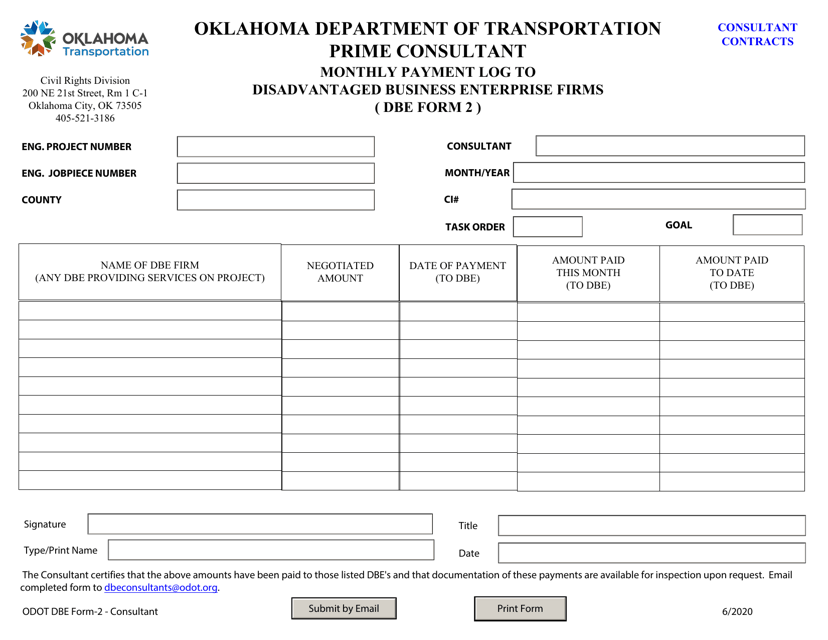

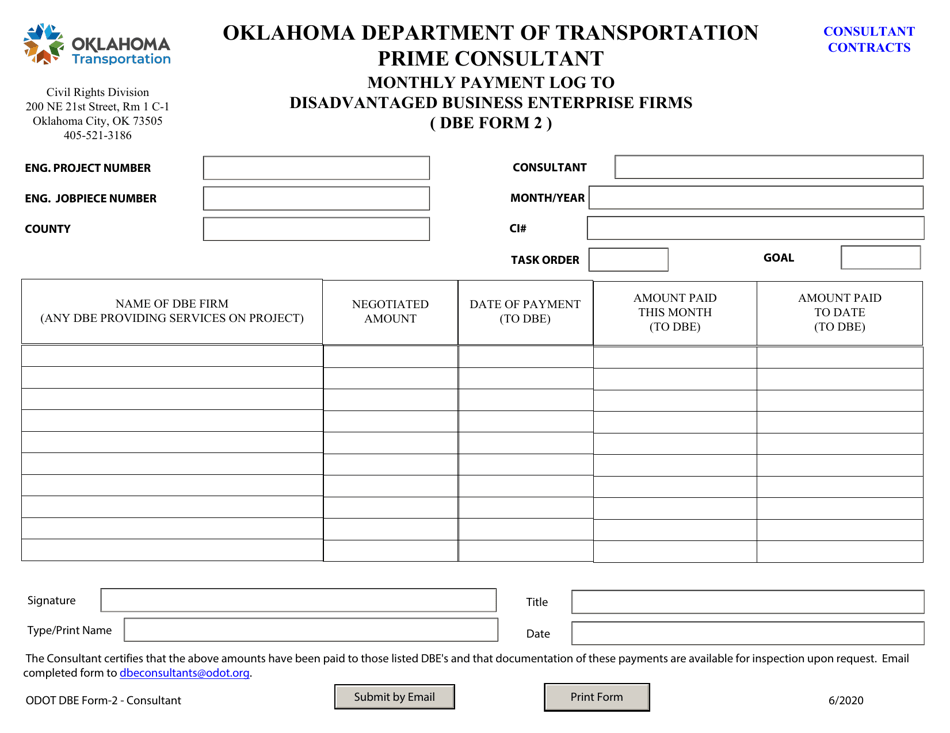

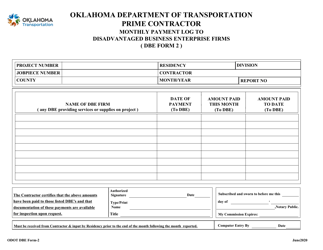

DBE Form 2 Monthly Payment Log to Disadvantaged Business Enterprise Firms - Prime Consultant - Oklahoma

What Is DBE Form 2?

This is a legal form that was released by the Oklahoma Department of Transportation - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DBE Form 2?

A: DBE Form 2 is a Monthly Payment Log to Disadvantaged Business Enterprise Firms.

Q: Who is the intended recipient of DBE Form 2?

A: DBE Form 2 is intended for Prime Consultants in Oklahoma.

Q: What is the purpose of DBE Form 2?

A: The purpose of DBE Form 2 is to track and log monthly payments made to Disadvantaged Business Enterprise Firms.

Q: What are Disadvantaged Business Enterprise Firms?

A: Disadvantaged Business Enterprise Firms are businesses that are owned and controlled by socially and economically disadvantaged individuals.

Q: Why is it important to track payments to Disadvantaged Business Enterprise Firms?

A: Tracking payments ensures compliance with government regulations and supports fair access to contracting opportunities for disadvantaged businesses.

Q: Is DBE Form 2 specific to Oklahoma?

A: Yes, DBE Form 2 is specific to Prime Consultants in Oklahoma.

Q: Are Prime Consultants the only ones required to submit DBE Form 2?

A: Yes, Prime Consultants are the intended recipients of DBE Form 2.

Q: How often should DBE Form 2 be completed?

A: DBE Form 2 should be completed on a monthly basis to track payments made to Disadvantaged Business Enterprise Firms.

Q: What information should be included in DBE Form 2?

A: DBE Form 2 should include details such as the name of the Disadvantaged Business Enterprise Firm, the amount of payment made, the date of payment, and any other required information as specified by the overseeing agency or organization.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Oklahoma Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of DBE Form 2 by clicking the link below or browse more documents and templates provided by the Oklahoma Department of Transportation.