This version of the form is not currently in use and is provided for reference only. Download this version of

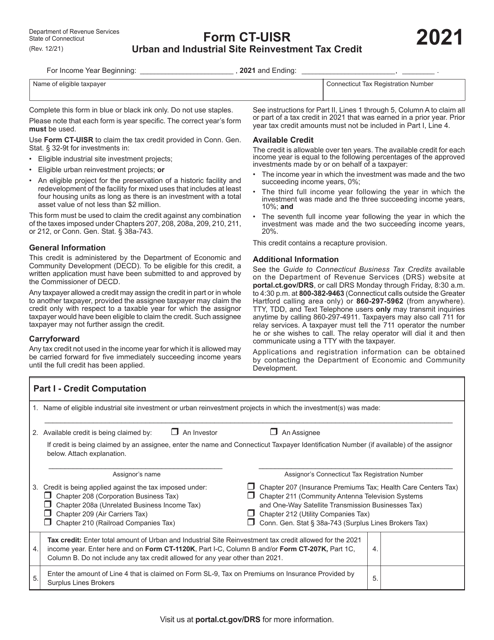

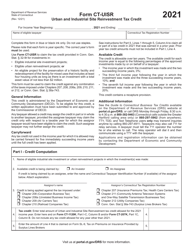

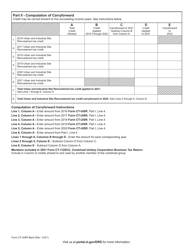

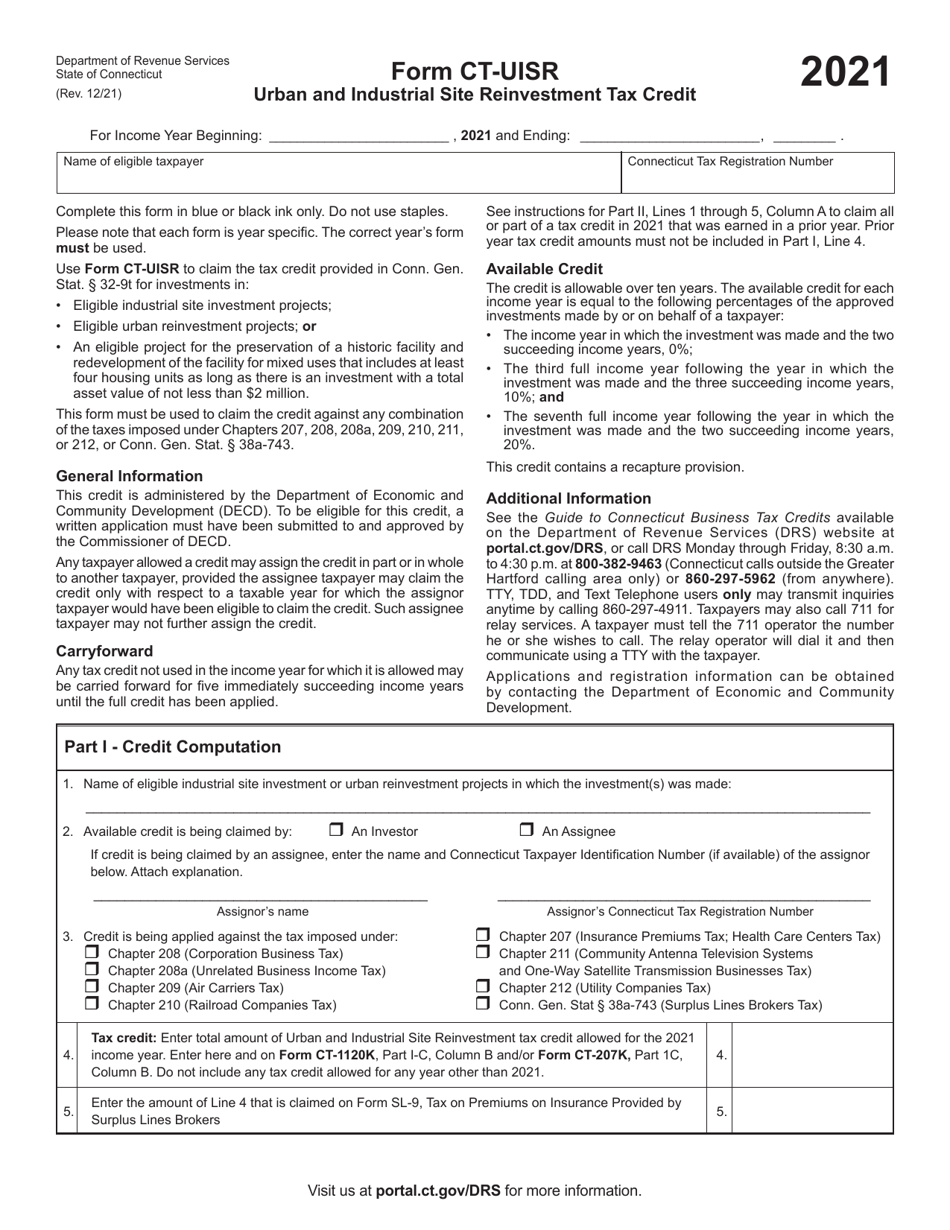

Form CT-UISR

for the current year.

