This version of the form is not currently in use and is provided for reference only. Download this version of

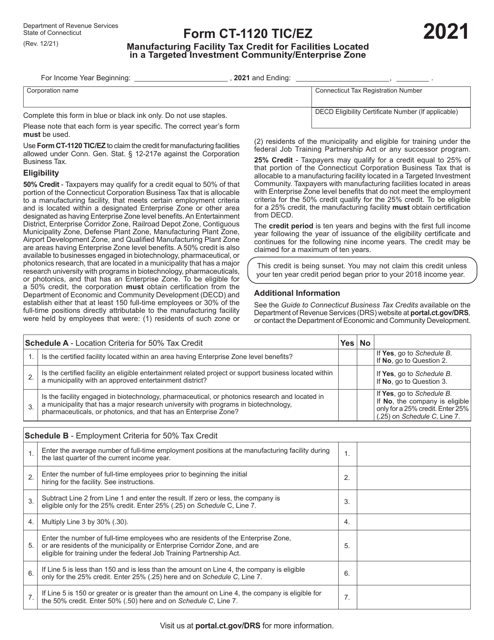

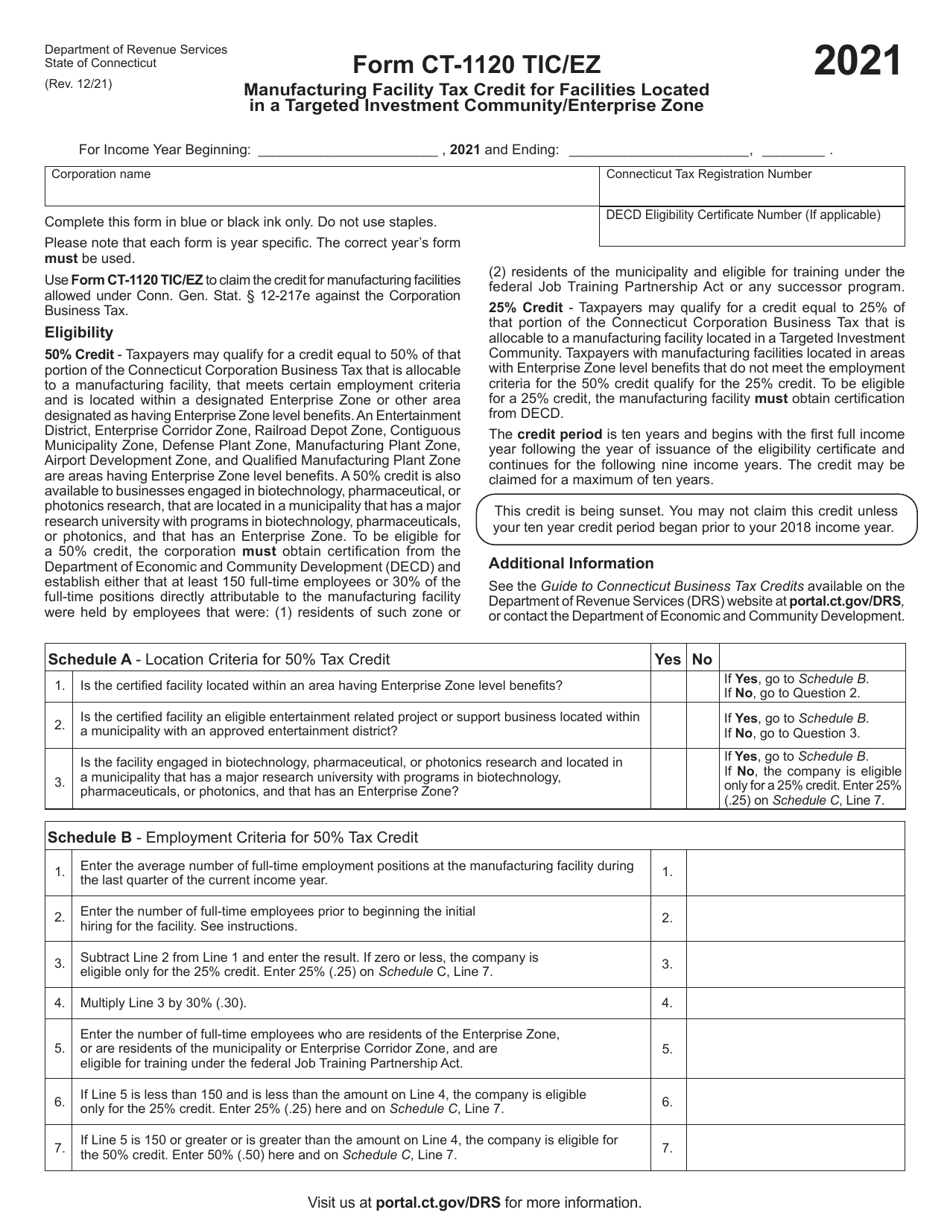

Form CT-1120 TIC/EZ

for the current year.

Form CT-1120 TIC / EZ Manufacturing Facility Tax Credit for Facilities Located in a Targeted Investment Community / Enterprise Zone - Connecticut

What Is Form CT-1120 TIC/EZ?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 TIC/EZ?

A: Form CT-1120 TIC/EZ is a tax form used to claim the manufacturing facility tax credit in Connecticut for facilities located in a targeted investment community or enterprise zone.

Q: What is the manufacturing facility tax credit?

A: The manufacturing facility tax credit is a credit provided to eligible businesses that operate manufacturing facilities in targeted investment communities or enterprise zones in Connecticut.

Q: Who is eligible for the manufacturing facility tax credit?

A: Businesses that operate manufacturing facilities in targeted investment communities or enterprise zones in Connecticut may be eligible for the tax credit.

Q: What is a targeted investment community (TIC)?

A: A targeted investment community (TIC) is a specific area designated by the state of Connecticut as economically distressed, where businesses may qualify for certain tax incentives.

Q: What is an enterprise zone?

A: An enterprise zone is an area designated by the state of Connecticut that offers certain tax incentives to encourage economic development and job creation.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 TIC/EZ by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.