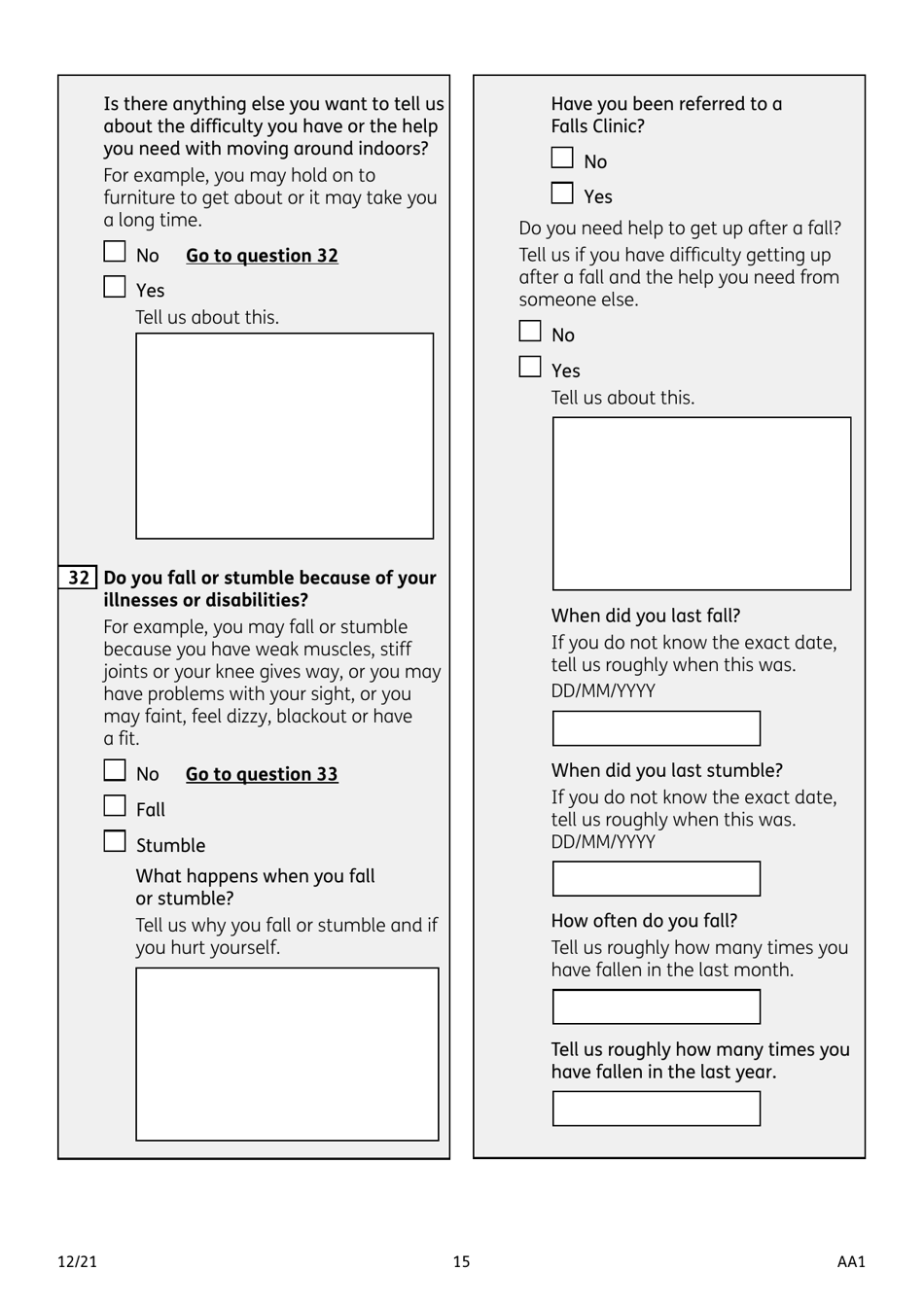

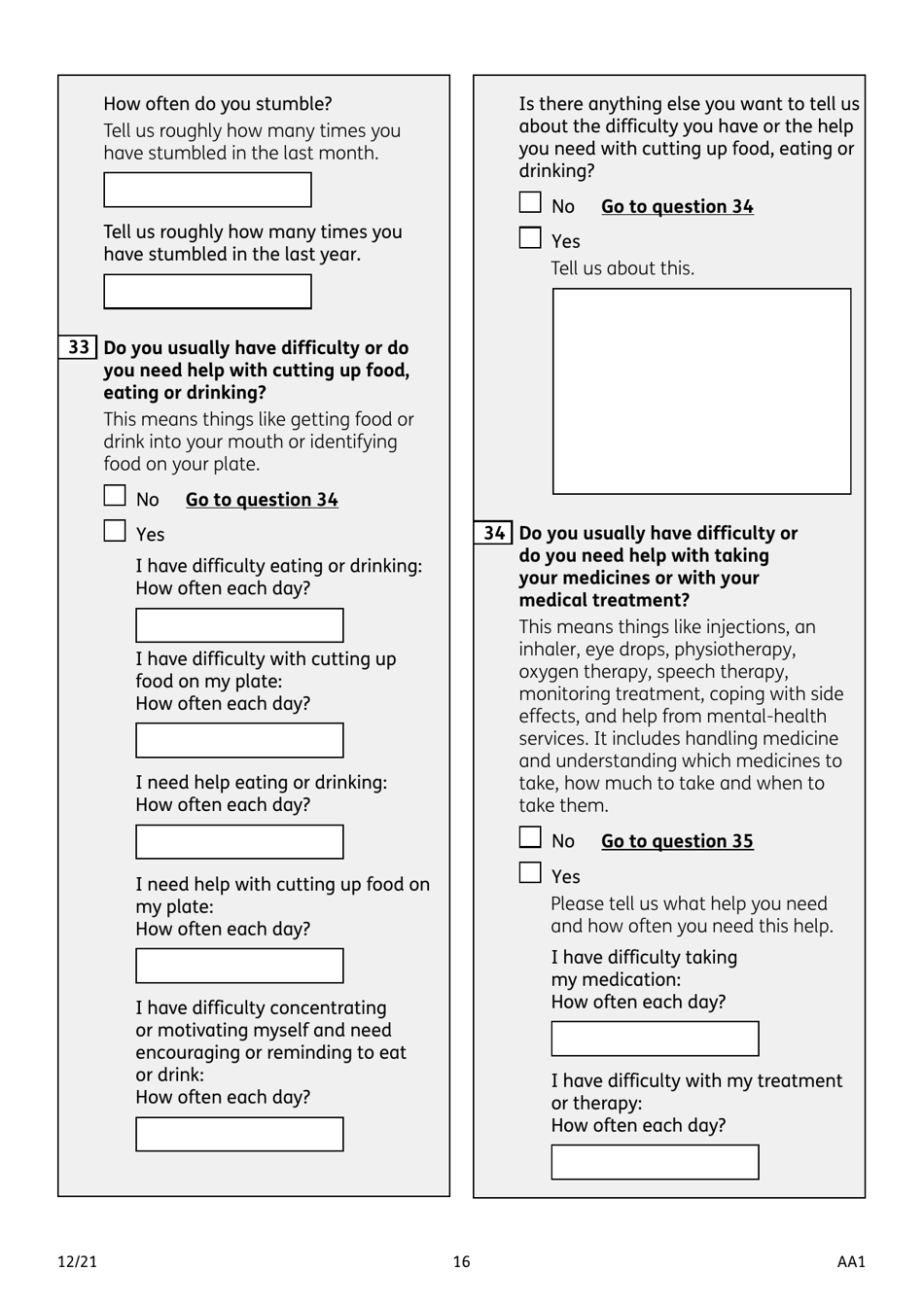

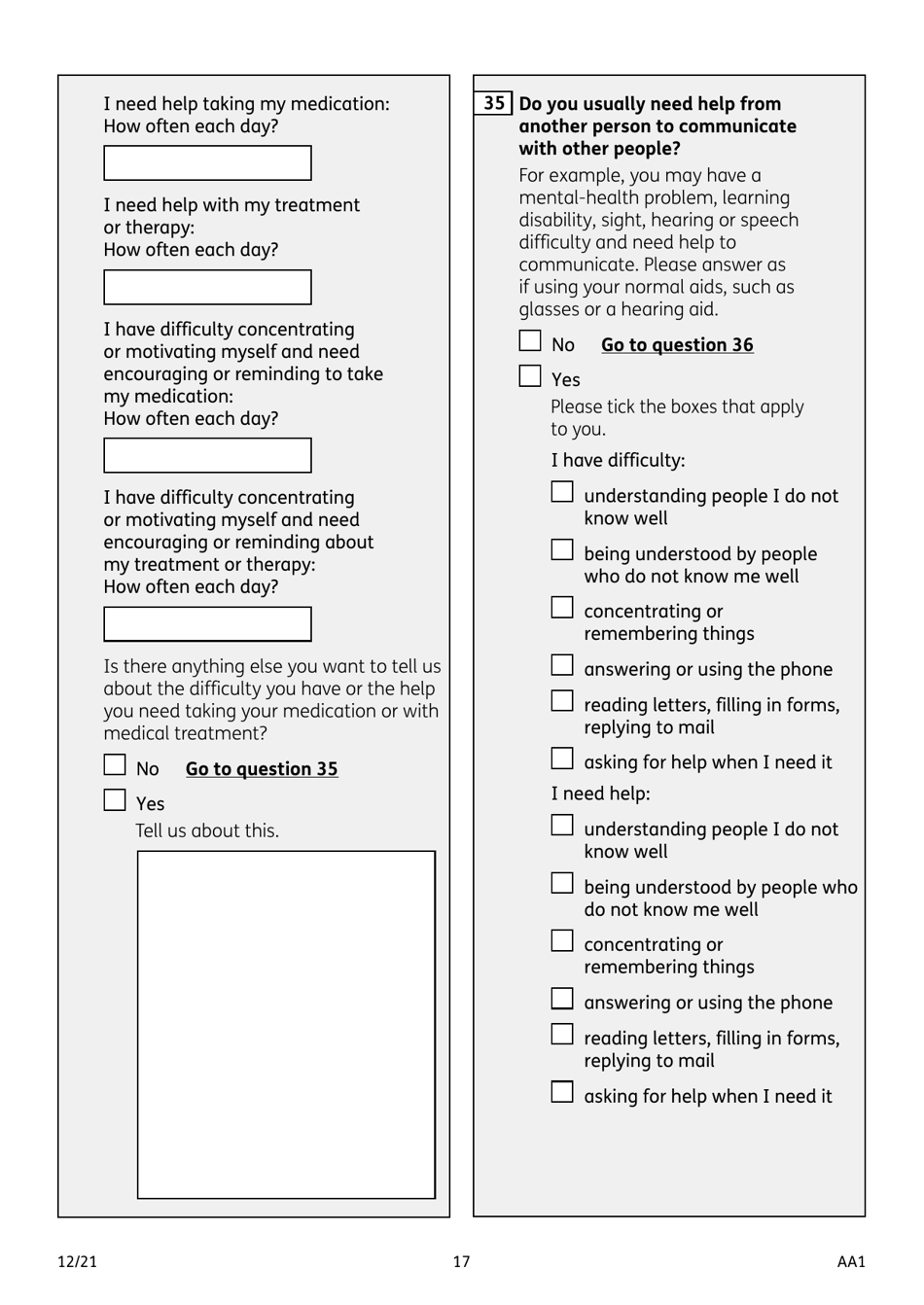