Form CT-UISR Urban and Industrial Site Reinvestment Tax Credit - Connecticut

What Is Form CT-UISR?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-UISR?

A: Form CT-UISR is a tax form used to claim the Urban and Industrial Site Reinvestment Tax Credit in Connecticut.

Q: What is the Urban and Industrial Site Reinvestment Tax Credit?

A: The Urban and Industrial Site Reinvestment Tax Credit is a tax credit program in Connecticut that encourages businesses to invest in urban and industrial areas.

Q: Who is eligible for the tax credit?

A: Businesses that make qualified investments in eligible urban or industrial areas in Connecticut may be eligible for the tax credit.

Q: What type of investments qualify for the tax credit?

A: Qualified investments include the substantial rehabilitation, reuse, or redevelopment of eligible urban or industrial sites.

Q: How much is the tax credit?

A: The amount of the tax credit is based on the qualified investment made by the business and varies depending on various factors.

Q: How do I claim the tax credit?

A: To claim the tax credit, businesses must complete and file Form CT-UISR with the Connecticut Department of Revenue Services.

Q: Are there any deadlines for filing the tax credit claim?

A: Yes, the tax credit claim must be filed on or before the due date of the business's Connecticut income tax return.

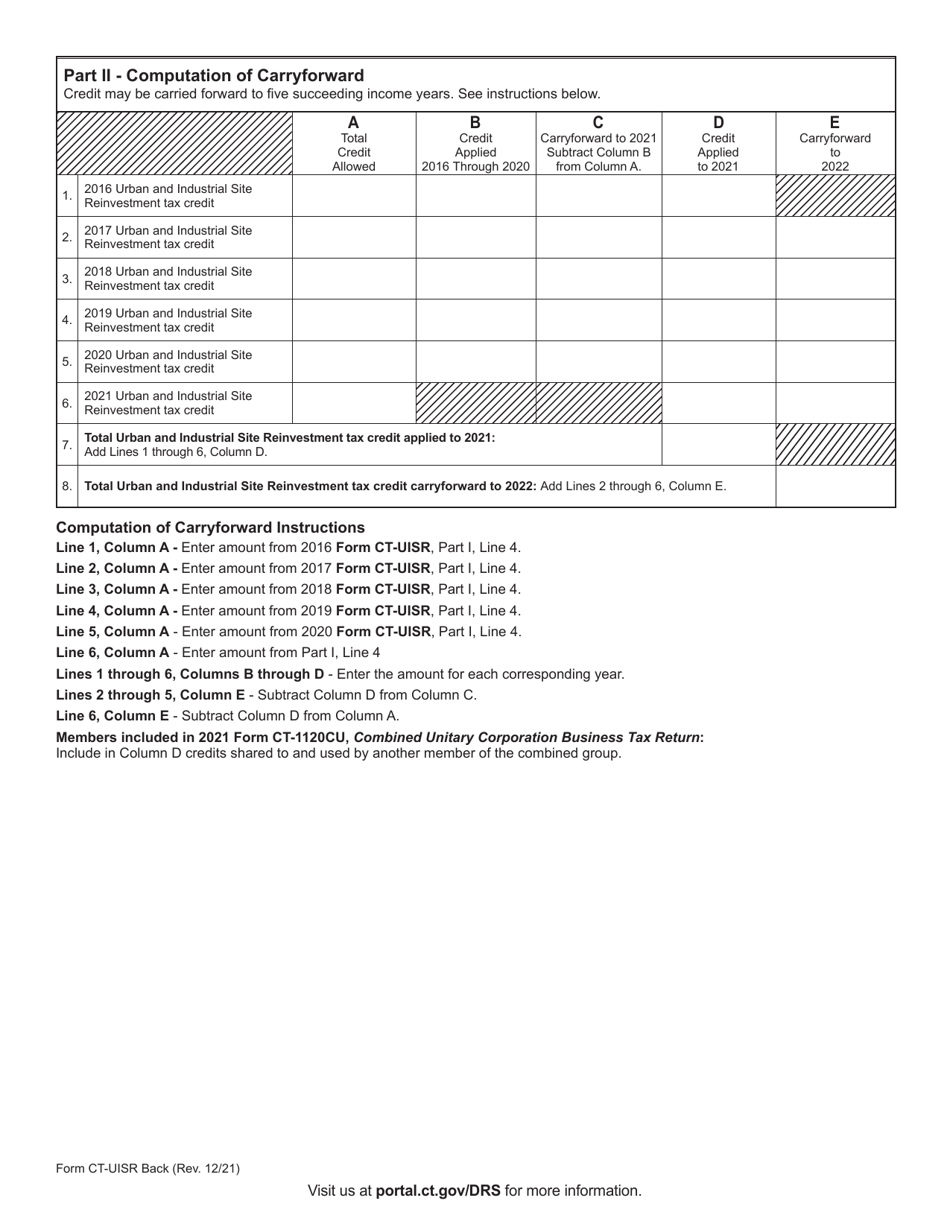

Q: Can the tax credit be carried over to future years?

A: Yes, any unused tax credit can be carried forward for up to five years.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-UISR by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.