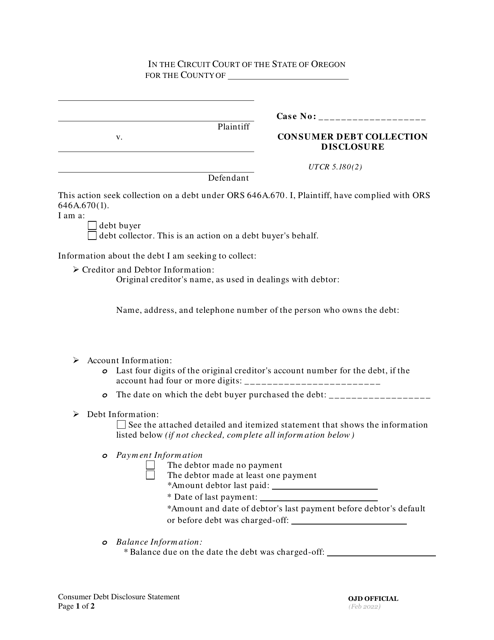

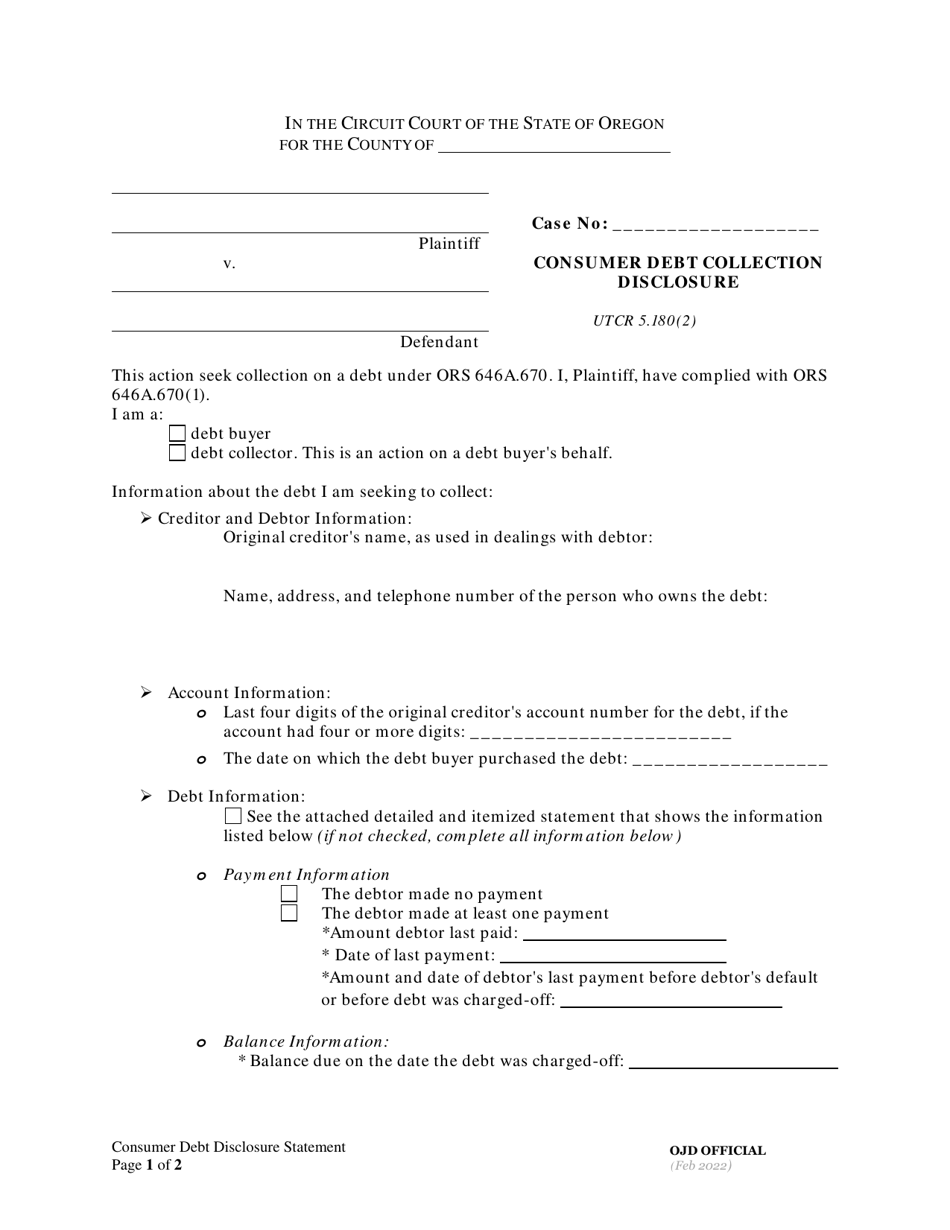

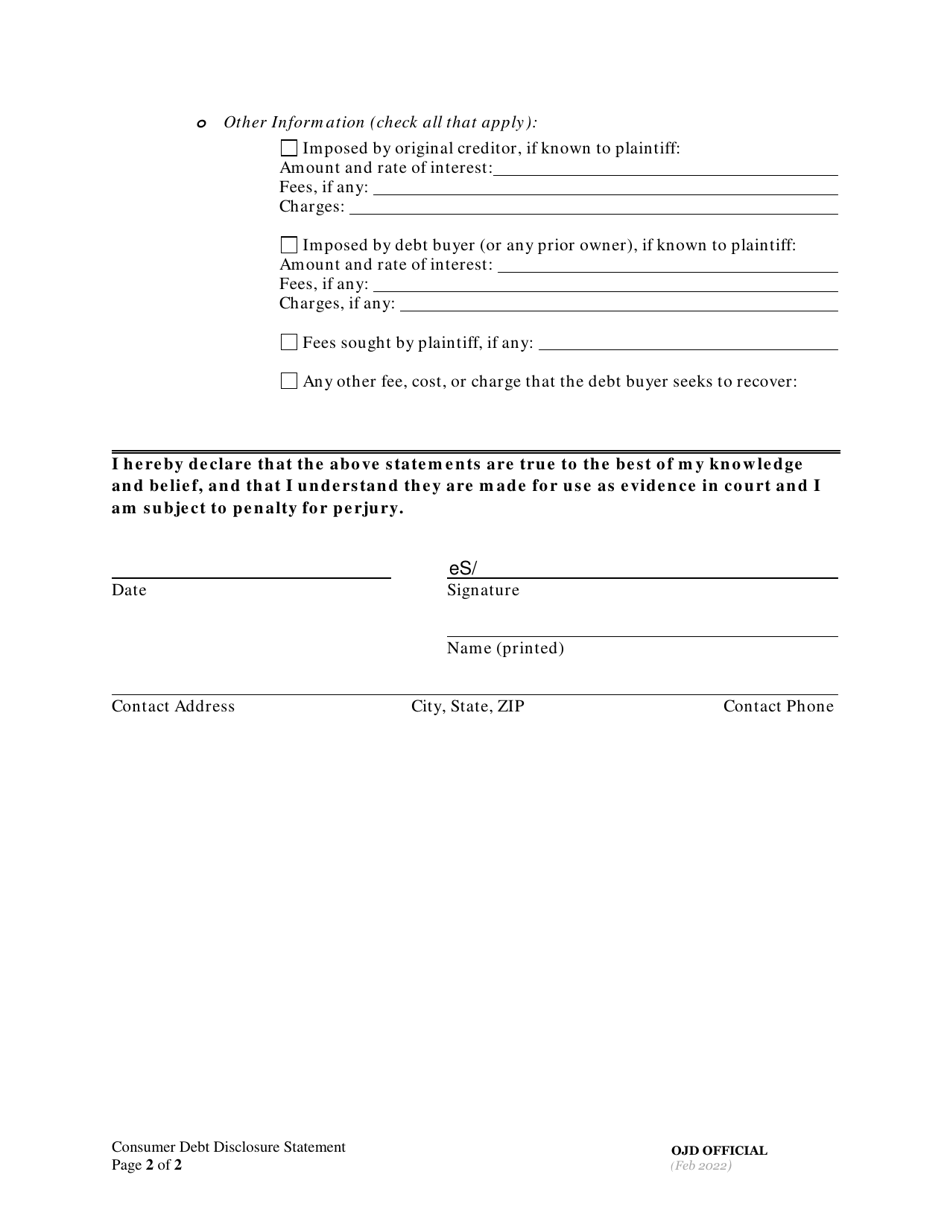

Consumer Debt Collection Disclosure - Oregon

Consumer Debt Collection Disclosure is a legal document that was released by the Oregon Circuit Courts - a government authority operating within Oregon.

FAQ

Q: What is the Consumer Debt Collection Disclosure?

A: The Consumer Debt Collection Disclosure is a legal requirement that debt collectors in Oregon must provide to consumers when attempting to collect a debt.

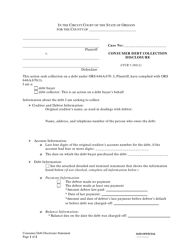

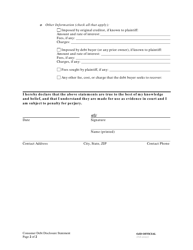

Q: What does the Consumer Debt Collection Disclosure include?

A: The Consumer Debt Collection Disclosure includes information about the debt being collected, the rights of the consumer, and how to dispute the debt.

Q: Why is the Consumer Debt Collection Disclosure important?

A: The Consumer Debt Collection Disclosure is important because it helps consumers understand their rights when dealing with debt collectors and provides guidance on how to dispute inaccurate or unfair debts.

Q: Who is required to provide the Consumer Debt Collection Disclosure?

A: Debt collectors in Oregon are required to provide the Consumer Debt Collection Disclosure to consumers.

Q: What should I do if I receive a Consumer Debt Collection Disclosure?

A: If you receive a Consumer Debt Collection Disclosure, you should carefully review the information provided, take note of your rights as a consumer, and take appropriate action if you believe the debt is inaccurate or unfair.

Form Details:

- Released on February 1, 2022;

- The latest edition currently provided by the Oregon Circuit Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Circuit Courts.