This version of the form is not currently in use and is provided for reference only. Download this version of

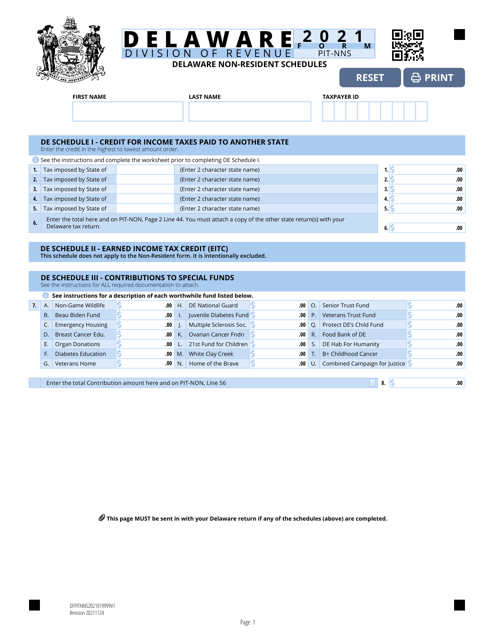

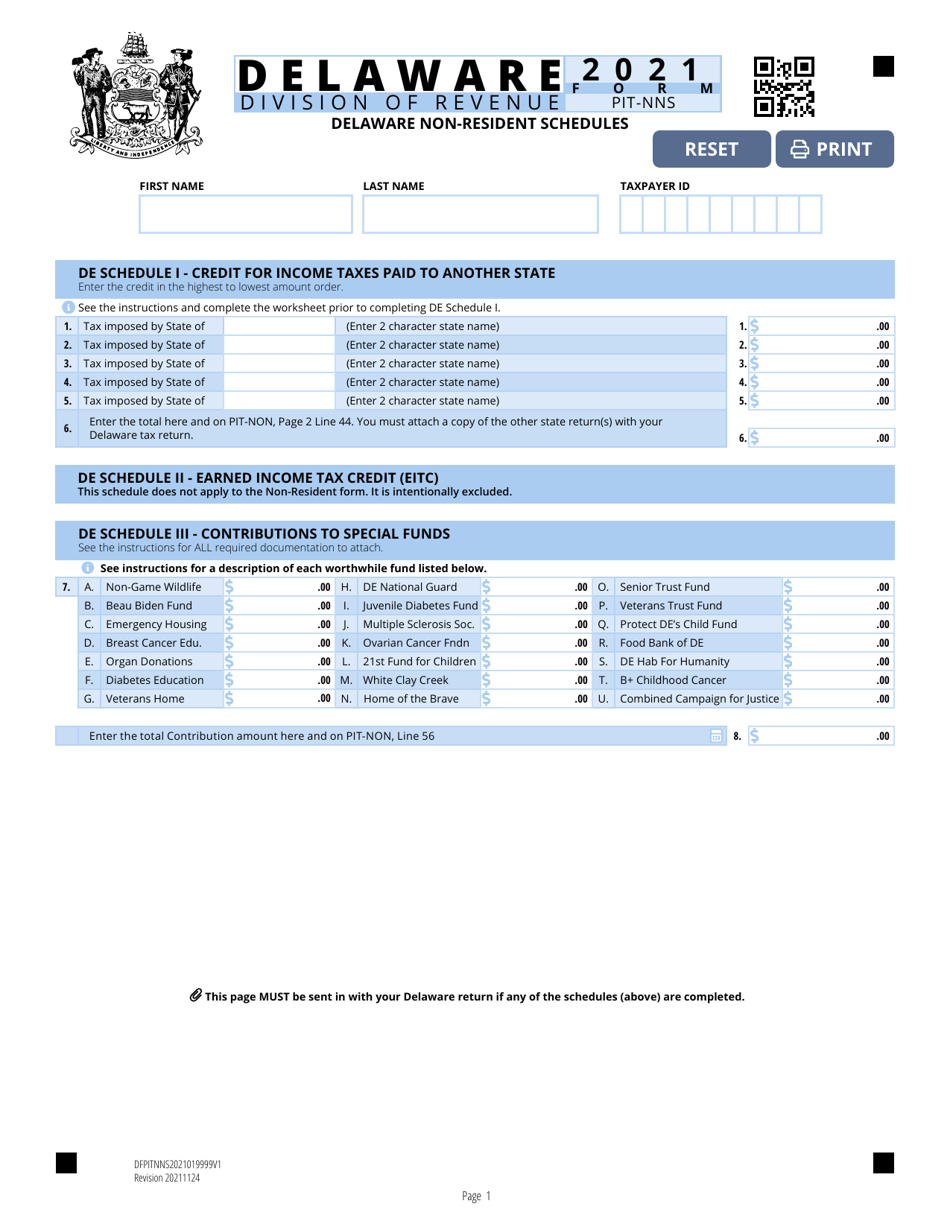

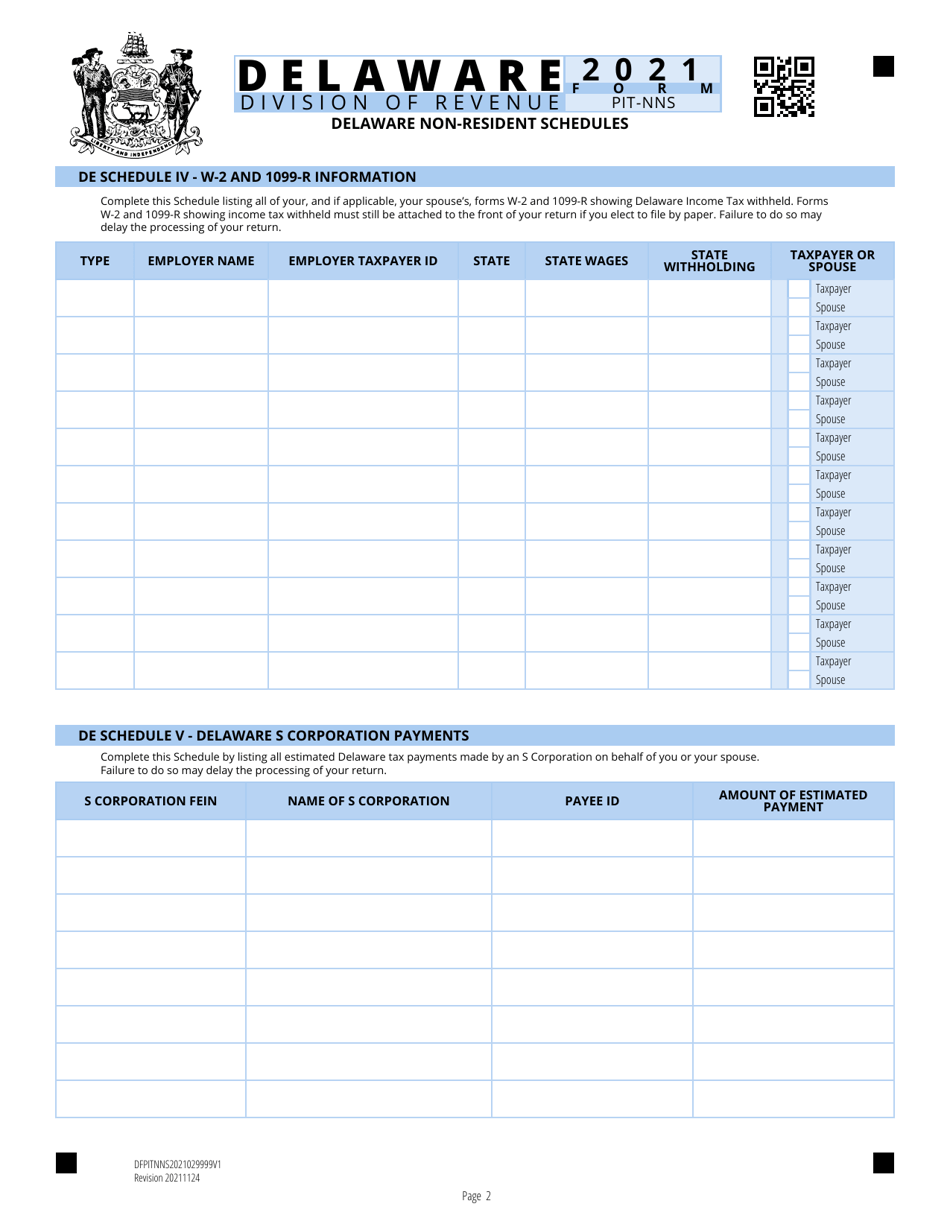

Form PIT-NNS

for the current year.

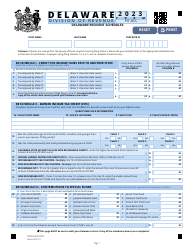

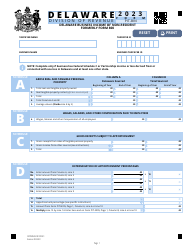

Form PIT-NNS Delaware Non-resident Schedules - Delaware

What Is Form PIT-NNS?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PIT-NNS?

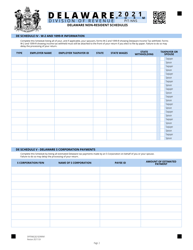

A: Form PIT-NNS is a tax form used by non-residents of Delaware to report their income and calculate their tax liability.

Q: Who needs to file Form PIT-NNS?

A: Non-residents of Delaware who have income from Delaware sources need to file Form PIT-NNS.

Q: What is the purpose of Form PIT-NNS?

A: Form PIT-NNS is used to determine the tax liability of non-residents who have income from Delaware sources.

Q: When is Form PIT-NNS due?

A: Form PIT-NNS is due on or before April 30 of the following year.

Q: What if I don't file Form PIT-NNS?

A: If you don't file Form PIT-NNS when required, you may be subject to penalties and interest on the unpaid tax amount.

Q: Do I need to include all my income on Form PIT-NNS?

A: Yes, you need to report all your income from Delaware sources on Form PIT-NNS.

Q: Can I claim deductions and credits on Form PIT-NNS?

A: Yes, you can claim deductions and credits on Form PIT-NNS to reduce your taxable income and lower your tax liability.

Form Details:

- Released on November 24, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-NNS by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.