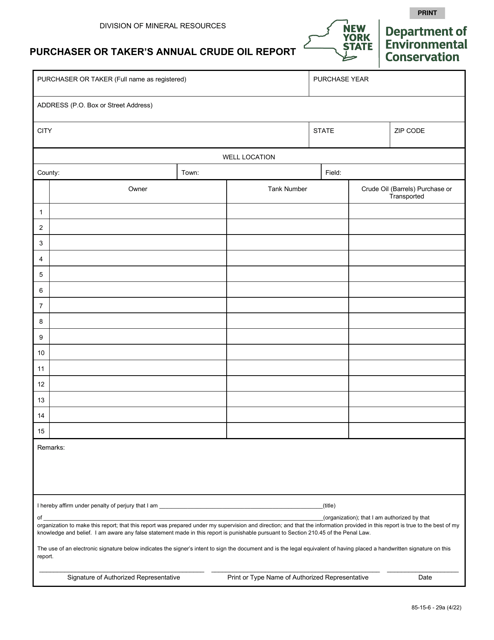

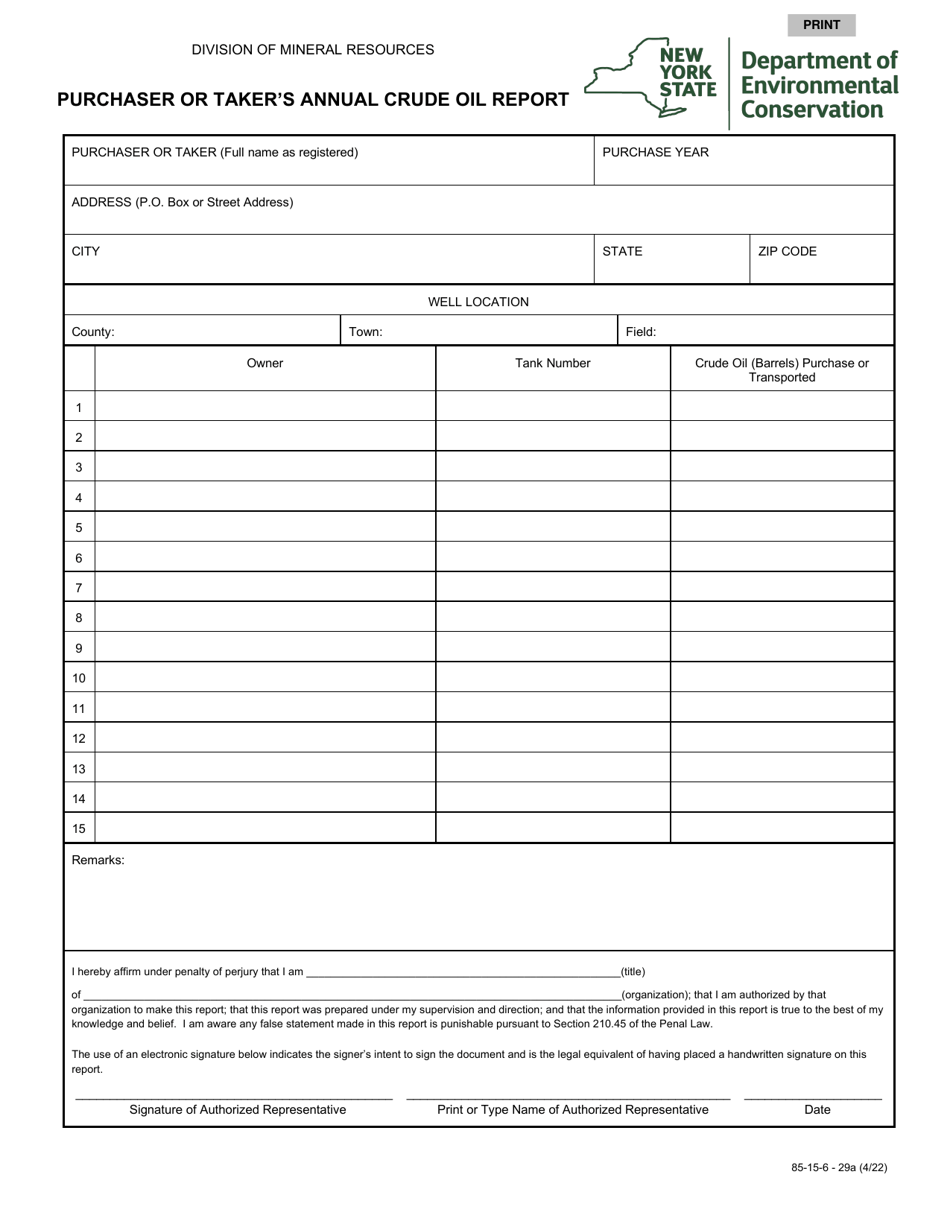

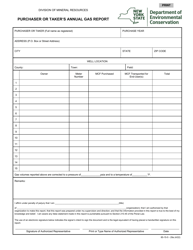

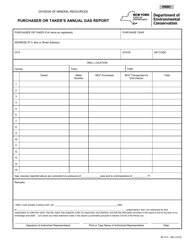

Form 85-15-6-29A Purchaser or Taker's Annual Crude Oil Report - New York

What Is Form 85-15-6-29A?

This is a legal form that was released by the New York State Department of Environmental Conservation - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 85-15-6-29A?

A: Form 85-15-6-29A is the Purchaser or Taker's Annual Crude Oil Report specifically for New York.

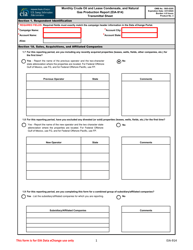

Q: Who needs to file Form 85-15-6-29A?

A: Purchasers or takers of crude oil in New York need to file Form 85-15-6-29A.

Q: What is the purpose of Form 85-15-6-29A?

A: The purpose of Form 85-15-6-29A is to report annual crude oil purchases or takings in New York.

Q: What information is required to be reported on Form 85-15-6-29A?

A: Form 85-15-6-29A requires information such as the purchaser or taker's name, address, and detailed information about crude oil purchases or takings.

Q: When is Form 85-15-6-29A due?

A: The due date for filing Form 85-15-6-29A may vary, so it is important to check with the regulatory authority for the specific deadline.

Q: Are there any penalties for late or incorrect filing of Form 85-15-6-29A?

A: Penalties may apply for late or incorrect filing of Form 85-15-6-29A. It is advisable to ensure timely and accurate submission.

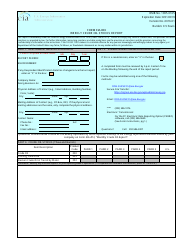

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the New York State Department of Environmental Conservation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 85-15-6-29A by clicking the link below or browse more documents and templates provided by the New York State Department of Environmental Conservation.