This version of the form is not currently in use and is provided for reference only. Download this version of

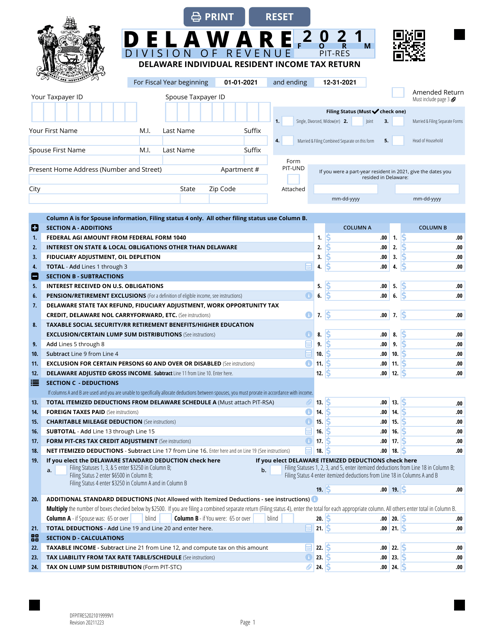

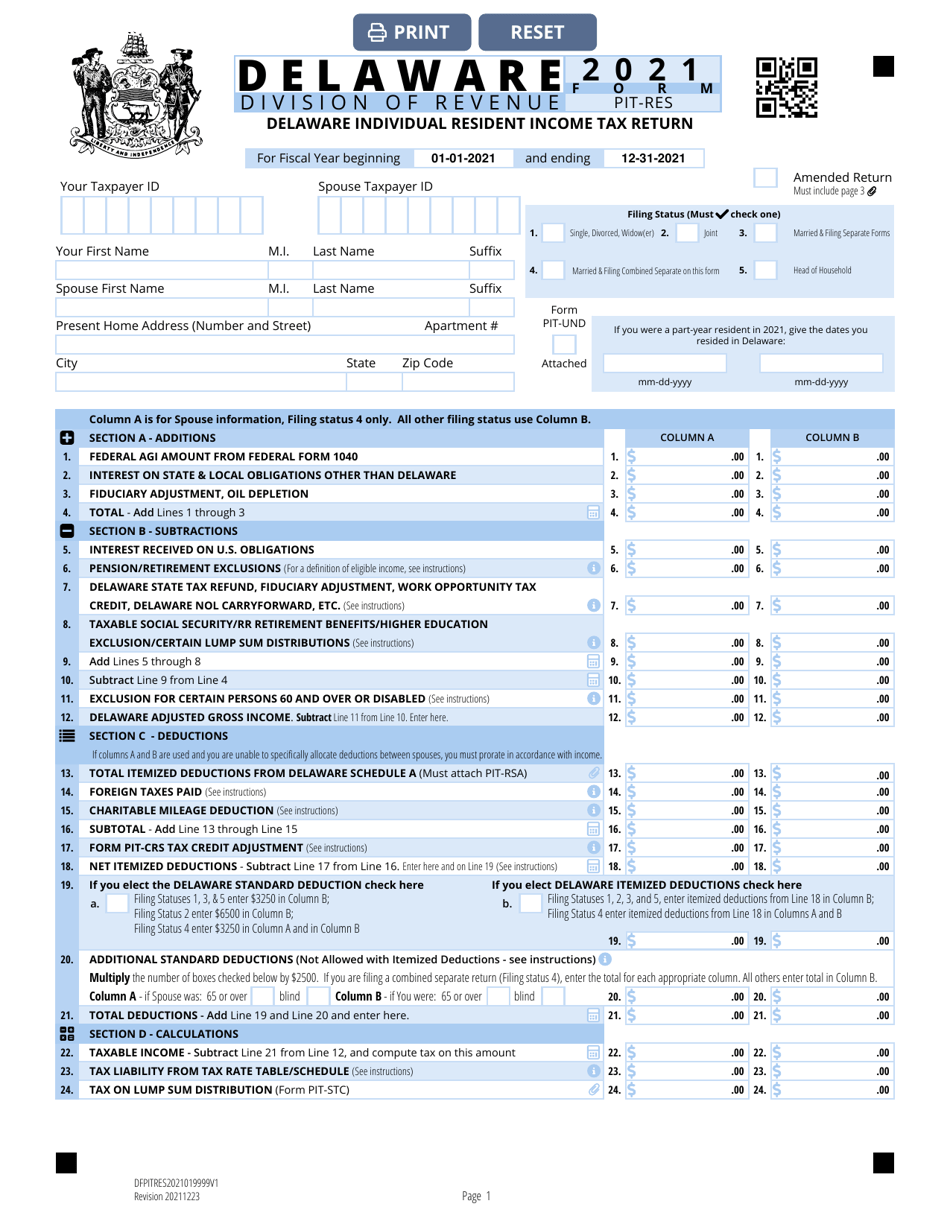

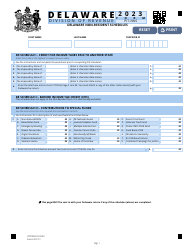

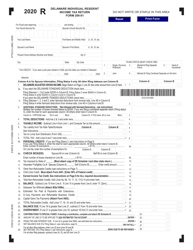

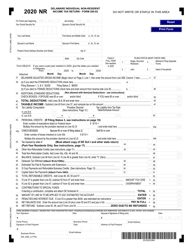

Form PIT-RES

for the current year.