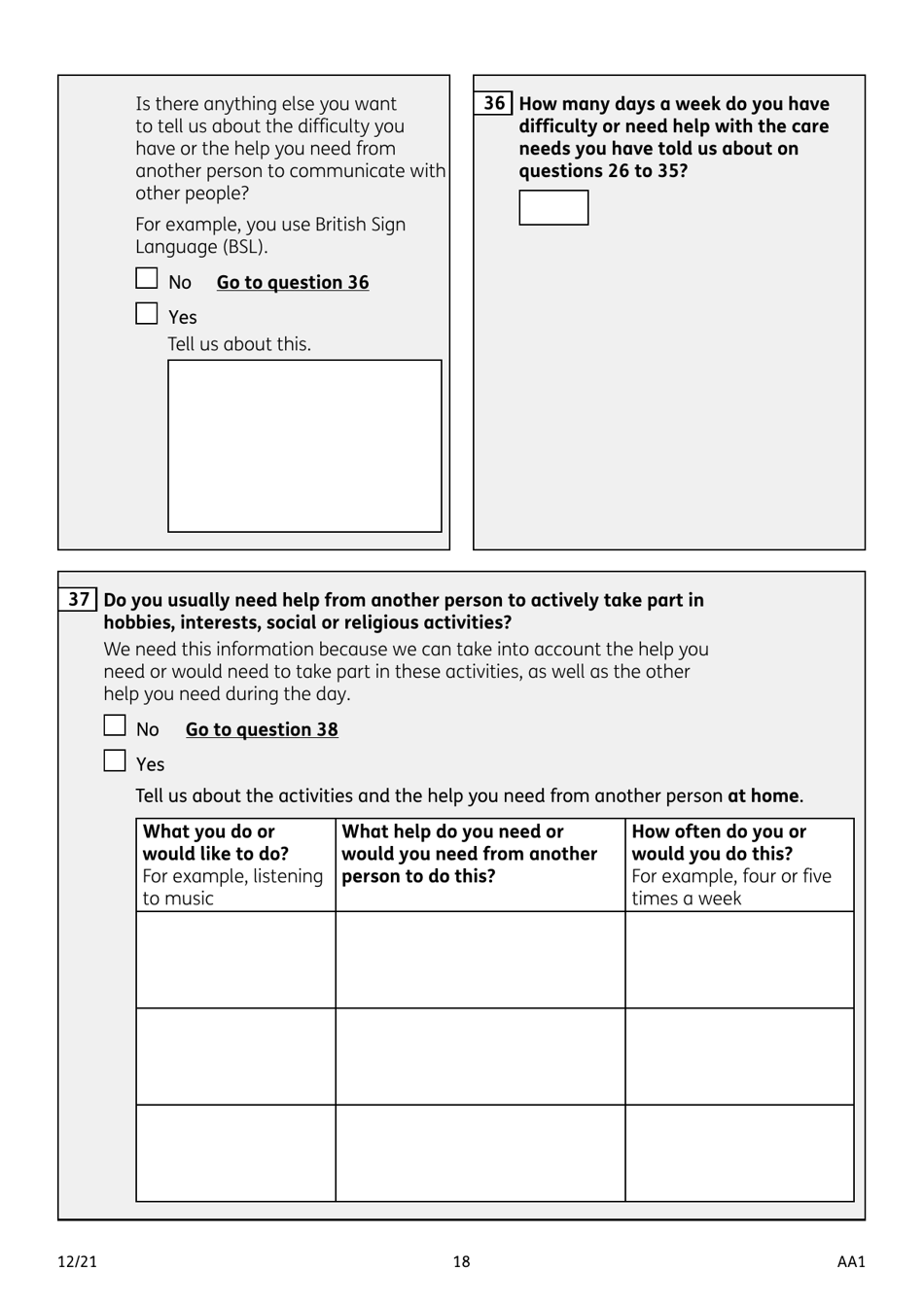

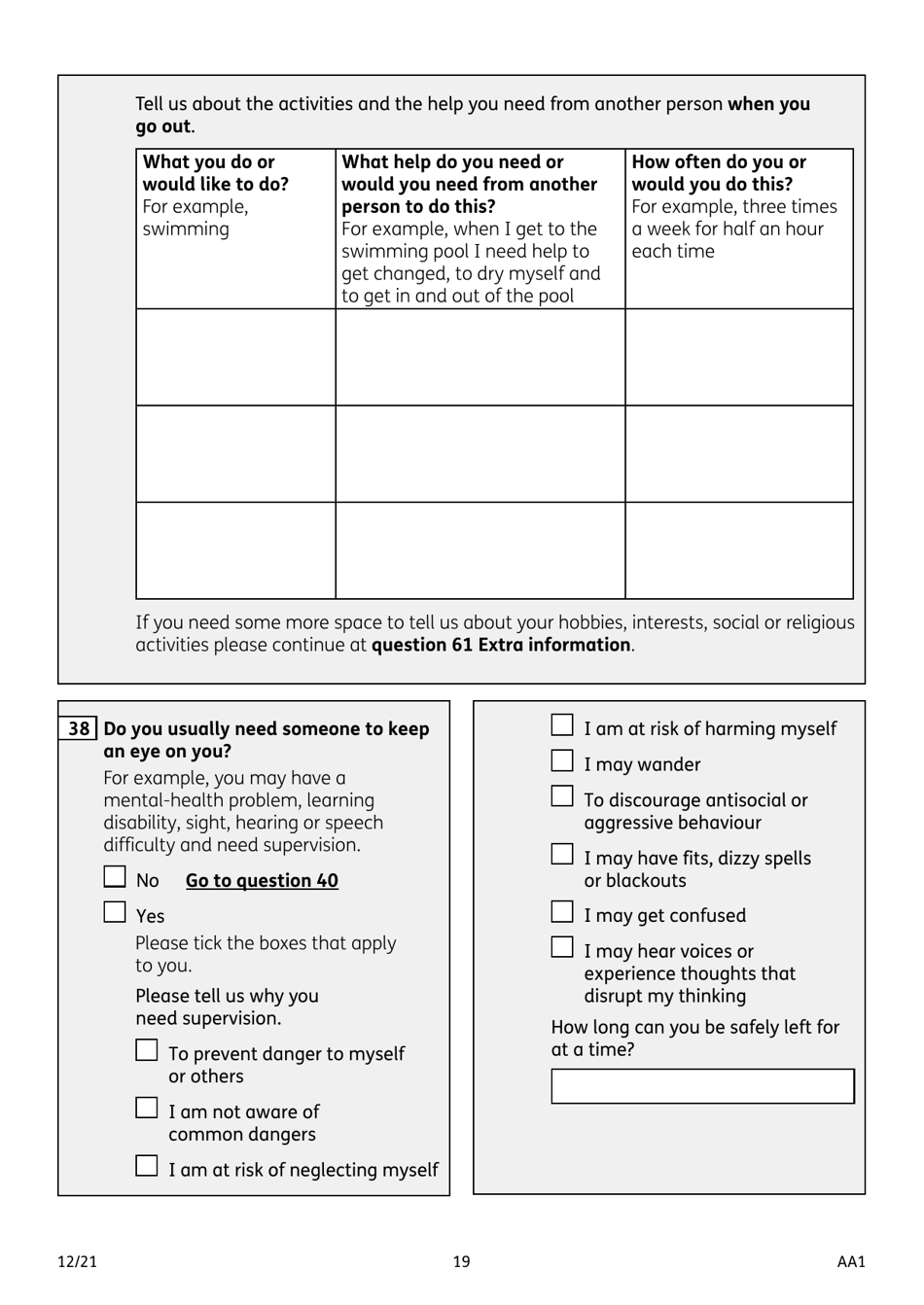

