This version of the form is not currently in use and is provided for reference only. Download this version of

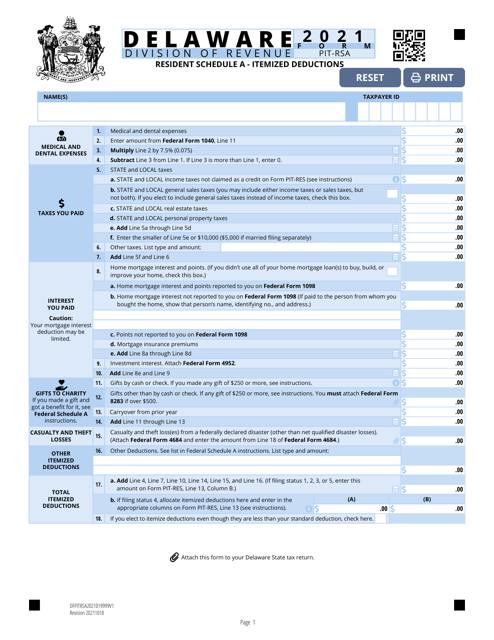

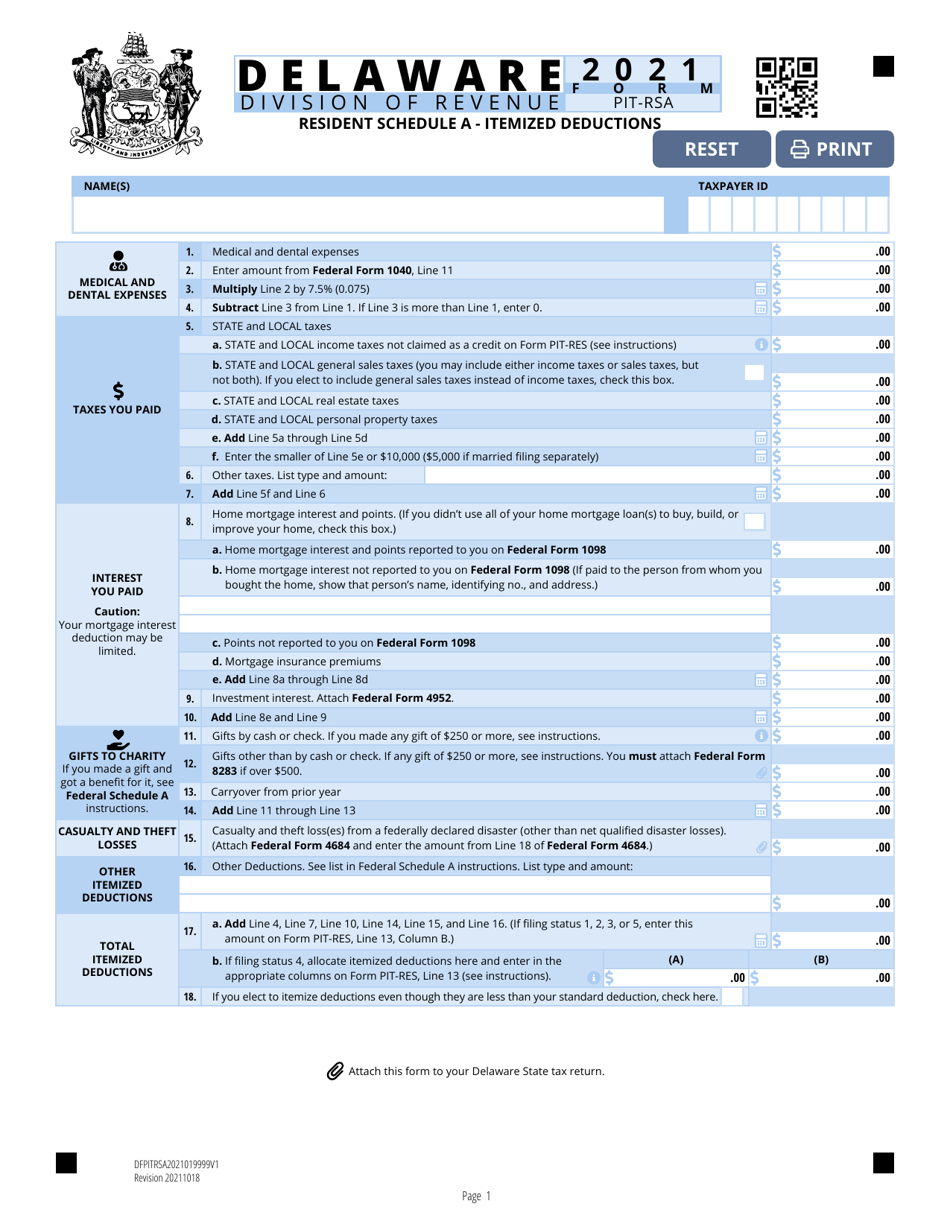

Form PIT-RSA Schedule A

for the current year.

Form PIT-RSA Schedule A Itemized Deductions - Delaware

What Is Form PIT-RSA Schedule A?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PIT-RSA Schedule A?

A: The PIT-RSA Schedule A is a form used to report itemized deductions in the state of Delaware.

Q: What are itemized deductions?

A: Itemized deductions are certain eligible expenses that can be deducted from your taxable income, such as medical expenses, mortgage interest, and charitable contributions.

Q: What expenses can be included in itemized deductions?

A: Some common expenses that can be included in itemized deductions are medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions.

Q: Why would someone choose to use itemized deductions instead of the standard deduction?

A: Someone may choose to use itemized deductions if the total amount of their eligible expenses is greater than the standard deduction, as it can potentially reduce their taxable income further.

Q: Is there a limit to how much can be deducted through itemized deductions?

A: Yes, there may be certain limitations and thresholds for certain types of itemized deductions, such as a limit on the amount of state and local taxes that can be deducted.

Q: Are itemized deductions the same for federal and state taxes?

A: No, the eligible expenses and rules for itemized deductions can vary between federal and state taxes, so it is important to review the specific guidelines for each.

Form Details:

- Released on October 18, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-RSA Schedule A by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.