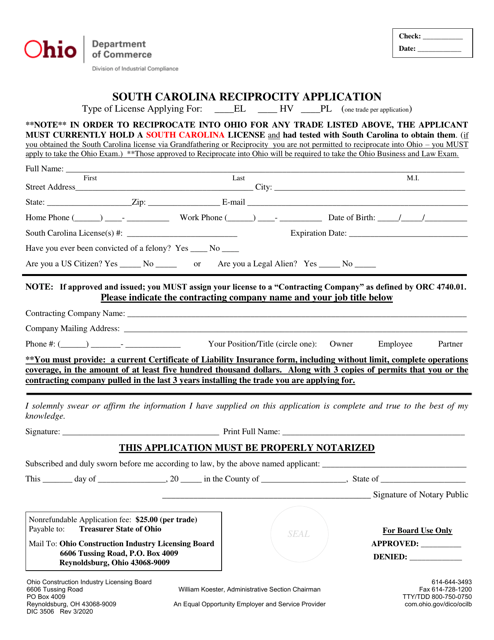

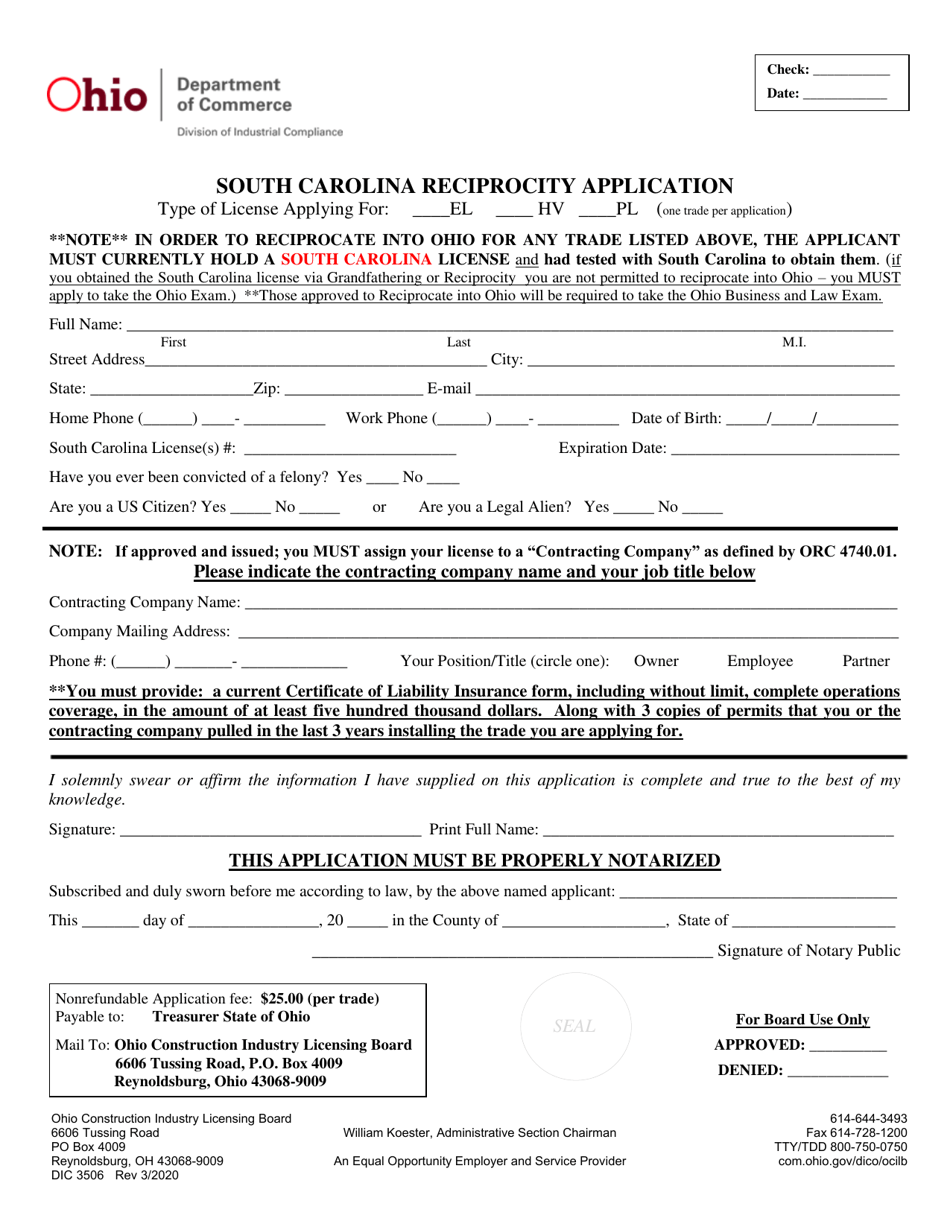

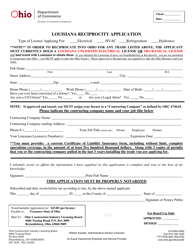

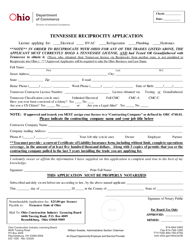

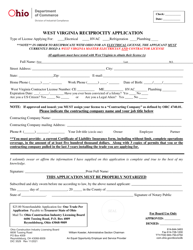

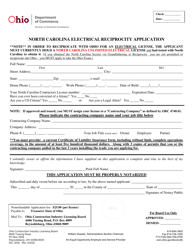

Form DIC3506 South Carolina Reciprocity Application - Ohio

What Is Form DIC3506?

This is a legal form that was released by the Ohio Department of Commerce - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DIC3506 South Carolina Reciprocity Application?

A: The DIC3506 South Carolina Reciprocity Application is a form that allows Ohio residents to apply for a reciprocity agreement with South Carolina regarding tax treatment of retirement income.

Q: What is a reciprocity agreement?

A: A reciprocity agreement is an agreement between two states that allows taxpayers to pay income taxes only to their state of residence, regardless of where the income is earned.

Q: Who is eligible to use the DIC3506 South Carolina Reciprocity Application?

A: Ohio residents who receive retirement income from South Carolina sources may be eligible to use this application.

Q: What types of retirement income does the DIC3506 South Carolina Reciprocity Application cover?

A: The application covers retirement income from sources such as pensions, annuities, and IRA distributions.

Q: What is the purpose of the DIC3506 South Carolina Reciprocity Application?

A: The purpose of the application is to ensure that Ohio residents are not subject to double taxation on their retirement income.

Q: Is there a deadline to submit the DIC3506 South Carolina Reciprocity Application?

A: The application should be submitted as soon as possible after receiving retirement income from South Carolina sources.

Q: Are there any fees associated with the DIC3506 South Carolina Reciprocity Application?

A: No, there are no fees associated with the application.

Q: What supporting documents are required to be submitted with the DIC3506 South Carolina Reciprocity Application?

A: You may need to submit copies of your federal tax return, South Carolina income tax return, and any other relevant documents.

Q: Who should I contact for more information about the DIC3506 South Carolina Reciprocity Application?

A: For more information, you can contact the Ohio Department of Taxation directly.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Ohio Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DIC3506 by clicking the link below or browse more documents and templates provided by the Ohio Department of Commerce.