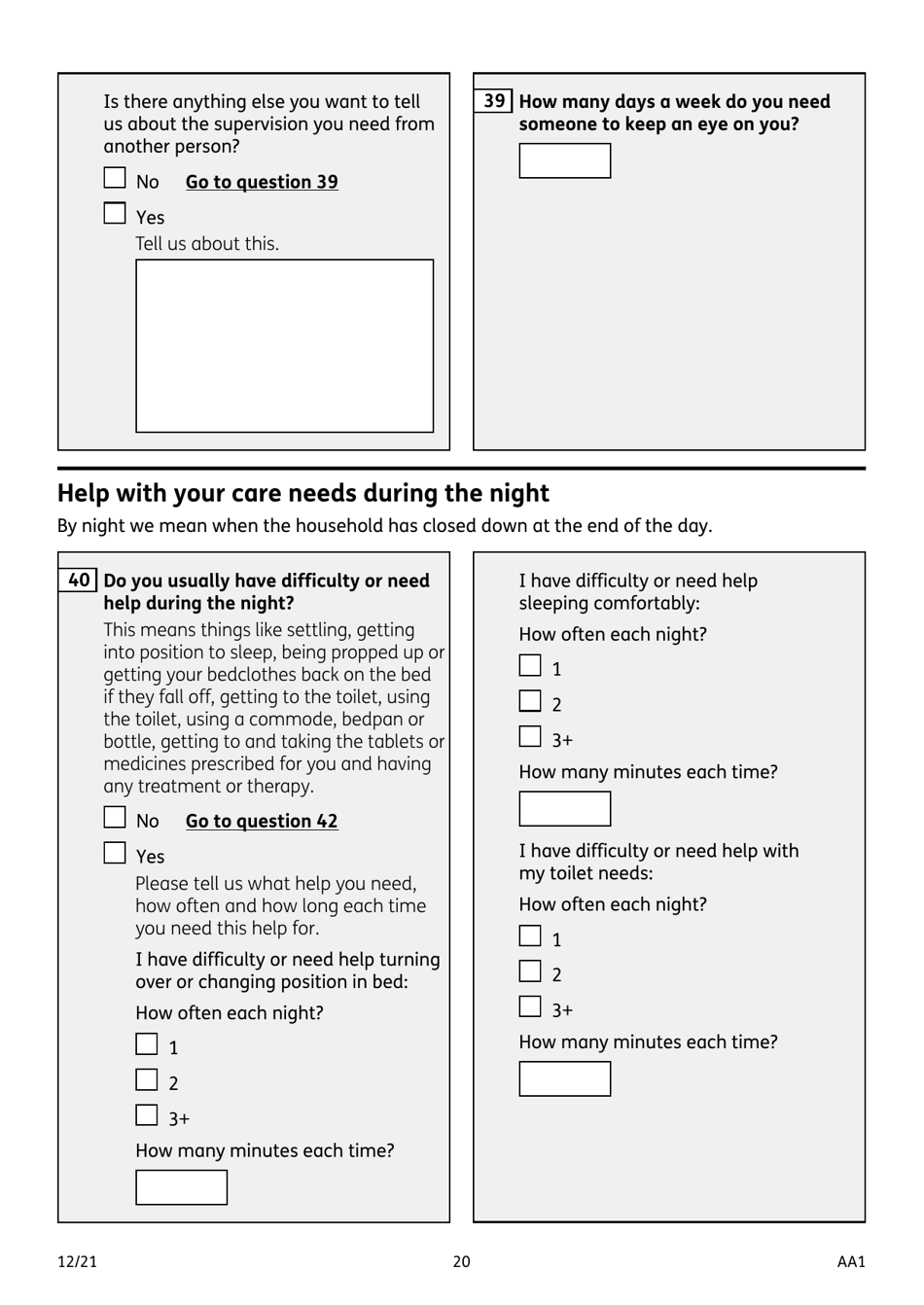

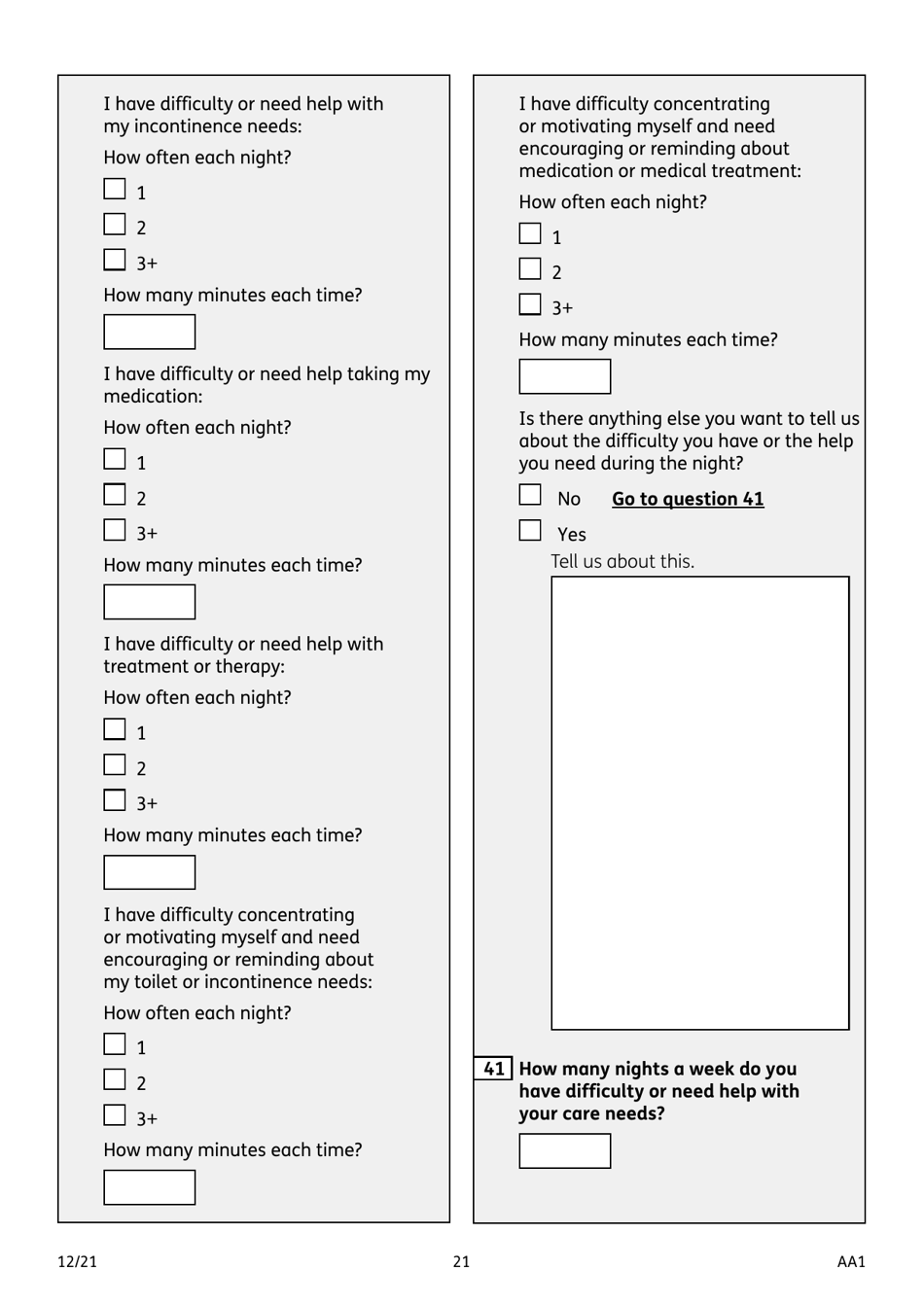

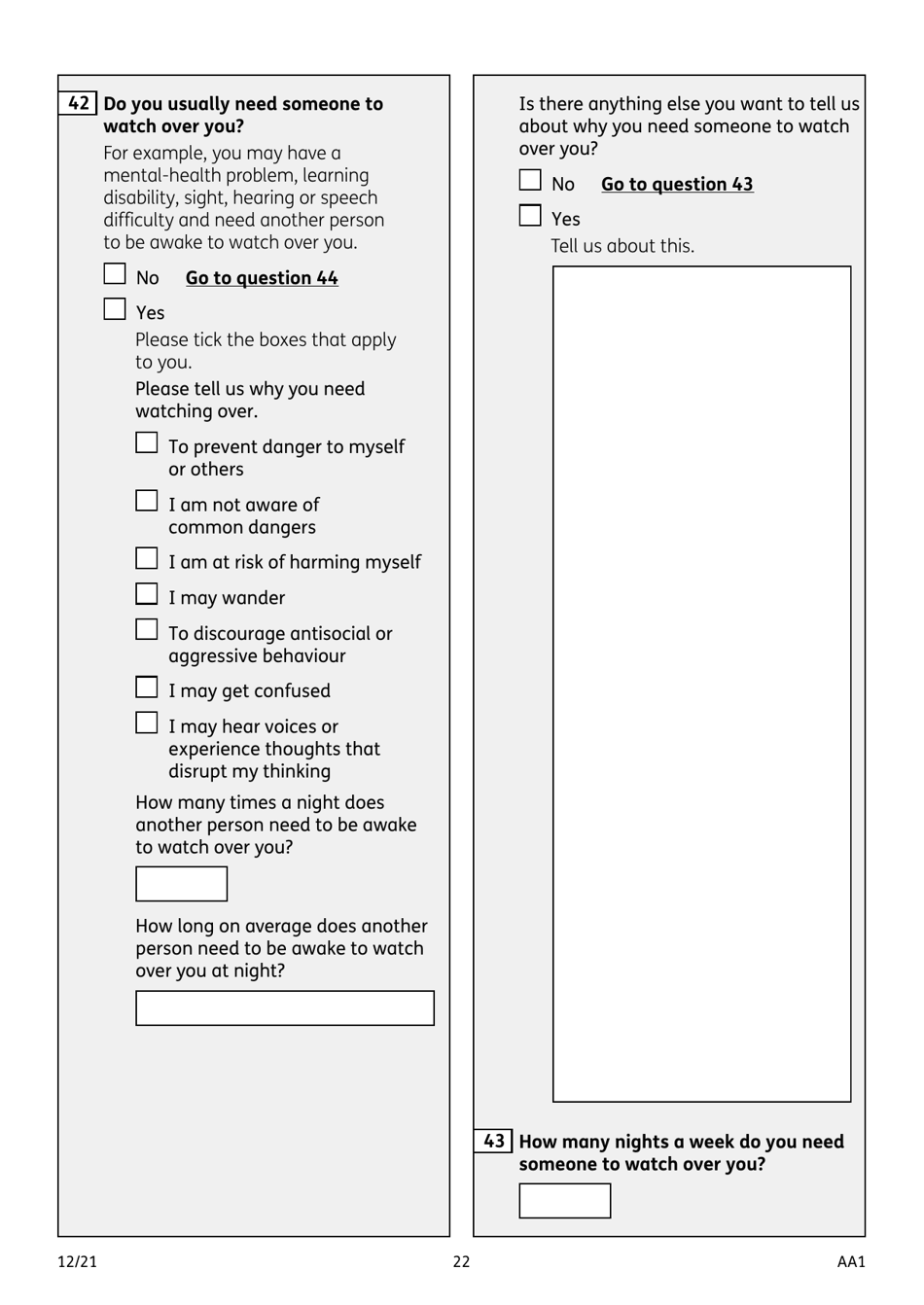

