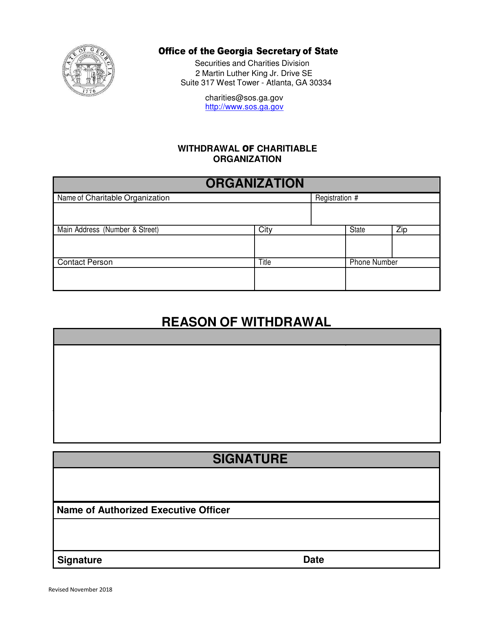

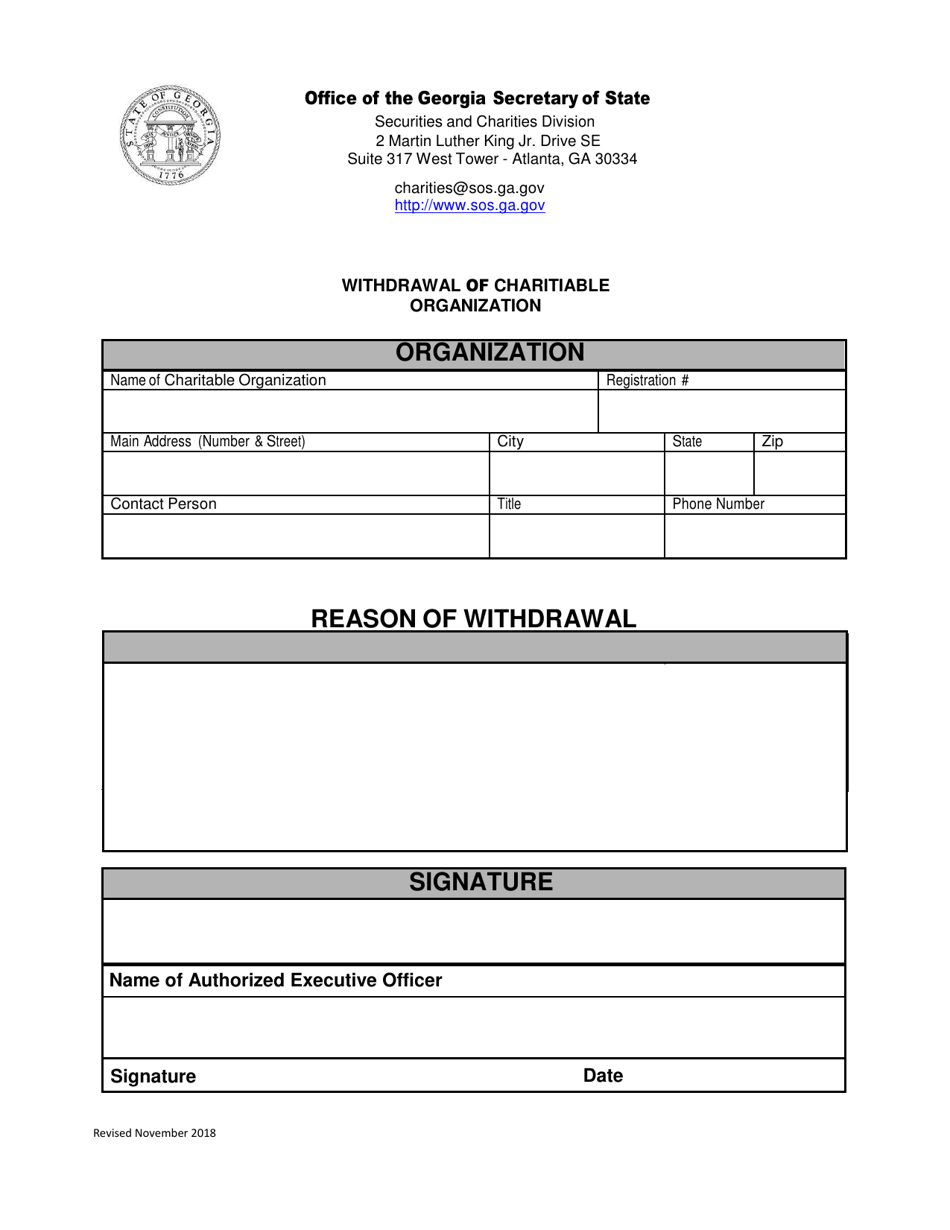

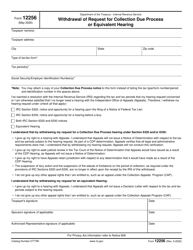

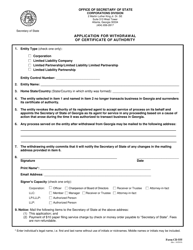

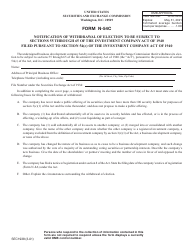

Withdrawal of Charitiable Organization - Georgia (United States)

Withdrawal of Charitiable Organization is a legal document that was released by the Georgia Secretary of State - a government authority operating within Georgia (United States).

FAQ

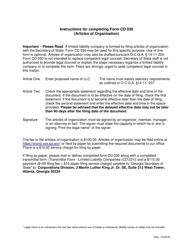

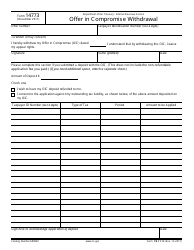

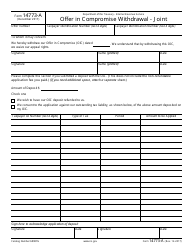

Q: What is the process for withdrawing a charitable organization in Georgia?

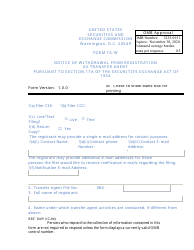

A: To withdraw a charitable organization in Georgia, you need to file a completed Withdrawal Application with the Georgia Secretary of State.

Q: Is there a fee for withdrawing a charitable organization in Georgia?

A: Yes, there is a fee for withdrawing a charitable organization in Georgia. The current fee is $10.

Q: What information is required on the Withdrawal Application for a charitable organization in Georgia?

A: The Withdrawal Application for a charitable organization in Georgia requires information such as the organization's name, federal employer identification number, address, and the name and address of a contact person.

Q: Can I withdraw a charitable organization in Georgia if it still owes taxes or has outstanding obligations?

A: No, you cannot withdraw a charitable organization in Georgia if it still owes taxes or has outstanding obligations. You must resolve these issues before filing the Withdrawal Application.

Form Details:

- Released on November 1, 2018;

- The latest edition currently provided by the Georgia Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Secretary of State.