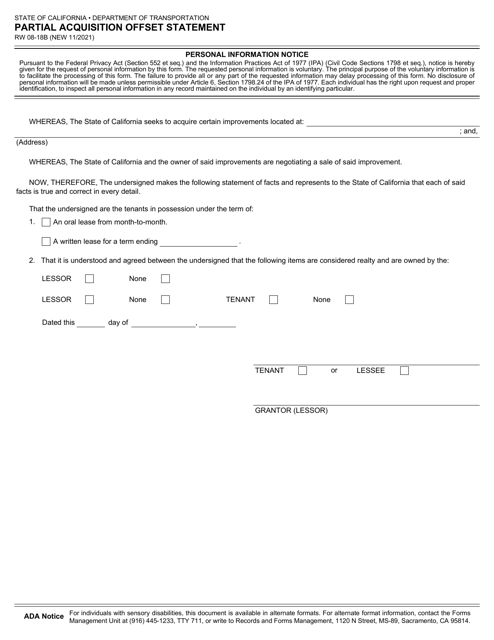

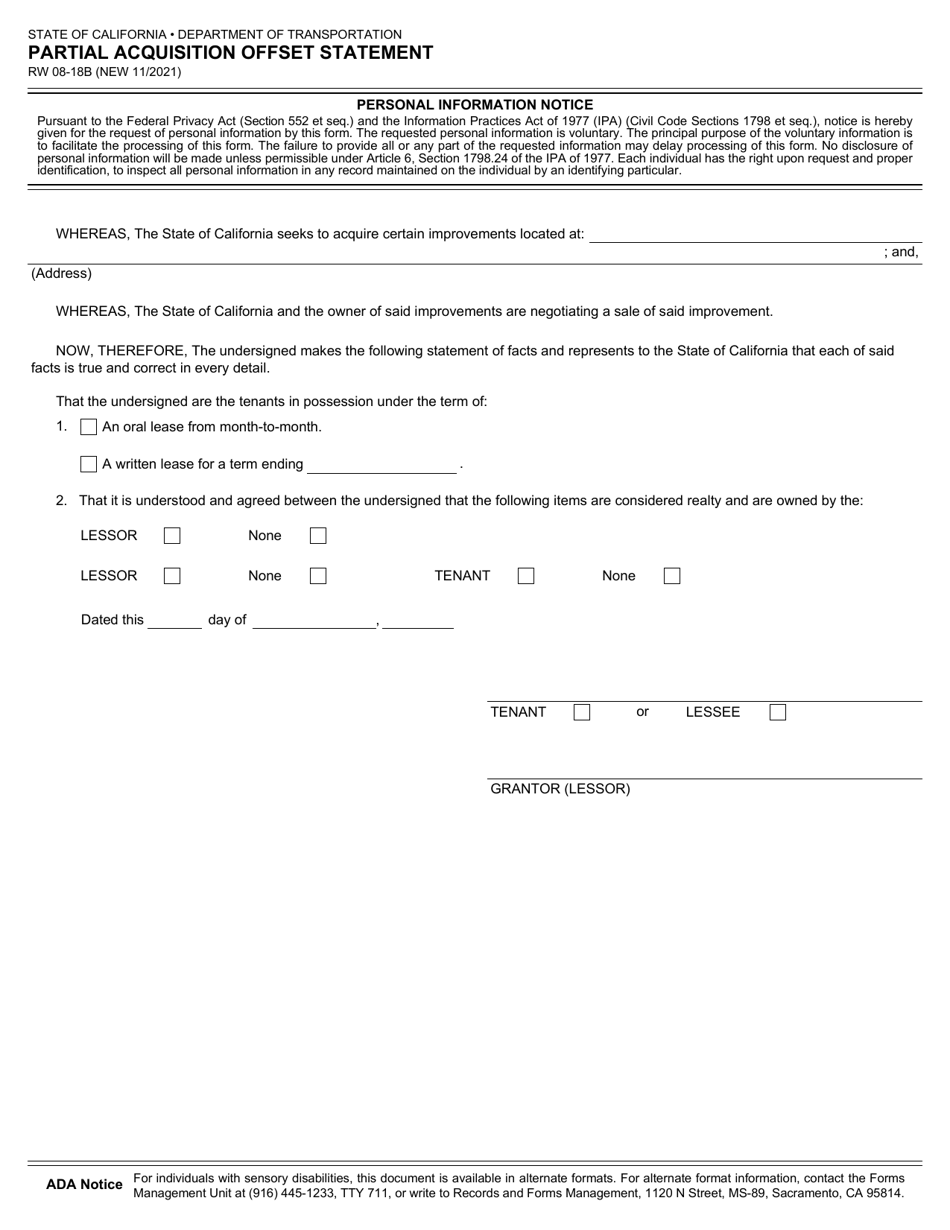

Form RW08-18B Partial Acquisition Offset Statement - California

What Is Form RW08-18B?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RW08-18B Partial Acquisition Offset Statement?

A: RW08-18B is a form used in California for reporting partial acquisitions and offsetting the acquisition costs.

Q: Who needs to file the RW08-18B form?

A: The RW08-18B form must be filed by property owners who have experienced a partial acquisition of their property and want to offset the costs.

Q: When does the RW08-18B form need to be filed?

A: The RW08-18B form must be filed within 180 days from the date of partial acquisition.

Q: What information is required on the RW08-18B form?

A: The RW08-18B form requires information such as property owner's name, contact information, property details, acquisition details, and cost offset calculations.

Q: Is there a filing fee for submitting the RW08-18B form?

A: No, there is no filing fee for submitting the RW08-18B form.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW08-18B by clicking the link below or browse more documents and templates provided by the California Department of Transportation.