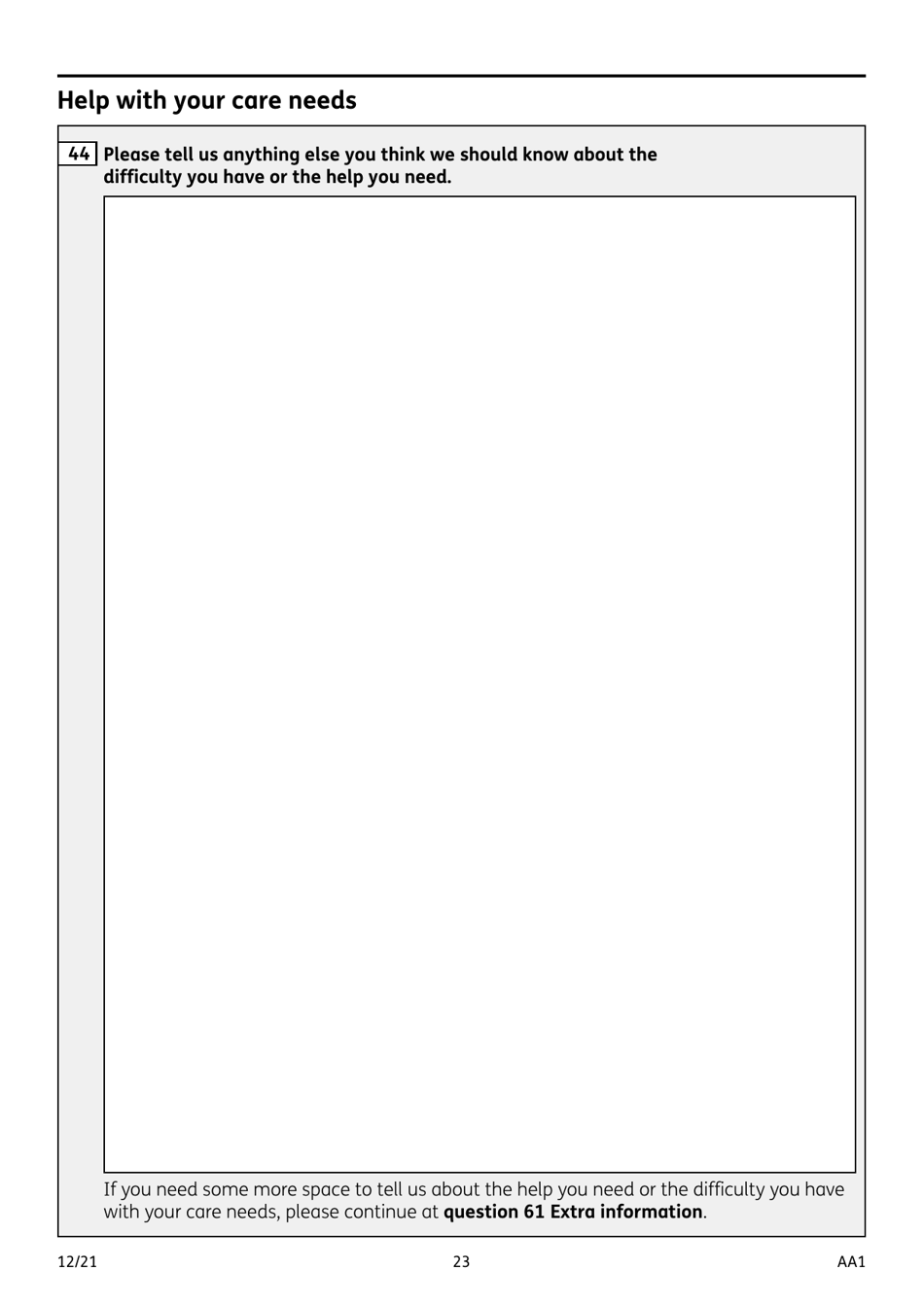

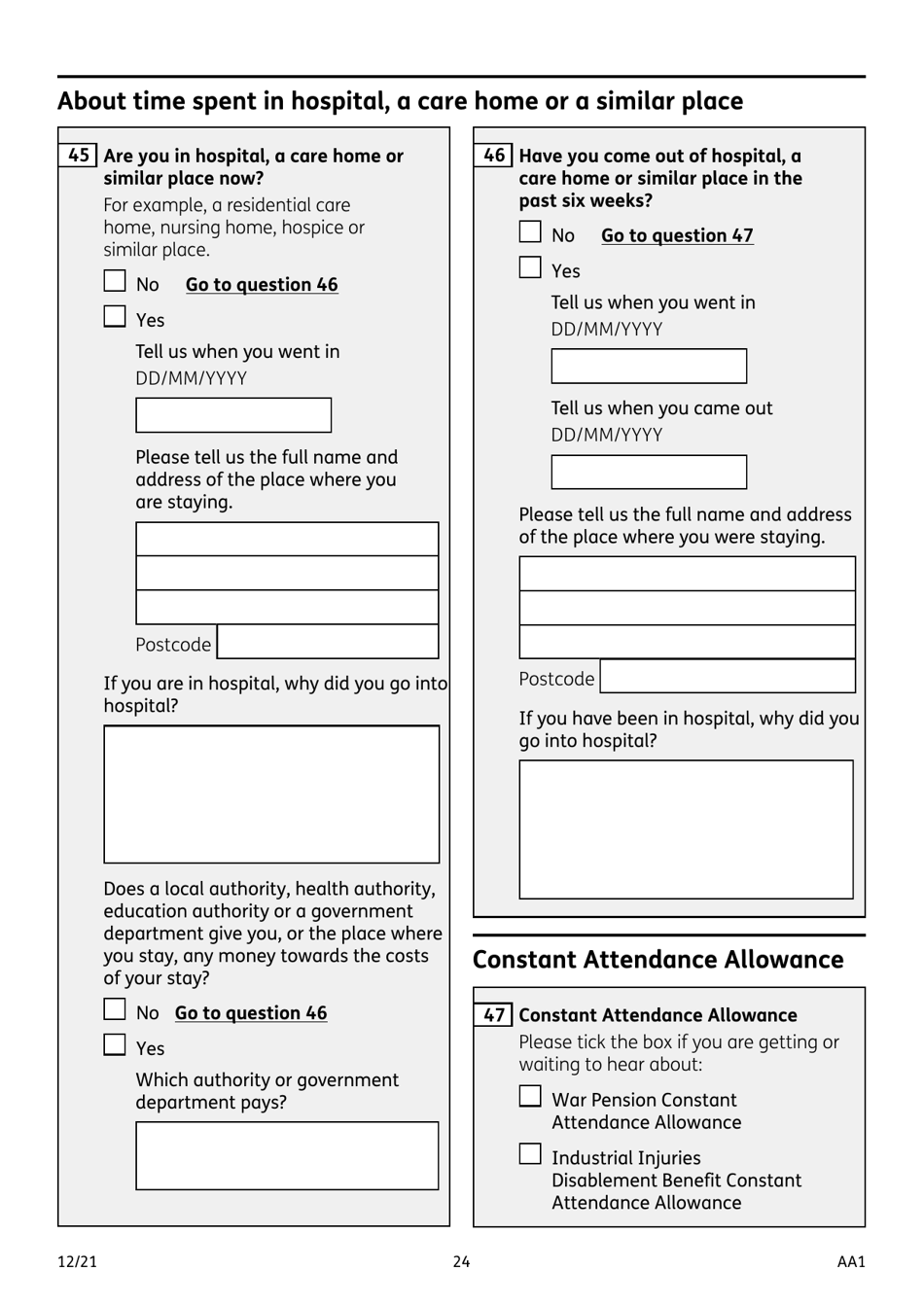

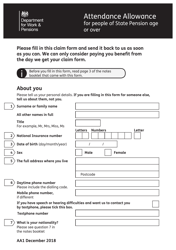

Form AA1 Attendance Allowance for People of State Pension Age or Over - United Kingdom

