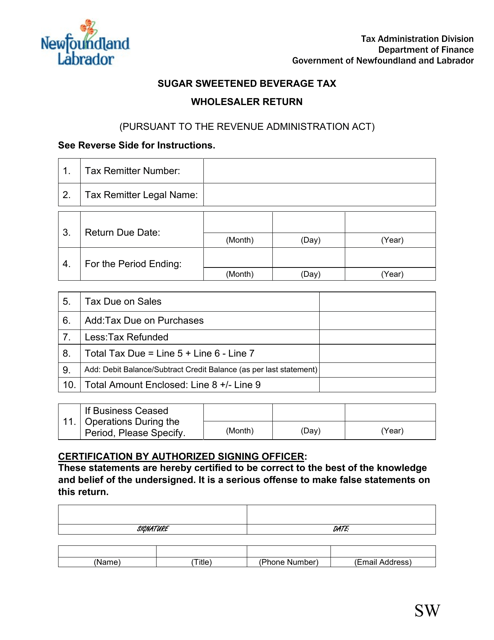

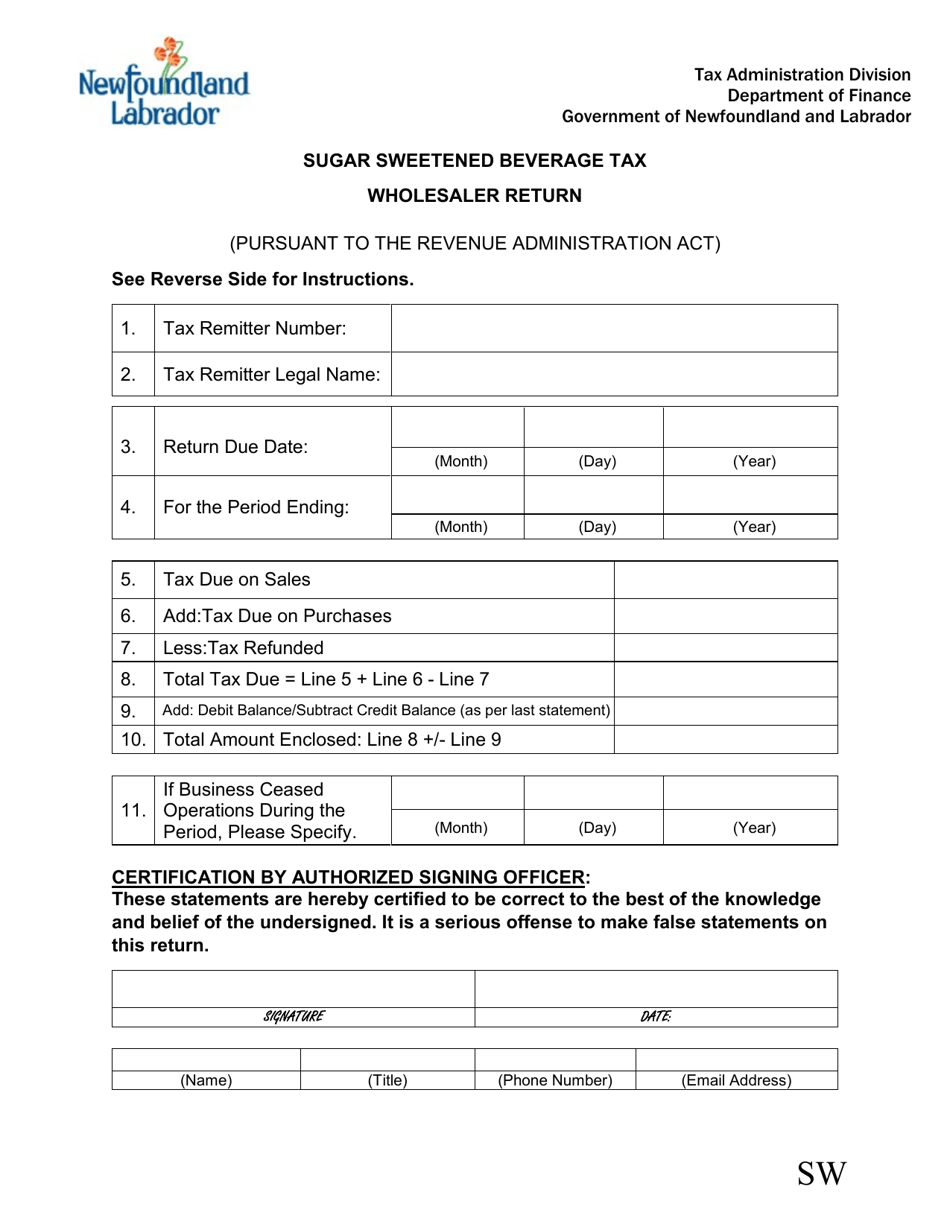

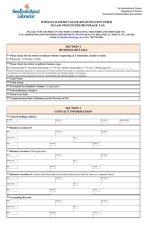

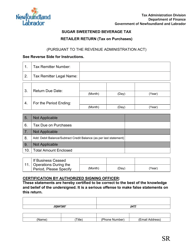

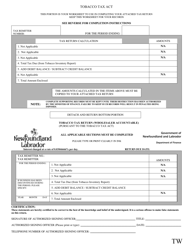

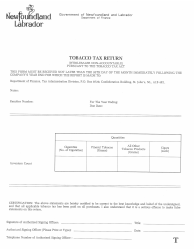

Form SW Sugar Sweetened Beverage Tax Wholesaler Return - Newfoundland and Labrador, Canada

Form SW Sugar Sweetened Beverage Tax Wholesaler Return is a tax form for wholesalers in Newfoundland and Labrador, Canada. It is used to report and remit the sugar sweetened beverage tax owed by wholesalers in the province.

The wholesaler is responsible for filing the Form SW Sugar Sweetened Beverage Tax Wholesaler Return in Newfoundland and Labrador, Canada.

FAQ

Q: What is the SW sugar sweetened beverage tax wholesaler return?

A: The SW sugar sweetened beverage tax wholesaler return is a form that wholesalers in Newfoundland and Labrador, Canada need to fill out to report and pay the sugar sweetened beverage tax.

Q: Who needs to fill out the SW sugar sweetened beverage tax wholesaler return?

A: Wholesalers in Newfoundland and Labrador, Canada need to fill out the SW sugar sweetened beverage tax wholesaler return.

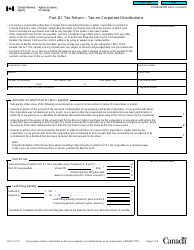

Q: What is the purpose of the sugar sweetened beverage tax?

A: The sugar sweetened beverage tax is implemented to discourage the consumption of sugary drinks and to generate revenue for the government.