Form PIT-RES Delaware Individual Resident Income Tax Return - Delaware

What Is Form PIT-RES?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form PIT-RES?

A: Form PIT-RES is the Delaware Individual Resident Income Tax Return.

Q: Who needs to file Form PIT-RES?

A: Delaware residents who need to report their income and pay state taxes must file Form PIT-RES.

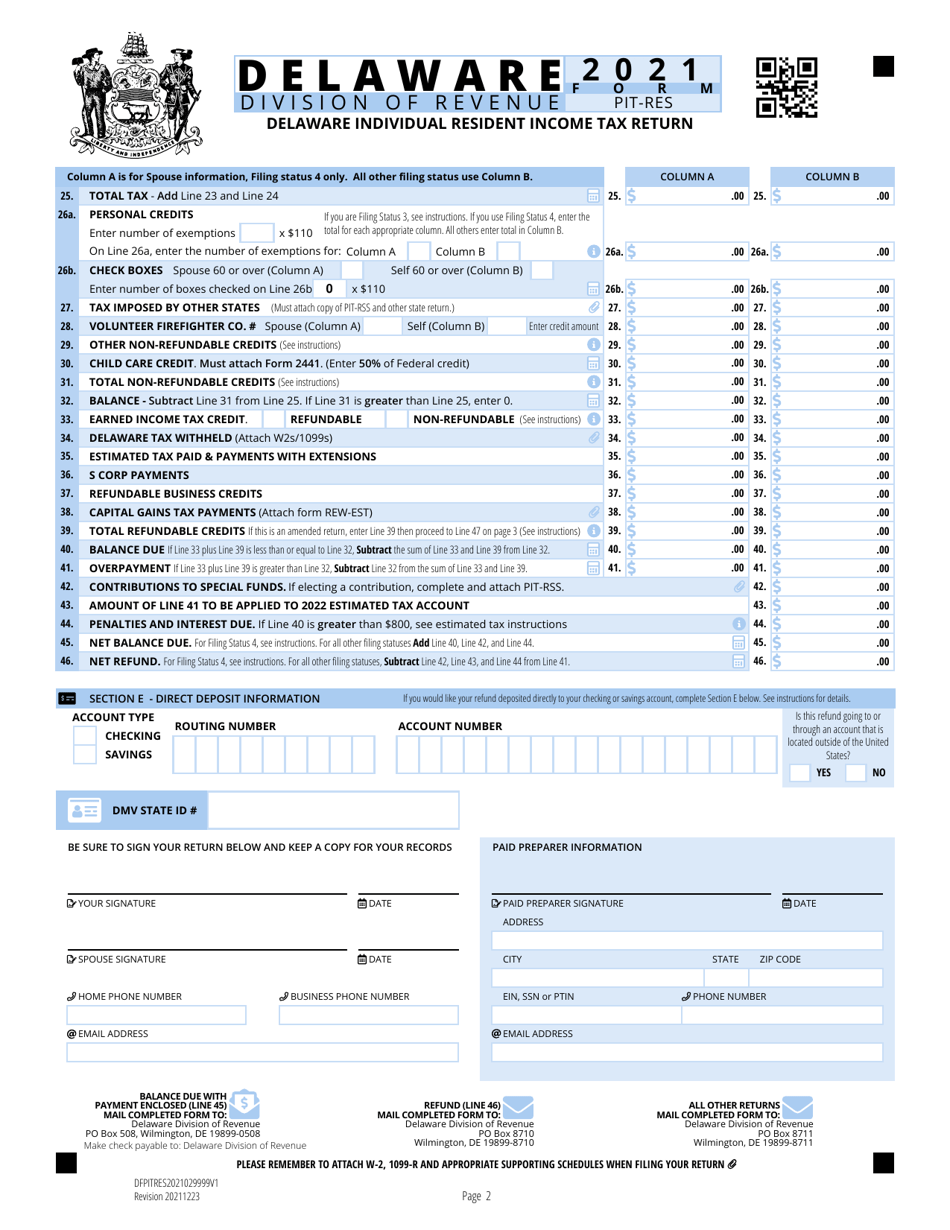

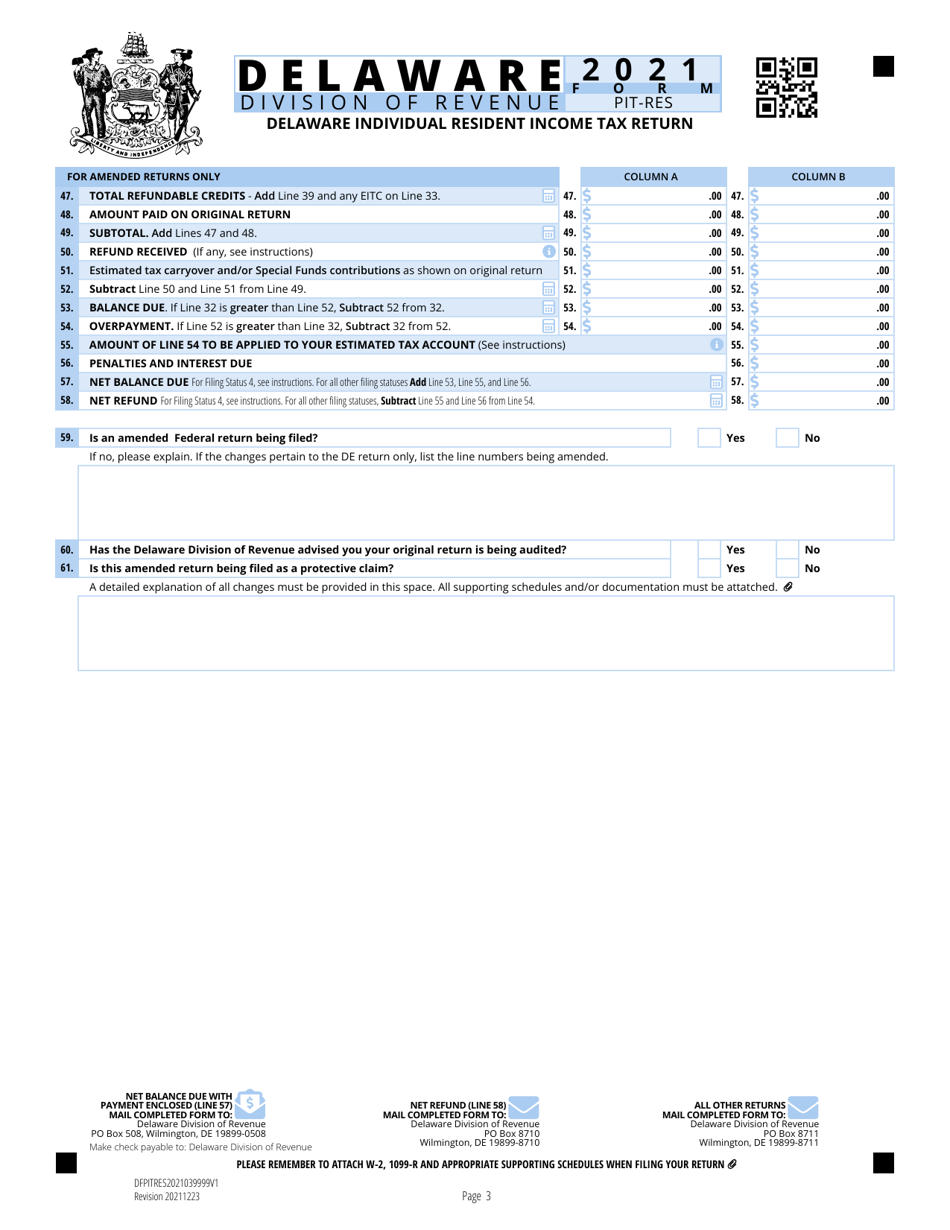

Q: What information is required on Form PIT-RES?

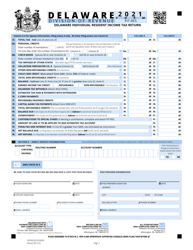

A: Form PIT-RES requires information about your income, deductions, and credits.

Q: When is the deadline to file Form PIT-RES?

A: The deadline to file Form PIT-RES in Delaware is usually April 30th.

Q: How can I file Form PIT-RES?

A: You can file Form PIT-RES electronically or by mail.

Q: Are there any penalties for late filing of Form PIT-RES?

A: Yes, there may be penalties for late filing of Form PIT-RES, so it's important to file on time.

Q: Can I claim any deductions or credits on Form PIT-RES?

A: Yes, you can claim deductions and credits on Form PIT-RES to reduce your taxable income.

Q: Do I need to include my federal tax return with Form PIT-RES?

A: No, you do not need to include your federal tax return with Form PIT-RES. However, you may need to reference information from your federal return.

Q: Is there a fee to file Form PIT-RES?

A: No, there is no fee to file Form PIT-RES in Delaware.

Form Details:

- Released on November 23, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-RES by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.