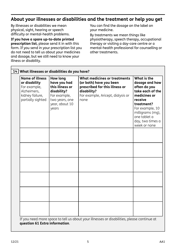

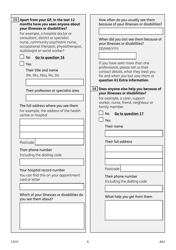

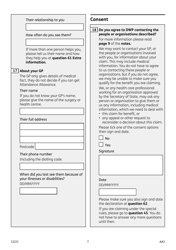

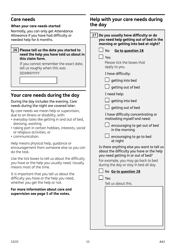

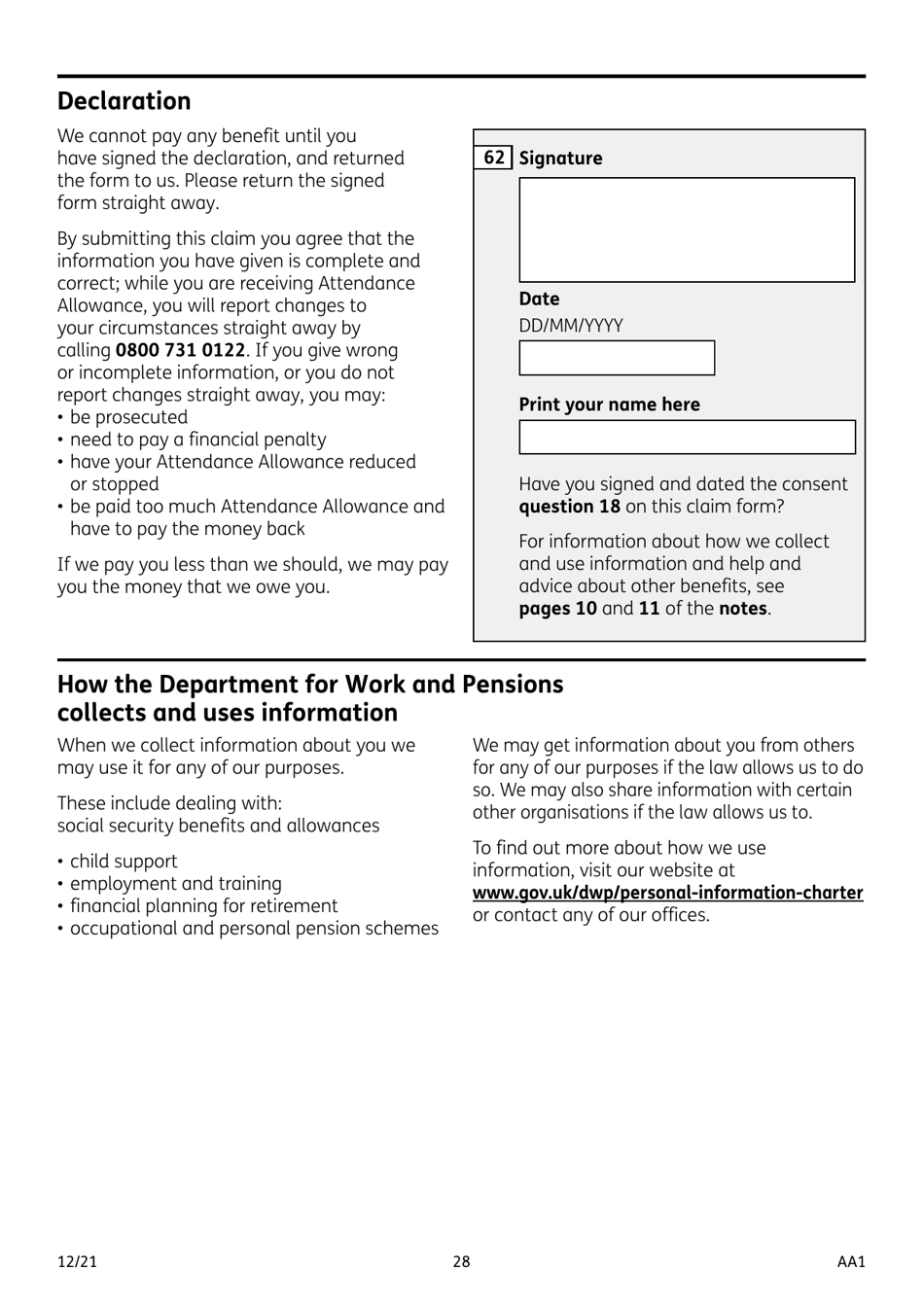

Form AA1 Attendance Allowance is a document used in the United Kingdom for applying for Attendance Allowance, which is a benefit for individuals of state pension age or over who have a disability or long-term illness that requires assistance with daily living or supervision to stay safe. This form helps assess eligibility and support the application process for this financial assistance.

In the United Kingdom, individuals who are of State Pension Age or over can file the Form AA1 Attendance Allowance themselves. The form is typically submitted by the person who requires assistance with their personal care due to a disability or illness.

FAQ

Q: What is Attendance Allowance?

A: Attendance Allowance is a benefit in the United Kingdom for people of State Pension Age or over who have a disability or illness that requires them to have help or supervision with their personal care needs.

Q: Who can receive Attendance Allowance?

A: Attendance Allowance is available for people of State Pension Age or over who have a disability or illness that requires them to have help or supervision with their personal care needs. It is not means-tested, so your income and savings will not affect your eligibility.

Q: How much is Attendance Allowance?

A: The amount of Attendance Allowance you can receive depends on the level of help or supervision you need. There are two rates: a lower rate and a higher rate. The current rates (2021/2022) are £60.00 per week for the lower rate and £89.60 per week for the higher rate.

