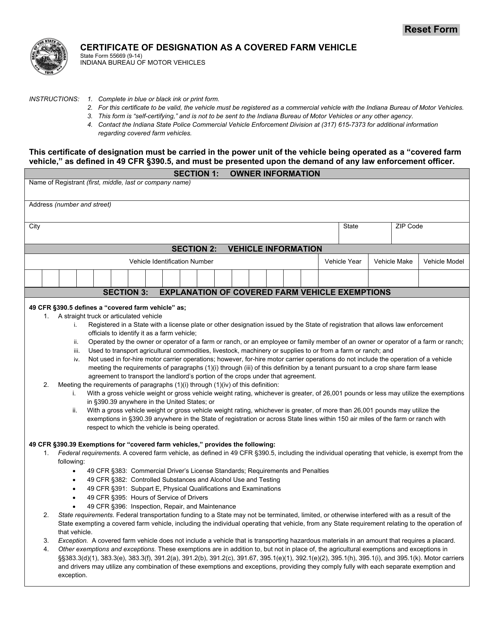

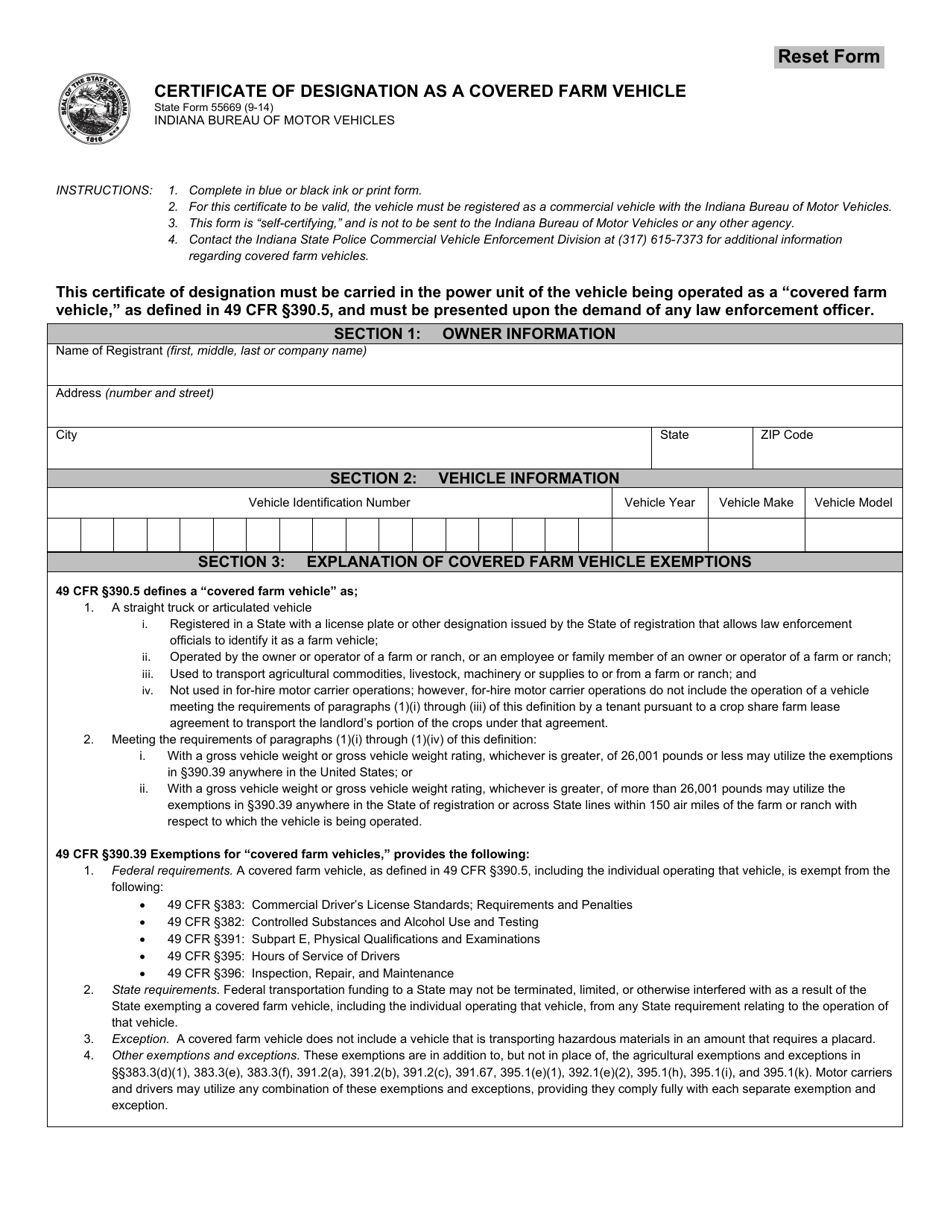

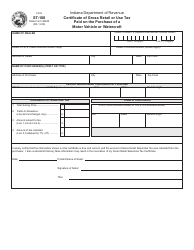

State Form 55669 Certificate of Designation as a Covered Farm Vehicle - Indiana

What Is State Form 55669?

This is a legal form that was released by the Indiana Bureau of Motor Vehicles - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

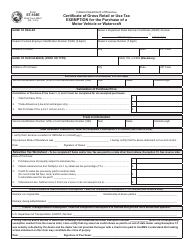

Q: What is Form 55669?

A: Form 55669 is the Certificate of Designation as a Covered Farm Vehicle.

Q: What is a Covered Farm Vehicle?

A: A Covered Farm Vehicle is a motor vehicle that is being used exclusively for agricultural purposes.

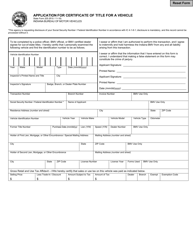

Q: Who needs to file Form 55669?

A: Any farmer who wants to designate their vehicle as a Covered Farm Vehicle needs to file Form 55669.

Q: What is the purpose of Form 55669?

A: The purpose of Form 55669 is to certify that a vehicle meets the criteria to be considered a Covered Farm Vehicle.

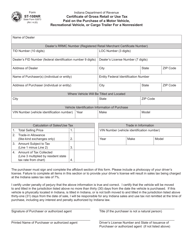

Q: What information is required on Form 55669?

A: Form 55669 requires information such as the vehicle owner's name and address, vehicle identification number (VIN), and a certification of compliance with the agricultural use requirements.

Q: Is there a fee to file Form 55669?

A: No, there is no fee to file Form 55669.

Q: What are the benefits of designating a vehicle as a Covered Farm Vehicle?

A: Designating a vehicle as a Covered Farm Vehicle may provide benefits such as exemptions from certain taxes and vehicle registration requirements.

Q: How long is the designation as a Covered Farm Vehicle valid?

A: The designation as a Covered Farm Vehicle is valid for the life of the vehicle.

Q: What should I do if I sell or transfer my Covered Farm Vehicle?

A: If you sell or transfer your Covered Farm Vehicle, you should notify the Indiana Department of Revenue within 30 days of the sale or transfer.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Indiana Bureau of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55669 by clicking the link below or browse more documents and templates provided by the Indiana Bureau of Motor Vehicles.