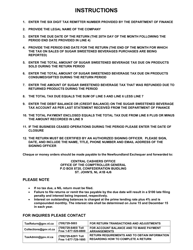

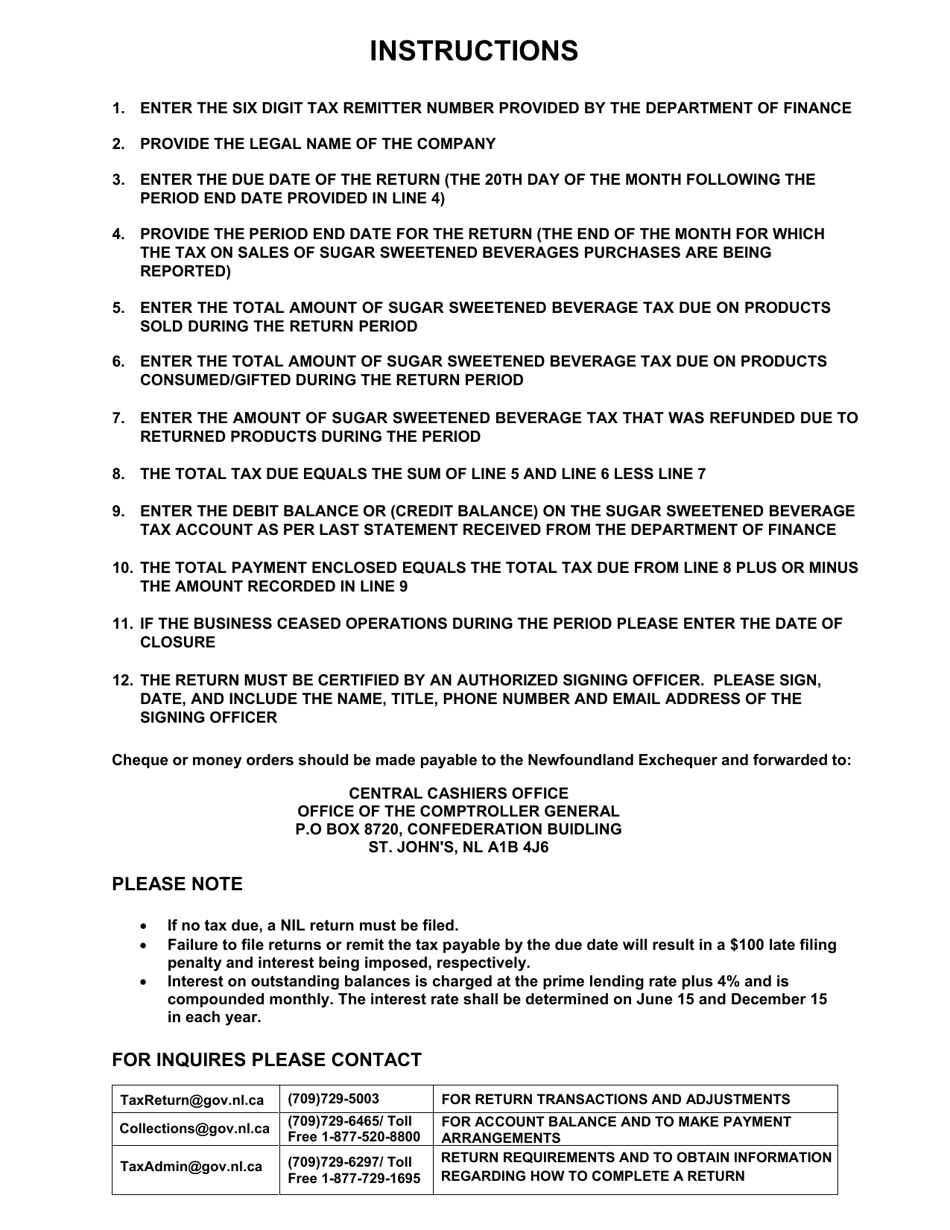

Q: When is the SW sugar sweetened beverage tax wholesaler return due?

A: The due date for the SW sugar sweetened beverage tax wholesaler return may vary and is usually determined by the provincial tax authority.

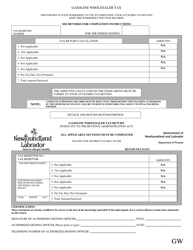

Q: What information is required on the SW sugar sweetened beverage tax wholesaler return?

A: The SW sugar sweetened beverage tax wholesaler return typically requires information such as the amount of sugar sweetened beverages sold, the tax rate applicable, and the total tax payable.

Q: How do I calculate the amount of tax payable?

A: The amount of tax payable is usually calculated by multiplying the volume or value of sugar sweetened beverages sold by the applicable tax rate.

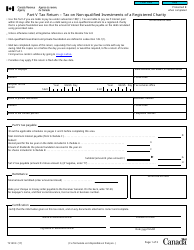

Q: What happens if I don't file or pay the SW sugar sweetened beverage tax?

A: Failure to file or pay the SW sugar sweetened beverage tax may result in penalties, fines, or other enforcement actions by the provincial tax authority.

Q: Can I claim a refund for the SW sugar sweetened beverage tax?

A: Refunds for the SW sugar sweetened beverage tax may be available in certain circumstances, such as in the case of returned or unsold products. It is best to consult the provincial tax authority for specific refund guidelines.