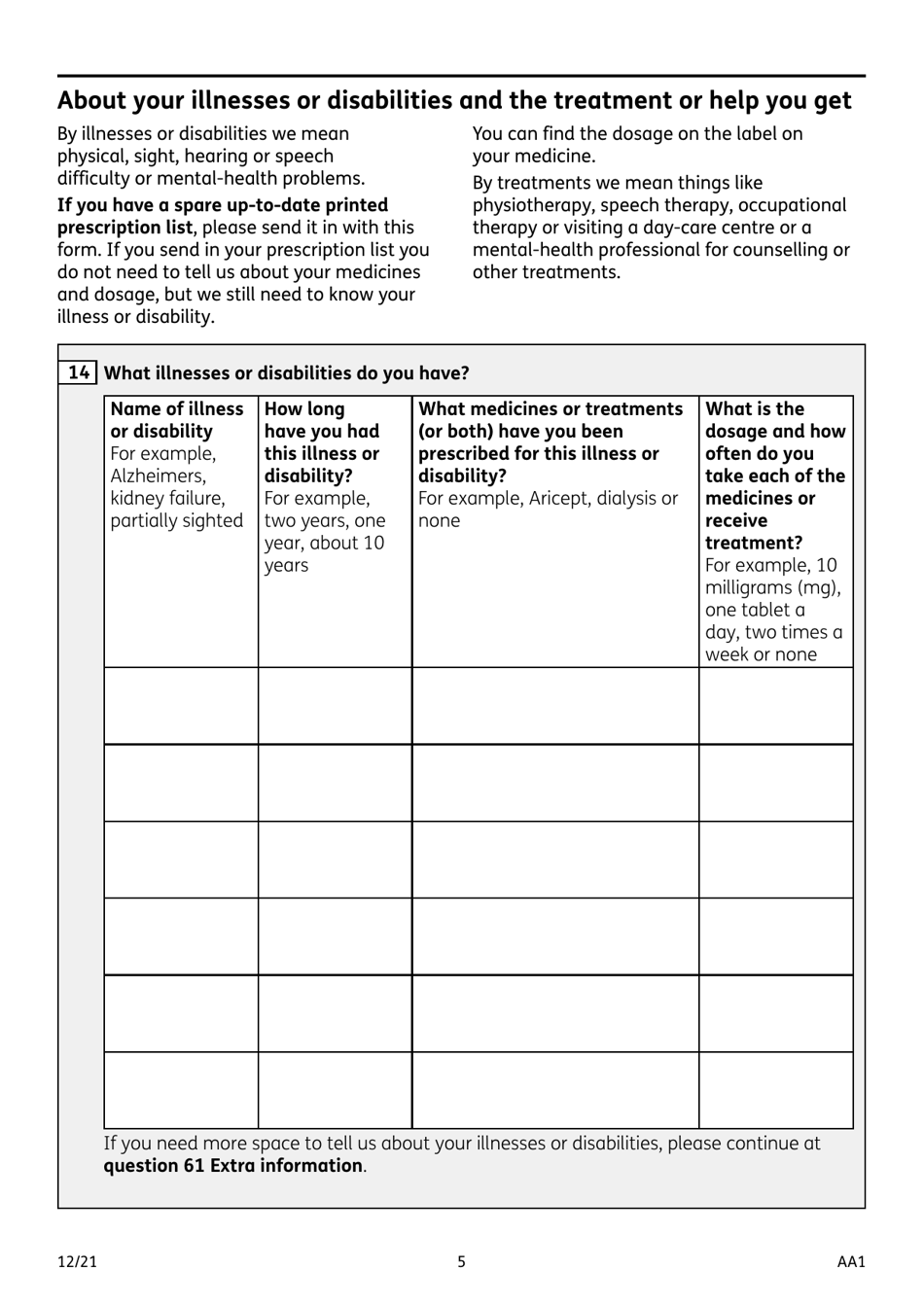

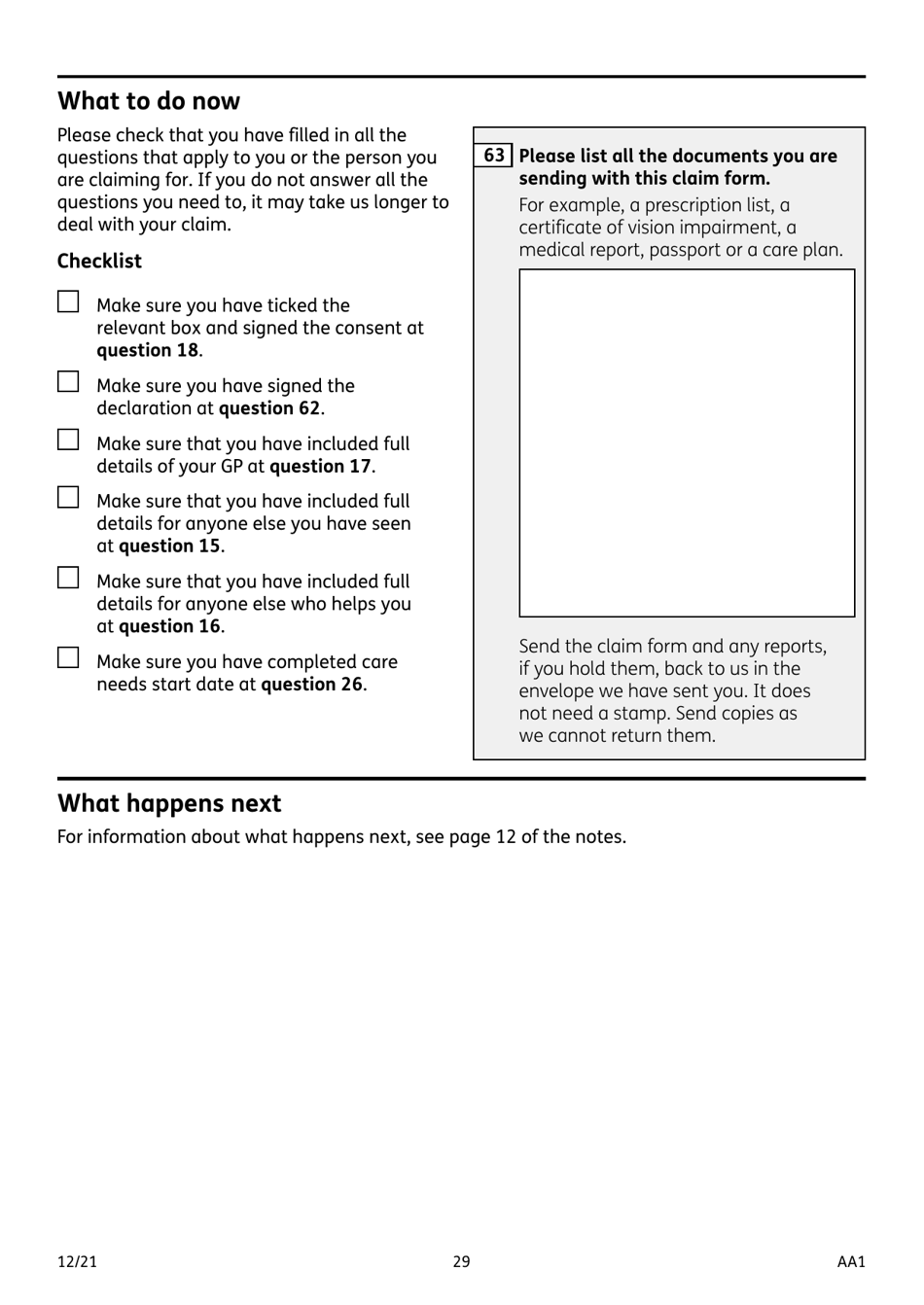

Q: What documents do I need to include with my application?

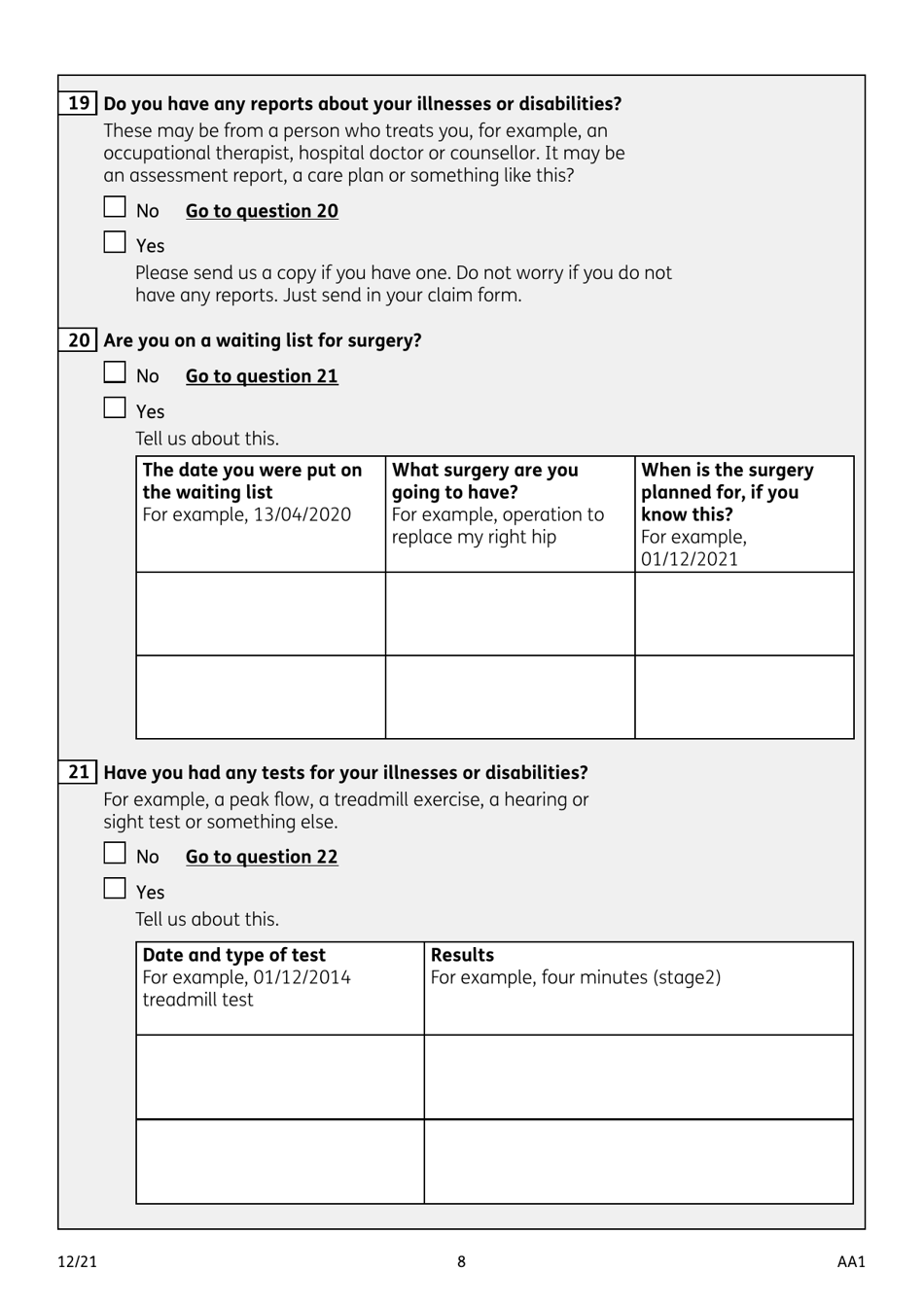

A: When applying for Attendance Allowance, it is not necessary to include supporting documents. However, providing any medical evidence or information about your condition can help support your claim and increase your chances of receiving the allowance.

Q: How long does it take to process an Attendance Allowance claim?

A: The processing time for an Attendance Allowance claim can vary. It usually takes around 21 days for the Department for Work and Pensions to reach a decision and inform you of the outcome. However, in some cases, it may take longer.

Q: Can I appeal if my Attendance Allowance claim is rejected?

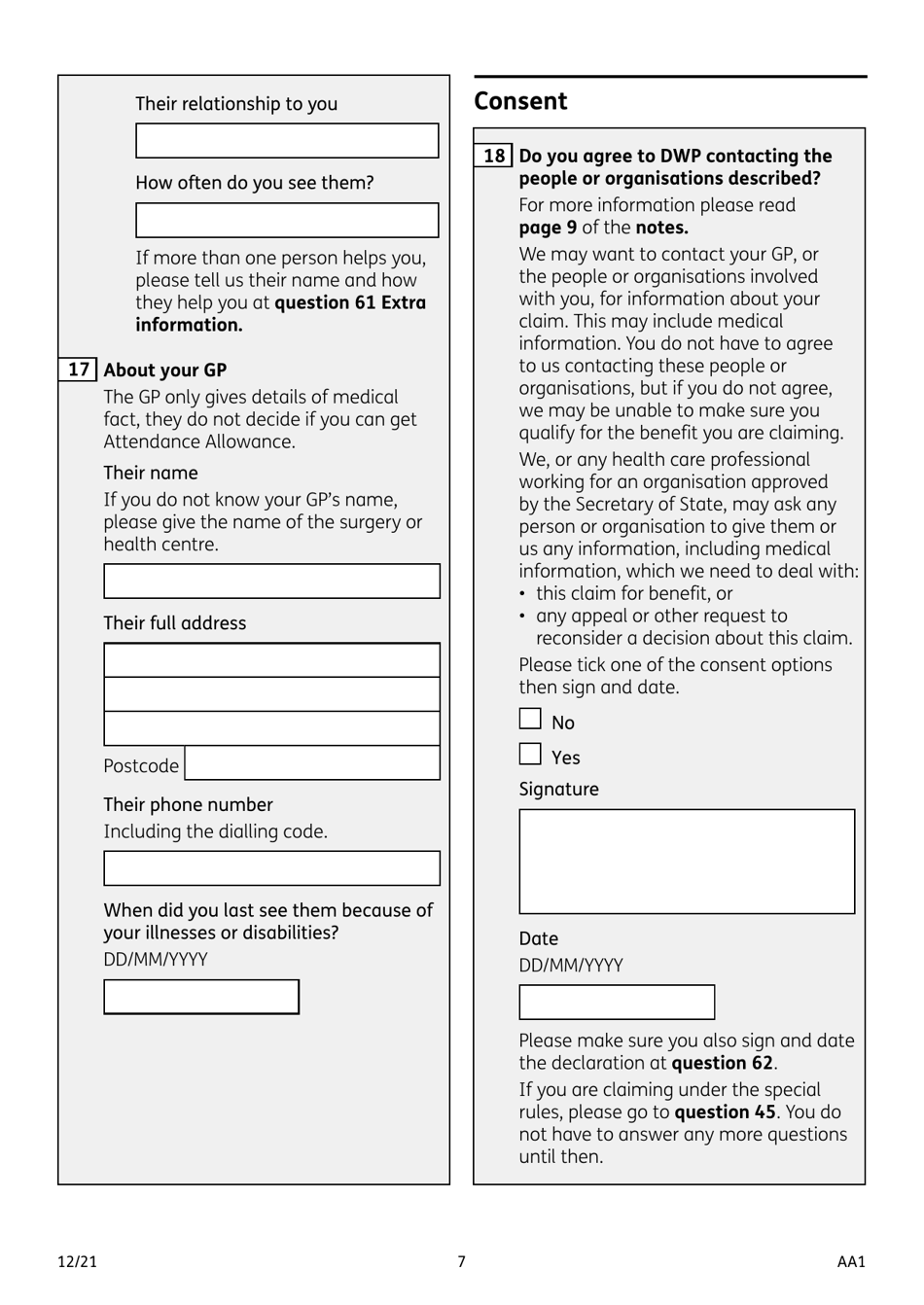

A: Yes, if your claim for Attendance Allowance is rejected, you have the right to appeal the decision. You must request an appeal within one month of receiving the decision letter. The appeal process involves providing additional evidence and attending a hearing.

Q: Is Attendance Allowance taxable?

A: No, Attendance Allowance is not taxable. It is considered a non-taxable social security benefit in the United Kingdom.

Q: Can I get Attendance Allowance if I live in a care home?

A: Yes, you can still receive Attendance Allowance if you live in a care home. However, the amount you receive may be lower if the care home provides you with personal care or covers the cost of personal care.

Q: Can I get Attendance Allowance if I am already receiving other benefits?

A: Yes, you can still receive Attendance Allowance even if you are already receiving other benefits, such as State Pension or Disability Living Allowance. Attendance Allowance is not means-tested and does not affect other benefits you may be entitled to.